How to Fail and Win in Wealth Management

- 1. HOW TO FAIL AND WIN IN WEALTH MANAGEMENT

- 2. How to win? 1. DonŌĆÖt lose 2. Follow rule No. 1 W. Buffett

- 4. Wealth Management today ŌĆ” Low income Low risks Low income Moderate risks High income High risks

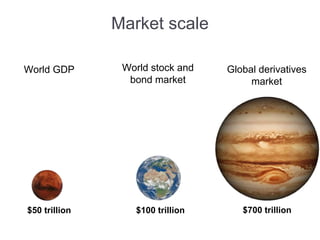

- 5. Market scale $50 trillion $100 trillion $700 trillion World GDP World stock and bond market Global derivatives market

- 6. Global Trend? vs. Manual trading Algorithmic trading ŌĆó Average Algo HF performance in 2015 was 10.8% ŌĆó >80% of trades globally are made by AlgoŌĆÖs ŌĆó Average HF performance in 2015 was 2,4% ŌĆó Manual trading is becoming more as a risk management tool for Algo strategies

- 7. TodayŌĆÖs formula of success Service provider reliability (broker, developer, bank) Personal psychological stability and discipline Right strategy and perfect timing

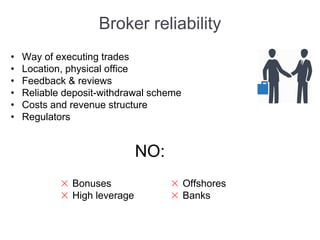

- 8. Broker reliability ŌĆó Way of executing trades ŌĆó Location, physical office ŌĆó Feedback & reviews ŌĆó Reliable deposit-withdrawal scheme ŌĆó Costs and revenue structure ŌĆó Regulators NO: Bonuses High leverage Offshores Banks

- 9. Psychological aspects ŌĆó Rules and strict discipline ŌĆó Verifiable, solid track record ŌĆó Team ŌĆó Clear strategy explanation Strategy and timing ŌĆó Standalone/diversified strategy ŌĆó Testing ŌĆó Estimated gains and risks

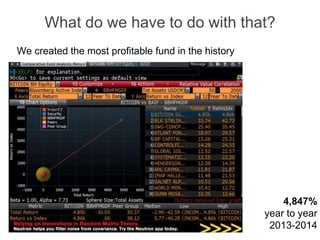

- 10. What do we have to do with that? We created the most profitable fund in the history 4,847% year to year 2013-2014

- 11. European license and MiFID regulation Guaranteed account segregation Audited by KPMG

- 12. Offices

- 14. Markets

- 15. All for Your Convenience Instruments St Op Fx Fi Bf Ft Fn Number of instruments 3k+ Bonds 7k+ Futures 10k+ Stocks 6k+ Options 200+ Funds 120+ Forex pairs Available on Customer service

- 16. Reliability and Service Category II European license issued by MFSA Malta Stock Exchange member The easiest way to purchase bonds for Malta passport

- 17. +356 20150248 ; +371 29966835 Z.A. Meierovica Blvd. 16, 4th floor, Riga, LV-1050, Latvia gp@exante.eu www.exante.eu Phone Address Email Url Guntars Pupelis Head of Sales