Green Spot Dan V 1.1

- 1. Project Greenspot: Pre-Final Financing and Structuring Strictly confidential. Case Studies. July 2012

- 2. Project overview AgroEnergo â located in Ukraine, Ivano-Frankivsk. Established in 2009. Initiator has invested EUR 2.5 MM. This bio-technology has a stable efficiency of 90%, which favorably compares with solar and wind energy with an efficiency of 25%. Initiator need investor in equity capital, as well as a potential creditor, to finished constructing process. Loan and equity financing âis a final round. Investment Terms: EUR 3.6MM â equity financing for of 49% of Company, EUR 8.5MM - debt financing (Maturity - 6 years, interest rate - 15%), Advisory â AIM Group, Seller â AgroEnergoTechnologies (mr. Taras Vynogradnyk, CEO), Buyer â Danford&Co. That business is the strong cash flow story. That is a real predicted value, because in Ukraine we see working âgreenâ tariffs, which is enshrined in law the Energy Strategy of Ukraine (up to 2030). According to the âgreenâ legislation, is present a guaranteed customer base, with the appropriate energy networks connection. Risk - cancellation of âgreenâ tariffs. Structuring of ownership shall be effected by the direct purchase with the trust agreement. Trust Agreement Terms: Manager â Danford&Co , Fee â 7% company stake ownership, Seats in the Board of Directors The purpose of the team Danford&Co, as well as the initiator of the project â is holding structuring, which will produce: electro-energy, thermal energy, bio-fertilizers. It should help us: to refinance the alleged debt, increase stable and predictable cash flow, build equity story, with the future mergering by conglomerate. Danford in touch with global and regional credit organizations, and thatâs why we understand leverage financing for the future Holding Company. Constructing possibilities â 5 generating assets like this one (per year). Customers - the municipalities, recreational areas, agro-companies. AgroEnergo â cornerstone asset for strong cash flow and step to build a market player. 1

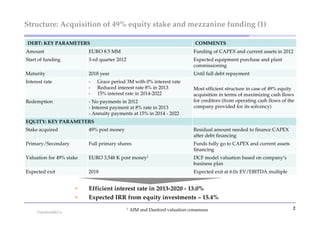

- 3. Structure: Acquisition of 49% equity stake and mezzanine funding (1) DEBT: KEY PARAMETERS COMMENTS Amount EURO 8.5 MM Funding of CAPEX and current assets in 2012 Start of funding 3-rd quarter 2012 Expected equipment purchase and plant commissioning Maturity 2018 year Until full debt repayment Interest rate - Grace period 3M with 0% interest rate - Reduced interest rate 8% in 2013 Most efficient structure in case of 49% equity - 15% interest rate in 2014-2022 acquisition in terms of maximizing cash flows Redemption - No payments in 2012 for creditors (from operating cash flows of the - Interest payment at 8% rate in 2013 company provided for its solvency) - Annuity payments at 15% in 2014 - 2022 EQUITY: KEY PARAMETERS Stake acquired 49% post money Residual amount needed to finance CAPEX after debt financing Primary/Secondary Full primary shares Funds fully go to CAPEX and current assets financing Valuation for 49% stake EURO 3,548 K post money1 DCF model valuation based on companyâs business plan Expected exit 2018 Expected exit at 6.0x EV/EBITDA multiple ï Efficient interest rate in 2013-2020 - 13.0% ï Expected IRR from equity investments â 15.4% 1 AIM and Danford valuation consensus 2

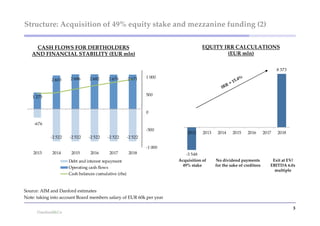

- 4. Structure: Acquisition of 49% equity stake and mezzanine funding (2) CASH FLOWS FOR DEBTHOLDERS EQUITY IRR CALCULATIONS AND FINANCIAL STABILITY (EUR mln) (EUR mln) 8 373 2 686 2 682 2 670 2 671 1 000 2 603 500 1 275 0 -676 -500 2012 2013 2014 2015 2016 2017 2018 -2 522 -2 522 -2 522 -2 522 -2 522 -1 000 2013 2014 2015 2016 2017 2018 -3 548 Debt and interest repayment Acquisition of No dividend payments Exit at EV/ 49% stake for the sake of creditors EBITDA 6.0x Operating cash flows multiple Cash balances cumulative (rhs) Source: AIM and Danford estimates Note: taking into account Board members salary of EUR 60k per year 3

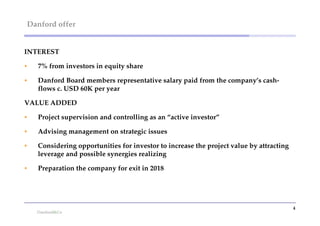

- 5. Danford offer INTEREST ï 7% from investors in equity share ï Danford Board members representative salary paid from the companyâs cash- flows c. USD 60K per year VALUE ADDED ï Project supervision and controlling as an âactive investorâ ï Advising management on strategic issues ï Considering opportunities for investor to increase the project value by attracting leverage and possible synergies realizing ï Preparation the company for exit in 2018 4

- 6. Next steps ï Making a Strategic go / no go decision by investor ï Preparation of a detailed term-sheet for equity and debt financing scheme together with advisors ï Finalizing the key terms incl. interest rates, debt maturity, redemption schedule as well as final valuation ï Preparation of SPA and loan agreement 5

- 7. Disclaimer This review is a description of potential equity and debt financing. The company Danford Group, established in the British Virgin Islands (BVI), and/or related entities, who act under the name Danford&Co, plans to carry out asset management and to build a holding structure in the sector of bio-energy, which will conduct activities on the territory of Ukraine and/or the CIS. This review was prepared on the basis of available indicators that was provide by the citizen of Ukraine, Mr. Taras Vynogradnyk (representative of the selling company, which operates on the basis of the constitution and/or other documents regulating the activity), and are analyzed by Kiev-based consulting company AïM, which acts as an advisor to the proposed transaction on the purchase and sale of shares, and to provide debt financing, and is authorized to contract for services entered into between the vendor representatives and AIM representatives. The company Danford Group, as well as owners, employees and representatives of related companies, which operate under the brand name Danford&Co, rely on the accuracy of figures and data was provide by the citizen of Ukraine, Mr. Taras Vynogradnyk, as well as taking into account the expertise and experience of the evaluation, enterprise advisory, and sell-side consulting, employees and company representatives of AïM, may carry out an research and description of a possible transaction structuring. This material does not constitute an offer to purchase and/or sale of shares, or to provide funding to any commercial and/or municipal and/or sovereign entities, which is governed by the law of the jurisdiction in which it is registered. Decision to conduct operations on purchase and/or sale of shares, or to provide funding to any commercial and/or municipal and/or a sovereign entities, which is regulated by law, the jurisdiction in which it is registered, the potential seller/or a buyer, and/or investor takes on their own. This document is an internal document and the property of Danford Group, as well as related companies, which operate under the brand name Danford&Co. 7