Hyundai capital 2024 1q Earnings release

- 2. Disclaimer This presentation and its contents have been prepared by Hyundai Capital Services, Inc. (ŌĆ£HCSŌĆØ or ŌĆ£the CompanyŌĆØ) solely for information purposes, and may not be reproduced, published, redistributed, or transferred, directly or indirectly to any other person, in whole or in part, for any purpose. The Company has not taken measures to independently verify data contained in this material. No representations or warranties, express or implied, are made as to, and no reliance should be placed on, the accuracy, fairness or completeness of the information presented or contained herein. This presentation shall not be construed as legal, tax, investment, or other advice. Financial statements in this document have been prepared in accordance with K-IFRS. Other additional contents such as market or industry information have been sourced internally or from various associations. The data contained in this presentation is current as of the date hereof, but the Company shall not be liable for any updates or verification of the contents thereafter. Certain information and statements in this presentation contain estimates and other ŌĆ£forward-looking statementsŌĆØ which should be approached with caution. The Company shall not be responsible for any losses or damages incurred based on these forward- looking statements.

- 3. Hyundai Capital Services (HCS) Leading Captive Finance Company in the Market Credit RatingsŌæĪ ŌĆó Domestic Business Portfolio Auto captive Auto maker 82.4% Auto ’┐” 17.6% Non-Auto Key FiguresŌæĀ Financial Assets 34.4 TKRW IBT 177.4 Bn KRW Shareholders ŌĆó Global A3 Baa1 Baa2 2022 2023 2024 1 Hyundai Motor Group (HMG) 99.9% ownership 59.7% 40.1% Hyundai Motor KIA ŌæĪ Rating agencies: Domestic (NICE), Global (MoodyŌĆÖs) 2022 2023 2024 AA+ AA AA- AAA ŌæĀ As of ŌĆś24.03 End

- 4. 76,814 75,809 81,760 Hyundai Motor Group (HMG) Maintaining Focus on Profitability, through Improved Regional Mix and Focus on High Value Vehicles HMG Sales Mix and Profitability ŌĆó Slight decrease in sales from temporary shutdown of production due to EV transition ŌĆó Increased share of high ASP models such as Genesis and SUV HMG Global Car SalesŌæĀ 6,666 6,845 7,306 2021 2022 2023 ŌĆó Maintaining high profitability from improved sales mix focused on high ASP models and hybrid vehicles Operating income Operating margin Revenues (T KRW) (K units) Car Sales by Region Global HMG Global Car Sales Others India EuropeŌæó North AmericasŌæĪ Korea 2 Korea North Americas Europe India HMC KIA ŌæĀ HMC, KIA Biz. Performance Report, Wholesale ŌæĪ HMC North Americas, KIA US Ōæó HMC Europe, KIA Western Europe ŌæŻ HMC Genesis+SUV, KIA RV 1,791 1,767 1Q23 1Q24 18,910 19,436 22% 13% 18% 31% 17% 1,767 1Q24 333 298 1Q23 1Q24 504 542 1Q23 1Q24 307 313 1Q23 1Q24 224 226 1Q23 1Q24 57.8% 62.8% 1Q23 1Q24 Portion of High ASP ModelsŌæŻ 66.1% 72.6% 1Q23 1Q24 HMC KIA +5.0%p +6.5%p 2.9 3.4 24 26 3.6 3.6 38 41 12.6% 13.1% 9.5% 8.7%

- 5. 2.3 1.9 1.0 0.9 3.6 3.4 3.2 3.2 0.8 1.6 1.5 1.6 0.3 0.3 0.5 0.5 7.0T 7.2T 6.2T 6.1T 2021 2022 2023 1Q24 Asset Stronger HMG Sales Support Resulted in Highest Auto Portion in 12 Years Auto Non-Auto ŌĆó New cars: Maintained asset volume despite decrease in production ŌĆó Lease: Continued growth, with focus on high ASP models ŌĆó Used cars: Offering captive financing for HMGŌĆÖs CPO business ŌĆó P-Loan: 100% X-Sell to Auto Finance Customers ŌĆó PF: Sound portfolio focused on term loan, senior tranche, metropolitan exposure (4.6%) New Car Lease Used car Portion 3 (T KRW) P-Loan Mortgage Others PF Portion (T KRW) 73.5% 73.3% 76.8% 78.7% HMG M/S 77.6% 78.3% 82.1% 82.4% P-Loan % 7.2% 5.6% 2.8% 2.5% 22.4% 21.7% 17.9% 17.6% 14.8 15.8 17.5 17.3 6.7 7.6 7.9 8.0 2.8 2.6 2.9 3.0 24.3T 26.1T 28.3T 28.4T 2021 2022 2023 1Q24

- 6. P&L Stronger Focus on Profitability Led to Income Growth Summary of Financial Statement (Bn KRW) Key Message ŌĆó Revenue increase from auto-centric asset growth (34.4T, YoY +4.4%) Lease income Operating RevenueŌæĀ Operating ExpenseŌæĪ Operating Income Interest expense Installment income IBT Bad debt expense Non-operating Income Equity Method income - Sharp increase in Installment income from enhanced product competitiveness - Lease income boosted from increased demand for high ASP vehicle leasing 30+ % ŌĆó Stable delinquency% from pre-emptive risk management ŌæĀ, ŌæĪ Excl. FX and derivatives impact Ōæó Reflects 40.5Bn KRW equity method losses by impairment assessment of HCBE after Allane acquisition ŌæŻ Reflecting reduction in corporate tax expense of 99.3Bn, due to change in the accounting treatment of deferred corporate tax following the dividend payout of HCUK, BHAF Net Income 4 SG&A 2022 3,787.0 3,311.8 474.5 711.8 583.3 1,799.8 610.5 198.3 108.8 103.8 437.1 676.0 2023 4,478.7 4,108.1 364.3 1,087.4 432.7 2,185.5 827.7 279.4 68.4 59.7Ōæó 459.9ŌæŻ 704.2 +13.9% YoY +10.4% +54.8% +16.3% +107.3% +29.4% +19.0% -15.2% +344.1% +280.9% +112.2% +8.3% 1Q23 1,053.2 954.7 96.8 254.9 85.5 488.4 186.4 66.4 -11.3 -13.4Ōæó 65.0 164.0 1Q24 1,199.7 1,054.2 149.9 296.4 177.4 581.0 241.2 56.3 27.5 24.2 137.8 177.6 1.48% 0.94% 1.04% 0.92% 0.91% 2020 2021 2022 2023 1Q24 ŌĆó Stronger focus on profitability, increase in operating income - Increased operating income from revenue growth & stabilized bad debt expense - Normalized equity method income resulting in IBT growth

- 7. Key Index Solid Financial Position Maintained Within Regulatory Guidelines Provision Funding ŌĆó Regulatory reserves managed above government guideline(100%) ŌĆó Stable funding through portfolio diversification Debt Balance 31.1T KRW 1Q24 Guideline 6M CoverageŌæĀ 130% 100% ALMŌæĪ 126% 100% Liquidity ŌĆó Stable liquidity mgmt. based on conservative internal guideline Capital Adequacy ŌĆó Leverage managed well below regulatory guideline (9x) 5 ŌĆó Leading the ESG bond market, through issuance of Green Bonds & SLB (Sustainability-linked Bonds) Asset Leverage (Asset/Equity) Regulatory Reserve Coverage ŌæĀ Total liquidity / 6M coverage ŌæĪ Average maturity of liability / Average maturity of asset 122.6% 129.4% 131.1% 131.5% 2021 2022 2023 1Q24 Domestic Bond 53% Overseas Bond 20% ABS 17% Bank 9% CP 1% USD JPY AUD CHF CNY EUR HKD SGD 7.2x 7.4x 7.2x 7.0x 2021 2022 2023 1Q24 No dividend Payout since ŌĆÖ21

- 9. 1. Financial Statements Consolidated Income Statement Consolidated Statement of Financial Position (Bn KRW) 2021 2022 2023 1Q24 Operating RevenueŌæĀ 2,941.2 3,787.0 4,478.7 1,199.7 Interest income 1,493.7 1,647.3 1,876.4 501.0 Installment income 588.8 610.5 827.7 241.2 Other interest income 904.9 1,036.8 1,048.7 259.8 Fee income 161.0 158.7 161.7 44.7 Lease income 1,109.4 1,799.8 2,185.5 581.0 Gain on sales of loan receivables 7.9 24.3 53.7 22.7 Others 169.2 156.9 201.4 50.3 Operating ExpenseŌæĪ 2,469.8 3,311.8 4,108.1 1,054.2 Interest expense 557.7 711.8 1,087.4 296.4 Fee expense 160.1 169.8 180.7 43.2 Lease expense 906.7 1,500.2 1,776.1 464.1 Bad debt expense 139.5 198.3 279.4 56.3 Loss on sales of loan receivables 0.0 2.7 2.0 0.4 SG&A 620.2 676.0 704.2 177.6 Others 85.6 53.0 78.3 16.2 Operating Income 486.1 474.5 364.3 149.9 Non-operating Income 89.1 108.8 68.4 27.5 Equity method income 71.5 103.8 59.7 24.2 IBT 575.2 583.3 432.7 177.4 Net Income 432.6 437.1 459.9 137.8 (Bn KRW) 2021 2022 2023 1Q24 Asset 34,917.1 38,647.5 39,602.0 39,518.0 Cash and deposit 525.1 1,973.3 1,136.4 799.3 Securities 2,654.4 2,743.0 3,371.4 3,688.4 Loan receivables 10,118.0 9,942.9 9,237.7 9,216.1 Installment assets 13,752.1 14,720.8 16,411.3 16,265.6 Lease receivables 2,108.3 2,044.9 2,011.3 2,032.9 Lease assets 4,559.0 5,538.1 5,876.9 5,928.4 Tangible assets 196.8 209.3 195.3 195.6 Others 1,003.3 1,475.3 1,361.7 1,391.8 Liabilities 29,710.3 33,017.8 33,565.9 33,313.9 Borrowings 28,519.1 31,399.2 31,828.8 31,654.2 Others 1,191.2 1,618.6 1,737.2 1,659.7 Equity 5,206.7 5,629.7 6,036.1 6,204.1 Capital 496.5 496.5 496.5 496.5 Capital surplus 388.6 388.6 388.6 388.6 Retained earnings 4,228.8 4,665.9 5,122.1 5,259.9 Others 92.8 78.7 28.8 59.0 ŌæĀ,ŌæĪ Excluding FX and derivatives effect

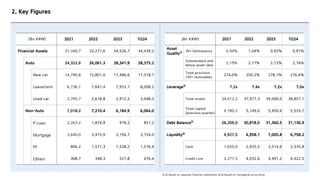

- 10. 2. Key Figures (Bn KRW) 2021 2022 2023 1Q24 Financial Assets 31,340.7 33,271.6 34,526.7 34,439.2 Auto 24,322.6 26,061.3 28,341.9 28,375.2 New car 14,790.8 15,801.0 17,496.6 17,318.7 Lease/rent 6,736.1 7,641.4 7,933.1 8,008.2 Used car 2,795.7 2,618.8 2,912.2 3,048.3 Non-Auto 7,018.2 7,210.4 6,184.9 6,064.0 P-Loan 2,263.2 1,874.9 978.2 857.2 Mortgage 3,640.0 3,415.9 3,156.7 3,154.0 PF 806.2 1,571.3 1,528.2 1,576.4 Others 308.7 348.3 521.8 476.4 (Bn KRW) 2021 2022 2023 1Q24 Asset QualityŌæĀ 30+ Delinquency 0.94% 1.04% 0.92% 0.91% Substandard and below asset ratio 2.19% 2.17% 2.12% 2.16% Total provision /30+ receivables 274.0% 250.2% 278.1% 276.6% LeverageŌæĪ 7.2x 7.4x 7.2x 7.0x Total assets 34,412.2 37,977.3 39,009.0 38,857.1 Total capital (previous quarter) 4,780.2 5,149.0 5,450.6 5,533.7 Debt BalanceŌæó 28,209.0 30,818.0 31,360.5 31,136.9 LiquidityŌæŻ 4,927.5 6,958.1 7,005.8 6,758.2 Cash 1,650.0 2,925.5 2,514.6 2,335.8 Credit Line 3,277.5 4,032.6 4,491.2 4,422.5 ŌæĀ,ŌæĪ Based on separate financial statements Ōæó,ŌæŻ Based on managerial accounting

- 11. THE END