Home Warranty Modeling

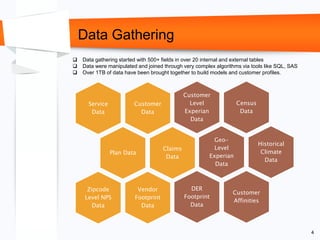

- 1. Data Gathering 4 Customer Data Service Data Plan Data Claims Data Vendor Footprint Data Zipcode Level NPS Data Census Data Customer Level Experian Data Geo- Level Experian Data Historical Climate Data Customer Affinities DER Footprint Data  Data gathering started with 500+ fields in over 20 internal and external tables  Data were manipulated and joined through very complex algorithms via tools like SQL, SAS  Over 1TB of data have been brought together to build models and customer profiles.

- 2. Segmentation Scoring 4 Value-Based Segmentation Under Current Plan Had Maintenance Done in Last 36 Mos (4) No Maintenance Done in Last 36 Mos (2) Not Under Current Plan Had Maintenance Done in Last 36 Mos (3) No Maintenance Done in Last 36 Mos (1) Attitudinal Segmentation Age Dwelling Type County Urbanicity Gender Length of Residence Yrs of Education  Value-based segmentation is built using plan penetration and maintenance history  Segment 4 has historically been the highest value segment  91% of Customers are not in a plan and have not had maintenance done in the past 36 months  38% of Customers have a plan, but no maintenance over the past 36 months  Attitudinal-based segmentation is built using customer and housing demographics and over 100 lines of code  Sustainable Self-Reliants have historically been the highest value segment  45% of Customers are in the Do-it-For- Me segment  53% of Customers are in the Do-it-For- Me segment Smart Shopper Deal Chaser Stability Seeker Do-It-For-Me Sustainable Self-reliant

- 3. Modeling Process 4 Prior to May 2014 After May 2014 History (Drivers) Ever Had a Plan? Any Claims / Services in the Last Year? Any Claims Rejected in Last 24 Months? Any Replacements in Last Year? Demographics e.g., HH Income Geographic e.g., In DER Footprint Attitudinal e.g., Promoter Logistic Modeling Engine Future (Events) Have A Active Plan? Renewed Plan? Upgraded Plan? Any a Claim/Service? Had a Replacement? Current (Predictions) Probability of Buying a Plan in Next 12 Months Probability of Renewal or Upgrade Probability to Have 1+ Services in Next 12 Months Probability to have a Replacement Given a Service in the Next 12 Months

- 4. Viginitile # Locations # Active DEPP Plans % Active Plans Plan Rate Lift (x times total) Cumulative Lift Current non- DEPP Holders Plan Probability Expected Plan (from non- plan holders) % Expected Plan Top 5% 74,721 24,148 39.8% 32.32% 8.0 8.0 50,573 29.82% 15,081 29.3% 2 74,717 8,953 14.7% 11.98% 2.9 5.4 65,764 9.93% 6,530 12.7% 3 74,720 5,368 8.8% 7.18% 1.8 4.2 69,352 7.02% 4,867 9.5% 4 74,719 4,206 6.9% 5.63% 1.4 3.5 70,513 5.65% 3,981 7.7% 5 74,733 3,425 5.6% 4.58% 1.1 3.0 71,308 4.76% 3,395 6.6% 6 74,706 2,723 4.5% 3.64% 0.9 2.7 71,983 4.10% 2,954 5.7% 7 74,719 2,186 3.6% 2.93% 0.7 2.4 72,533 3.58% 2,600 5.1% 8 74,719 1,770 2.9% 2.37% 0.6 2.2 72,949 3.15% 2,301 4.5% 9 74,720 1,666 2.7% 2.23% 0.5 2.0 73,054 2.78% 2,033 3.9% 10 74,719 1,439 2.4% 1.93% 0.5 1.8 73,280 2.45% 1,797 3.5% 11 74,719 1,327 2.2% 1.78% 0.4 1.7 73,392 2.15% 1,579 3.1% 12 74,720 1,195 2.0% 1.60% 0.4 1.6 73,525 1.87% 1,377 2.7% 13 74,719 922 1.5% 1.23% 0.3 1.5 73,797 1.60% 1,182 2.3% 14 74,719 805 1.3% 1.08% 0.3 1.4 73,914 1.32% 979 1.9% 15 74,720 549 0.9% 0.73% 0.2 1.3 74,171 0.99% 733 1.4% 16 74,768 64 0.1% 0.09% 0.0 1.2 74,704 0.13% 94 0.2% 17 74,768 0 0.0% 0.00% - 1.2 74,768 0.00% - 0.0% 18 74,707 0 0.0% 0.00% - 1.1 74,707 0.00% - 0.0% 19 74,697 0 0.0% 0.00% - 1.1 74,697 0.00% - 0.0% Bot 5% 74,656 0 0.0% 0.00% - 1.0 74,656 0.00% - 0.0% Total 1,494,386 60,746 100.0% 4.06% 1,433,640 4.07% 51,484 Sample Plan Model Performance 2  The top 5% have an active plan rate 8x the overall rate.  The top 15% of households (“Top Tier”) has a active plan rate 4x higher.  Scoring the non-plan households, Top Tier households are 3.5x more likely to take a plan

- 5. Contact Us 2 If you want to see more or chat about how JD Analytical can help your business, please contact us:  Phone: 312-533-8268  Email: jdanalytical@att.net  Facebook: www.facebook.com/jdanalytical Analytics…From Ideation to Execution