How Do You Calculate Success?

- 1. Tax Lien Mathematics How Do You Calculate Success? VADAR Systems Rob Natale, COO Jed Reitler, VP Sales Feb 27, 2015 theNTLA.com | vadarsystems.com 1 #NTLAANNUAL15 WI-FI Password: NTLA213

- 2. Lien Math Principles 1. Foundation Collecting Metrics 2. Framing Factoring State Regulations 3. Development Systemize Calculations and Processes vadarsystems.com 2

- 3. Yield Calculations Business Rules Factored Into Algorithms âĒ Interest and Accrual âĒ Penalties and Fees âĒ Premiums âĒ Redemption Periods Each State is Its Own Market vadarsystems.com 3

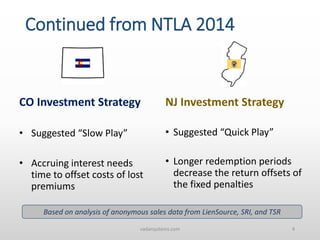

- 4. vadarsystems.com 4 Continued from NTLA 2014 CO Investment Strategy âĒ Suggested âSlow Playâ âĒ Accruing interest needs time to offset costs of lost premiums NJ Investment Strategy âĒ Suggested âQuick Playâ âĒ Longer redemption periods decrease the return offsets of the fixed penalties Based on analysis of anonymous sales data from LienSource, SRI, and TSR

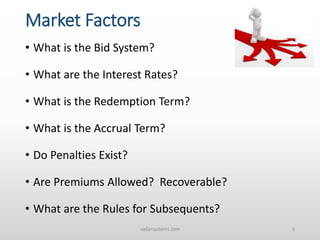

- 5. Market Factors âĒ What is the Bid System? âĒ What are the Interest Rates? âĒ What is the Redemption Term? âĒ What is the Accrual Term? âĒ Do Penalties Exist? âĒ Are Premiums Allowed? Recoverable? âĒ What are the Rules for Subsequents? vadarsystems.com 5

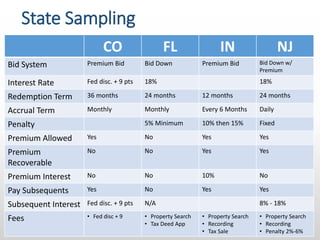

- 6. State Sampling theNTLA.com | vadarsystems.com 6 CO FL IN NJ Bid System Premium Bid Bid Down Premium Bid Bid Down w/ Premium Interest Rate Fed disc. + 9 pts 18% 18% Redemption Term 36 months 24 months 12 months 24 months Accrual Term Monthly Monthly Every 6 Months Daily Penalty 5% Minimum 10% then 15% Fixed Premium Allowed Yes No Yes Yes Premium Recoverable No No Yes Yes Premium Interest No No 10% No Pay Subsequents Yes No Yes Yes Subsequent Interest Fed disc. + 9 pts N/A 8% - 18% Fees âĒ Fed disc + 9 âĒ Property Search âĒ Tax Deed App âĒ Property Search âĒ Recording âĒ Tax Sale âĒ Property Search âĒ Recording âĒ Penalty 2%-6%

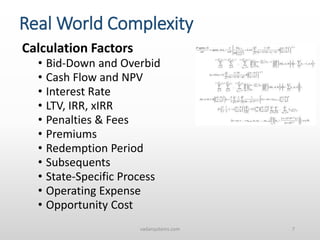

- 7. Calculation Factors âĒ Bid-Down and Overbid âĒ Cash Flow and NPV âĒ Interest Rate âĒ LTV, IRR, xIRR âĒ Penalties & Fees âĒ Premiums âĒ Redemption Period âĒ Subsequents âĒ State-Specific Process âĒ Operating Expense âĒ Opportunity Cost vadarsystems.com 7 Real World Complexity

- 8. Are You Making Money? vadarsystems.com 8 Receipt â Purchase Price Purchase Price

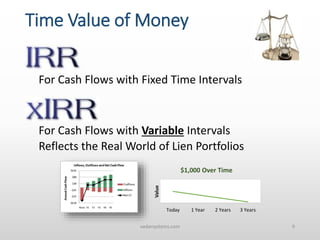

- 9. Time Value of Money For Cash Flows with Fixed Time Intervals For Cash Flows with Variable Intervals Reflects the Real World of Lien Portfolios vadarsystems.com 9 Today 1 Year 2 Years 3 Years Value $1,000 Over Time

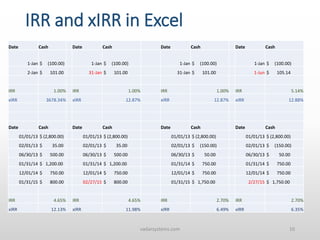

- 10. IRR and xIRR in Excel vadarsystems.com 10 Date Cash Date Cash Date Cash Date Cash 1-Jan $ (100.00) 1-Jan $ (100.00) 1-Jan $ (100.00) 1-Jan $ (100.00) 2-Jan $ 101.00 31-Jan $ 101.00 31-Jan $ 101.00 1-Jun $ 105.14 IRR 1.00% IRR 1.00% IRR 1.00% IRR 5.14% xIRR 3678.34% xIRR 12.87% xIRR 12.87% xIRR 12.88% Date Cash Date Cash Date Cash Date Cash 01/01/13 $ (2,800.00) 01/01/13 $ (2,800.00) 01/01/13 $ (2,800.00) 01/01/13 $ (2,800.00) 02/01/13 $ 35.00 02/01/13 $ 35.00 02/01/13 $ (150.00) 02/01/13 $ (150.00) 06/30/13 $ 500.00 06/30/13 $ 500.00 06/30/13 $ 50.00 06/30/13 $ 50.00 01/31/14 $ 1,200.00 01/31/14 $ 1,200.00 01/31/14 $ 750.00 01/31/14 $ 750.00 12/01/14 $ 750.00 12/01/14 $ 750.00 12/01/14 $ 750.00 12/01/14 $ 750.00 01/31/15 $ 800.00 02/27/15 $ 800.00 01/31/15 $ 1,750.00 2/27/15 $ 1,750.00 IRR 4.65% IRR 4.65% IRR 2.70% IRR 2.70% xIRR 12.13% xIRR 11.98% xIRR 6.49% xIRR 6.35%

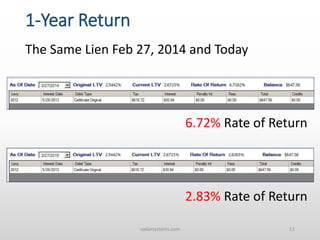

- 11. 1-Year Return The Same Lien Feb 27, 2014 and Today 6.72% Rate of Return 2.83% Rate of Return vadarsystems.com 11

- 13. âWhen you buy your first lien, you enter the lien servicing business.â vadarsystems.com 13

Editor's Notes

- #2: Agenda NOT a boring list of 29 states to list all calculations 3 Principles of Lien Mathematics State Market Factors and State Sampling Revenue is Wonderful, but Cash Flow is King (xIRR) Optimizing Your Business Intelligence

- #3: Data and Metrics: redemption AND payment âĶ 1st dollar AND final dollar State Regulations: factoring the nuances of premiums, penalties, accruals, subsequents, etc. Systemization: consistent, repeatable, efficient methodologies and processes

- #4: Interest â Fixed vs. Variable (Bid Down) Accrual â Monthly vs. Per Diem Penalties & Fees â Recoverable or Non-Recoverable Premiums â Recoverable or Non-Recoverable How do you currently account for ______? [Fee mix of recoverable and non-recoverable, different accrual rates, etc.]

- #5: Review of sale lists and assumption of redeeming full portfolios @ 1 Year, 2 Years, or Partial every 6 months for 2 Years Frank Natale, panelist and speaker

- #6: Quickly demonstrate factors and their impact on Yield calculations for every variable Set up the State Sampling of these factors and calculations

- #7: 29 States â each with different calculations Sampling â6 states to represent and encompass all variables and rules in the industry CO âLost premiums need time for interest to accrue FL â 0.25% interest is very common âĶ NJ âMajority with 0% interest âĶ 1-time flat rate penalties change the game

- #8: Framing the Valuation House considers nuances of State Lien regulations Doing more than a simple calculation of (all the money out â all the money in)

- #9: Asset Performance â Are You Making Money? Example: $100 lien and $112 redemption = 12% ROI Time Value of Money â Factoring in the Time Element and Cash Flow is crucial How close are your time-factored returns to state Interest Rates?

- #10: [Choose an image to convey TVM, variable payment, free cash flow] Lack of bias If your Return/Yield doesnât factor for irregular payment intervals, your valuation may not be accurate. xIRR â annualized yield for cash flows occurring with irregular time periods; iterative technique of cycling through changing rates

- #11: Walk through the BIG differences between IRR and xIRR The reality is Tax Lien Investments have IRREGULAR time periods of cash flow. If youâre not accounting for more than simple annualized IRR, youâre imprecise and less than credible.

- #12: A Year Before Today and Today Instant Return analysis

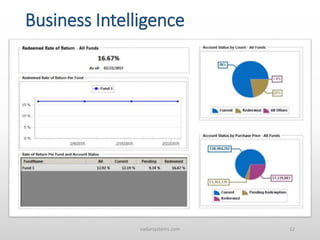

- #13: How Would Your Investment Strategy Change If Your Business Intelligence: Could Calculate xIRR from Any Time Past, Present, or Even into the Future Spent Less Time Tracking Liens and More Time Perfecting Your Investment Strategy Factored In State-Specific Processes In Addition to Business Rules Factored Your Redemption Payment Float by County or Parcel Type

- #14: Do you measure your costs of servicing? Man-hours of entry, error checking, and analysis Man-hours of notices and other paperwork Opportunity cost of servicing vs. due diligence

- #15: Thank you for your time, and we look forward to answering any questions you may have.