Harkirat fm assignment

- 1. TOPIC: COST OF CAPITAL Submitted towards the partial fulfillment of the requirement for the degree of MASTERS OF BUSINESS ADMINISTRATION MBA Batch 2012 ÔÇô 2014 Submitted to: Submitted by: Dr. DHEERAJ SHARMA Harkirat Brar(120425709) MBA 1st Year Section F SCHOOL OF MANAGEMENT STUDIES PUNJABI UNIVERSITY, PATIALA

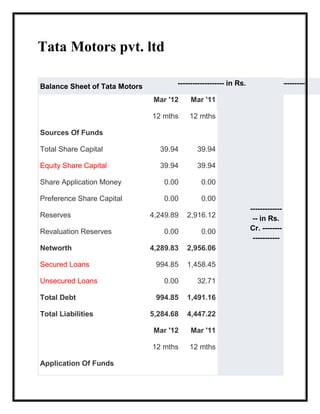

- 2. Tata Motors pvt. ltd Balance Sheet of Tata Motors ------------------- in Rs. Cr. ------------------- Mar '12 Mar '11 12 mths 12 mths Sources Of Funds Total Share Capital 39.94 39.94 Equity Share Capital 39.94 39.94 Share Application Money 0.00 0.00 Preference Share Capital 0.00 0.00 Reserves 4,249.89 2,916.12 Revaluation Reserves 0.00 0.00 Networth 4,289.83 2,956.06 Secured Loans 994.85 1,458.45 Unsecured Loans 0.00 32.71 Total Debt 994.85 1,491.16 Total Liabilities 5,284.68 4,447.22 Mar '12 Mar '11 12 mths 12 mths Application Of Funds ------------- -- in Rs. Cr. -------- -----------

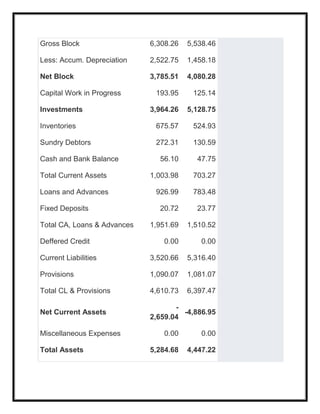

- 3. Gross Block 6,308.26 5,538.46 Less: Accum. Depreciation 2,522.75 1,458.18 Net Block 3,785.51 4,080.28 Capital Work in Progress 193.95 125.14 Investments 3,964.26 5,128.75 Inventories 675.57 524.93 Sundry Debtors 272.31 130.59 Cash and Bank Balance 56.10 47.75 Total Current Assets 1,003.98 703.27 Loans and Advances 926.99 783.48 Fixed Deposits 20.72 23.77 Total CA, Loans & Advances 1,951.69 1,510.52 Deffered Credit 0.00 0.00 Current Liabilities 3,520.66 5,316.40 Provisions 1,090.07 1,081.07 Total CL & Provisions 4,610.73 6,397.47 Net Current Assets - 2,659.04 -4,886.95 Miscellaneous Expenses 0.00 0.00 Total Assets 5,284.68 4,447.22

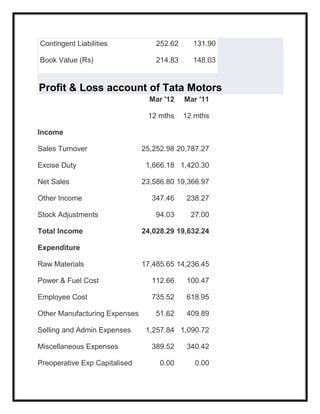

- 4. Contingent Liabilities 252.62 131.90 Book Value (Rs) 214.83 148.03 Profit & Loss account of Tata Motors Mar '12 Mar '11 12 mths 12 mths Income Sales Turnover 25,252.98 20,787.27 Excise Duty 1,666.18 1,420.30 Net Sales 23,586.80 19,366.97 Other Income 347.46 238.27 Stock Adjustments 94.03 27.00 Total Income 24,028.29 19,632.24 Expenditure Raw Materials 17,485.65 14,236.45 Power & Fuel Cost 112.66 100.47 Employee Cost 735.52 618.95 Other Manufacturing Expenses 51.62 409.89 Selling and Admin Expenses 1,257.84 1,090.72 Miscellaneous Expenses 389.52 340.42 Preoperative Exp Capitalised 0.00 0.00

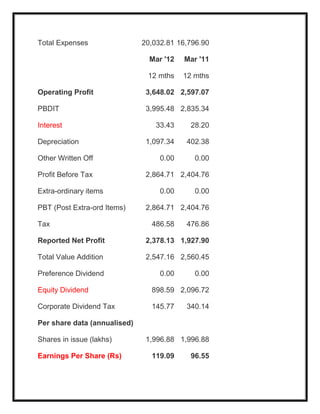

- 5. Total Expenses 20,032.81 16,796.90 Mar '12 Mar '11 12 mths 12 mths Operating Profit 3,648.02 2,597.07 PBDIT 3,995.48 2,835.34 Interest 33.43 28.20 Depreciation 1,097.34 402.38 Other Written Off 0.00 0.00 Profit Before Tax 2,864.71 2,404.76 Extra-ordinary items 0.00 0.00 PBT (Post Extra-ord Items) 2,864.71 2,404.76 Tax 486.58 476.86 Reported Net Profit 2,378.13 1,927.90 Total Value Addition 2,547.16 2,560.45 Preference Dividend 0.00 0.00 Equity Dividend 898.59 2,096.72 Corporate Dividend Tax 145.77 340.14 Per share data (annualised) Shares in issue (lakhs) 1,996.88 1,996.88 Earnings Per Share (Rs) 119.09 96.55

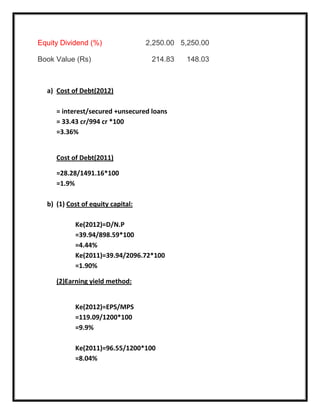

- 6. Equity Dividend (%) 2,250.00 5,250.00 Book Value (Rs) 214.83 148.03 a) Cost of Debt(2012) = interest/secured +unsecured loans = 33.43 cr/994 cr *100 =3.36% Cost of Debt(2011) =28.28/1491.16*100 =1.9% b) (1) Cost of equity capital: Ke(2012)=D/N.P =39.94/898.59*100 =4.44% Ke(2011)=39.94/2096.72*100 =1.90% (2)Earning yield method: Ke(2012)=EPS/MPS =119.09/1200*100 =9.9% Ke(2011)=96.55/1200*100 =8.04%

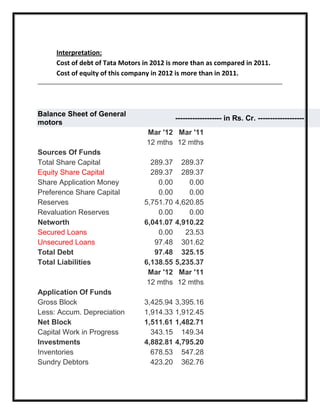

- 7. Interpretation: Cost of debt of Tata Motors in 2012 is more than as compared in 2011. Cost of equity of this company in 2012 is more than in 2011. Balance Sheet of General motors ------------------- in Rs. Cr. ------------------- Mar '12 Mar '11 12 mths 12 mths Sources Of Funds Total Share Capital 289.37 289.37 Equity Share Capital 289.37 289.37 Share Application Money 0.00 0.00 Preference Share Capital 0.00 0.00 Reserves 5,751.70 4,620.85 Revaluation Reserves 0.00 0.00 Networth 6,041.07 4,910.22 Secured Loans 0.00 23.53 Unsecured Loans 97.48 301.62 Total Debt 97.48 325.15 Total Liabilities 6,138.55 5,235.37 Mar '12 Mar '11 12 mths 12 mths Application Of Funds Gross Block 3,425.94 3,395.16 Less: Accum. Depreciation 1,914.33 1,912.45 Net Block 1,511.61 1,482.71 Capital Work in Progress 343.15 149.34 Investments 4,882.81 4,795.20 Inventories 678.53 547.28 Sundry Debtors 423.20 362.76

- 8. Cash and Bank Balance 446.49 155.45 Total Current Assets 1,548.22 1,065.49 Loans and Advances 1,744.82 3,891.66 Fixed Deposits 1,208.36 401.04 Total CA, Loans & Advances 4,501.40 5,358.19 Deffered Credit 0.00 0.00 Current Liabilities 2,925.53 2,624.35 Provisions 2,174.89 3,925.72 Total CL & Provisions 5,100.42 6,550.07 Net Current Assets -599.02 - 1,191.88 Miscellaneous Expenses 0.00 0.00 Total Assets 6,138.55 5,235.37 Contingent Liabilities 1,445.67 959.66 Book Value (Rs) 208.77 169.69 Profit and loss account Mar'12 Mar'11 Mar'10 12 Months 12 Months 12 Months Sales Turnover 20,475.74 17,386.51 12,420.95 Excise Duty 959.09 934.71 607.70 NET SALES 19,516.65 16,451.80 11,813.25 Other Income 0.00 0.00 0.00 TOTAL INCOME 19,872.38 16,859.96 11,964.37 Manufacturing Expenses 175.61 148.38 127.89 Material Consumed 14,486.09 11,882.51 8,139.51

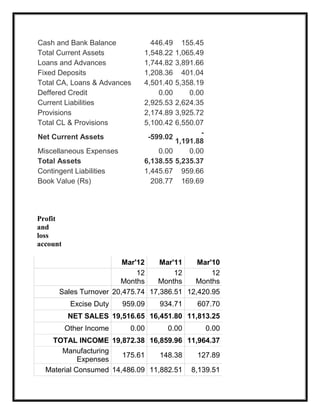

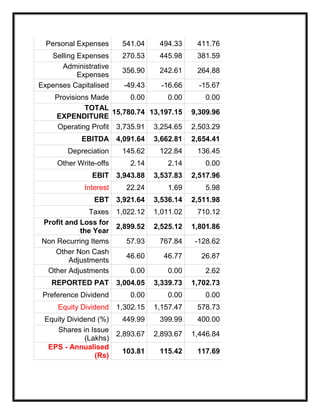

- 9. Personal Expenses 541.04 494.33 411.76 Selling Expenses 270.53 445.98 381.59 Administrative Expenses 356.90 242.61 264.88 Expenses Capitalised -49.43 -16.66 -15.67 Provisions Made 0.00 0.00 0.00 TOTAL EXPENDITURE 15,780.74 13,197.15 9,309.96 Operating Profit 3,735.91 3,254.65 2,503.29 EBITDA 4,091.64 3,662.81 2,654.41 Depreciation 145.62 122.84 136.45 Other Write-offs 2.14 2.14 0.00 EBIT 3,943.88 3,537.83 2,517.96 Interest 22.24 1.69 5.98 EBT 3,921.64 3,536.14 2,511.98 Taxes 1,022.12 1,011.02 710.12 Profit and Loss for the Year 2,899.52 2,525.12 1,801.86 Non Recurring Items 57.93 767.84 -128.62 Other Non Cash Adjustments 46.60 46.77 26.87 Other Adjustments 0.00 0.00 2.62 REPORTED PAT 3,004.05 3,339.73 1,702.73 Preference Dividend 0.00 0.00 0.00 Equity Dividend 1,302.15 1,157.47 578.73 Equity Dividend (%) 449.99 399.99 400.00 Shares in Issue (Lakhs) 2,893.67 2,893.67 1,446.84 EPS - Annualised (Rs) 103.81 115.42 117.69

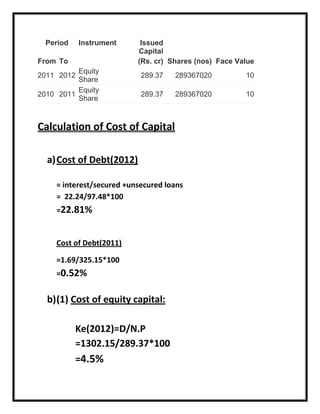

- 10. Period Instrument Issued Capital From To (Rs. cr) Shares (nos) Face Value 2011 2012 Equity Share 289.37 289367020 10 2010 2011 Equity Share 289.37 289367020 10 Calculation of Cost of Capital a)Cost of Debt(2012) = interest/secured +unsecured loans = 22.24/97.48*100 =22.81% Cost of Debt(2011) =1.69/325.15*100 =0.52% b)(1) Cost of equity capital: Ke(2012)=D/N.P =1302.15/289.37*100 =4.5%

- 11. Ke(2011)=3339.73/289.37*100 =11.54% (2)Earning yield method: Ke(2012)=EPS/MPS =103.81/1700*100 =6.1% Ke(2011)=115.42/1700*100 =6.7% Interpretation: Cost of debt of General motors in 2012 is more than i.e. 22.81% than 0.52% in 2011. It is clear from above figures that the Cost of equity capital of this company is less in 2012 than in 2011 Conclusion : By the calculation of cost of capital of General and Tata motors we can say that in 2012 Cost of debt of both the companies is more than the previous year i.e. 2011. But there is more gap in the cost of debt of Tata than the General Motors.

- 12. The cost of equity of Tata is more than the General motors.