ICBC Case group1 final

- 1. 1 CORPORATE EXPENSE MANAGEMENT SOLUTIONS DRIVE SAVINGS | BENEFIT EMPLOYEES | MANAGE GLOBALLY | MAXIMISE CONTROL | DRIVE SAVINGS | BENEFIT EMPLOYEES | MANAGE GLOBALLY | REAL BUSINESS. REAL SOLUTIONS.SM HKUST – SZ PT MBA ICBC International expansion Strategy Group 1 Feb 2014

- 2. Agenda • ICBC Business introduction. • Challenge on China Banking Market and opportunity in international. • ICBC current Competitive advantage and industry KSF. • How competitive advantage can help to international expansion. • Conclusion. 2

- 3. Overview 3 1984 Industrial and Commercial Bank of China Limited, formerly known as Industrial and Commercial Bank of China, was established. 2005 Wholly restructured to a joint-stock limited company 2006 Listed on SSE and SSHK 2007 Ranked as No. 1 Bank in Stock Value

- 5. Challenges from Domestic Banking Market  Interests rate Labialization  New Market entrance, incl bank with foreign capital 5 0 2 4 6 8 Deposite ( 1Y benchmark) Load(1~3Y benchmark)  The bloom of Internet Finance:  Estimated almost 800b RMB out flow from bank deposit to internet finance  It raised the carrying cost of bank’s deposit, and also cannibalize the capital fund. Net interest Margin ICBC about 2.6% Big 5 2%~2.6% TW 1% Japan 1%~1.2%

- 6. Size of price of international Market Spurred needs for migration, education and tourism. China Copr go outside. China High net worth client Investment RMB offshore business Emerging market opportunity . 2003-2006 2007-2011 State owned company Private company China Annual Value of FDI Unit: Million $ $774.7 $2048.3 $580.8 $51.3 11% 9% 11% 7% 9% 0% 5% 10% 15% Bratain Germany Singapore Italy US % Enterprises use RMB as settlement currency • In Feb 2013, ICBC Singapore branch become the 1st RMB clearing bank outside China • In the whole 2013, ICBC Singapore branch have completed 38,000 clearing settlements, the total amount arrived to 2.6 trillion RMB. • Up to 2013, The number of Chinese emigrants has reached 934.3 million • Up to 2012, Chinese students studying abroad reached 1,136,900 • In 2013 China's outbound tourism reached 98 million passengers • 60% contribution to global economy • Closed trade with China market • Low barriers to entry

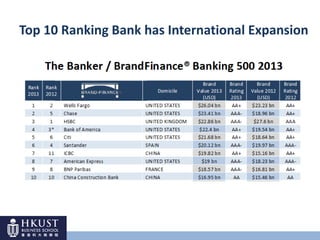

- 7. Top 10 Ranking Bank has International Expansion

- 8. Good coverage in all tiers cities High sales turnover Highest numbers of ATMs in country Good return and low risk products Capability to cope with different Customer profiles Diversified investment Matured operations Secured security system Focused talent development Motivated employees Leadership in finance solutions providers Account management High Quality Of Services Great corporate relationship Trusty brand image Capital risk management Strong IT operations in Internet and Mobile Apps Staff trainings Network coverage Cross sale capability Full Finance Solutions Win Customers’ Trust Efficient Transactions ICBC’s ACTIVITY MAP

- 9. ICBC competitive advantages in Domestic ÔÇ° Full finance solutions ÔÇ° Good network coverage (outlet, Internet and Mobile Apps) ÔÇ° Account management/customer relationship ÔÇ° Strong IT and operations ÔÇ° Capital risk management

- 10. How competitive advantage can help to ICBC International Expansion? Key Success factor for International banking Competitive advantage support Global Network and expert • Strong profit to support international expand investment. • Can focus on China related market: Import/export related Trade finance market. China Corp global expansion. Strong IT and Operation • IT and operation advantage can expand on global service. Global capital Risk management • Need to build up Cross sale capability in global account • Scale Full Finance Solution capability

- 11. Recommendation: International Expansion Domestic Market expansion: Interest income International expansion International expansion SizeofPrice Competitive advantage Strong Weak Strong Domestic Market expansion: Non Interest income Current In 5 Year

- 12. ICBC Global Banking Strategy

- 13. International Expansion Result: Good Progress

- 14. International Expansion Result: Good Progress 1.5 2 2.5 3 3.5 4 2007 2008 2009 2010 2011 2012 International Operational Income % international income

- 15. ICBC: Pride of China

- 16. Q&A

- 18. International Expansion Result: Good Progress 30%

- 19. International Expansion Result: Good Progress