IIM Calcutta Valuation Book for students.pdf

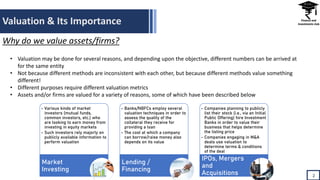

- 2. Valuation & Its Importance âĒ Valuation may be done for several reasons, and depending upon the objective, different numbers can be arrived at for the same entity âĒ Not because different methods are inconsistent with each other, but because different methods value something different! âĒ Different purposes require different valuation metrics âĒ Assets and/or firms are valued for a variety of reasons, some of which have been described below 2 Why do we value assets/firms? âĒ Various kinds of market investors (mutual funds, common investors, etc.) who are looking to earn money from investing in equity markets âĒ Such investors rely majorly on publicly available information to perform valuation Market Investing âĒ Banks/NBFCs employ several valuation techniques in order to assess the quality of the collateral they receive for providing a loan âĒ The cost at which a company can borrow/raise money also depends on its value Lending / Financing âĒ Companies planning to publicly list their stock (i.e., via an Initial Public Offering) hire Investment Banks in order to value their business that helps determine the listing price âĒ Companies engaging in M&A deals use valuation to determine terms & conditions of the deal IPOs, Mergers and Acquisitions

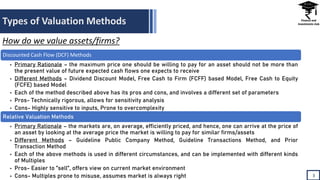

- 3. Types of Valuation Methods 3 How do we value assets/firms? Discounted Cash Flow (DCF) Methods âĒ Primary Rationale â the maximum price one should be willing to pay for an asset should not be more than the present value of future expected cash flows one expects to receive âĒ Different Methods â Dividend Discount Model, Free Cash to Firm (FCFF) based Model, Free Cash to Equity (FCFE) based Model âĒ Each of the method described above has its pros and cons, and involves a different set of parameters âĒ Pros- Technically rigorous, allows for sensitivity analysis âĒ Cons- Highly sensitive to inputs, Prone to overcomplexity Relative Valuation Methods âĒ Primary Rationale â the markets are, on average, efficiently priced, and hence, one can arrive at the price of an asset by looking at the average price the market is willing to pay for similar firms/assets âĒ Different Methods â Guideline Public Company Method, Guideline Transactions Method, and Prior Transaction Method âĒ Each of the above methods is used in different circumstances, and can be implemented with different kinds of Multiples âĒ Pros- Easier to âsellâ, offers view on current market environment âĒ Cons- Multiples prone to misuse, assumes market is always right

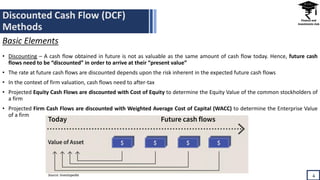

- 4. Discounted Cash Flow (DCF) Methods 4 Basic Elements âĒ Discounting â A cash flow obtained in future is not as valuable as the same amount of cash flow today. Hence, future cash flows need to be âdiscountedâ in order to arrive at their âpresent valueâ âĒ The rate at future cash flows are discounted depends upon the risk inherent in the expected future cash flows âĒ In the context of firm valuation, cash flows need to after-tax âĒ Projected Equity Cash Flows are discounted with Cost of Equity to determine the Equity Value of the common stockholders of a firm âĒ Projected Firm Cash Flows are discounted with Weighted Average Cost of Capital (WACC) to determine the Enterprise Value of a firm Source: Investopedia

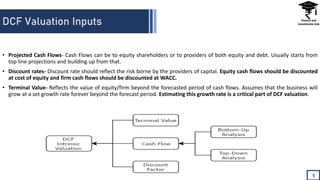

- 5. DCF Valuation Inputs 5 âĒ Projected Cash Flows- Cash Flows can be to equity shareholders or to providers of both equity and debt. Usually starts from top line projections and building up from that. âĒ Discount rates- Discount rate should reflect the risk borne by the providers of capital. Equity cash flows should be discounted at cost of equity and firm cash flows should be discounted at WACC. âĒ Terminal Value- Reflects the value of equity/firm beyond the forecasted period of cash flows. Assumes that the business will grow at a set growth rate forever beyond the forecast period. Estimating this growth rate is a critical part of DCF valuation.

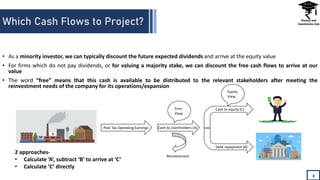

- 6. Which Cash Flows to Project? 6 âĒ As a minority investor, we can typically discount the future expected dividends and arrive at the equity value âĒ For firms which do not pay dividends, or for valuing a majority stake, we can discount the free cash flows to arrive at our value âĒ The word âfreeâ means that this cash is available to be distributed to the relevant stakeholders after meeting the reinvestment needs of the company for its operations/expansion Post Tax Operating Earnings Reinvestment Cash to claimholders (A) Firm View Cash to equity (C) Debt repayment (B) Equity View 2 approaches- âĒ Calculate âAâ, subtract âBâ to arrive at âCâ âĒ Calculate âCâ directly

- 7. Discount rate 7 The discount rate, or the required rate of return (re) is the return shareholders demand to compensate them for the time value of money tied up in their investment and the uncertainty of the future cash flows from these investments. The discount rate, should match the nature of cash flows which are being discounted. Cash flows attributable to equity shareholders are discounted at the cost of equity whereas cash flows attributable to the firm are discounted at Weighted Average Cost of Capital (WACC)

- 8. Estimating discount rates 8 Cost of Equity âĒ Risk includes not only less than expected returns but also more than expected returns âĒ Diversifiable vs Non Diversifiable risk- In a diversified portfolio, firm specific risk goes down since (a) very small % of overall portfolio (b) Same risk factor affects different sectors in different ways and risk averages out to zero over time âĒ However, non diversifiable risk affects all the sectors in the same direction âĒ Prices of stocks are set by the marginal investor-most likely to be trading the stock and setting the price. Often large institutions like mutual funds, hedge funds etc. Marginal Investor is well diversified

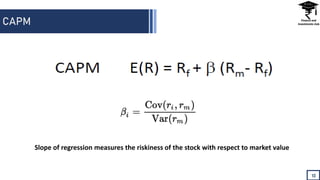

- 9. CAPM 9 âĒ Why would a marginal investor stop diversifying? oTransaction costs leading to marginal costs>marginal gains oActive investors believing they can select undervalued stocks via private info âĒ CAPM Assumptions- o0 transaction costs oNo access to private info âĒ Result- oInvestors keep diversifying till they hold the market portfolio oRisk of an asset becomes risk added to the market portfolio Removed reasons to stop diversifying

- 10. CAPM 10 Slope of regression measures the riskiness of the stock with respect to market value

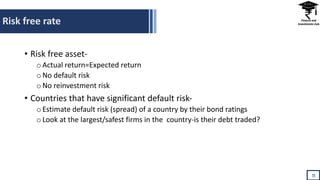

- 11. Risk free rate 11 âĒ Risk free asset- oActual return=Expected return oNo default risk oNo reinvestment risk âĒ Countries that have significant default risk- oEstimate default risk (spread) of a country by their bond ratings oLook at the largest/safest firms in the country-is their debt traded?

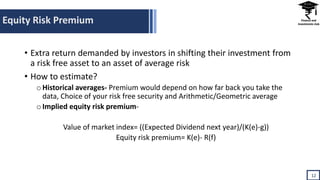

- 12. Equity Risk Premium 12 âĒ Extra return demanded by investors in shifting their investment from a risk free asset to an asset of average risk âĒ How to estimate? oHistorical averages- Premium would depend on how far back you take the data, Choice of your risk free security and Arithmetic/Geometric average oImplied equity risk premium- Value of market index= ((Expected Dividend next year)/(K(e)-g)) Equity risk premium= K(e)- R(f)

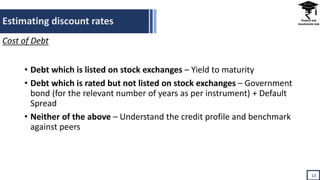

- 13. Estimating discount rates 13 Cost of Debt âĒ Debt which is listed on stock exchanges â Yield to maturity âĒ Debt which is rated but not listed on stock exchanges â Government bond (for the relevant number of years as per instrument) + Default Spread âĒ Neither of the above â Understand the credit profile and benchmark against peers

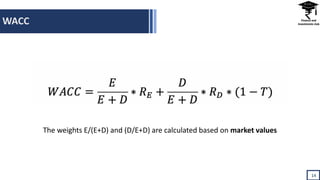

- 14. WACC 14 The weights E/(E+D) and (D/E+D) are calculated based on market values

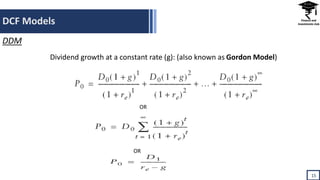

- 15. DCF Models 15 Dividend growth at a constant rate (g): (also known as Gordon Model) OR OR DDM

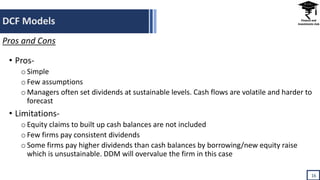

- 16. DCF Models 16 Pros and Cons âĒ Pros- oSimple oFew assumptions oManagers often set dividends at sustainable levels. Cash flows are volatile and harder to forecast âĒ Limitations- oEquity claims to built up cash balances are not included oFew firms pay consistent dividends oSome firms pay higher dividends than cash balances by borrowing/new equity raise which is unsustainable. DDM will overvalue the firm in this case

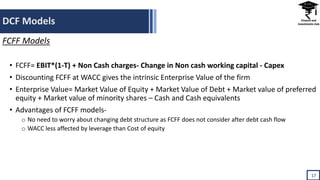

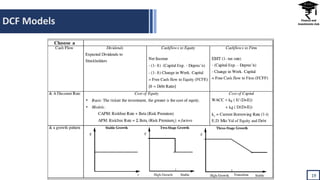

- 17. DCF Models 17 FCFF Models âĒ FCFF= EBIT*(1-T) + Non Cash charges- Change in Non cash working capital - Capex âĒ Discounting FCFF at WACC gives the intrinsic Enterprise Value of the firm âĒ Enterprise Value= Market Value of Equity + Market Value of Debt + Market value of preferred equity + Market value of minority shares â Cash and Cash equivalents âĒ Advantages of FCFF models- o No need to worry about changing debt structure as FCFF does not consider after debt cash flow o WACC less affected by leverage than Cost of equity

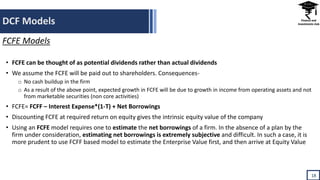

- 18. DCF Models 18 FCFE Models âĒ FCFE can be thought of as potential dividends rather than actual dividends âĒ We assume the FCFE will be paid out to shareholders. Consequences- o No cash buildup in the firm o As a result of the above point, expected growth in FCFE will be due to growth in income from operating assets and not from marketable securities (non core activities) âĒ FCFE= FCFF â Interest Expense*(1-T) + Net Borrowings âĒ Discounting FCFE at required return on equity gives the intrinsic equity value of the company âĒ Using an FCFE model requires one to estimate the net borrowings of a firm. In the absence of a plan by the firm under consideration, estimating net borrowings is extremely subjective and difficult. In such a case, it is more prudent to use FCFF based model to estimate the Enterprise Value first, and then arrive at Equity Value

- 19. DCF Models 19

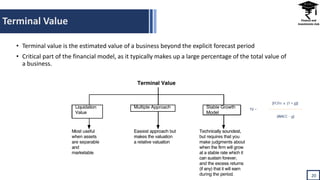

- 20. Terminal Value 20 âĒ Terminal value is the estimated value of a business beyond the explicit forecast period âĒ Critical part of the financial model, as it typically makes up a large percentage of the total value of a business.

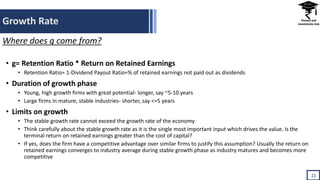

- 21. Growth Rate 21 âĒ g= Retention Ratio * Return on Retained Earnings âĒ Retention Ratio= 1-Dividend Payout Ratio=% of retained earnings not paid out as dividends âĒ Duration of growth phase âĒ Young, high growth firms with great potential- longer, say ~5-10 years âĒ Large firms in mature, stable industries- shorter, say <=5 years âĒ Limits on growth âĒ The stable growth rate cannot exceed the growth rate of the economy âĒ Think carefully about the stable growth rate as it is the single most important input which drives the value. Is the terminal return on retained earnings greater than the cost of capital? âĒ If yes, does the firm have a competitive advantage over similar firms to justify this assumption? Usually the return on retained earnings converges to industry average during stable growth phase as industry matures and becomes more competitive Where does g come from?

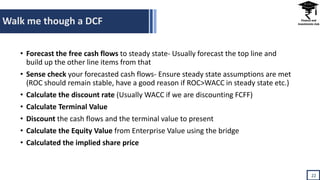

- 22. Walk me though a DCF 22 âĒ Forecast the free cash flows to steady state- Usually forecast the top line and build up the other line items from that âĒ Sense check your forecasted cash flows- Ensure steady state assumptions are met (ROC should remain stable, have a good reason if ROC>WACC in steady state etc.) âĒ Calculate the discount rate (Usually WACC if we are discounting FCFF) âĒ Calculate Terminal Value âĒ Discount the cash flows and the terminal value to present âĒ Calculate the Equity Value from Enterprise Value using the bridge âĒ Calculated the implied share price

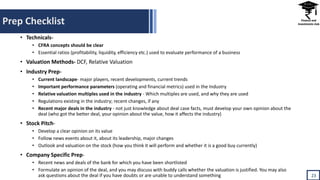

- 23. Prep Checklist 23 âĒ Technicals- âĒ CFRA concepts should be clear âĒ Essential ratios (profitability, liquidity, efficiency etc.) used to evaluate performance of a business âĒ Valuation Methods- DCF, Relative Valuation âĒ Industry Prep- âĒ Current landscape- major players, recent developments, current trends âĒ Important performance parameters (operating and financial metrics) used in the Industry âĒ Relative valuation multiples used in the industry - Which multiples are used, and why they are used âĒ Regulations existing in the industry; recent changes, if any âĒ Recent major deals in the industry - not just knowledge about deal case facts, must develop your own opinion about the deal (who got the better deal, your opinion about the value, how it affects the industry) âĒ Stock Pitch- âĒ Develop a clear opinion on its value âĒ Follow news events about it, about its leadership, major changes âĒ Outlook and valuation on the stock (how you think it will perform and whether it is a good buy currently) âĒ Company Specific Prep- âĒ Recent news and deals of the bank for which you have been shortlisted âĒ Formulate an opinion of the deal, and you may discuss with buddy calls whether the valuation is justified. You may also ask questions about the deal if you have doubts or are unable to understand something