Gratuity

- 1. Income Tax Law and Practice -I Gratuity

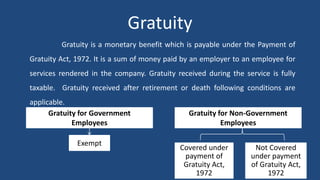

- 2. Gratuity Gratuity is a monetary benefit which is payable under the Payment of Gratuity Act, 1972. It is a sum of money paid by an employer to an employee for services rendered in the company. Gratuity received during the service is fully taxable. Gratuity received after retirement or death following conditions are applicable. Gratuity for Government Employees Gratuity for Non-Government Employees Exempt Covered under payment of Gratuity Act, 1972 Not Covered under payment of Gratuity Act, 1972

- 3. Death -cum-Retirement Gratuity received by other employees who are covered under Gratuity Act, 1972 Computation of Taxable Gratuity Particulars Amount Amount Amount of gratuity received xxxx Less: Least of the following a) actual amount of gratuity received xxx b) 15/26*Last drawn salary* X completed year of service xxx c) Rs. 20,00,000 xxx Exempted Gratuity xxxx Taxable Garatuity xxxx Last Salary drawn= basic salary + DA Completed year of service is to be rounded off

- 4. Death -cum-Retirement Gratuity received by other employees who are Not covered under Gratuity Act, 1972 Computation of Taxable Gratuity Particulars Amount Amount Amount of gratuity received xxxx Less: Least of the following a) actual amount of gratuity received xxx 1/2 X Average salary X completed year of service xxx c) Rs. 20,00,000 xxx Exempted Gratuity xxxx Taxable Gratuity xxxx Average Salary = Average Salary of last 10 months immediately preceding the month of retirement Salary = Salary = Basic Pay + Dearness Allowance (to the extent it forms part of retirement benefits)+ turnover based commission

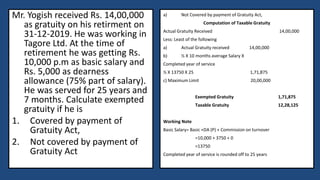

- 5. Mr. Yogish received Rs. 14,00,000 as gratuity on his retirment on 31-12-2019. He was working in Tagore Ltd. At the time of retirement he was getting Rs. 10,000 p.m as basic salary and Rs. 5,000 as dearness allowance (75% part of salary). He was served for 25 years and 7 months. Calculate exempted gratuity if he is 1. Covered by payment of Gratuity Act, 2. Not covered by payment of Gratuity Act a) Covered by payment of Gratuity Act, Computation of Taxable Gratuity Actual Gratuity Received 14,00,000 Less: Least of the following a) Actual Gratuity received 14,00,000 b) 15/26 X Last Salary Drawn X Completed year of service 15/26 X 15,000 X 26 2,25,000 c) Maximum Limit 20,00,000 Exempted Gratuity 2,25,000 Taxable Gratuity 11,75,000 Working Note Basic Salary= Basic +DA 10,000 + 5,000 = 15,000 Completed year of service is rounded off to 26 years

- 6. Mr. Yogish received Rs. 14,00,000 as gratuity on his retirment on 31-12-2019. He was working in Tagore Ltd. At the time of retirement he was getting Rs. 10,000 p.m as basic salary and Rs. 5,000 as dearness allowance (75% part of salary). He was served for 25 years and 7 months. Calculate exempted gratuity if he is 1. Covered by payment of Gratuity Act, 2. Not covered by payment of Gratuity Act a) Not Covered by payment of Gratuity Act, Computation of Taxable Gratuity Actual Gratuity Received 14,00,000 Less: Least of the following a) Actual Gratuity received 14,00,000 b) Â― X 10 months average Salary X Completed year of service Â― X 13750 X 25 1,71,875 c) Maximum Limit 20,00,000 Exempted Gratuity 1,71,875 Taxable Gratuity 12,28,125 Working Note Basic Salary= Basic +DA (P) + Commission on turnover =10,000 + 3750 + 0 =13750 Completed year of service is rounded off to 25 years