Grasim

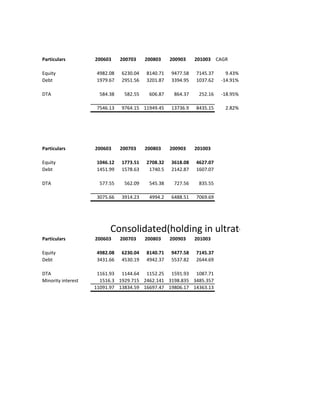

- 1. Particulars 200603 200703 200803 200903 201003 CAGR Equity 4982.08 6230.04 8140.71 9477.58 7145.37 9.43% Debt 1979.67 2951.56 3201.87 3394.95 1037.62 -14.91% DTA 584.38 582.55 606.87 864.37 252.16 -18.95% 7546.13 9764.15 11949.45 13736.9 8435.15 2.82% Particulars 200603 200703 200803 200903 201003 Equity 1046.12 1773.51 2708.32 3618.08 4627.07 Debt 1451.99 1578.63 1740.5 2142.87 1607.07 DTA 577.55 562.09 545.38 727.56 835.55 3075.66 3914.23 4994.2 6488.51 7069.69 Consolidated(holding in ultratech is through 100% Particulars 200603 200703 200803 200903 201003 Equity 4982.08 6230.04 8140.71 9477.58 7145.37 Debt 3431.66 4530.19 4942.37 5537.82 2644.69 DTA 1161.93 1144.64 1152.25 1591.93 1087.71 Minority interest 1516.3 1929.715 2462.141 3198.835 3485.357 11091.97 13834.59 16697.47 19806.17 14363.13

- 2. Grasim Particulars 200603 200703 200803 200903 201003 CAGR Net Fixed Assets 3311.03 4597.12 7053.96 8307.77 1829.04 -13.79% Investments 3481.71 4274.7 4080.79 4609.1 6324.79 16.09% Cash 155.58 116.38 127.47 113.38 15.92 -43.44% NCWC 597.81 775.95 687.23 706.65 265.4 -18.37% 7546.13 9764.15 11949.45 13736.90 8435.15 2.82% Ultratech Particulars 200603 200703 200803 200903 201003 Net Fixed Assets 2,710.91 3,242.94 4,808.89 5,340.15 5,224.83 Investments 148.15 459.21 146.66 1,009.49 1,636.68 Cash 68.39 100.11 114.3 104.68 111.69 NCWC 148.21 111.97 -75.65 34.17 96.47 3,075.66 3,914.23 4,994.20 6,488.51 7,069.69 g in ultratech is through 100% equity) Particulars 200603 200703 200803 200903 201003 Net Fixed Assets 6,021.94 7,840.06 11,862.85 13,647.92 7,053.87 Investments 1,922.35 2,290.19 1,548.73 1,319.43 2,740.46 Cash 223.97 216.49 241.77 218.06 127.61 NCWC 746.02 887.92 611.58 740.82 361.87 Good will 2,177.69 2,599.93 2,432.54 3,879.94 4,079.32 11,091.97 13,834.59 16,697.47 19,806.17 14,363.13

- 3. At the consolidated level, on account of the demerger of the Cement Business, while there is no change in the Revenue and Operating Profit of the Company, Net Profit after minority share stands at Rs.3,096 crores. Net Profit after minority share has been impacted due to the differential tax rate and minority share (35%) of Samruddhi, representing shares to be issued to Grasim s shareholders in terms of the demerger scheme.

- 4. Gross Block 6126.88 6785.3 7592.54 11061.67 Less : Accumulated Depreciation 3109.49 3380.53 3564.89 3972.54 Net Block 3017.39 3404.77 4027.65 7089.13 Capital Work in Progress 293.64 1192.35 3026.31 1218.64 Investments 3481.71 4274.7 4080.79 4609.1

- 5. 3102.16 1316.1 1786.06 42.98 3311.03 4597.12 7053.96 8307.77 1829.04 6324.79