IARU value of research apr 2012

- 1. HOW NOVOZYMES MEASURES R&D Per Falholt, EVP and Chief Scientific Officer of Novozymes A/S At International Alliance of Research Universities (IARU) workshop: The Value of Research Universities. April 2012

- 2. NOVOZYMES IN BRIEF WORLD LEADER IN BIO-INNOVATION WE GREEN THE WORLD: ? Enzymes save energy, chemicals, raw- materials and water ? Microorganisms in agriculture improve yield and reduce the need for pesticides ? In 2011, Novozymes helped customers save 45 million tons of CO2 BASED ON INNOVATION: ? 14% of sales re-invested in R&D ? 7000 patents granted or pending ? >1100 employees in R&D

- 3. Ī░If you are not keeping score, you are only practicingĪ▒ Jan Leschly Former CEO of SmithKline Beecham

- 4. But it is challenging to measure different business areas or university faculties by the same criteria...

- 5. ĪŁif the prerequisites are not the same. e.g. varying cost associated with regulatory approval of enzymes

- 6. 6 22/08/2012 NOVOZYMES PRESENTATION So how do we do it in Novozymes ? Internal Rate of Return of New Product & Concept Sales

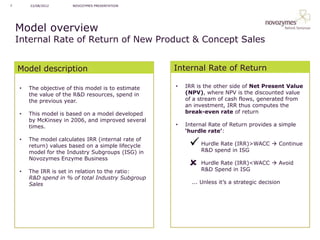

- 7. 7 22/08/2012 NOVOZYMES PRESENTATION Model overview Internal Rate of Return of New Product & Concept Sales Model description Internal Rate of Return ? The objective of this model is to estimate ? IRR is the other side of Net Present Value the value of the R&D resources, spend in (NPV), where NPV is the discounted value the previous year. of a stream of cash flows, generated from an investment, IRR thus computes the ? This model is based on a model developed break-even rate of return by McKinsey in 2006, and improved several times. ? Internal Rate of Return provides a simple Ī«hurdle rateĪ»: ? The model calculates IRR (internal rate of return) values based on a simple lifecycle ? Hurdle Ratein ISG ? R&D spend (IRR)>WACC ? Continue model for the Industry Subgroups (ISG) in Novozymes Enzyme Business ? The IRR is set in relation to the ratio: ?? Hurdle Rate (IRR)<WACC ? Avoid R&D Spend in ISG R&D spend in % of total Industry Subgroup Sales ... Unless itĪ»s a strategic decision

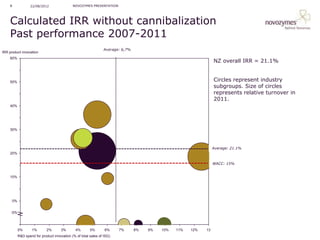

- 8. 8 22/08/2012 NOVOZYMES PRESENTATION Calculated IRR without cannibalization Past performance 2007-2011 Average: 6,7% IRR product innovation 60% NZ overall IRR = 21.1% 50% Circles represent industry subgroups. Size of circles represents relative turnover in 2011. 40% 30% Average: 21.1% 20% WACC: 15% 10% 0% -5% 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13 R&D spend for product innovation (% of total sales of ISG)

- 9. Thank you for your attention

Editor's Notes

- #3: Enzymes save energyEnzymes save chemicalsEnzymes save raw materialsEnzymes save limited resources and reduce water pollution

- #5: With industrial enzymes there is a big difference in the cost associated with regulatory approval of a animal feed enzyme, and dish washing enzyme.

- #8: - Forklar problematikken ved at anvende IRR som portef?ljev?rkt?j