Grade 9 basic accountig questions.doc

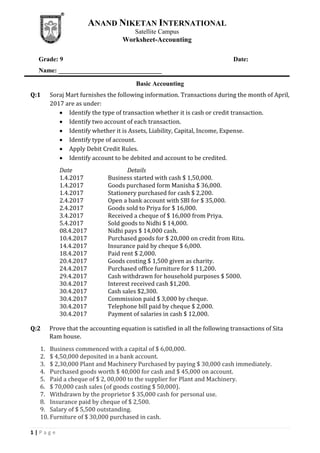

- 1. 1 | P a g e ANAND NIKETAN INTERNATIONAL Satellite Campus Worksheet-Accounting Grade: 9 Date: Name: ________________________________ Basic Accounting Q:1 Soraj Mart furnishes the following information. Transactions during the month of April, 2017 are as under: ï‚· Identify the type of transaction whether it is cash or credit transaction. ï‚· Identify two account of each transaction. ï‚· Identify whether it is Assets, Liability, Capital, Income, Expense. ï‚· Identify type of account. ï‚· Apply Debit Credit Rules. ï‚· Identify account to be debited and account to be credited. Date Details 1.4.2017 Business started with cash $ 1,50,000. 1.4.2017 Goods purchased form Manisha $ 36,000. 1.4.2017 Stationery purchased for cash $ 2,200. 2.4.2017 Open a bank account with SBI for $ 35,000. 2.4.2017 Goods sold to Priya for $ 16,000. 3.4.2017 Received a cheque of $ 16,000 from Priya. 5.4.2017 Sold goods to Nidhi $ 14,000. 08.4.2017 Nidhi pays $ 14,000 cash. 10.4.2017 Purchased goods for $ 20,000 on credit from Ritu. 14.4.2017 Insurance paid by cheque $ 6,000. 18.4.2017 Paid rent $ 2,000. 20.4.2017 Goods costing $ 1,500 given as charity. 24.4.2017 Purchased office furniture for $ 11,200. 29.4.2017 Cash withdrawn for household purposes $ 5000. 30.4.2017 Interest received cash $1,200. 30.4.2017 Cash sales $2,300. 30.4.2017 Commission paid $ 3,000 by cheque. 30.4.2017 Telephone bill paid by cheque $ 2,000. 30.4.2017 Payment of salaries in cash $ 12,000. Q:2 Prove that the accounting equation is satisfied in all the following transactions of Sita Ram house. 1. Business commenced with a capital of $ 6,00,000. 2. $ 4,50,000 deposited in a bank account. 3. $ 2,30,000 Plant and Machinery Purchased by paying $ 30,000 cash immediately. 4. Purchased goods worth $ 40,000 for cash and $ 45,000 on account. 5. Paid a cheque of $ 2, 00,000 to the supplier for Plant and Machinery. 6. $ 70,000 cash sales (of goods costing $ 50,000). 7. Withdrawn by the proprietor $ 35,000 cash for personal use. 8. Insurance paid by cheque of $ 2,500. 9. Salary of $ 5,500 outstanding. 10. Furniture of $ 30,000 purchased in cash.

- 2. 2 | P a g e Q:3 Classify the following items into Personal, Real and Nominal Accounts. 1. Capital 2. Sales 3. Drawings 4. Outstanding salary 5. Cash 6. Rent 7. Interest paid 8. Indian Bank 9. Discount received 10. Building 11. Bank 12. Chan 13. Murugan Library 14. Advertisement 15. Purchases 16. State Bank of India 17. Electricity Charges 18. Patent Q:4 Mention type of account and Identify the account to be debited and account to be credited. 2017 March 1 Bought goods for cash $ 25,000 2 Sold goods for cash $ 50,000 3 Bought goods from Gopi $19,000 5 Sold goods on credit to Robert $8,000 7 Received from Robert $ 6,000 9 Paid to Gopi $5,000 20 Bought furniture for cash $ 7,000