GSC-Customs Tariff-Budget-2016-17

- 1. Union Budget 2016-2017 Key Customs Tariff Amendments 2/19, Nityanand Nagar, Sahar Road, Andheri (East), Mumbai-400 069. 03/03/2016

- 2. Union Budget 2016-2017 Right advice at right time.... Address: 2/19, Nityapriya, Nityanand Nagar, Sahar Road, Andheri (East), Mumbai ŌĆō 400 069. Tel: +91 22 26836519; Email: info@gscintime.com Page 2 of 12 Abbreviations: Name Particulars BCD Basic Customs Duty CVD Countervailing Duty SAD Special Additional Duty

- 3. Union Budget 2016-2017 Right advice at right time.... Address: 2/19, Nityapriya, Nityanand Nagar, Sahar Road, Andheri (East), Mumbai ŌĆō 400 069. Tel: +91 22 26836519; Email: info@gscintime.com Page 3 of 12 1. Customs Duty imposed (BCD/CVD/SAD): Sr. No. Particulars Existing Rate New Rate 1 Magnetic - Heads (all types), Ceramic/ Magnetic cartridges and stylus, Antennas, EHT cables, Level meters/level indicators/ tuning indicators/ peak level meters/ battery meter/VC meters/ Tape counters, Tone arms, Electron guns: BCD NIL 7.50%/10% 2 Specified machinery required for construction of roads : CVD NIL 12.50% 3 Charger / adapter, battery and wired headsets / speakers for manufacture of mobile phones: I) BCD II) CVD III) SAD NIL NIL NIL 10% 12..50% 4.00% 4 Plans, drawings and designs falling under chapter 49 : BCD NIL 10% 5 Specified telecommunication equipment [Soft switches and Voice over Internet Protocol (VoIP) equipment namely VoIP phones, media gateways etc. : BCD NIL 10% 6 Preform of silica for manufacture of telecom grade optical fibre/cables : BCD NIL 10% 7 E-Readers : BCD NIL 7.5% 8 Solar tempered glass / solar tempered (anti- reflective coated) glass : BCD NIL 5% 9 Cashew nuts in shell : BCD NIL 5% 10 Populated PCBs for manufacture of personal computers (laptop or desktop) : SAD NIL 4% 11 Populated PCBs for manufacture of mobile phone/tablet computer : SAD NIL 2%

- 4. Union Budget 2016-2017 Right advice at right time.... Address: 2/19, Nityapriya, Nityanand Nagar, Sahar Road, Andheri (East), Mumbai ŌĆō 400 069. Tel: +91 22 26836519; Email: info@gscintime.com Page 4 of 12 2. Customs Duty exempted on inputs/Capital Goods (BCD/CVD/SAD): Sr. No. Particulars Existing Rate New Rate 1 Machinery, electrical equipment and instrument and parts thereof (except populated PCBs) for semiconductor wafer fabrication / LCD fabrication units i) BCD ii) SAD 7.5%/10% 4% NIL NIL 2 Machinery, electrical equipment and instrument and parts thereof (except populated PCBs) imported for Assembly, Test, Marking and Packaging of semiconductor chips (ATMP) i) BCD ii) SAD 7.5%/10% 4% NIL NIL 3 Inputs, parts and components, subparts for manufacture of charger / adapter, battery and wired headsets/speakers of mobile phones : i) BCD, ii) CVD iii) SAD 7.5%/10% 12.5% 4% NIL NIL NIL 4 Parts and components, subparts for manufacture of Routers, broadband Modems, Set-top boxes for gaining access to internet, set top boxes for TV, digital video recorder (DVR) / network video recorder (NVR), CCTV camera / IP camera, lithium ion battery [other than those for mobile handsets : i) BCD ii) CVD iii) SAD 7.5%/10% 12.5% 4% NIL NIL NIL 5 Specified capital goods and inputs for use in manufacture of Micro fuses, Sub-miniature fuses, Resettable fuses, and Thermal fuses : BCD 7.5%/10% NIL 6 Capital goods and spare thereof, raw materials, parts, material handling equipment and consumable for repairs of ocean-going vessels by a ship repair unit : CVD 12.5% NIL

- 5. Union Budget 2016-2017 Right advice at right time.... Address: 2/19, Nityapriya, Nityanand Nagar, Sahar Road, Andheri (East), Mumbai ŌĆō 400 069. Tel: +91 22 26836519; Email: info@gscintime.com Page 5 of 12 Sr. No. Particulars Existing Rate New Rate 7 Disposable sterilized dialyzer and micro barrier of artificial kidney : i) BCD, ii) CVD iii) SAD 7.5%/10% 12.5% 4% NIL NIL NIL 8 Specified goods required for exploration & production of hydrocarbon activities undertaken under Petroleum Exploration Licenses (PEL) or Mining Leases (ML) issued or renewed before 1st April 1999 : i) BCD, ii) CVD iii) SAD 7.5%/10% 12.5% 4% NIL NIL NIL 9 Foreign Satellite dataŌĆØ on storage media when imported by National Remote Sensing Centre (NRSC), Hyderabad : i) BCD ii) CVD iii) SAD 10% 12.5% 4% NIL NIL NIL 10 Specified imported fabrics for manufacture of textile garments for exports : BCD 10% NIL 11 Braille paper : BCD 10% NIL 12 Magnetron of capacity of 1 KW to 1.5 KW for use in manufacture of domestic microwave ovens : BCD 10% NIL 13 Polypropylene granules / resins for the manufacture of capacitor grade plastic films :BCD 7.5% NIL 14 Medical Use Fission Molybdenum-99 imported by Board of Radiation and Isotope Technology (BRIT) for manufacture of radio pharmaceuticals : BCD 7.5% NIL 15 Wood in chips or particles for manufacture of paper, paperboard and news print : BCD 5% NIL 16 Electrolysers, membranes and their parts required by caustic soda / potash unit using membrane cell technology : BCD 2.5% NIL

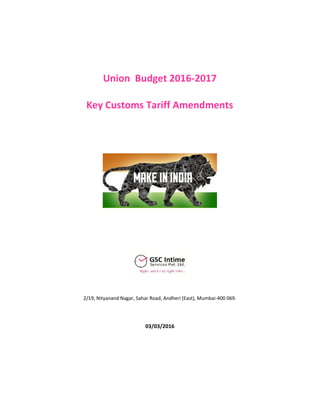

- 6. Union Budget 2016-2017 Right advice at right time.... Address: 2/19, Nityapriya, Nityanand Nagar, Sahar Road, Andheri (East), Mumbai ŌĆō 400 069. Tel: +91 22 26836519; Email: info@gscintime.com Page 6 of 12 3. Customs Duty (BCD/CVD/SAD): Enhanced: Sr. No. Particulars Existing Rate New Rate 1 Golf cars : BCD 10% 60% 2 Natural latex rubber made balloons falling under specified headings : BCD 10% 20% 3 Imitation jewellery : BCD 10% 15% 4 Other aluminium products : BCD 7.50% 10% 5 Industrial solar water heater : BCD 7.5% 10% 6 Capital goods and parts thereof (Increase the tariff rate of BCD for 96 specified tariff lines in Chapters 84, 85 and 90) 7.5% 10% 7 Primary aluminium : BCD 5% 7.5% 8 Gold dore bars : CVD 8% 8.75% 9 Silver dore bars : CVD 7% 7.75% 10 Zinc alloys : BCD 5% 7.5%

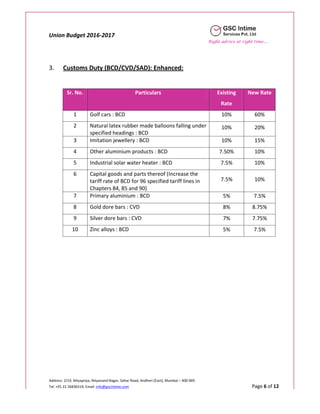

- 7. Union Budget 2016-2017 Right advice at right time.... Address: 2/19, Nityapriya, Nityanand Nagar, Sahar Road, Andheri (East), Mumbai ŌĆō 400 069. Tel: +91 22 26836519; Email: info@gscintime.com Page 7 of 12 4. Customs duty (BCD/CVD/SAD) reduced: Sr. No. Particulars Existing Rate New Rate 1 Parts of E-readers : BCD 7.5% 5% 2 Neodymium Magnet (before Magnetization) and Magnet Resin (Strontium Ferrite compound / before formed, before magnetization) for manufacture of BLDC motors, subject to actual user condition : BCD 7.5%/10% 2.5% 3 Engine for hybrid electric vehicle I) BCD II) CVD Tariff rate Tariff rate NIL 6% 4 Cold chain including pre-cooling unit, packhouses, sorting and grading lines and ripening chambers : BCD 10% 5% 5 Refrigerated containers : BCD 10% 5% 6 Coal; briquettes, ovoids and similar solid fuels manufactured from coal : BCD 10% 2.5% 7 Lignite, whether or not agglomerated, excluding jet : BCD 10% 2.5% 8 Peat (including peat litter), whether or not agglomerated : BCD 10% 2.5% 9 Coke and semi-coke of coal, of lignite or of peat, whether or not agglomerated; retort carbon : BCD 10% 5% 10 Coal gas, water gas, producer gas and similar gases, other than petroleum gases and other gaseous hydrocarbons : BCD 10% 5% 11 Tar distilled from coal, from lignite or from peat and other mineral tars, whether or not dehydrated or partially distilled, including reconstituted tars : BCD 10% 5% 12 Oils and other products of the distillation of high temperature coal tar similar products in which the weight of the aromatic constituents exceeds that of the non-aromatic constituents : BCD 10%/5% 2.5%

- 8. Union Budget 2016-2017 Right advice at right time.... Address: 2/19, Nityapriya, Nityanand Nagar, Sahar Road, Andheri (East), Mumbai ŌĆō 400 069. Tel: +91 22 26836519; Email: info@gscintime.com Page 8 of 12 Sr. No. Particulars Existing Rate New Rate 13 Pitch and pitch coke, obtained from coal tar or from other mineral tars : BCD 10% 5% 14 Aluminium Oxide for use in the manufacture of Wash Coat, which is used in the manufacture of catalytic converters : BCD 7.5% 5% 15 Super Absorbent Polymer when used for the manufacture of sanitary pads, napkins & tampons : BCD 7.5% 5% 16 All acyclic hydrocarbons and all cyclic hydrocarbons [other than para-xylene which attracts NIL BCD and styrene which attracts 2% BCD] : BCD 5% 2.5% 17 Silica sand : BCD 5% 2.5% 18 Brass scrap : BCD 5% 2.5% 19 Denatured ethyl alcohol (Ethanol) : BCD 5% 2.5% 20 Specified fibres and yarns: BCD 5% 2.5% 21 Pulp of wood for manufacture of sanitary pads, napkins & tampons : BCD 5% 2.5% 22 Orthoxylene for the manufacture of phthalic anhydride (SAD): BCD 4% 2%

- 9. Union Budget 2016-2017 Right advice at right time.... Address: 2/19, Nityapriya, Nityanand Nagar, Sahar Road, Andheri (East), Mumbai ŌĆō 400 069. Tel: +91 22 26836519; Email: info@gscintime.com Page 9 of 12 5. Amendment in Export duty (BCD/CVD and SAD): Sr. No. Particulars Existing Rate New Rate 1 Iron ore fines with Fe content below 58% 10% NIL 2 Iron ore lumps with Fe content below 58% 30% NIL 3 Chromium ores and concentrates, all sorts 30% NIL 4 Bauxite (natural), not calcined or calcined 20% 15%

- 10. Union Budget 2016-2017 Right advice at right time.... Address: 2/19, Nityapriya, Nityanand Nagar, Sahar Road, Andheri (East), Mumbai ŌĆō 400 069. Tel: +91 22 26836519; Email: info@gscintime.com Page 10 of 12 6. Other amendments: Sr. No. Particulars 1 Notification no. 12/2012ŌĆōCus. dated 17.03.2012 prescribed concessional imports of phosphoric acid for the manufacture of fertilizers and now actual user condition is being prescribed 2 Notification no. 12/2012ŌĆō Customs, dated 17.03.2012 prescribed concessional imports of anhydrous ammonia for the manufacture of goods falling under Chapter 31 for use as fertilizers and now actual user condition is being prescribed 3 The validity period of exemption granted to specified goods for the use in the manufacture of electrically operated vehicles and hybrid vehicles is being extended without time limit 4 All dutiable articles, intended for personal use, imported by post or air limit increased from Rs. 10,000/- to Rs. 20,000/-

- 11. Union Budget 2016-2017 Right advice at right time.... Address: 2/19, Nityapriya, Nityanand Nagar, Sahar Road, Andheri (East), Mumbai ŌĆō 400 069. Tel: +91 22 26836519; Email: info@gscintime.com Page 11 of 12 Disclaimer 1. The document highlights general understanding of indirect tax amendments through Union Budget 2016-2017. The same cannot be construed to be the opinion of the Author. 2. Before using the same for any statutory interpretations, raising demands or taking any business decisions, prior written consent of the author is mandatory. 3. In any case, the author or GSC Intime Services Pvt. Ltd. are not responsible for the usage of the document without any written consent of the Author. 4. The views presented in the Document are personal views of the Author and may not be accepted by the Tax or Judicial Authorities. 5. The document endeavors to explain the situation of the Law as on or before the date of the document. The Author does not undertake any responsibility to update the same in the future. ┬® Author

- 12. Union Budget 2016-2017 Right advice at right time.... Address: 2/19, Nityapriya, Nityanand Nagar, Sahar Road, Andheri (East), Mumbai ŌĆō 400 069. Tel: +91 22 26836519; Email: info@gscintime.com Page 12 of 12 2/19 Nityanand Nagar, Sahar Road, Andheri (East), Mumbai-400 069. 6-A, Ranjit Studio Compound, DSP Road, Dadar (East), Mumbai-400 014. +91 22 2683 6519 info@gscintime.com Areas of FocusŌĆ” ŌĆóCorporate Retainerships ŌĆóTax Structuring/Optimization ŌĆóOpinions/Notes ŌĆóCorporate Trainings ŌĆóRefunds ŌĆóLitigation Support ŌĆóMulti-State VAT ŌĆóERP Implementation ŌĆóTax Reviews/Due Diligence ŌĆóRepresentation to Governments

![Union Budget 2016-2017

Right advice at right time....

Address: 2/19, Nityapriya, Nityanand Nagar, Sahar Road, Andheri (East), Mumbai ŌĆō 400 069.

Tel: +91 22 26836519; Email: info@gscintime.com Page 8 of 12

Sr. No. Particulars Existing

Rate

New Rate

13 Pitch and pitch coke, obtained from coal tar or

from other mineral tars : BCD

10% 5%

14 Aluminium Oxide for use in the manufacture of

Wash Coat, which is used in the manufacture of

catalytic converters : BCD

7.5% 5%

15 Super Absorbent Polymer when used for the

manufacture of sanitary pads, napkins &

tampons : BCD

7.5% 5%

16 All acyclic hydrocarbons and all cyclic

hydrocarbons [other than para-xylene which

attracts NIL BCD and styrene which attracts 2%

BCD] : BCD

5% 2.5%

17 Silica sand : BCD 5% 2.5%

18 Brass scrap : BCD 5% 2.5%

19 Denatured ethyl alcohol (Ethanol) : BCD 5% 2.5%

20 Specified fibres and yarns: BCD 5% 2.5%

21 Pulp of wood for manufacture of sanitary pads,

napkins & tampons : BCD

5% 2.5%

22 Orthoxylene for the manufacture of phthalic

anhydride (SAD): BCD

4% 2%](https://image.slidesharecdn.com/51920b4f-b666-45ad-917f-e6d2da505cab-160302210913/85/GSC-Customs-Tariff-Budget-2016-17-8-320.jpg)