Guide_for_Determining_Adequacy_of_Contractor_Incurred_Cost_Proposal

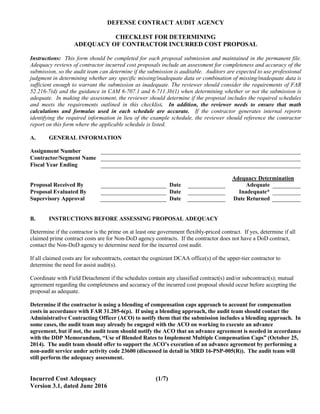

- 1. DEFENSE CONTRACT AUDIT AGENCY CHECKLIST FOR DETERMINING ADEQUACY OF CONTRACTOR INCURRED COST PROPOSAL Incurred Cost Adequacy (1/7) Version 3.1, dated June 2016 Instructions: This form should be completed for each proposal submission and maintained in the permanent file. Adequacy reviews of contractor incurred cost proposals include an assessment for completeness and accuracy of the submission, so the audit team can determine if the submission is auditable. Auditors are expected to use professional judgment in determining whether any specific missing/inadequate data or combination of missing/inadequate data is sufficient enough to warrant the submission as inadequate. The reviewer should consider the requirements of FAR 52.216-7(d) and the guidance in CAM 6-707.1 and 6-711.3b(1) when determining whether or not the submission is adequate. In making the assessment, the reviewer should determine if the proposal includes the required schedules and meets the requirements outlined in this checklist. In addition, the reviewer needs to ensure that math calculations and formulas used in each schedule are accurate. If the contractor generates internal reports identifying the required information in lieu of the example schedule, the reviewer should reference the contractor report on this form where the applicable schedule is listed. A. GENERAL INFORMATION Assignment Number Contractor/Segment Name Fiscal Year Ending Adequacy Determination Proposal Received By Date Adequate Proposal Evaluated By Date Inadequate* Supervisory Approval Date Date Returned B. INSTRUCTIONS BEFORE ASSESSING PROPOSAL ADEQUACY Determine if the contractor is the prime on at least one government flexibly-priced contract. If yes, determine if all claimed prime contract costs are for Non-DoD agency contracts. If the contractor does not have a DoD contract, contact the Non-DoD agency to determine need for the incurred cost audit. If all claimed costs are for subcontracts, contact the cognizant DCAA office(s) of the upper-tier contractor to determine the need for assist audit(s). Coordinate with Field Detachment if the schedules contain any classified contract(s) and/or subcontract(s); mutual agreement regarding the completeness and accuracy of the incurred cost proposal should occur before accepting the proposal as adequate. Determine if the contractor is using a blending of compensation caps approach to account for compensation costs in accordance with FAR 31.205-6(p). If using a blending approach, the audit team should contact the Administrative Contracting Officer (ACO) to notify them that the submission includes a blending approach. In some cases, the audit team may already be engaged with the ACO on working to execute an advance agreement, but if not, the audit team should notify the ACO that an advance agreement is needed in accordance with the DDP Memorandum, “Use of Blended Rates to Implement Multiple Compensation Caps” (October 25, 2014). The audit team should offer to support the ACO’s execution of an advance agreement by performing a non-audit service under activity code 23600 (discussed in detail in MRD 16-PSP-005(R)). The audit team will still perform the adequacy assessment.

- 2. DEFENSE CONTRACT AUDIT AGENCY CHECKLIST FOR DETERMINING ADEQUACY OF CONTRACTOR INCURRED COST PROPOSAL Incurred Cost Adequacy (2/7) Version 3.1, dated June 2016 Received Adequate Sch Final Indirect Cost Rate Proposal Y/N/NA Y/N Comments A Summary of All Claimed Indirect Expense Rates, Including Pool, Base, and Calculated Indirect Rate. 1. Did the contractor identify all claimed pools, bases, and rates, including COM (if applicable)? 2. Did the contractor provide a cost schedule for each final indirect pool claimed on Schedule A (Schedules B and C)? 3. Did the contractor provide a cost schedule for each intermediate cost pool claimed on Schedule A (Schedule D)? 4. Do total pool amounts from Schedule A tie to the total claimed expenses on Schedules B and C? 5. Do base amounts from Schedule A for intermediate cost pools tie to the base amounts on Schedule D? 6. Do base amounts from Schedule A for final pools tie to the base amounts on Schedule E? B General & Administrative (G&A) Expenses (Final Indirect Cost Pool) 7. Do total G&A pool costs tie to Schedule H? 8. Did the contractor include explanatory notes for any amounts contained in an adjustment column or amounts omitted from the claim? 9. Do the intermediate allocations appear on source schedules (e.g., Schedule B intermediate allocation amounts to Schedule D allocations)? 10. Was the applicable fringe and overheads applied to the IR&D/B&P? C Overhead Expenses (Final Indirect Cost Pool) 11. Do total OH pool costs for each pool tie to Schedule H? 12. Did the contractor include explanatory notes for any amounts contained in an adjustment column or amounts omitted from the claim? 13. Do the intermediate allocations appear on source schedules (e.g., Schedule C intermediate

- 3. DEFENSE CONTRACT AUDIT AGENCY CHECKLIST FOR DETERMINING ADEQUACY OF CONTRACTOR INCURRED COST PROPOSAL Incurred Cost Adequacy (3/7) Version 3.1, dated June 2016 Received Adequate Sch Final Indirect Cost Rate Proposal Y/N/NA Y/N Comments allocation amounts to Schedule D allocations)? D Occupancy Expenses (Intermediate Indirect Cost Pool(s)) 14. Did the contractor include explanatory notes for any amounts contained in an adjustment column or amounts omitted from the claim? 15. Do the intermediate allocations appear on source schedules (e.g., Schedule D intermediate allocations to Schedule B allocation amounts)? 16. Does the schedule identify (1) the allocation base by recipient, (2) the percentage of the total base for each recipient, and (3) the dollars allocated to each recipient? E Claimed Allocation Bases by Element of Cost, Used to Distribute Indirect Costs 17. Does the schedule include an explanation of each base? 18. Do base amounts show individual cost elements that tie with costs on referenced schedules and include explanatory notes (e.g., direct cost elements in bases tie to Schedule H totals)? F Facilities Capital Cost of Money Factors Computation 19. Do the allocation bases used match corresponding allocation bases claimed in Schedule A? 20. Did the contractor calculate a separate COM rate (if applicable) for each final indirect pool? G Reconciliation of Books of Account and Claimed Direct Costs by Major Costs Element 21. Do the direct cost amount per general ledger column tie to Schedule H? 22. Did the contractor include explanatory notes for any amounts contained in an adjustment column or amounts omitted from the claim? H Schedule of Direct Costs by Contract and Subcontract and Indirect Expense Applied at

- 4. DEFENSE CONTRACT AUDIT AGENCY CHECKLIST FOR DETERMINING ADEQUACY OF CONTRACTOR INCURRED COST PROPOSAL Incurred Cost Adequacy (4/7) Version 3.1, dated June 2016 Received Adequate Sch Final Indirect Cost Rate Proposal Y/N/NA Y/N Comments Claimed Rates as well as a Subsidiary Schedule of Government Participation Percentages in Each of the Allocation Base Amounts. 23. Are the flexibly priced contracts and subcontracts, including commercial T&M, listed by contract and subtotaled by contract type? (Note: FFP and other commercial contracts may be shown on one summary line each) 24. Do subcontract costs incurred/claimed by contract tie to Schedule J? 25. Is the cost detail in the same level used for billing costs (e.g., by delivery order)? 26. Were indirect expenses calculated using claimed rates from Schedule A? 27. Is the Government participation calculated for each indirect expense pool? 28. Do base amounts used for calculating Government participation tie to Schedules E and H? I Schedule of Cumulative Direct and Indirect Costs Claimed and Billed by Contract and Subcontract 29. Is the cost detail in the same level used for billing costs (e.g., by delivery order)? 30. Do FY claimed dollars tie to Schedule H for cost type contracts? 31. Do FY claimed dollars tie to Schedule K (not Sch. H) for T&M contracts? 32. Are prior years settled total costs the same as the prior year’s Cumulative Allowable Cost Worksheet? 33. Are contracts identified as physically complete reported on Schedule O? J Subcontract Information 34. Does the schedule include all types of subcontracts (e.g., cost-type, T&M/LH, IDIQ with a variable element, and FFP) and inter- company costs claimed by the contractor on flexibly priced prime contracts and/or upper-tier subcontracts? 35. Did the contractor include all of the detail for

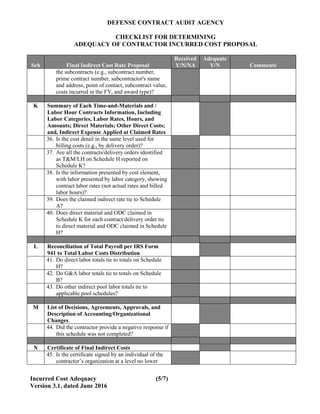

- 5. DEFENSE CONTRACT AUDIT AGENCY CHECKLIST FOR DETERMINING ADEQUACY OF CONTRACTOR INCURRED COST PROPOSAL Incurred Cost Adequacy (5/7) Version 3.1, dated June 2016 Received Adequate Sch Final Indirect Cost Rate Proposal Y/N/NA Y/N Comments the subcontracts (e.g., subcontract number, prime contract number, subcontractor's name and address, point of contact, subcontract value, costs incurred in the FY, and award type)? K Summary of Each Time-and-Materials and / Labor Hour Contracts Information, Including Labor Categories, Labor Rates, Hours, and Amounts; Direct Materials; Other Direct Costs; and, Indirect Expense Applied at Claimed Rates 36. Is the cost detail in the same level used for billing costs (e.g., by delivery order)? 37. Are all the contracts/delivery orders identified as T&M/LH on Schedule H reported on Schedule K? 38. Is the information presented by cost element, with labor presented by labor category, showing contract labor rates (not actual rates and billed labor hours)? 39. Does the claimed indirect rate tie to Schedule A? 40. Does direct material and ODC claimed in Schedule K for each contract/delivery order tie to direct material and ODC claimed in Schedule H? L Reconciliation of Total Payroll per IRS Form 941 to Total Labor Costs Distribution 41. Do direct labor totals tie to totals on Schedule H? 42. Do G&A labor totals tie to totals on Schedule B? 43. Do other indirect pool labor totals tie to applicable pool schedules? M List of Decisions, Agreements, Approvals, and Description of Accounting/Organizational Changes. 44. Did the contractor provide a negative response if this schedule was not completed? N Certificate of Final Indirect Costs 45. Is the certificate signed by an individual of the contractor’s organization at a level no lower

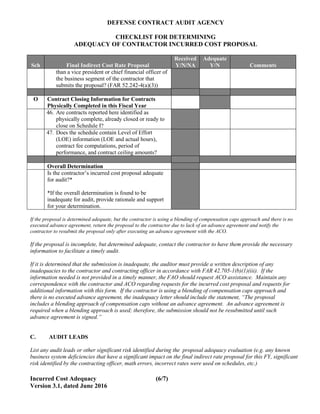

- 6. DEFENSE CONTRACT AUDIT AGENCY CHECKLIST FOR DETERMINING ADEQUACY OF CONTRACTOR INCURRED COST PROPOSAL Incurred Cost Adequacy (6/7) Version 3.1, dated June 2016 Received Adequate Sch Final Indirect Cost Rate Proposal Y/N/NA Y/N Comments than a vice president or chief financial officer of the business segment of the contractor that submits the proposal? (FAR 52.242-4(a)(3)) O Contract Closing Information for Contracts Physically Completed in this Fiscal Year 46. Are contracts reported here identified as physically complete, already closed or ready to close on Schedule I? 47. Does the schedule contain Level of Effort (LOE) information (LOE and actual hours), contract fee computations, period of performance, and contract ceiling amounts? Overall Determination Is the contractor’s incurred cost proposal adequate for audit?* *If the overall determination is found to be inadequate for audit, provide rationale and support for your determination. If the proposal is determined adequate, but the contractor is using a blending of compensation caps approach and there is no executed advance agreement, return the proposal to the contractor due to lack of an advance agreement and notify the contractor to resubmit the proposal only after executing an advance agreement with the ACO. If the proposal is incomplete, but determined adequate, contact the contractor to have them provide the necessary information to facilitate a timely audit. If it is determined that the submission is inadequate, the auditor must provide a written description of any inadequacies to the contractor and contracting officer in accordance with FAR 42.705-1(b)(1)(iii). If the information needed is not provided in a timely manner, the FAO should request ACO assistance. Maintain any correspondence with the contractor and ACO regarding requests for the incurred cost proposal and requests for additional information with this form. If the contractor is using a blending of compensation caps approach and there is no executed advance agreement, the inadequacy letter should include the statement, “The proposal includes a blending approach of compensation caps without an advance agreement. An advance agreement is required when a blending approach is used; therefore, the submission should not be resubmitted until such advance agreement is signed.” C. AUDIT LEADS List any audit leads or other significant risk identified during the proposal adequacy evaluation (e.g. any known business system deficiencies that have a significant impact on the final indirect rate proposal for this FY, significant risk identified by the contracting officer, math errors, incorrect rates were used on schedules, etc.)

- 7. DEFENSE CONTRACT AUDIT AGENCY CHECKLIST FOR DETERMINING ADEQUACY OF CONTRACTOR INCURRED COST PROPOSAL Incurred Cost Adequacy (7/7) Version 3.1, dated June 2016 Audit Lead Reference D. CORRESPONDENCE The contractor should be notified in writing of the need for additional information with a copy to the ACO. If the needed information is not provided in a timely manner, the FAO should request ACO assistance. Date of Request Information Requested Date Information Received Note: Attach any correspondence with the contractor regarding requests for the incurred cost proposal, requests for additional information if the proposal is not complete, and/or returning an inadequate proposal.