How to Amend/Correct/Rectify in Gst Returns

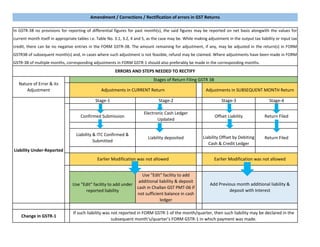

- 1. Stage-1 Stage-2 Stage-3 Stage-4 Confirmed Submission Electronic Cash Ledger Updated Offset Liability Return Filed Liability & ITC Confirmed & Submitted Liability deposited Liability Offset by Debiting Cash & Credit Ledger Return Filed Use "Edit" facility to add under reported liability Use "Edit" facility to add additional liability & deposit cash in Challan GST PMT-06 if not sufficient balance in cash ledger Change in GSTR-1 If such liability was not reported in FORM GSTR-1 of the month/quarter, then such liability may be declared in the subsequent monthŌĆÖs/quarterŌĆÖs FORM GSTR-1 in which payment was made. Liability Under-Reported Earlier Modification was not allowed Earlier Modification was not allowed Add Previous month additional liability & deposit with Interest Amendment / Corrections / Rectification of errors in GST Returns In GSTR-3B no provisions for reporting of differential figures for past month(s), the said figures may be reported on net basis alongwith the values for current month itself in appropriate tables i.e. Table No. 3.1, 3.2, 4 and 5, as the case may be. While making adjustment in the output tax liability or input tax credit, there can be no negative entries in the FORM GSTR-3B. The amount remaining for adjustment, if any, may be adjusted in the return(s) in FORM GSTR3B of subsequent month(s) and, in cases where such adjustment is not feasible, refund may be claimed. Where adjustments have been made in FORM GSTR-3B of multiple months, corresponding adjustments in FORM GSTR-1 should also preferably be made in the corresponding months. ERRORS AND STEPS NEEDED TO RECTIFY Nature of Error & its Adjustment Stages of Return Filing GSTR 3B Adjustments in CURRENT Return Adjustments in SUBSEQUENT MONTH Return

- 2. Stage-1 Stage-2 Stage-3 Stage-4 Confirmed Submission Electronic Cash Ledger Updated Offset Liability Return Filed Liability & ITC Confirmed & Submitted Liability deposited Liability Offset by Debiting Cash & Credit Ledger Return Filed Use "Edit" facility to reduce over reported liability Use "Edit" facility to reduce over-reported liability, offset correct liability with cash ledger and apply for extra amount as refund or carry forward for future liability. Change in GSTR-1 Where the liability was over reported in the monthŌĆÖs / quarterŌĆÖs FORM GSTR-1 also, then such liability may be amended through amendments under Table 9 of FORM GSTR-1 Nature of Error & its Adjustment Stages of Return Filing GSTR 3B Adjustments in CURRENT Return Adjustments in SUBSEQUENT MONTH Return Liability Over-Reported Earlier Modification was not allowed Earlier Modification was not allowed Liability may be adjusted in return of subsequent month(s) or refund may be claimed where adjustment is not feasible

- 3. Stage-1 Stage-2 Stage-3 Stage-4 Confirmed Submission Electronic Cash Ledger Updated Offset Liability Return Filed Liability & ITC Confirmed & Submitted Liability deposited Liability Offset by Debiting Cash & Credit Ledger Return Filed Use "Edit" facility to rectify wrong liability reported Use ŌĆ£EditŌĆØ facility to rectify wrongly reported liability and cash ledger may be debited to offset new liability, where sufficient balances are not available in the credit ledger. Remaining balance, if any may be either claimed as refund or used to offset future liabilities Change in GSTR-1 (Source: Circular No. 26/26/2017-GST Dated 29 December 2017 issued by GST Policy Wing of CBEC: F.No.349/164/2017/-GST) File for amendments by filling Table 9 of the subsequent monthŌĆÖs / quarterŌĆÖs FORM GSTR-1. Same process for Under-Reported ITC, Over-Reported ITC and Wrong Reported ITC be adopted Liability wrongly Reported Earlier Modification was not allowed Earlier Modification was not allowed Unreported liability may be added in the next monthŌƤs return with interest, if applicable. Also, adjustment may be made in return of subsequent month(s) or refund may be claimed where adjustment is not feasible Nature of Error & its Adjustment Stages of Return Filing GSTR 3B Adjustments in CURRENT Return Adjustments in SUBSEQUENT MONTH Return