IBC Presentation

- 1. THE INSOLVENCY AND BANKRUPTCY CODE, 2016 PRESENTATION BY:- ADVOCATE ASHOK JUNEJA (LLB, FCS, ACMA, DBF, ADICA, M.COM) A REGISTERED INSOLVENCY PROFESSIONAL WITH INSOLVENCY & BANKRUPTCY BOARD OF INDIA (IBBI) MANAGING PARTNER MANTRAH LAW HOUSE LLP 1302, Vijaya Building, 17 Barakhamba Road, Connaught Place, New Delhi-110001 Mobile No: +91-9810532462, 9711361479 Landline No: 011-41563467/ 43011969 Email: ashokjuneja@gmail.com

- 2. Object: The Object of the present Insolvency and Bankruptcy Code (IBC), 2016 is to consolidate the existing framework by creating a single law for Insolvency and Bankruptcy. It has replaced the long Tedious and Complex Legal Process by a speedy, expeditious and effective mechanism for recovery of dues from corporate and non-corporate sector. Earlier Mechanisms Companies Act,2013 Companies Act,1956 The recovery of debts due to banks and financial institutions act,1993 SARFAESI Act,2002 The Sick Industrial Companies (Special Provisions) Act, 1985 The Presidency Towns Insolvency Act,1909 The Provincial Insolvency Act,1920 CDR/SDR/S4A ARC New Mechanisms The Insolvency and Bankruptcy Code,2016 The Insolvency and Bankruptcy Code, 2016 will replace the existing laws pertaining to Insolvency and Bankruptcy The Insolvency and Bankruptcy Code, 2016

- 3. Insolvency and Bankruptcy Ecosystem Insolvency and Bankruptcy Board of India Insolvency Professional Agency Information Utility Adjudicating Authority Insolvency Professionals (IP) Insolvency and Bankruptcy Board of India (IBBI) • IBBI is an apex body governing Insolvency and Bankruptcy Code. • It is setting up the necessary infrastructure and accredit Insolvency Professionals (IPs) and Information Utilities (IUs) Insolvency Professionals (IPs) •IPs are licensed professionals registered with IBBI who act as resolution professional/ liquidator/ bankruptcy trustee in an insolvency resolution process. Information Utilities • Information Utilities would collect, store and distribute information related to the indebtedness of Companies Insolvency Professional Agency • Insolvency Professional Agencies (IPAs) are enrolling insolvency professionals as members. • Currently there are three IPAs: (i) ICSI Insolvency professional Agency (ii) Indian Institute of Insolvency Professionals of ICAI (iii) Insolvency professional Agency of Institute of cost Accountants of India Adjudicating Authority •Adjudicating Authorities (AA) have the exclusive jurisdiction to deal with insolvency related matters. •National Company Law Tribunal (NCLT) is the AA for Corporate and LLP insolvency •Debt Recovery Tribunal (DRT) would be AA for individual or partnership Firms insolvency. NCLT DRT

- 4. Salient features of the Insolvency and Bankruptcy Code Exclusive Jurisdiction of Adjudicating Authority Adjudicating Authority (NCLT and DRT) will have excusive jurisdiction in insolvency related matters. No injunction can be granted by any Civil Court, Tribunal or Authority in respect to action taken by Adjudicating Authority. Committee of Creditors A committee of creditors is formed and it will work intendem with Insolvency Professional. Time-bound Resolution Process The entire process should be completed in 180 days (270 days in case of extension). Appointment of Registered IPs The board of directions are suspended and creditor approved resolution professional is appointed to manage the Company as a going concern. Duties and Functions of Insolvency Professional (IP) • To make a public announcement of Insolvency process in English and Local Language Newspaper. •To manage the affairs of the company as a going concern; •To collect information relating to the assets, finances and operations of corporate debtor for determining the financial position; •To collect all claims received from creditors and assess them. •To constitute a committee of creditors (COC) etc. •To appoint two registered Valuers to evaluate the assets. •To coordinate with NCLT and IBBI.

- 5. Corporate Insolvency Resolution Process (CIRP) Default Failure to pay whole or any part or installment of the amount of debt or interest due (min INR 1 Lakh) Who Can File the Application •Financial creditors •Operational creditors (including government & employees or workmen) •Corporate debtor, member, partner, person in charge of operations or finance Interim Resolution Professional / Resolution Professional (IRP/RP) • Financial creditor and/or corporate applicant shall propose the name of an IP in the application •It is optional for the operational creditor to propose the name of an interim IP •All powers of the board and management shall vest with the IRP/IP • IP is responsible to run the company as a going conmsern during CIRP. Approve or Reject petition within 14 days Appointment to be confirmed within 30 days. Appoint the Interim Resolution Professional The Adjudication Authority File Application Default

- 6. Corporate Insolvency Resolution Process (CIRP) Committee of Creditors •Usually consists of financial creditors •Operational creditors to constitute committee when there are no financial creditors or all of them are related to corporate debtor •Will confirm or replace IRP as RP •To approve several actions of RP Resolution Plan The resolution plan must provide for operational creditors (including government & employees or workmen) •Payment of insolvency resolution process costs •Repayment of the debts of operational creditors •Management of the affairs of the borrower after plan is approved •Implementation and supervision of the approved plan. Voting Power •Only financial creditors have voting power in the committee in the ratio of debt owed. •All decisions of the committee shall be approved by 75% of financial creditors/ operational creditors, as the case may be. Continue Formation of Committee of creditors (CoC) Appointment of Interim Resolution Professional confirmed by the CoC Preparation of Resolution plan 75% of the creditors to Approve plan No Yes Application for AA approval Implement the resolution plan Compulsory Liquidation if resolution is not agreed within 180 days / extended period.

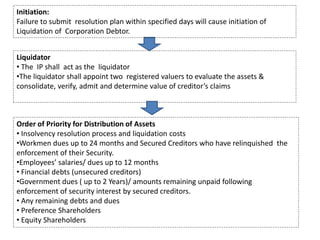

- 7. Liquidator • The IP shall act as the liquidator •The liquidator shall appoint two registered valuers to evaluate the assets & consolidate, verify, admit and determine value of creditor’s claims Order of Priority for Distribution of Assets • Insolvency resolution process and liquidation costs •Workmen dues up to 24 months and Secured Creditors who have relinquished the enforcement of their Security. •Employees’ salaries/ dues up to 12 months • Financial debts (unsecured creditors) •Government dues ( up to 2 Years)/ amounts remaining unpaid following enforcement of security interest by secured creditors. • Any remaining debts and dues • Preference Shareholders • Equity Shareholders Initiation: Failure to submit resolution plan within specified days will cause initiation of Liquidation of Corporation Debtor.

- 8. For Any Query/ Clarification Please Contact us: ADVOCATE ASHOK JUNEJA (LLB, FCS, ACMA, DBF, ADICA, M.COM) A REGISTERED INSOLVENCY PROFESSIONAL WITH INSOLVENCY & BANKRUPTCY BOARD OF INDIA (IBBI) MANAGING PARTNER MANTRAH LAW HOUSE LLP 1302, Vijaya Building, 17 Barakhamba Road, Connaught Place, New Delhi-110001 Mobile No: +91-9810532462, 9711361479 Landline No: 011-41563467/ 43011969 Email: ashokjuneja@gmail.com