How to do customer KYC?

- 1. How to do customer KYC? âĒ Acceptable KYC documents âĒ Golden Gate (GG) app âĒ KYC guidelines

- 2. 2 KYC - Know Your Customer Know your customer (KYC) is the process of a business, identifying and verifying the identity of its customer Importance of KYC: ïž A mandatory document as per regulations of the Government ïž Regulations of the RBI Guidelines for any company that deals with money of customers ïž Reason for KYC is to prevent identity theft, financial fraud, money laundering and terrorist financing

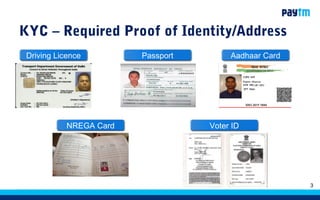

- 3. 3 KYC â Required Proof of Identity/Address Driving Licence Passport Aadhaar Card NREGA Card Voter ID

- 4. What is GG App and what is it used for? GG App GG App is also know as the Golden Gate App. It is used for completing KYC process. AA Introduction to GG App

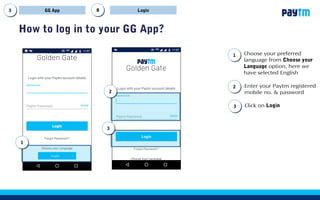

- 5. How to log in to your GG App? LoginGG App BB Enter your Paytm registered mobile no. & password Choose your preferred language from Choose your Language option, here we have selected English 11 Click on Login 22 33 22 33 11

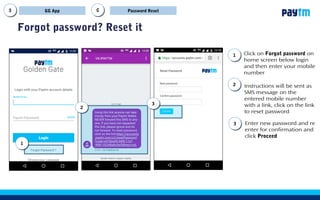

- 6. 6 Forgot password? Reset it Password ResetGG App CC Instructions will be sent as SMS message on the entered mobile number with a link, click on the link to reset password Click on Forgot password on home screen below login and then enter your mobile number 11 Enter new password and re enter for confirmation and click Proceed 22 33 11 22 33

- 7. 7 Accepting Terms & Conditions to access GG App Accept T&CGG App DD 11 Upon first login, one needs to accept the T&C to be able to access the GG app 11

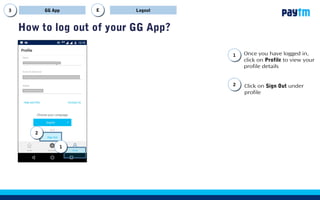

- 8. 8 How to log out of your GG App? LogoutGG App EE 11 22 Click on Sign Out under profile Once you have logged in, click on Profile to view your profile details 11 22

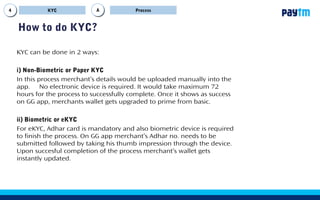

- 9. 9 How to do KYC? ProcessKYC AA KYC can be done in 2 ways: i) Non-Biometric or Paper KYC In this process merchantâs details would be uploaded manually into the app. No electronic device is required. It would take maximum 72 hours for the process to successfully complete. Once it shows as success on GG app, merchants wallet gets upgraded to prime from basic. ii) Biometric or eKYC For eKYC, Adhar card is mandatory and also biometric device is required to finish the process. On GG app merchantâs Adhar no. needs to be submitted followed by taking his thumb impression through the device. Upon succesful completion of the process merchantâs wallet gets instantly updated.

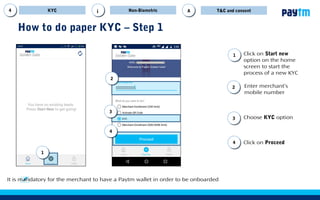

- 10. Click on Proceed Click on Start new option on the home screen to start the process of a new KYC 11 How to do paper KYC â Step 1 22 44 Choose KYC option33 Enter customerâs mobile number It is mandatory for the customer to have a Paytm wallet in order to be on-boarded Non-BiometricKYC T&CA 33 44 22 11 i

- 11. Scroll down the Terms & Conditions section 55 66 55 66 Click on Accept option at the end Non-BiometricKYC T&CAA 77 Paytm Code will be sent to customerâs mobile number through sms 77 88 88 Enter Paytm Code and click on Confirm which will be considered as customerâs consent How to do paper KYCâ Step 2 i Paytm Code is sent to customerâs mobile What should you do if Paytm code is not received on customerâs mobile?

- 12. What needs to be done if customer hasnât received OTP? Click on Pay option on Paytm App home screen 11 Click on See Instant Paytm Payment OTP 22 Use Instant Paytm Payment OTP instead of Paytm Code 33 KYC Non-Biometric T&CAAi 11 22 33

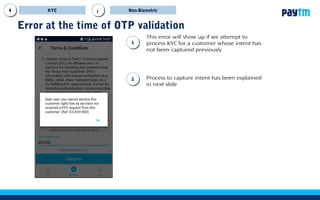

- 13. Error at the time of OTP validation 11 Upon clicking on confirm this error will show up if you attempt to process KYC for a customer whose consent has not been captured previously 22 Process to capture consent has been explained in next slide KYC Non-Biometrici

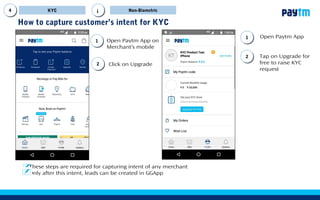

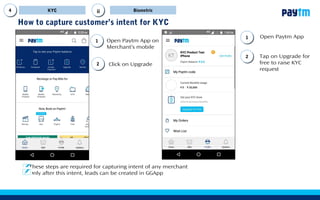

- 14. How to capture customerâs consent for KYC These steps are required for capturing intent of any customer Only after this consent, leads can be created in GGApp KYC Non-Biometrici Open Paytm App on customerâs mobile 11 Tap on Upgrade for free to raise KYC request 22 11 22

- 15. How to capture customerâs consent for KYC These steps are required for capturing consent of any customer Only after this consent, leads can be created in GGApp KYC Non-Biometricii 33 44 55 66 77 Enter the Number mentioned on the document followed by Name on the document and if Expiry Date is an option enter that 5 Click on Donât have Adhar card? Now select any one from the list of documents which customer can provide , here we have selected Passport 3 4 Now select I agree Terms & Conditions 6 Upon successful submission You will be able to see this screen. Now continue on GG App 7

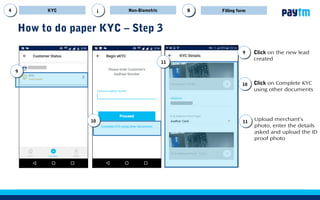

- 16. 16 How to do paper KYC â Step 3 99 Click on the new lead created Click on Complete KYC using other documents 99 11 10 1110 Upload customerâs photo, enter customerâs mobile no. from the drop down select the type of document e.g: Passport, driving license and then upload front and back photo of the document KYC Non-Biometric Filling formBBi

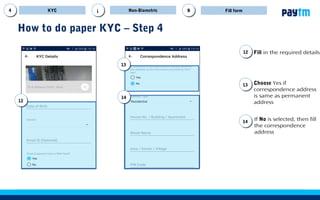

- 17. 17 How to do paper KYC â Step 4 Fill in customerâs date of birth Select gender from drop down iii 14 Enter customerâs email ID, if any 13 12 KYC Non-Biometric Fill formBBi 12 13 14 15 15a 16 15 16 Select Yes if customer has a PAN card Enter the PAN number 15b 15a 15b Select No if customer does not have PAN card On selecting No, pop up will come click Ok

- 18. 18 How to do paper KYC â Step 4 From the drop down select customerâs Marital Status From the drop down select customerâs Profession iii 19 Enter customerâs Motherâs first & last name 18 17 KYC Non-Biometric Fill formBBi 17 18 19 20 21 22 20 Select from Fatherâs Name or Spouseâs Name(applicable if married) here we have selected Fatherâs Name 21 Enter Fatherâs first & last name 22 Click Next

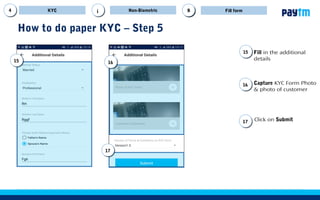

- 19. 19 How to do paper KYC â Step 5 Upload the photo of filled KYC form Upload the photo of customerâs signature 25 Make sure itâs on Version1.4 24 23 KYC Non-Biometric Fill formBBi 23 24 25 26 26 Click on Submit 27 27 Read the pop up and click Ok. Make sure not to switch of your mobile phone or sign out from GG App

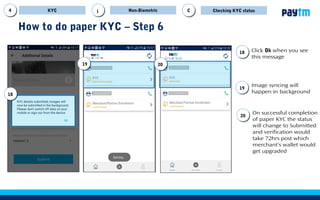

- 20. 20 How to do paper KYC â Step 6 Upon clicking on the status, pop up will show, read instruction & click Ok 29 If the images are still not submitted the status will read as Submitting Images, click on it on the status to read details 28 KYC Non-Biometric Checking KYC statusCCi 28 29

- 21. 21 How to do paper KYC â Step 6 Once images are submitted KYC status would read as Submitted 31 Click on the refresh button to sync images as directed in the pop up 30 KYC Non-Biometric Checking KYC statusCCi Within 72hrs the KYC process would complete and KYC status would read as Success and customerâs wallet would get successfully upgraded 32 30 31

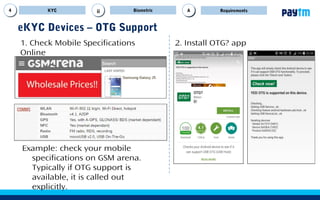

- 22. 22 eKYC Devices â OTG Support Example: check your mobile specifications on GSM arena. Typically if OTG support is available, it is called out explicitly. 1. Check Mobile Specifications Online 2. Install OTG? app KYC Biometric RequirementsAAii

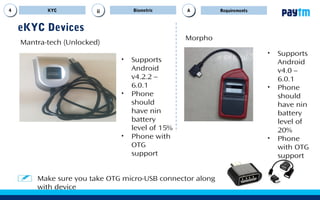

- 23. 23 eKYC Devices Mantra-tech (Unlocked) Morpho Make sure you take OTG micro-USB connector along with device âĒ Supports Android v4.2.2 â 6.0.1 âĒ Phone should have nin battery level of 15% âĒ Phone with OTG support âĒ Supports Android v4.0 â 6.0.1 âĒ Phone should have nin battery level of 20% âĒ Phone with OTG support KYC Biometric RequirementsAAii

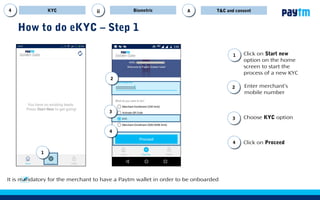

- 24. Click on Proceed Click on Start new option on the home screen to start the process of a new KYC 11 How to do eKYC â Step 1 22 44 Choose KYC option33 Enter customerâs mobile number It is mandatory for the customer to have a Paytm wallet in order to be on-boarded BiometricKYC T&CA 33 44 22 11 i

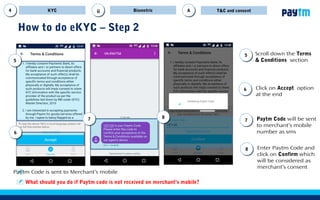

- 25. Scroll down the Terms & Conditions section 55 66 55 66 Click on Accept option at the end BiometricKYC T&CAA 77 Paytm Code will be sent to customerâs mobile number through sms 77 88 88 Enter Paytm Code and click on Confirm which will be considered as customerâs consent How to do eKYCâ Step 2 i Paytm Code is sent to customerâs mobile What should you do if Paytm code is not received on customerâs mobile?

- 26. What needs to be done if customer hasnât received OTP? Click on Pay option on Paytm App home screen 11 Click on See Instant Paytm Payment OTP 22 Use Instant Paytm Payment OTP instead of Paytm Code 33 KYC Biometric T&CAAi 11 22 33

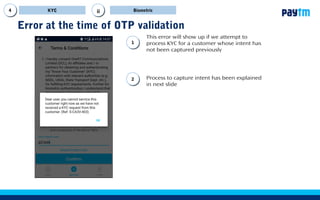

- 27. Error at the time of OTP validation 11 Upon clicking on confirm this error will show up if you attempt to process KYC for a customer whose consent has not been captured previously 22 Process to capture consent has been explained in next slide KYC Biometrici

- 28. How to capture customerâs consent for KYC These steps are required for capturing consent of any customer Only after this intent, leads can be created in GGApp KYC Biometrici Open Paytm App on customerâs mobile 11 Tap on Upgrade for free to raise KYC request 22 11 22

- 29. How to capture customerâs consent for KYC These steps are required for capturing intent of any customer Only after this consent, leads can be created in GGApp KYC Biometricii 33 44 55 66 77 Enter the Number mentioned on the document followed by Name on the document and if Expiry Date is an option enter that 5 Click on Donât have Adhar card? Now select any one from the list of documents which customer can provide , here we have selected Passport 3 4 Now select I agree Terms & Conditions 6 Upon successful submission You will be able to see this screen. Now continue on GG App 7

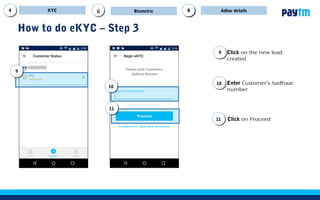

- 30. 30 How to do eKYC â Step 3 99 Click on the new lead created Enter Customerâs Aadhaar number 99 11 10 Click on Proceed 10 11 KYC Biometric Adhar detailsBBii

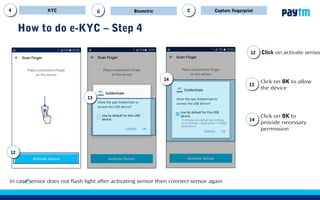

- 31. 31 How to do eKYC â Step 4 Click on activate sensor Click on OK to allow the device Click on OK to provide necessary permission 13 In case sensor does not flash light after activating sensor then connect sensor again 12 14 14 13 12 KYC Biometric Capture fingerprintCCii

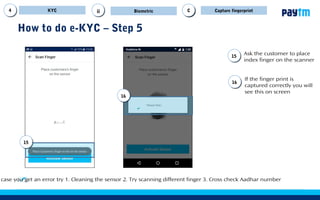

- 32. 32 How to do eKYC â Step 5 case you get an error try 1. Cleaning the sensor 2. Try scanning different finger 3. Cross check Aadhar number Ask the customer to place index finger on the scanner If the finger print is captured correctly you will see this on screen 15 15 16 16 KYC Biometric Capture fingerprintCCii

- 33. 33 How to do eKYC â Step 6 Cross check the information with the customer If details are correct click on Confirm button 17 18 17 18 KYC Biometric Confirm Adhar detailsDDii

- 34. 34 How to do paper KYC â Step 4 Fill in customerâs date of birth Select gender from drop down iii 21 Enter customerâs email ID, if any 20 19 KYC Non-Biometric Fill formBBi 19 20 21 22 22a 23 22 23 Select Yes if customer has a PAN card Enter the PAN number 22b 22a 22b Select No if customer does not have PAN card On selecting No, pop up will come click Ok

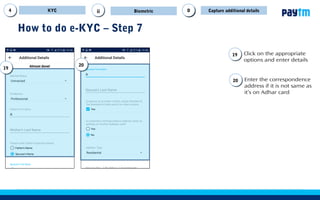

- 35. 35 How to do paper KYC â Step 4 From the drop down select customerâs Marital Status From the drop down select customerâs Profession iii 26 Enter customerâs Motherâs first & last name 25 24 KYC Non-Biometric Fill formBBi 24 25 26 27 28 29 27 Select from Fatherâs Name or Spouseâs Name(applicable if married) here we have selected Fatherâs Name 28 Enter Fatherâs first & last name 29 Click Next

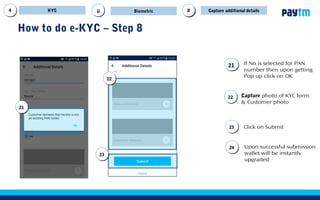

- 36. 36 How to do paper KYC â Step 5 Upload the photo of filled KYC form Upload the photo of customerâs signature 32 Make sure itâs on Version1.4 31 30 KYC Non-Biometric Fill formBBi 30 31 32 33 33 Click on Submit, upon successful submission wallet will be instantly upgraded

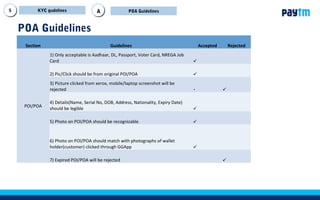

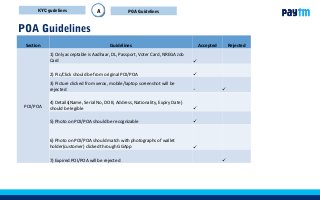

- 37. 37 POA Guidelines Section Guidelines Accepted Rejected POI/POA 1) Only acceptable is Aadhaar, DL, Passport, Voter Card, NREGA Job Card ïž 2) Pic/Click should be from original POI/POA ïž 3) Picture clicked from xerox, mobile/laptop screenshot will be rejected ï ïž 4) Details(Name, Serial No, DOB, Address, Nationality, Expiry Date) should be legible ïž 5) Photo on POI/POA should be recognizable ïž 6) Photo on POI/POA should match with photographs of wallet holder(customer) clicked through GGApp ïž 7) Expired POI/POA will be rejected ïž KYC gudelines POA GuidelinesA

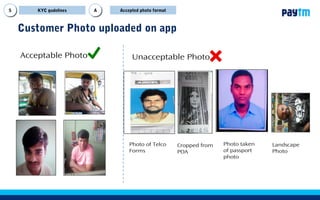

- 38. Customer Photo uploaded on app Accepted photo format Acceptable Photos Unacceptable Photos Cropped from POA Photo taken of passport photo Photo of Telco Forms Landscape Photo BBKYC gudelines

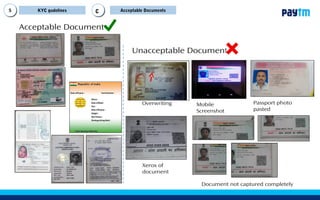

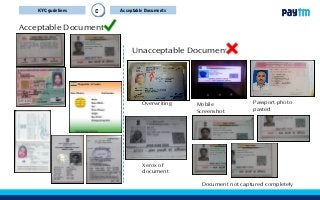

- 39. Acceptable DocumentsC Acceptable Documents Unacceptable Documents Mobile Screenshot Passport photo pasted Overwriting Document not captured completely Xerox of document KYC gudelines

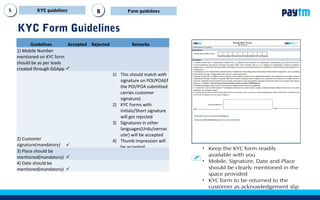

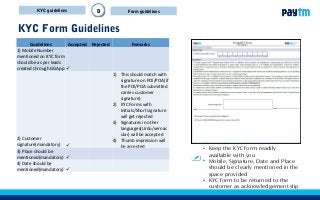

- 40. 40 KYC Form Guidelines âĒ Keep the KYC form readily available with you âĒ Mobile, Signature, Date and Place should be clearly mentioned in the space provided âĒ KYC form to be returned to the customer as acknowledgement slip Guidelines Accepted Rejected Remarks 1) Mobile Number mentioned on KYC form should be as per leads created through GGApp ïž 2) Customer signature(mandatory) ïž 1) This should match with signature on POI/POA(if the POI/POA submitted carries customer signature) 2) KYC Forms with Initials/Short signature will get rejected 3) Signatures in other languages(Urdu/vernac ular) will be accepted 4) Thumb impression will be accepted 3) Place should be mentioned(mandatory) ïž 4) Date should be mentioned(mandatory) ïž KYC guidelines Form guidelinesD

- 41. Thank you! 41