How to calculate TDS on Flipkart Commission Invoice.

- 1. How to Calculate TDS on Commission CA Devesh Thakur For Online Sellers If, TDS is not deducted at right time* then Penalty is Greater than Normal Tax PENALTY TAXES Always

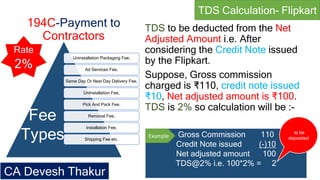

- 2. 194C-Payment to Contractors TDS to be deducted from the Net Adjusted Amount i.e. After considering the Credit Note issued by the Flipkart. Suppose, Gross commission charged is âđ110, credit note issued âđ10, Net adjusted amount is âđ100. TDS is 2% so calculation will be :- Gross Commission 110 Credit Note issued (-)10 Net adjusted amount 100 TDS@2% i.e. 100*2% = 2 Uninstallation Packaging Fee, Ad Services Fee, Same Day Or Next Day Delivery Fee, UnInstallation Fee, Pick And Pack Fee, Removal Fee, Installation Fee, Shipping Fee etc. Fee Types to be deposited TDS Calculation- Flipkart CA Devesh Thakur Example Rate 2%

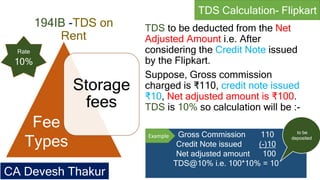

- 3. 194IB -TDS on Rent TDS to be deducted from the Net Adjusted Amount i.e. After considering the Credit Note issued by the Flipkart. Suppose, Gross commission charged is âđ110, credit note issued âđ10, Net adjusted amount is âđ100. TDS is 10% so calculation will be :- Gross Commission 110 Credit Note issued (-)10 Net adjusted amount 100 TDS@10% i.e. 100*10% = 10 Storage fees Fee Types to be deposited TDS Calculation- Flipkart CA Devesh Thakur Example Rate 10%

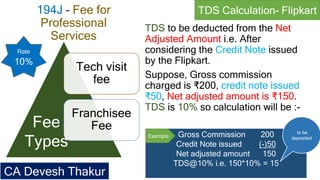

- 4. 194J â Fee for Professional Services TDS to be deducted from the Net Adjusted Amount i.e. After considering the Credit Note issued by the Flipkart. Suppose, Gross commission charged is âđ200, credit note issued âđ50, Net adjusted amount is âđ150. TDS is 10% so calculation will be :- Gross Commission 200 Credit Note issued (-)50 Net adjusted amount 150 TDS@10% i.e. 150*10% = 15 Tech visit fee Franchisee FeeFee Types to be deposited TDS Calculation- Flipkart CA Devesh Thakur Example Rate 10%

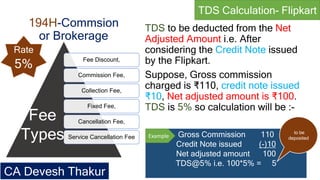

- 5. 194H-Commsion or Brokerage TDS to be deducted from the Net Adjusted Amount i.e. After considering the Credit Note issued by the Flipkart. Suppose, Gross commission charged is âđ110, credit note issued âđ10, Net adjusted amount is âđ100. TDS is 5% so calculation will be :- Gross Commission 110 Credit Note issued (-)10 Net adjusted amount 100 TDS@5% i.e. 100*5% = 5 Fee Discount, Commission Fee, Collection Fee, Fixed Fee, Cancellation Fee, Service Cancellation Fee Fee Types to be deposited TDS Calculation- Flipkart CA Devesh Thakur Example Rate 5%

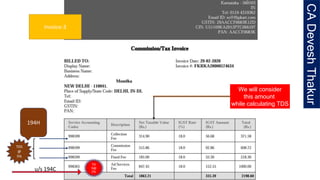

- 6. u/s 194C TDS @ 2% We will consider this amount while calculating TDS CADeveshThakur Invoice-1

- 7. u/s 194C TDS @ 2%We will consider this amount while calculating TDS Important CADeveshThakur Place of Supply Invoice-2

- 8. u/s 194C TD S@ 2% We will consider this amount while calculating TDS CADeveshThakur 194H TDS @ 5% Invoice-3

- 9. u/s 194H TDS @ 5% We will consider this amount while calculating TDS Important CADeveshThakur Invoice-4

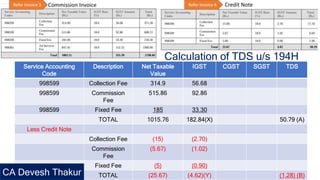

- 10. Service Accounting Code Description Net Taxable Value IGST CGST SGST TDS 998599 Collection Fee 314.9 56.68 998599 Commission Fee 515.86 92.86 998599 Fixed Fee 185 33.30 TOTAL 1015.76 182.84(X) 50.79 (A) Less Credit Note Collection Fee (15) (2.70) Commission Fee (5.67) (1.02) Fixed Fee (5) (0.90) TOTAL (25.67) (4.62)(Y) (1.28) (B) Commission Invoice Credit NoteRefer Invoice 3 Refer Invoice 4 Calculation of TDS u/s 194H CA Devesh Thakur

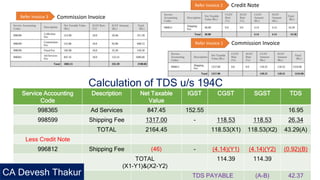

- 11. Service Accounting Code Description Net Taxable Value IGST CGST SGST TDS 998365 Ad Services 847.45 152.55 16.95 998599 Shipping Fee 1317.00 - 118.53 118.53 26.34 TOTAL 2164.45 118.53(X1) 118.53(X2) 43.29(A) Less Credit Note 996812 Shipping Fee (46) - (4.14)(Y1) (4.14)(Y2) (0.92)(B) TOTAL (X1-Y1)&(X2-Y2) 114.39 114.39 TDS PAYABLE (A-B) 42.37 Commission Invoice Credit Note Refer Invoice 3 Refer Invoice 2 Calculation of TDS u/s 194C Commission InvoiceRefer Invoice 1 CA Devesh Thakur