Grameen banking

- 2. Agenda ? Introduction ? History ? Working of Grameen Banking ? Benefits ? Microedit ? Awards & Criticism ? Grameen Bank II ? Related Ventures

- 3. Introduction ? It is a quasi-governmental and microfinance organization started in Bangladesh that makes small loans (known as microcredit or "grameencredit" )to the impoverished without requiring collateral. ? The word "Grameen", derived from the word "gram" or "village", means "of the village". ? The origin of Grameen Bank can be traced back to 1976 when Professor Muhammad Yunus, a Fulbright scholar and Professor at University of Chittagong, launched a research project to examine the possibility of designing a credit delivery system to provide banking services targeted to the rural poor. ? In October 1983, the Grameen Bank Project was transformed into an independent bank by government legislation. ? The organization and its founder, Muhammad Yunus, were jointly awarded the Nobel Peace Prize in 2006.

- 4. History ? Muhammad Yunus, the bank's founder, earned a doctorate in economics from Vanderbilt University in the United States. He was inspired during the terrible Bangladesh famine of 1974 to make a small loan of USD 27 to a group of 42 families so that they could create small items for sale without the burdens of predatory lending . ? The Bank was immensely successful and the project, with support from the central Bangladesh Bank, was introduced in 1979 to the Tangail District (to the north of the capital, Dhaka). ? By a Bangladeshi government ordinance on October 2, 1983, the project was transformed into an independent bank. ? Bankers from ShoreBank, a community development bank in Chicago, helped Yunus with the official incorporation of the bank under a grant from the Ford Foundation. ? The bank's repayment rate was hit following the 1998 flood of Bangladesh before recovering again in subsequent years. By the beginning of 2005, the bank had loaned over USD 4.7 billion to the poor.

- 5. History(Contd..) ? By 2006, Grameen Bank branches numbered over 2,100. ? Its success has inspired similar projects in more than 40 countries around the world and has made World Bank to take an initiative to finance Grameen-type schemes. ? The bank gets its funding from different sources, and the main contributors have shifted over time. ? In the initial years, donor agencies used to provide the bulk of capital at very cheap rates. In the mid-1990s, the bank started to get most of its funding from the central bank of Bangladesh.

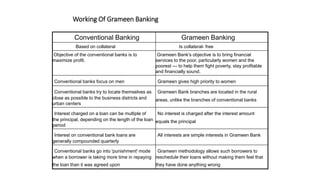

- 6. Working Of Grameen Banking Conventional Banking Grameen Banking Based on collateral Is collateral- free Objective of the conventional banks is to maximize profit. Grameen Bank's objective is to bring financial services to the poor, particularly women and the poorest ĄŠ to help them fight poverty, stay profitable and financially sound. Conventional banks focus on men Grameen gives high priority to women Conventional banks try to locate themselves as close as possible to the business districts and urban centers Grameen Bank branches are located in the rural areas, unlike the branches of conventional banks Interest charged on a loan can be multiple of the principal, depending on the length of the loan period No interest is charged after the interest amount equals the principal Interest on conventional bank loans are generally compounded quarterly All interests are simple interests in Grameen Bank Conventional banks go into 'punishment' mode when a borrower is taking more time in repaying the loan than it was agreed upon Grameen methodology allows such borrowers to reschedule their loans without making them feel that they have done anything wrong

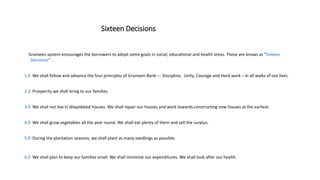

- 7. Sixteen Decisions Grameen system encourages the borrowers to adopt some goals in social, educational and health areas. These are knows as "Sixteen Decisions" . 1.0 We shall follow and advance the four principles of Grameen Bank --- Discipline, Unity, Courage and Hard work ĻC in all walks of out lives. 2.0 Prosperity we shall bring to our families. 3.0 We shall not live in dilapidated houses. We shall repair our houses and work towards constructing new houses at the earliest. 4.0 We shall grow vegetables all the year round. We shall eat plenty of them and sell the surplus. 5.0 During the plantation seasons, we shall plant as many seedlings as possible. 6.0 We shall plan to keep our families small. We shall minimize our expenditures. We shall look after our health.

- 8. Sixteen Decisions(Contd..) 7.0 We shall educate our children and ensure that they can earn to pay for their education. 8.0 We shall always keep our children and the environment clean. 9.0 We shall build and use pit-latrines. 10.0 We shall drink water from tubewells. If it is not available, we shall boil water or use alum. 11.0 We shall not take any dowry at our sons' weddings, neither shall we give any dowry at our daughters wedding. We shall keep our centre free from the curse of dowry. We shall not practice child marriage. 12.0 We shall not inflict any injustice on anyone, neither shall we allow anyone to do so. 13.0 We shall collectively undertake bigger investments for higher incomes. 14.0 We shall always be ready to help each other. If anyone is in difficulty, we shall all help him or her. 15.0 If we come to know of any breach of discipline in any centre, we shall all go there and help restore discipline. 16.0 We shall take part in all social activities collectively.

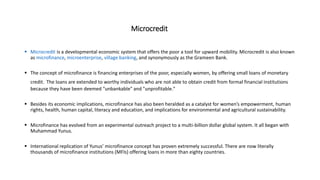

- 9. Microcredit ? Microcredit is a developmental economic system that offers the poor a tool for upward mobility. Microcredit is also known as microfinance, microenterprise, village banking, and synonymously as the Grameen Bank. ? The concept of microfinance is financing enterprises of the poor, especially women, by offering small loans of monetary credit. The loans are extended to worthy individuals who are not able to obtain credit from formal financial institutions because they have been deemed "unbankable" and "unprofitable." ? Besides its economic implications, microfinance has also been heralded as a catalyst for womenĄŊs empowerment, human rights, health, human capital, literacy and education, and implications for environmental and agricultural sustainability. ? Microfinance has evolved from an experimental outreach project to a multi-billion dollar global system. It all began with Muhammad Yunus. ? International replication of YunusĄŊ microfinance concept has proven extremely successful. There are now literally thousands of microfinance institutions (MFIs) offering loans in more than eighty countries.

- 10. Microcredit(Contd..) ? The United Nations made 2005 the "International Year of Microcredit," and the Gates Foundation, Google, the World Bank, Citigroup, and USAID are investing billions of dollars into the system of microfinance. ? Many microfinance cooperatives loan exclusively to women, and most have loan repayment rates of 99% and close to 100%. The successful repayment rates are due to ĄŪjoint liability groupsĄŊ (JLGs), in which borrowers are placed in a small group and act as guarantors for each other. ? When a group of borrowers form a joint-business their entrepreneurship is called a microcluster.

- 11. Awards received By Grameen Bank 1.SWITZERLAND : Aga Khan Award For Architecture : 1989Awarded Aga Khan Award For Architecture, 1989 by Geneva based Aga Khan Foundation for designing and operating Grameen Bank Housing Programme for the poor, which helped poor members of Grameen Bank to construct 60,000 housing units by 1989, each costing on an average $ 300. 2.BELGIUM : King Baudouin International Development Prize : 1993Awarded "The King Baudouin International Development Prize 1992" for its recognition of the role of women in the process of development and the novelty of a financial credit system contributing to the improvement of the social and material condition of women and their families in rural areas. 3.BANGLADESH : Independence Day Award : 1994Awarded Independence Day Award for outstanding contribution to Rural Development. 4.MALAYSIA : Tun Abdul Razak Award : 1994Awarded 1994 Tun Abdul Razak Award for the Bank's unique programme to lend money to the poorest of the poor and thus transform the lives of thousands of impoverished people. 5.UNITED KINGDOM : World Habitat Award : 1997Awarded Ą°World Habitat Award : 1997Ąą by Building and Social Housing Foundation.

- 12. Awards Received By Grameen Bank(Contd..) 6.INDIA : Gandhi Peace Prize : 2000Awarded "Gandhi Peace Prize :2000" by Government of India. 7.U.S.A. : Petersberg Prize : 2004Awarded "Petersberg Prize 2004" by the Development Gateway Foundation, U.S.A. in 2004. 8.Norway : Nobel Peace Prize : 2006Awarded "Nobel Peace Prize 2006" in October, 2006.

- 13. Criticism ? Sudhirendar Sharma, a development analyst, claims that the Grameen Bank has "landed poor communities in a perpetual debt-trap", and that its ultimate benefit goes to the corporations that sell capital goods and infrastructure to the borrowers. ? It has also attracted criticism from the former Prime Minister of Bangladesh, Sheikh Hasina, who commented, "There is no difference between usurers [Yunus] and corrupt people." Hasina touches upon one criticism of Grameen Bank: the high rate of interest that the bank demands from those seeking credit. ? The Mises Institute's Jeffrey Tucker has criticized the Grameen Bank, asserting that the Grameen Bank and others based on the Grameen model are not economically viable and depend on subsidies in order to operate, thus essentially becoming another example of welfare. ? Another source of criticism is that of the Grameen's Sixteen Decisions. Critics say that the bank's Sixteen Decisions force families and borrowers to abide by the rules and regulations set forth by the bank. In response to this, the Grameen bank neither forces or instills its morals into those who do not choose to become a part of the Grameen Bank.

- 14. Grameen Bank II ? Grameen II, an improved and flexible version of the classical Grameen model that is currently being used to financially empower the poorest families in more than a hundred countries across the globe through savings and loans. It describes how a flagship institution such as Grameen Bank accomplished a complete and effective overhaul of its system.

- 15. Related Ventures ? The Grameen Bank has grown into over two dozen enterprises represented by the Grameen Family of Enterprises. These organizations include : Grameen Communications: A member of Grameen family of enterprises, is a not for profit Information Technology company. It has been providing complete systems solution through developing software products and services, internet services, hardware & networking services and IT education services since its inception in 1997 under the Companies Act, 1994. Grameen Shakti (Grameen Energy): Grameen Shakti (GS) is a not-for-profit rural power company whose purpose is to supply renewable energy to unelectrified villages in Bangladesh. Grameen Telecom: Grameen Telecom is a company dedicated to bringing the information revolution to the rural people of Bangladesh. Grameen Telecom is planning, over the next 4 years, to provide GSM 900/1100 cellular mobile phone service to 100 million rural inhabitants in 68,000 villages of Bangladesh by (1) financing 60,000 members of Grameen Bank to provide village pay phone service and (2) providing direct phones to potential subscribers.

- 16. Related Ventures(Contd..) Grameen Phone: In the fast-paced world of telecommunications, vibrant and dynamic Corporate Governance practices are an essential ingredient to success. Grameenphone believes in the continued improvement of corporate governance. This in turn has led the Company to commit considerable resources and implement internationally accepted Corporate Standards in its day-to-day operations. Grameen Shikkha (Grameen Education): Grameen Shikkha is a company in the family of Grameen companies. Established in 1997 its main objectives are to promote mass education in rural areas, provide financial support in the form of loans and grants for the purpose of education, use IT for alleviation of illiteracy and evelopment of education, promote new technologies and innovate ideas and methods for development of education etc. Grameen CyberNet Limited: Grameen Cybernet Ltd. has been Bangladesh's leader in Internet service provision since it commenced operation in July 1996.

- 17. Related Ventures(Contd..) Others include: - Grameen Fund - Grameen Motsho (Grameen Fisheries) - Grameen Baybosa Bikash (Grameen Business Development) - Grameen Software Limited - Grameen Knitwear Limited - Grameen Uddog (owner of the brand Grameen Check)

- 18. Thank You

![Criticism

? Sudhirendar Sharma, a development analyst, claims that the Grameen Bank has "landed poor communities in a perpetual

debt-trap", and that its ultimate benefit goes to the corporations that sell capital goods and infrastructure to the

borrowers.

? It has also attracted criticism from the former Prime Minister of Bangladesh, Sheikh Hasina, who commented, "There is no

difference between usurers [Yunus] and corrupt people." Hasina touches upon one criticism of Grameen Bank: the high

rate of interest that the bank demands from those seeking credit.

? The Mises Institute's Jeffrey Tucker has criticized the Grameen Bank, asserting that the Grameen Bank and others based on

the Grameen model are not economically viable and depend on subsidies in order to operate, thus essentially becoming

another example of welfare.

? Another source of criticism is that of the Grameen's Sixteen Decisions. Critics say that the bank's Sixteen Decisions force

families and borrowers to abide by the rules and regulations set forth by the bank. In response to this, the Grameen bank

neither forces or instills its morals into those who do not choose to become a part of the Grameen Bank.](https://image.slidesharecdn.com/grameenbanking-180815044834/85/Grameen-banking-13-320.jpg)