Hb463 presentation

- 1. Preserving Our Neighborhoods: An Educational Webinar on Ohio’s Recently Passed HB463 February 21, 2017 Hosted by: Alison Goebel Executive Director Greater Ohio Policy Center

- 2. House Bill 463 Today’s Panelists: ? Jason Warner, Manager of Government Affairs, Greater Ohio Policy Center ? Adam Hewit, President, Government Solutions Group ? Robert Klein, Founder & Chairman, Community Blight Solutions ? Aaron Klein, former United States Treasury Department Deputy Assistant Secretary for Economic Policy ? Josh Harmon, Chief Environmental Specialist, Franklin County Municipal Court and President, Ohio Code Enforcement Officials Association

- 3. House Bill 463 Summary of changes enacted in House Bill 463 (Dever) Jason Warner Manager of Government Affairs, Greater Ohio Policy Center Adam Hewit President, Government Solutions Group

- 4. House Bill 463 Approved by the Ohio Legislature: December 8, 2016 Approved by Governor Kasich: January 4, 2017 Effective Date of the Law: April 6, 2017

- 5. House Bill 463 o Property Tax Exemptions on Properties Undergoing Redevelopment o Revisions to Real Property Foreclosure Process for Expedited Mortgage Foreclosures

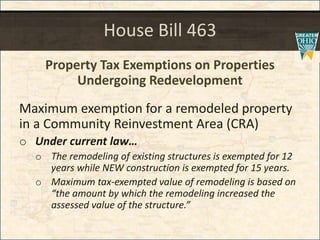

- 6. House Bill 463 Property Tax Exemptions on Properties Undergoing Redevelopment Maximum exemption for a remodeled property in a Community Reinvestment Area (CRA) o Under current law… o The remodeling of existing structures is exempted for 12 years while NEW construction is exempted for 15 years. o Maximum tax-exempted value of remodeling is based on “the amount by which the remodeling increased the assessed value of the structure.”

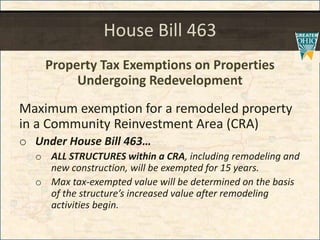

- 7. House Bill 463 Property Tax Exemptions on Properties Undergoing Redevelopment Maximum exemption for a remodeled property in a Community Reinvestment Area (CRA) o Under House Bill 463… o ALL STRUCTURES within a CRA, including remodeling and new construction, will be exempted for 15 years. o Max tax-exempted value will be determined on the basis of the structure’s increased value after remodeling activities begin.

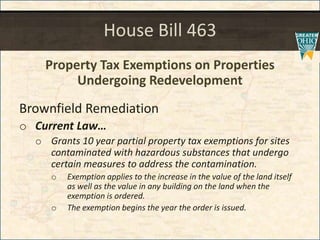

- 8. House Bill 463 Property Tax Exemptions on Properties Undergoing Redevelopment Brownfield Remediation o Current Law… o Grants 10 year partial property tax exemptions for sites contaminated with hazardous substances that undergo certain measures to address the contamination. o Exemption applies to the increase in the value of the land itself as well as the value in any building on the land when the exemption is ordered. o The exemption begins the year the order is issued.

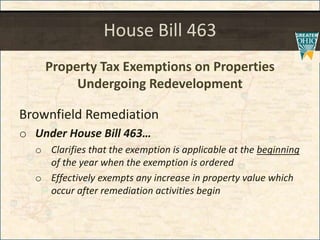

- 9. House Bill 463 Property Tax Exemptions on Properties Undergoing Redevelopment Brownfield Remediation o Under House Bill 463… o Clarifies that the exemption is applicable at the beginning of the year when the exemption is ordered o Effectively exempts any increase in property value which occur after remediation activities begin

- 10. House Bill 463 Revisions to Real Property Foreclosure Process for Expedited Mortgage Foreclosures Property Taxes o Current Law… o Plaintiffs may approve or disapprove property charges being taken out of the sale proceeds of foreclosed properties o The Officer conducting the sale determines whether the property charges may be taken out of the sale proceeds, subject to the plaintiffs approval

- 11. House Bill 463 Revisions to Real Property Foreclosure Process for Expedited Mortgage Foreclosures Property Taxes o Under House Bill 463… o The Judgement Creditor may approve or disapprove property charges being taken out of the sale proceeds of foreclosed properties o The Court conducting the sale determines whether the property charges may be taken out of the sale proceeds, subject to the judgement creditor’s approval

- 12. House Bill 463 Revisions to Real Property Foreclosure Process for Expedited Mortgage Foreclosures Expedited Hearings o Current Law… o Silent on the type of hearing which must be held to proceed on a foreclosure action in an expedited manner

- 13. House Bill 463 Revisions to Real Property Foreclosure Process for Expedited Mortgage Foreclosures Expedited Hearings o Under House Bill 463… o Specifies that the hearing on whether to proceed on a foreclosure action in an expedited manner must be oral hearings

- 14. House Bill 463 Revisions to Real Property Foreclosure Process for Expedited Mortgage Foreclosures Fees o Current Law… o Purchasers of expedited mortgage foreclosed real property must pay recording fees and associated costs

- 15. House Bill 463 Revisions to Real Property Foreclosure Process for Expedited Mortgage Foreclosures Fees o Under House Bill 463… o Eliminates the requirement the purchaser pay recording fees and associated costs

- 16. House Bill 463 Revisions to Real Property Foreclosure Process for Expedited Mortgage Foreclosures Minimum Bids o Current Law… o No set minimum bid for expedited mortgage foreclosure sales

- 17. House Bill 463 Revisions to Real Property Foreclosure Process for Expedited Mortgage Foreclosures Minimum Bids o Under House Bill 463… o For foreclosure sales initiated by a county prosecutor, sets a minimum bid for the sale to be equal to the total amount of unpaid taxes and court costs

- 18. House Bill 463 Revisions to Real Property Foreclosure Process for Expedited Mortgage Foreclosures Minimum Bids o Under House Bill 463… o If the amount is greater than the properties apprised value, the court is required to determine the minimum bid, which cannot exceed the apprised value o The county auditor must discharge unpaid taxes and costs if sold for less than those amounts

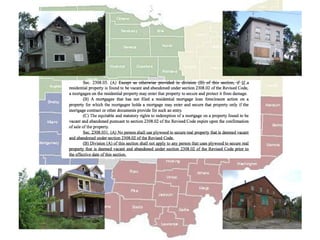

- 19. House Bill 463 Revisions to Real Property Foreclosure Process for Expedited Mortgage Foreclosures Plywood o Under House Bill 463… o Prohibits the use of plywood to secure real property that is deemed vacant and abandoned under continuing law; the prohibition does not apply to persons that used plywood prior to the effective date of the bill.

- 20. House Bill 463 Robert Klein Founder & Chairman Community Blight Solutions

- 21. Increasing Value By Improving How Vacant Properties are Secured Aaron Klein Former Deputy Assistant Secretary U.S. Treasury Department Chief Economist, Senate Banking, Housing, and Urban Affairs Committee

- 22. Vacant and Abandoned Homes ? 1.3 Million vacant residential homes ? Each vacant building imposes costs – Loss of value to the property itself – Loss of value to neighbors – Increase in crime and fire – Increase in police and fire department costs

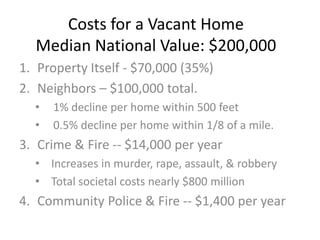

- 23. Costs for a Vacant Home Median National Value: $200,000 1. Property Itself - $70,000 (35%) 2. Neighbors – $100,000 total. ? 1% decline per home within 500 feet ? 0.5% decline per home within 1/8 of a mile. 3. Crime & Fire -- $14,000 per year ? Increases in murder, rape, assault, & robbery ? Total societal costs nearly $800 million 4. Community Police & Fire -- $1,400 per year

- 24. How You Secure the Building Matters Plywood Clearboard

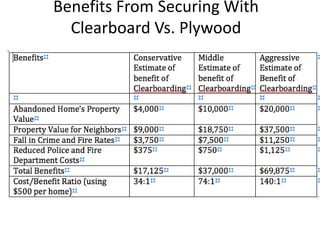

- 25. Benefits From Securing With Clearboard Vs. Plywood

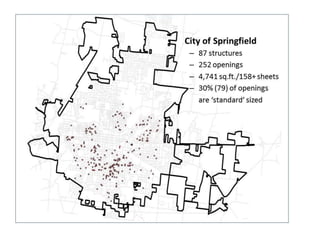

- 28. City of Springfield – 87 structures – 252 openings – 4,741 sq.ft./158+ sheets – 30% (79) of openings are ‘standard’ sized

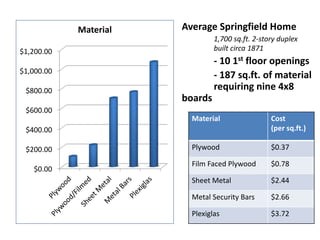

- 29. Average Springfield Home 1,700 sq.ft. 2-story duplex built circa 1871 - 10 1st floor openings - 187 sq.ft. of material requiring nine 4x8 boards $0.00 $200.00 $400.00 $600.00 $800.00 $1,000.00 $1,200.00 Material Material Cost (per sq.ft.) Plywood $0.37 Film Faced Plywood $0.78 Sheet Metal $2.44 Metal Security Bars $2.66 Plexiglas $3.72

- 31. House Bill 463 Questions? Please type these into the Questions function in the webinar panel that appears on the right side of your screen

- 32. House Bill 463 For more resources on how to stabilize neighborhoods and communities, register for GOPC’s upcoming Summit, Investing in Ohio’s Future, March 7th and 8th in Columbus. greaterohio.wixsite.com/2017-summit greaterohio.org

Editor's Notes

- #27: By way of introduction, the Ohio Code Enforcement Officials Association, or OCEOA for short, is a non-profit, professional association for property maintenance, health, safety, and zoning code enforcement officers and agencies. We primarily focus on the education needs and technical support of our local members and their respective communities and so our interest and role in this conversation and for the overall future of this legislation is rather specific and cautionary.

- #28: The one particular section of House Bill 463 that has drawn such interest from our members – relates to section 2308.031 (A) – which is the provision regarding the prohibition on the use of plywood for securing structures foreclosed under the fast-track foreclosure section. As we have already heard, there are both a significant anecdotal and empirical evidence that the number of vacant properties in our communities have both economic and social costs for our communities. Though federal and state funded initiatives over the past decade or so have focused on reducing the volume of chronically vacant structures through demolition, the reality is that vacant properties will remain an issue in many of Ohio’s communities for decades. Even the most conservative of figures place the number of vacant and abandoned residential units in the tens of thousands, not to mention vacant commercial and industrial sites. And as we all know, properties become vacant for a number of reasons and can remain that way for different time periods, but whether it is the result of a house fire; the death of a homeowner; the foreclosure of a mortgage; or just general neglect -- properties in all our communities can become vacant and require securing. And while this legislation specifically applies to structures that become the subject of fast-track foreclosure initiated under ORC 2308 – this reality and the research being offered - make the topic of alternative methods for securing a vacant property a source of conversation that we should not shy away from. We know the prevailing method for securing vacant structures is plywood, and that the potential costs of alternatives can become an issue that many of our smaller communities are not ready to digest, but let’s take a quick look at an example community and one project in particular to put this question in context.

- #29: So in preparing for this conversation, we took a quick look at one traditional Ohio community. The City of Springfield has historically been a bellwether community for many of the issues facing our state. And it is in that vein I wanted to briefly look at some of the specific impacts of this legislative change on both the immediate future and what it would mean should our communities consider expanding this blight-mitigation philosophy to other types of vacant property securing methods – and also offer some thoughts and considerations for future modifications to these initiatives. In 2016 alone, this small middle-class community effected the boarding of 87 structures. That accounts for 252 separate openings, using 4,741 square feet of plywood. A review of the available data for each structure, shows that on average 30% of openings have a common/standard size – this type of standardization can become important when looking at overall abatement costs and material-needs. In 2016 a little over $20,000 was spent securing these 87 structure; accounting for 1/10th the annual abatement budget for weeds/grass cutting, junk/debris removal, and demolition in this city of 60,000 residents.

- #30: Taking a note from our coastal communities – we know there are alternatives to plywood for securing structures. Each has its benefits and challenges – and so we looked at an average randomnly selected structure from the 2016 list and found a 1,700 square foot duplex that was built around 1871. This structure had 10 openings that were accessible from the first floor and which required securing. Under the current system – plywood boards were used and the material costs alone were $106.56 ($0.37 per square foot) – the costs/pricing I am referencing are prices available through either the local Lowes/Home Depot and/or vendors that supply these materials currently. If we were to obtain a film-covered plywood (similar to the disguised plywood boards that were the rave several years ago) we would see a cost of about $224.64 roughly $0.78 per square foot If we were to obtain a sheet metal covering we would see a cost of about $556.32 being roughly $2.44 per square foot. Metal security bars would cost roughly $766.08 at a little over $2.66 per square foot. If we were to obtain plexiglas material from a supplier like Lowes we would spend $1,071.36 about $3.72 per square foot on materials. I’m sure these higher material costs will come down as demand increases; and while I will defer to my fellow panelists to discuss the benefits and long-term cost-savings of these more expensive products. And before I go through my last side and give up the floor – I want to underscore that many of our members and myself personally see great value and potential in the future use of these newer products and believe that their strategic use can improve community safety and resilience. But we must be mindful of the full costs and impact of future changes.

- #31: In my last minute or two I want to discuss the future consideration that we at the Ohio Code Enforcement Association humbly suggest our communities leaders and legislators evaluate when determining the effectiveness of this law and future legislative amendments. The use of these newer polycarbonate materials provides an opportunity to divert materials from the waste stream as we see potential for upwards of 30% of materials being salvage and reused in future structure securing efforts. We must evaluate and work with local communities and code development entities to ensure that our model building-safety codes, local ordinances, and government abatement contracts do not conflict with these provisions in the dictation of permissible materials; both in this current application and any future local expansions. We must make sure that local emergency personnel have adequate training and awareness on methods for gaining entry to structures secured with these new products. We must be cognizant of potential needs for exemptions and exclusions associated with insurance claims and natural disasters. These alternative products and methods for securing vacant and abandoned structures, when used strategically, can truly be tools for reclaiming our communities that have seen blight run rampant – but I encourage all communities listening to this presentation to consider evaluating your existing practices and ordinances - see how you can encourage the use of these types of smart redevelopment tool in your own community.