Life Insurance Trusts and Charitable Planning Techniques

- 1. Advanced Estate Planning -- Life Insurance Trusts and Charitable Planning Presented By: Richard J. Shapiro, J.D. and Mindy Menke, J.D. Blustein, Shapiro, Rich & Barone, LLP www.mid-hudsonlaw.com

- 2. The Objectives Of Using Life Insurance: Liquidity â funds available when needed Leverage â the biggest bang for the buck Estate Tax Funding

- 3. Compounding the Problem Should Not Be Part of the Plan Estate Tax Funding

- 4. $2.5 Million Estate + $1,000,000 Life Ins. Policy = $3.5 Million Taxable Estate With $801,060 Estate Tax Due (in 2008) vs $301,340 ET due if Life Ins. Outside of Estate Estate Tax Funding

- 5. The $1,000,000 Life Policy Should be Held Outside of the Estate Estate Tax Funding

- 6. With or without a trust, we can get money out of the estate. Annual Exclusion Gifts Taxable Gifts (Unified Credit) Leveraging life insurance Cash Value vs. Death Benefit Irrevocable Giving

- 7. The Objectives: Exclusion From Taxable Estate Control of Distributions Protection From Creditors Irrevocable Life Insurance Trust

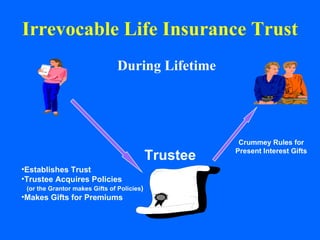

- 8. Established During Life Three Parties Trustmakers (Grantor) Beneficiaries Trustee Irrevocable Life Insurance Trust T r u s t

- 9. Irrevocable Life Insurance Trust During Lifetime Establishes Trust Trustee Acquires Policies (or the Grantor makes Gifts of Policies ) Makes Gifts for Premiums ILIT Crummey Rules for Present Interest Gifts Trustee

- 10. Irrevocable Life Insurance Trust During Lifetime Pays Premiums ILIT Insurance Policy Trustee Establishes Trust Trustee Acquires Policies (or the Grantor makes Gifts of Policies ) Makes Gifts for Premiums

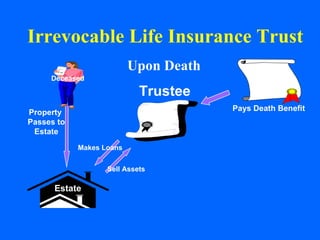

- 11. Upon Death Irrevocable Life Insurance Trust Pays Death Benefit Property Passes to Estate Makes Loans Sell Assets Insurance Policy ILIT Estate Deceased Trustee

- 12. During Settlement Irrevocable Life Insurance Trust Property Subject to Estate Tax Income & Property ILIT Estate Trustee Not Subject to Estate Tax

- 13. Power of Appointment Crummey vs. Commissioner Present Interest Gifts Cristofani vs. Commissioner Contingent Beneficiaries IRS

- 14. Cristofani vs. Commissioner Contingent Beneficiaries Children Robert - Sarah - Donald Childrenâs children Robertâs - Bobby, Sue & Doug Sarahâs - Tom, Troy & Trent Donaldâs - Chris

- 15. Estate Exclusion Creditor Protection Trust Protector Income taxation â to whom? â Crummeyâ powers Control of Distributions - standards Trust Document Drafting Some Important Issues:

- 16. Charitable Planning Basics Charitable Deductions Amount you give to charity entitles you to an income tax deduction Write off up to 50% of your AGI Example: Made $80,000 this year Contribute $20,000 to 501(c)(3) organization Pay income tax on $60,000

- 17. Charitable Planning Basics Charitable Deductions Donate appreciated assets Stock you bought for $5,000 but now is worth $20,000 If you do anything else with that stock, it is only worth $16,723 ($3,277 less) Capital gain taxes of 21.85% of $15,000 Contribute: tax deduction for $20,000

- 18. Charitable Planning Basics Split Interest Gift Trusts Form a Trust - an agreement One party gets the Income for a term - a defined period of time The other party gets the assets later - the Remainder Wealth is like an orchard youâve built up over a lifetime. Taxes take the trees. When the trees are gone, no more apples!

- 19. Charitable Remainder Trusts Charitable Remainder Trusts You keep the apples for life, and the charity gets the trees when you die Use some of the apples to replace the orchard for your kids

- 20. Charitable Remainder Trust Donate an asset to the Trust highly appreciated asset works best Sell and reinvest proceeds (diversified for safety and at higher rate of return) Keep income (some tax-free) for life Use excess income to buy tax free insurance policy in âILITâ At death everything goes tax-free!

- 21. Charitable Remainder Trust John & Mary

- 22. Charitable Remainder Trust John & Mary Asset placed in Trust CRT Income Trust

- 23. Charitable Remainder Trust John & Mary CRT Income Trust Income for life

- 24. Charitable Remainder Trust John & Mary, Deceased CRT Income Trust 501(c)(3) Charity Receives remainder

- 25. Charitable Remainder Trust John & Mary, Deceased CRT Income Trust The transaction is a gift to the end Beneficiary, subject to the retained right to income for a number of years. 501(c)(3) Charity Receives remainder

- 26. Charitable Remainder Trust What good is a CRT? Provide future benefit to charity of choice Take profits: Liquidate appreciated asset without paying capital gain taxes Diversify clientâs investments Current income tax deduction Removes asset from taxable estate

- 27. Charitable Remainder Trust Bank Stock worth $3,000,000 Basis $100,000 Increase Income Current income: dividend 2.5% $75,000 ---------------------------------------------------------------------------------------------------------------------------------------------------- Transfer to CRT, sell stock, reinvest, take 7% per year $210,000 Increase of $135,000 Bonus! Up to $105,000 for 6 years is income tax free!

- 28. Charitable Remainder Trust Bank Stock worth $3,000,000 Basis $100,000 Avoid Capital Gain Tax/Increase Income Sell as is, lose 21.85% of $2.9M gain lost $633,650; balance of $2,366,350 invested at 7% return $165,644 ----------------------------------------------------------------------------------------------------------------------------------------------------- Using CRT, sell stock, no capital gain tax reinvest full $3M at 7% $210,000 Increase per year of $44,356

- 29. Charitable Remainder Trust Bank Stock worth $3,000,000 Also avoid Estate Tax $3M >> $2,344,500 after Cap Gain tax $655,500 Death: Federal and State estate taxes $284,050 To IRS from original $3M: $939,550 To Heirs from original $3M: $2,060,450 ----------------------------------------------------------------------------------------------------------------------------------------------------- Using CRT & investing some of the extra $37,450 into a guaranteed $3,000,000 2 nd to Die Life Insurance Policy held in an ILIT To Charity at Death $3,000,000 To Heirs at Death $3,000,000 TO IRS: $0

- 30. Charitable Remainder Trust PLUS John & Mary Income for life Asset placed in Trust Charitable Remainder Trust

- 31. Charitable Remainder Trust PLUS John & Mary Income for life Asset placed in Trust Charitable Remainder Trust From extra income, invest Gifts into Trust Life Insurance Trust

- 32. Charitable Remainder Trust PLUS No Death Taxes!! John & Mary Income for life Asset placed in Trust Charitable Remainder Trust From extra income, invest small Gifts into Trust Family Receives $3,000,000 Charity Receives $3,000,000 Life Insurance Trust

- 33. CRT Variations: NIMCRUT John & Mary, Deceased CRT Income Trust More flexibility on distributions vs. pushing growth inside the CRT John & Mary 501(c)(3) Charity Receives remainder

- 34. Another twist Charitable Lead Trust ZERO-OUT your estate taxes At death, from Living Trust, place part of estate in the CLT Income for a few years goes to Charity After those years, property to kids Let charity âpick the applesâ for a few years, then the kids get the trees

- 35. Another twist Charitable Lead Trust John & Mary Asset placed in Trust Charitable Lead Trust

- 36. Another twist Charitable Lead Trust John & Mary Income Charitable Lead Trust

- 37. Another twist Charitable Lead Trust John & Mary Children Receive Remaining assets Charitable Lead Trust

- 38. Basic Estate Tax Planning Johnâs Death Maryâs Death IRS Supermarket Johnâs RLT Maryâs Living Trust Children Family Trust plus Maryâs coupon, tax free; Estate Taxes on all over that Family Trust (coupon) Maryâs Living Trust Marital Trust

- 39. Basic Estate Tax Planning plus a Testamentary CLT Children Family Trust IRS Supermarket Maryâs RLT Marital Trust Maryâs RLT Johnâs RLT Charitable Lead Trust

- 40. Social Capital How to use our Social Capital Government: 1/4 gets to end user Private charity: 90% + to end user Which makes more sense?

- 41. Who has paid enough? â So youâve made $20 million in your lifetime. After you paid income taxes , your net worth is $13.2 million . â After your children pay estate taxes upon your death, it will be worth $6.33 million . â After your grandchildren pay estate taxes on the death of your children, it will be worth $3,401,400 . â Your estate will be worth only 17% of its original value after only two generations of taxation.â Barry Kaye, Save a Fortune on Your Estate Taxes

- 42. Advanced Estate Planning -- Life Insurance Trusts and Charitable Planning Presented By: Richard J. Shapiro, J.D. and Mindy Menke, J.D. Blustein, Shapiro, Rich & Barone, LLP www.mid-hudsonlaw.com