Impact investment hub lunch 240511

1 like826 views

This document summarizes a discussion on impact investment and social finance. It provides background on Vancity Community Capital, an impact investment firm, and discusses key terms in social finance like impact investment, social finance, and challenges and opportunities to better connect social financiers and social enterprises. Ideas are proposed to help impact investors understand social enterprises better through job shadowing, peer reviews, and moving outside financial measures to consider behavioral aspects of investing in social missions.

1 of 13

Downloaded 10 times

Ad

Recommended

Collectively wick wick curiosity shop session 3 march

Collectively wick wick curiosity shop session 3 marchBonnie Foley-Wong, CA, CFA

?

This document outlines a plan to develop buildings in East London through community involvement and trust. It discusses exploring the idea of a development trust, working collaboratively with local residents and community organizations. The plan involves 8 stages: 1) obtaining empty space from landowners, 2) feasibility testing of space uses, 3) community engagement, 4) creating demand for the space, 5) starting local economic activity, 6) growing the local economy sustainably, 7) expanding activities through new development, and 8) continuing economic growth through new income streams. The goal is alternative approaches to property development that engage the community.Fundamentals of Impact Investing - A Finance Matters Workshop - October 2014

Fundamentals of Impact Investing - A Finance Matters Workshop - October 2014Finance Matters

?

The document outlines a workshop focused on impact investing, emphasizing the dual goal of achieving social and environmental impact alongside financial returns. It discusses the skills, tools, and strategies necessary for successful investments while encouraging group discussions on personal objectives and the impact of investments. Additionally, it highlights examples of organizations aimed at improving health in underserved communities through innovative gym facilities.Accelerating Impact Impact Investing & Innovative Financing for Development

Accelerating Impact Impact Investing & Innovative Financing for DevelopmentKarim Harji

?

This document discusses the growth and potential of impact investing as a means to address social issues and leverage private capital, particularly in the context of slow economic growth and increasing inequality. It outlines various types of impact investments, the importance of accountability and measurement, and emphasizes the need for collaboration among governments, businesses, and the social sector to foster this evolving industry. The document also highlights challenges and opportunities, urging a focus on capacity development, innovative financing methods, and continuous learning in the impact investing space.Inside out finance issue-Indigo Article Page 14-17

Inside out finance issue-Indigo Article Page 14-17Loren Treisman

?

The document discusses innovative finance in South Africa, focusing on initiatives such as social impact bonds (SIBs) and the Bertha Centre's role in promoting them. It highlights the growing interest in innovative finance among various stakeholders and its potential to integrate financial returns with social impact, while also addressing challenges such as regulatory limitations and the need for scalable organizations. The document emphasizes the importance of aligning public and private sector interests to enhance social development and achieve systemic change in the region.Crowdfunding Presentation - Jan 21

Crowdfunding Presentation - Jan 21Alicia Templeton

?

Crowdfunding involves raising money from a large number of people, typically via the Internet. There are several crowdfunding models, including start-up equity crowdfunding which allows people to invest in early start-ups, and rewards-based crowdfunding where investors receive a reward in exchange for their pledge. Legislation regarding crowdfunding differs between countries, with the U.S. passing laws in 2012 to encourage small business funding through crowdfunding and Canada taking a more cautious "wait-and-see" approach. Successful crowdfunding campaigns convey ideas clearly and quickly, target the right amount of funding, and involve live fundraising and pitching events.Shawn Westcott: Impact Investing - Lessons globally and from Sweden (8.4.2014)

Shawn Westcott: Impact Investing - Lessons globally and from Sweden (8.4.2014)Sitra the Finnish Innovation Fund

?

The document provides information about impact investing from a global and local Scandinavian perspective. It discusses the growth of impact investing globally and the founding of organizations like Impact Invest Scandinavia and Toniic to facilitate impact investing. It outlines the market for impact investing, including social enterprises addressing problems like poverty, education, and the environment. It also discusses the evolving ecosystem supporting impact investing and how governments can support this area through convening stakeholders, providing legal/tax frameworks, and other measures.Crowd funding

Crowd fundingMohammad Albattikhi

?

The document discusses the evolution and types of crowd-funding, highlighting its distinction from traditional funding methods. It explains various crowd-sourcing types, including crowd-funding, and outlines the benefits and challenges associated with it. Successful platforms like Kickstarter are mentioned, showcasing their impact and revenue model.Social Finance and Impact Investing in Canada

Social Finance and Impact Investing in CanadaKarim Harji

?

The document discusses social finance in Canada, defining it as an investment approach delivering social and environmental benefits alongside financial returns. It highlights the involvement of various stakeholders including credit unions and community loan funds while illustrating existing initiatives like the Regent Park revitalization. Key issues in the sector include regulatory challenges, the need for innovation in solving social problems, and balancing financial and social returns.Impact Investing: A New Asset Class?

Impact Investing: A New Asset Class?Benjamin A. Ersing

?

The document discusses impact investing, which provides both social and financial returns through investments. Impact investing aims to assess performance through more than just financial measures. While the term was coined in 2007, it emerged from interest in assessing capital performance through non-financial lenses as well. The impact investing market includes philanthropic organizations, boutique funds, mainstream institutional investors, and others. Assets under management in impact investing are projected to approach $1 trillion by 2020 according to some estimates, as nearly two-thirds of U.S. pension funds anticipate making such investments. The document raises questions about careers, returns, industry trends, and opportunities in impact investing.ODA for Capacity Building in the Social Enterprise- and the SME-Sector in India

ODA for Capacity Building in the Social Enterprise- and the SME-Sector in IndiaMartin Vogelsang PhD

?

The document emphasizes the need for enhanced official development assistance (ODA) in India to support the capacity building of social enterprises and SMEs, targeting the bottom-of-the-pyramid demographic. It outlines a strategy for mobilizing public and private investments, improving infrastructure, and creating decentralized incubators to overcome the current funding gap. The proposal aims to foster innovative solutions and sustainable development while addressing poverty and environmental challenges in India.A4 b4 social innovation_hadley nelles_2011 ocasi ed

A4 b4 social innovation_hadley nelles_2011 ocasi edocasiconference

?

The document discusses social innovation as a tool for poverty reduction. It introduces SiG@MaRS, which is an organization that develops programs to support the launch and growth of social ventures through advisory services, events, and accelerating social entrepreneurs. Examples are provided of how social innovations, social entrepreneurship, social finance, and social partnerships can work together to drive positive social change and address issues like poverty.Crowdfunding Overview

Crowdfunding OverviewRobin Teigland

?

Crowdfunding has grown significantly in recent years and is challenging traditional banks and other financial institutions in their role of financing new businesses and projects. In Sweden alone, several fintech companies focusing on areas like payments, lending, and cryptocurrency have been successfully crowdfunded. The document discusses the different types of crowdfunding and provides statistics on the growth and size of the global crowdfunding industry. It also examines some of the opportunities and challenges of crowdfunding, including its potential role in democratizing access to capital.Social entrepreneurship

Social entrepreneurshipNiilm-Cms

?

The document discusses the origins and rise of social entrepreneurship. It notes that social entrepreneurship was boosted by Muhammad Yunus and the Grameen Bank in Bangladesh, which provided microloans to help people lift themselves out of poverty without collateral. Yunus developed microcredit with the belief that it could effectively and scalably fight poverty if profits were a means to an end, rather than the ultimate goal. It was then realized that profits could be made while also serving society through this approach.Social business

Social businessVikram Dahiya

?

This document discusses social entrepreneurship over 32 pages. It defines social entrepreneurship as pursuing opportunities to create social value rather than maximizing profits. Social entrepreneurs are driven by their mission to create social impact, which can be difficult to measure. They continuously innovate and adapt to serve their social mission. While businesses may create social impacts unintentionally, social entrepreneurs design their organizations and solutions specifically to create sustained positive social change. The document also notes that while MBAs can help social sector organizations with skills like leveraging resources and improving efficiency, it is important for those with business backgrounds to respect the work already being done and understand the limits of market-based solutions for social problems.What is Venture Philanthropy

What is Venture PhilanthropyZiad K Abdelnour

?

The document discusses venture philanthropy, emphasizing that effective philanthropy should adopt an entrepreneurial mindset to tackle large social problems as opportunities for scalable solutions. It advocates for treating philanthropic funds as venture capital, focusing on sustainable business models and the necessity of building strong teams to achieve impactful results. Ultimately, true philanthropic success hinges on innovation and a disruptive approach to address humanity's grand challenges.Crowdfunding indian scenario(new)

Crowdfunding indian scenario(new)Aseem R

?

1. Crowdfunding is a process of raising funds from the general public through small individual contributions to support a project or business. It has emerged as an alternative form of capital formation, especially for entrepreneurs and startups who have difficulty accessing traditional bank financing.

2. While the concept of collecting donations or investments from communities is not new, crowdfunding has gained popularity in recent years through internet-enabled platforms. It provides a way for individuals and organizations to get funding and validation for their ideas.

3. Crowdfunding is a new concept in India but growing as it allows talented people to pursue their dreams without large upfront investments. Regulations are needed to protect investors and support its development as an alternativeSocial Enterpreneurships and Social Development

Social Enterpreneurships and Social Developmentprofessionalpanorama

?

The document discusses the role of social entrepreneurs in driving sustainable social development, particularly focusing on the underserved populations at the bottom of the pyramid. It illustrates how social entrepreneurship can bridge gaps between business, environmental, and social sectors, leading to innovative solutions for societal challenges. The article identifies characteristics of successful social entrepreneurship initiatives and emphasizes the importance of adaptability and stakeholder engagement for long-term impact.Crowd funding

Crowd fundingSharavan Aravind Kumar G

?

Crowdfunding provides SMEs access to capital through small contributions from many investors. It helps accumulate funds for future IPOs while spreading risk. Crowdfunding can also serve as marketing. In India, crowdfunding offers a new financing mode for the 29.8 million MSME enterprises that employ 69 million people but face difficulties obtaining bank loans. Regulated equity crowdfunding through platforms allows qualified investors like institutions, high net worth individuals, and eligible retail investors to participate and helps startups and SMEs raise funds at lower costs than traditional methods. Successful crowd funding companies aim to reach million dollar valuations.Cs investing for-impact

Cs investing for-impactch7m

?

This document discusses impact investing, which aims to generate both social/environmental benefits and financial returns. It provides definitions and examples of impact investments, which typically provide capital to social enterprises working on issues like education, health, and sustainability. While still developing, impact investing is growing as more individuals reject choosing only financial returns or donations, and seek investment solutions that create impact. The report explores trends in impact metrics, financing models for social enterprises, and lessons from pioneers in the field.Exploring Social Finance & Social Enterprise

Exploring Social Finance & Social EnterpriseAdam Spence

?

The document provides background on social enterprise and social finance. It explores the motivation for these activities, including addressing complex social problems with constrained government finances. Various models are examined, such as housing funds, community loan funds, and social impact bonds. Case studies of the New York City Acquisition Fund and social enterprises like Friends Catering Company and St. John's Bakery are also summarized.Crowdfunding x Scholarship

Crowdfunding x ScholarshipSimon Douw

?

This document summarizes a crowdfunding kick-off event. It includes an agenda with topics on a case study, the rise of crowdfunding, and the Crowdfunding Canvas tool. The document also provides tips on building supporter relations in crowdfunding campaigns and choosing an appropriate crowdfunding platform.KickStart Case Study - IA Summit Presentation

KickStart Case Study - IA Summit PresentationSarah Rice

?

The document presents a case study on Kickstart, a non-profit organization using for-profit techniques to combat poverty by creating affordable pumps for farmers in rural Kenya. It discusses the importance of framing and conceptual blending in effectively communicating the organization's mission and addressing misunderstandings from potential donors regarding its operational model. The study highlights the significance of social entrepreneurship and the dual focus on financial and social returns in alleviating poverty.The Venture Philanthropy Mindset

The Venture Philanthropy Mindset Facilitation & Process, LLC

?

The document outlines the venture philanthropy model, which emphasizes long-term partnerships, performance measurement, and a shift from traditional nonprofit practices towards community-focused investments. It discusses the importance of understanding overhead costs and developing a clear plan for nonprofit capacity building to break the cycle of 'nonprofit starvation.' Additionally, it highlights the role of various funding sources and the need for strategic planning in the nonprofit sector.Intro to entrepreneurship slide share

Intro to entrepreneurship slide shareMohammad Albattikhi

?

The document discusses the misconceptions about entrepreneurship and outlines essential concepts such as lean startup methodology, product-market fit, customer acquisition, and revenue streams. It emphasizes the importance of validating business ideas, understanding customer lifetime value, and effective marketing strategies. Additionally, it includes a market-size analysis example for a babysitting app in Jordan, providing insights into potential customer demographics.Alan Barrell - Cambridge Rare Disease Summit 2015

Alan Barrell - Cambridge Rare Disease Summit 2015CamRARE Disease Network

?

The document discusses the rise of alternative finance and impact investing, emphasizing its potential to democratize access to finance and create both financial returns and positive social or environmental impacts. It highlights the growth of crowdfunding and the need for innovative funding models to support social enterprises. Key figures in the field stress that impact investing may soon go mainstream and bring transformative opportunities for social improvement.impactGrid - The next gen platform for Impact Investing, powered by blockchai...

impactGrid - The next gen platform for Impact Investing, powered by blockchai...Investrata Foundation for Social Entrepreneurship

?

The Investrata Foundation is developing an innovative impact investing platform called Impact Grid, powered by blockchain technology, to connect investors and social enterprises while addressing key challenges in the sector. The project aims to create a transparent and decentralized exchange for new financial instruments that will democratize impact investing and enhance measurement and reporting of social impacts. Despite the growth of impact investing as an asset class, it faces challenges such as illiquidity, small fund sizes, and a lack of standardization and understanding.Accelerate from Social Entrepreneurs

Accelerate from Social Entrepreneurs Christopher Hill

?

This document discusses Charity Bank, a not-for-profit bank that lends exclusively to charities, voluntary organizations, and social enterprises. It outlines key factors Charity Bank considers when evaluating proposals for social lending, including viability, sustainability, and social impact of projects. It describes how Charity Bank assesses proposals based on the organization's history, governance, finances, project details, repayment plan, security, and expected social impact. The document also notes trends in the growing social investment market, including more sources of funding and support for social organizations, but competition remains tough for early-stage startups.Connecting Capital: The Rise of Social Finance

Connecting Capital: The Rise of Social FinanceColin Habberton

?

The document discusses the emerging field of social finance, which links commercial finance strategies with nonprofit fundraising innovations. It highlights the importance of understanding social finance for nonprofit leaders and includes case studies such as social impact bonds and notes. The session aims to explore various social finance instruments, their relevance in addressing wealth inequality, and opportunities for transforming fundraising approaches in the nonprofit sector.Investing for Impact -

Supply-Side Perspectives

Investing for Impact -

Supply-Side PerspectivesKarim Harji

?

The document discusses the concept and practice of social finance in Canada, emphasizing its role in blending social and economic returns through various financial tools and strategies. It highlights different organizations, funds, and initiatives that exemplify social finance, as well as the growing interest in incorporating environmental, social, and governance (ESG) criteria in investments. The presentation concludes by underscoring the importance of innovative capital structures and aligning financial investments with social impact goals.Skeptic's guide to social finance

Skeptic's guide to social financeCanadaHelps

?

This document provides an overview of social finance, including definitions, examples of social finance instruments, and challenges. Social finance aims to use capital markets to generate both financial returns and positive social/environmental impacts. It includes debt, equity, and grants/donations used by non-profits, impact investors, foundations, and others. However, social finance faces challenges in areas like market development, confusing return expectations, and restrictive regulations/legislation. The document argues that continued development of this space will require strengthening both supply and demand, as well as modernizing rules and building capacity of organizations involved.More Related Content

What's hot (20)

Impact Investing: A New Asset Class?

Impact Investing: A New Asset Class?Benjamin A. Ersing

?

The document discusses impact investing, which provides both social and financial returns through investments. Impact investing aims to assess performance through more than just financial measures. While the term was coined in 2007, it emerged from interest in assessing capital performance through non-financial lenses as well. The impact investing market includes philanthropic organizations, boutique funds, mainstream institutional investors, and others. Assets under management in impact investing are projected to approach $1 trillion by 2020 according to some estimates, as nearly two-thirds of U.S. pension funds anticipate making such investments. The document raises questions about careers, returns, industry trends, and opportunities in impact investing.ODA for Capacity Building in the Social Enterprise- and the SME-Sector in India

ODA for Capacity Building in the Social Enterprise- and the SME-Sector in IndiaMartin Vogelsang PhD

?

The document emphasizes the need for enhanced official development assistance (ODA) in India to support the capacity building of social enterprises and SMEs, targeting the bottom-of-the-pyramid demographic. It outlines a strategy for mobilizing public and private investments, improving infrastructure, and creating decentralized incubators to overcome the current funding gap. The proposal aims to foster innovative solutions and sustainable development while addressing poverty and environmental challenges in India.A4 b4 social innovation_hadley nelles_2011 ocasi ed

A4 b4 social innovation_hadley nelles_2011 ocasi edocasiconference

?

The document discusses social innovation as a tool for poverty reduction. It introduces SiG@MaRS, which is an organization that develops programs to support the launch and growth of social ventures through advisory services, events, and accelerating social entrepreneurs. Examples are provided of how social innovations, social entrepreneurship, social finance, and social partnerships can work together to drive positive social change and address issues like poverty.Crowdfunding Overview

Crowdfunding OverviewRobin Teigland

?

Crowdfunding has grown significantly in recent years and is challenging traditional banks and other financial institutions in their role of financing new businesses and projects. In Sweden alone, several fintech companies focusing on areas like payments, lending, and cryptocurrency have been successfully crowdfunded. The document discusses the different types of crowdfunding and provides statistics on the growth and size of the global crowdfunding industry. It also examines some of the opportunities and challenges of crowdfunding, including its potential role in democratizing access to capital.Social entrepreneurship

Social entrepreneurshipNiilm-Cms

?

The document discusses the origins and rise of social entrepreneurship. It notes that social entrepreneurship was boosted by Muhammad Yunus and the Grameen Bank in Bangladesh, which provided microloans to help people lift themselves out of poverty without collateral. Yunus developed microcredit with the belief that it could effectively and scalably fight poverty if profits were a means to an end, rather than the ultimate goal. It was then realized that profits could be made while also serving society through this approach.Social business

Social businessVikram Dahiya

?

This document discusses social entrepreneurship over 32 pages. It defines social entrepreneurship as pursuing opportunities to create social value rather than maximizing profits. Social entrepreneurs are driven by their mission to create social impact, which can be difficult to measure. They continuously innovate and adapt to serve their social mission. While businesses may create social impacts unintentionally, social entrepreneurs design their organizations and solutions specifically to create sustained positive social change. The document also notes that while MBAs can help social sector organizations with skills like leveraging resources and improving efficiency, it is important for those with business backgrounds to respect the work already being done and understand the limits of market-based solutions for social problems.What is Venture Philanthropy

What is Venture PhilanthropyZiad K Abdelnour

?

The document discusses venture philanthropy, emphasizing that effective philanthropy should adopt an entrepreneurial mindset to tackle large social problems as opportunities for scalable solutions. It advocates for treating philanthropic funds as venture capital, focusing on sustainable business models and the necessity of building strong teams to achieve impactful results. Ultimately, true philanthropic success hinges on innovation and a disruptive approach to address humanity's grand challenges.Crowdfunding indian scenario(new)

Crowdfunding indian scenario(new)Aseem R

?

1. Crowdfunding is a process of raising funds from the general public through small individual contributions to support a project or business. It has emerged as an alternative form of capital formation, especially for entrepreneurs and startups who have difficulty accessing traditional bank financing.

2. While the concept of collecting donations or investments from communities is not new, crowdfunding has gained popularity in recent years through internet-enabled platforms. It provides a way for individuals and organizations to get funding and validation for their ideas.

3. Crowdfunding is a new concept in India but growing as it allows talented people to pursue their dreams without large upfront investments. Regulations are needed to protect investors and support its development as an alternativeSocial Enterpreneurships and Social Development

Social Enterpreneurships and Social Developmentprofessionalpanorama

?

The document discusses the role of social entrepreneurs in driving sustainable social development, particularly focusing on the underserved populations at the bottom of the pyramid. It illustrates how social entrepreneurship can bridge gaps between business, environmental, and social sectors, leading to innovative solutions for societal challenges. The article identifies characteristics of successful social entrepreneurship initiatives and emphasizes the importance of adaptability and stakeholder engagement for long-term impact.Crowd funding

Crowd fundingSharavan Aravind Kumar G

?

Crowdfunding provides SMEs access to capital through small contributions from many investors. It helps accumulate funds for future IPOs while spreading risk. Crowdfunding can also serve as marketing. In India, crowdfunding offers a new financing mode for the 29.8 million MSME enterprises that employ 69 million people but face difficulties obtaining bank loans. Regulated equity crowdfunding through platforms allows qualified investors like institutions, high net worth individuals, and eligible retail investors to participate and helps startups and SMEs raise funds at lower costs than traditional methods. Successful crowd funding companies aim to reach million dollar valuations.Cs investing for-impact

Cs investing for-impactch7m

?

This document discusses impact investing, which aims to generate both social/environmental benefits and financial returns. It provides definitions and examples of impact investments, which typically provide capital to social enterprises working on issues like education, health, and sustainability. While still developing, impact investing is growing as more individuals reject choosing only financial returns or donations, and seek investment solutions that create impact. The report explores trends in impact metrics, financing models for social enterprises, and lessons from pioneers in the field.Exploring Social Finance & Social Enterprise

Exploring Social Finance & Social EnterpriseAdam Spence

?

The document provides background on social enterprise and social finance. It explores the motivation for these activities, including addressing complex social problems with constrained government finances. Various models are examined, such as housing funds, community loan funds, and social impact bonds. Case studies of the New York City Acquisition Fund and social enterprises like Friends Catering Company and St. John's Bakery are also summarized.Crowdfunding x Scholarship

Crowdfunding x ScholarshipSimon Douw

?

This document summarizes a crowdfunding kick-off event. It includes an agenda with topics on a case study, the rise of crowdfunding, and the Crowdfunding Canvas tool. The document also provides tips on building supporter relations in crowdfunding campaigns and choosing an appropriate crowdfunding platform.KickStart Case Study - IA Summit Presentation

KickStart Case Study - IA Summit PresentationSarah Rice

?

The document presents a case study on Kickstart, a non-profit organization using for-profit techniques to combat poverty by creating affordable pumps for farmers in rural Kenya. It discusses the importance of framing and conceptual blending in effectively communicating the organization's mission and addressing misunderstandings from potential donors regarding its operational model. The study highlights the significance of social entrepreneurship and the dual focus on financial and social returns in alleviating poverty.The Venture Philanthropy Mindset

The Venture Philanthropy Mindset Facilitation & Process, LLC

?

The document outlines the venture philanthropy model, which emphasizes long-term partnerships, performance measurement, and a shift from traditional nonprofit practices towards community-focused investments. It discusses the importance of understanding overhead costs and developing a clear plan for nonprofit capacity building to break the cycle of 'nonprofit starvation.' Additionally, it highlights the role of various funding sources and the need for strategic planning in the nonprofit sector.Intro to entrepreneurship slide share

Intro to entrepreneurship slide shareMohammad Albattikhi

?

The document discusses the misconceptions about entrepreneurship and outlines essential concepts such as lean startup methodology, product-market fit, customer acquisition, and revenue streams. It emphasizes the importance of validating business ideas, understanding customer lifetime value, and effective marketing strategies. Additionally, it includes a market-size analysis example for a babysitting app in Jordan, providing insights into potential customer demographics.Alan Barrell - Cambridge Rare Disease Summit 2015

Alan Barrell - Cambridge Rare Disease Summit 2015CamRARE Disease Network

?

The document discusses the rise of alternative finance and impact investing, emphasizing its potential to democratize access to finance and create both financial returns and positive social or environmental impacts. It highlights the growth of crowdfunding and the need for innovative funding models to support social enterprises. Key figures in the field stress that impact investing may soon go mainstream and bring transformative opportunities for social improvement.impactGrid - The next gen platform for Impact Investing, powered by blockchai...

impactGrid - The next gen platform for Impact Investing, powered by blockchai...Investrata Foundation for Social Entrepreneurship

?

The Investrata Foundation is developing an innovative impact investing platform called Impact Grid, powered by blockchain technology, to connect investors and social enterprises while addressing key challenges in the sector. The project aims to create a transparent and decentralized exchange for new financial instruments that will democratize impact investing and enhance measurement and reporting of social impacts. Despite the growth of impact investing as an asset class, it faces challenges such as illiquidity, small fund sizes, and a lack of standardization and understanding.Accelerate from Social Entrepreneurs

Accelerate from Social Entrepreneurs Christopher Hill

?

This document discusses Charity Bank, a not-for-profit bank that lends exclusively to charities, voluntary organizations, and social enterprises. It outlines key factors Charity Bank considers when evaluating proposals for social lending, including viability, sustainability, and social impact of projects. It describes how Charity Bank assesses proposals based on the organization's history, governance, finances, project details, repayment plan, security, and expected social impact. The document also notes trends in the growing social investment market, including more sources of funding and support for social organizations, but competition remains tough for early-stage startups.Connecting Capital: The Rise of Social Finance

Connecting Capital: The Rise of Social FinanceColin Habberton

?

The document discusses the emerging field of social finance, which links commercial finance strategies with nonprofit fundraising innovations. It highlights the importance of understanding social finance for nonprofit leaders and includes case studies such as social impact bonds and notes. The session aims to explore various social finance instruments, their relevance in addressing wealth inequality, and opportunities for transforming fundraising approaches in the nonprofit sector.ODA for Capacity Building in the Social Enterprise- and the SME-Sector in India

ODA for Capacity Building in the Social Enterprise- and the SME-Sector in IndiaMartin Vogelsang PhD

?

impactGrid - The next gen platform for Impact Investing, powered by blockchai...

impactGrid - The next gen platform for Impact Investing, powered by blockchai...Investrata Foundation for Social Entrepreneurship

?

Similar to Impact investment hub lunch 240511 (20)

Investing for Impact -

Supply-Side Perspectives

Investing for Impact -

Supply-Side PerspectivesKarim Harji

?

The document discusses the concept and practice of social finance in Canada, emphasizing its role in blending social and economic returns through various financial tools and strategies. It highlights different organizations, funds, and initiatives that exemplify social finance, as well as the growing interest in incorporating environmental, social, and governance (ESG) criteria in investments. The presentation concludes by underscoring the importance of innovative capital structures and aligning financial investments with social impact goals.Skeptic's guide to social finance

Skeptic's guide to social financeCanadaHelps

?

This document provides an overview of social finance, including definitions, examples of social finance instruments, and challenges. Social finance aims to use capital markets to generate both financial returns and positive social/environmental impacts. It includes debt, equity, and grants/donations used by non-profits, impact investors, foundations, and others. However, social finance faces challenges in areas like market development, confusing return expectations, and restrictive regulations/legislation. The document argues that continued development of this space will require strengthening both supply and demand, as well as modernizing rules and building capacity of organizations involved.Impact investing perspectives dimensions

Impact investing perspectives dimensionsDrs Alcanne Houtzaager MA

?

The document analyzes impact investing through various perspectives and dimensions, categorizing motivations and actions across three cultures while emphasizing trends in market evolution. It discusses the shift from traditional philanthropic investments to inclusive impact investing, highlighting critiques of exclusivity in the sector and stresses the necessity for transparency and accountability. The author reflects on the growing discontent with conventional investment strategies and the need for innovative frameworks that better align with social justice and sustainable development goals.Causeway - SIO Presentation - 070529

Causeway - SIO Presentation - 070529Michael Lewkowitz

?

Social finance is sustainable investing that aims to generate both social/environmental benefits and financial returns. The document discusses how social finance is gaining momentum in Canada but still lags behind other countries. It outlines various social finance mechanisms like social venture capital funds and investments in areas like affordable housing and community energy. The document proposes a national collaboration called CAUSEWAY to improve awareness of social finance opportunities in Canada and catalyze new financial pathways and products to build the field.Trajectory and Opportunity of Social Finance

Trajectory and Opportunity of Social FinanceAdam Spence

?

The document discusses the 3rd annual sustainable business conference at the University of Ottawa, focusing on social finance as a method to address pressing social and environmental issues while generating financial returns. It emphasizes the need for businesses to redefine their purpose towards creating shared value and outlines key recommendations for the advancement of social finance. The document also presents various case studies and local market potentials, advocating for a transformative change towards a more equitable economy.Volans Social Innovation Tour - Canadian Government

Volans Social Innovation Tour - Canadian GovernmentKevin Teo

?

The document summarizes key takeaways from a UK social innovation policy tour organized by Social Innovation Generation (SiG). It discusses social finance, public policy, culture and enabling environment, and actions to support social innovation. The tour explored models of social finance, social enterprises, public programs and advocacy groups that have helped advance social innovation in the UK.Investor Spotlight - JP Morgan & Rockefeller

Investor Spotlight - JP Morgan & Rockefeller Nonprofit Finance Fund_SIB Learning Hub

?

The document summarizes an interview with J.P. Morgan and Rockefeller Foundation about their research report on impact investing. Some key findings of the interview are:

1) J.P. Morgan and Rockefeller Foundation published the research to support the growth of impact investing and help address social issues at scale by complementing traditional philanthropy and government efforts with private sector investment.

2) The research findings show that impact investing is emerging as a distinct asset class, with a potential market in studied sectors approaching $1 trillion. Early surveys also indicate many impact investments may achieve commercial or near-commercial returns.

3) Defining impact investing as an asset class will help organize investors around the field's unique skills and accelerateImpact investing

Impact investingRhiddi Singh

?

This directory provides resources for sustainable and impact investing, organized by topic. It includes local and community banking projects, community development financial institutions, microfinance organizations, impact investing funds and platforms, ratings and reporting standards for ESG and sustainability, and conferences and publications on related issues. The goal is to support creating positive social and environmental change through investing and business.THE IMPACT INVESTORˇŻS HANDBOOK Lessons from the World of Microfinance

THE IMPACT INVESTORˇŻS HANDBOOK Lessons from the World of MicrofinanceIDIS

?

The document is the 'Impact Investor's Handbook' published by CAF Venturesome, which provides insights from the microfinance industry to enhance the UK social investment market. It outlines key challenges, including market fragility, the need for better infrastructure, and the importance of informed demand and diverse funding mechanisms. The handbook serves as a resource for practitioners seeking to strategically advance the impact investing sector by learning from past experiences in microfinance.Patrick Decoodt Ceo Panel 4

Patrick Decoodt Ceo Panel 4ADFIAP

?

The document discusses social finance and financial inclusion. It defines social finance as using financial tools to promote decent work and inclusive access to banking services. Social finance includes micro-lending, social enterprises, and outcome-based grants. It benefits the poor through credit, savings, and risk management. The document advocates a sustainable and diverse banking system to promote social, environmental and economic development through inclusive access to financial services and support for small and medium enterprises.Impact Investing Seminar: Revolutionising capital markets for greater societa...

Impact Investing Seminar: Revolutionising capital markets for greater societa...United Nations Association of Australia (Vic)

?

The document discusses the challenges faced by traditional non-profit funding models, emphasizing reliance on short-term government and philanthropic support. It explores the emerging impact investing sector, which aims to generate positive social and environmental outcomes alongside financial returns, and notes the gradual overcoming of barriers to growth in Australia. Key concepts include the differentiation of impact investments from traditional investments, the potential for publicly traded opportunities, and the importance of measuring positive outcomes as part of investment success.4B - Impact of impact - Jim Clifford

4B - Impact of impact - Jim CliffordCFG

?

Jim Clifford is the Head of Non-Profit Advisory Services at Baker Tilly. He has authored several studies on social impact and helped develop methodologies to assess social impact. Understanding social impact is important for non-profits to influence stakeholders, manage funding, and measure outcomes. Common frameworks for measuring impact include SROI, GRI, and evaluating performance. Social impact data can be used internally to improve projects and externally to influence funders and partners. New social finance models like social impact bonds link funding to impact by tying payments to results.160727_Aspects_impact investing 2.0_global drivers and trends_final3

160727_Aspects_impact investing 2.0_global drivers and trends_final3socialimpactmarkets

?

1) Impact investing is a rapidly growing field that aims to generate both social/environmental impact and financial returns. Globally, impact investors manage $77.9 billion in assets.

2) Impact investments intentionally invest in opportunities that generate measurable positive societal impact, through funds, real estate, social businesses, or enterprises. Return expectations range from below to market rates.

3) Several trends are driving growth in impact investing, including demand for sustainable products, innovations in public services, and opportunities in underserved markets. New types of investors beyond foundations, such as pension funds and corporations, are beginning to engage in impact investing.Solutions for Impact Investors

Solutions for Impact InvestorsNonprofit Finance Fund_SIB Learning Hub

?

Rockefeller Philanthropy Advisors is a 501(c)(3) nonprofit organization established in 1991 that provides services to help donors advance effective and strategic philanthropy. It traces its origins to John D. Rockefeller Sr. who began professionally managing his philanthropy in 1891. Rockefeller Philanthropy Advisors provides research, counsel, and complete program management for foundations and trusts. It currently advises on over $300 million in annual giving across many countries.ENTR4800 Class 7: Impact Investing and Social Finance

ENTR4800 Class 7: Impact Investing and Social FinanceSocial Entrepreneurship

?

The document outlines the agenda and content of a social entrepreneurship class focused on impact investing and social capital markets. It discusses various investment approaches, the spectrum of financial markets, and provides insights on social finance dynamics in Canada. Additionally, it emphasizes the importance of intermediaries in aligning supply and demand within the sector.Impact Investing

Impact InvestingNonprofit Finance Fund_SIB Learning Hub

?

1) Impact investing seeks to generate financial returns while also creating positive social and environmental impacts. It provides capital to address issues where charitable and government funds fall short.

2) The article profiles several impact investments that provide affordable housing, education, jobs, and other benefits. These investments involve a variety of players, including banks, foundations, and individuals, showing the potential of impact investing to attract capital from diverse sources.

3) For impact investing to achieve its potential, industry leaders must work together to measure impacts, build infrastructure, and create financial products that meet investor needs for transparency and liquidity. Recent innovations point to new opportunities for banks and other players in impact investing.NWSVF - Impact Investing Education Series Info

NWSVF - Impact Investing Education Series InfoNorthWest Social Venture Fund

?

The document outlines an Impact Investing Education Series aimed at students, investors, and professionals, promoting scalable social entrepreneurship and impact investing. It details program structure, including workshops, milestone setting, hands-on learning, and peer discussions, as well as the benefits and outcomes of participating. Participants are encouraged to set achievable personal and professional impact milestones while engaging with various organizations in the social impact sector.Smarter money review 3 spring 2015

Smarter money review 3 spring 2015Big Path Capital

?

Big Path Capital assists purpose-driven companies and funds in financial transactions like acquisitions, mergers, and capital raises to ensure their social missions are preserved. They have worked on over 100 deals, more than any other impact investing bank. Big Path represents the largest impact investing network and focuses on assisting companies and funds, hosting events, and providing education to institutional investors on impact investing strategies. The article provides an overview of impact investing and highlights several papers that have helped define and develop the field, showing how impact investing is growing beyond private investments into other asset classes.SmarterMoney+ Review 3 Spring 2015

SmarterMoney+ Review 3 Spring 2015Impact Capitalism Summit

?

Big Path Capital assists purpose-driven companies and funds in financial transactions like acquisitions, mergers, and capital raises to ensure their social missions are preserved. They have worked on over 100 deals, more than any other impact investing bank. Big Path represents the largest impact investing network and focuses on assisting companies and funds, hosting events, and providing education to institutional investors on impact investing strategies. The article provides an overview of impact investing and highlights several papers that have helped define and develop the field, showing how impact investing is growing beyond private investments into other asset classes.Social Finance: Its promise and its challenges

Social Finance: Its promise and its challengesSocial Innovation Generation

?

The document discusses the challenges and opportunities in social finance as presented by Tim Draimin, Executive Director of Social Innovation Generation (SIG). It highlights the need for innovative approaches to address social and ecological problems, emphasizing collaboration across sectors and the importance of impact investing in mobilizing private capital for public good. The text also outlines barriers to social innovation and suggests that a shift towards social finance could create sustainable revenue models for non-profits and stimulate social improvements.Impact Investing Seminar: Revolutionising capital markets for greater societa...

Impact Investing Seminar: Revolutionising capital markets for greater societa...United Nations Association of Australia (Vic)

?

Ad

Impact investment hub lunch 240511

- 1. Impact Investment: A New Asset Class? That's what JP Morgan calls it Social Finance, Impact Investment, and Finance for Social Enterprise A Conversation Hub Lunch @ Islington 24 May 2011

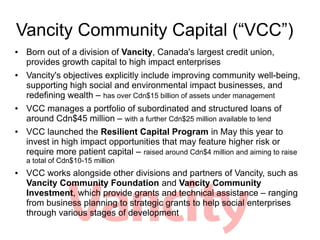

- 2. Vancity Community Capital (ˇ°VCCˇ±) ˇń Born out of a division of Vancity, Canada's largest credit union, provides growth capital to high impact enterprises ˇń Vancity's objectives explicitly include improving community well-being, supporting high social and environmental impact businesses, and redefining wealth ¨C has over Cdn$15 billion of assets under management ˇń VCC manages a portfolio of subordinated and structured loans of around Cdn$45 million ¨C with a further Cdn$25 million available to lend ˇń VCC launched the Resilient Capital Program in May this year to invest in high impact opportunities that may feature higher risk or require more patient capital ¨C raised around Cdn$4 million and aiming to raise a total of Cdn$10-15 million ˇń VCC works alongside other divisions and partners of Vancity, such as Vancity Community Foundation and Vancity Community Investment, which provide grants and technical assistance ¨C ranging from business planning to strategic grants to help social enterprises through various stages of development

- 3. Impact

- 5. Impact Investment Impact investments are investments intended to create positive impact beyond financial return. They require the management of social and environmental performance in addition to financial risk and return. JP Morgan/ Rockefeller Foundation

- 6. Social

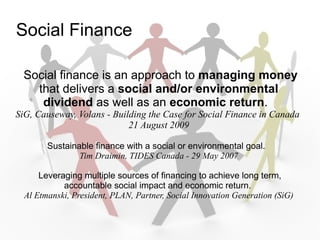

- 8. Social Finance Social finance is an approach to managing money that delivers a social and/or environmental dividend as well as an economic return. SiG, Causeway, Volans - Building the Case for Social Finance in Canada 21 August 2009 Sustainable finance with a social or environmental goal. Tim Draimin, TIDES Canada - 29 May 2007 Leveraging multiple sources of financing to achieve long term, accountable social impact and economic return. Al Etmanski, President, PLAN, Partner, Social Innovation Generation (SiG)

- 9. Social Finance & Impact Investment Social impact bonds, Big Society Bank, Big Issue Invest ¨C a specialised provider of finance to social enterprises or trading arms of charities that are finding business solutions that create social and environmental transformation, Bridges Ventures ¨C a sustainable growth investor, Microfinance, Kiva, Community Development Finance Institutions, Credit Unions & Financial Co-ops, Transform Capital Management ¨C a global impact investment bank Socially responsible investment, Philanthropy & Philanthrocapitalism, Patient Capital, UnLtd, UnLtd Big Venture Challenge, NESTA, Young Foundation, RSF Social Finance ¨C founded as the Rudolf Steiner Foundation, Nonprofit Finance Fund ¨C Where money meets mission, Renewal Partners ¨C funding change through investments, grants, and collaboration, Vancity Community Capital Some frequently recurring phrases: mission-based, change, social and environmental performance/ return/ benefits/ dividend, investment, grants, finance, sustainable, growth, global

- 10. Challenges ˇń Gaps in language and terminology used amongst investors, entrepreneurs, and social purpose business people ˇń Many professionals working at impact investment firms are from the conventional investment sector (note: based on personal observation, not empirical evidence) ˇń Lack of innovation, creativity, and openness in the impact investment sector ¨C does not mirror the organisations they seek to finance and support ¨C Slow to embrace co-design of finance, neither side seeing each other truly as a partner, attempts to innovate with financial instruments rather than addressing behaviours or culture of social finance ˇń Risk of value extraction and exploitation of social enterprises rather than true capacity building ˇń Frequent use of terminology such as ˇ°fast growthˇ±, ˇ°scaleˇ±, ˇ°replicableˇ±, which are not necessarily appropriate for social enterprises

- 11. Challenges What other challenges do you see or have you experienced? Solutions & Opportunities What are the solutions and opportunities to bridge the gap between social financiers and the enterprises they want to support? Let's open up the conversation...

- 12. Ideas ˇń Impact investors and social financiers must look at their own business model and strategy ¨C Consider co-operative, open-source, and other unconventional ways of doing things and ask themselves how they could apply those models ˇń They should walk a mile in the shoes of their investee companies ¨C secondments to social enterprises, sit on the Board ¨C and learn their language, experience their issues first hand ˇń Invite social enterprises to shadow impact investors or conduct peer reviews of business models and business plans ¨C so that they can understand better the investment process, improve transparency ˇń Impact investors and social financiers need to move out of their comfort zone ¨C step away from the numbers, examine behavioural and intuitive aspects of investment in social enterprises ¨C consider non- financial incentives, measures, resources, and services (the importance of advice, strong management teams and operational experience, training and continuing education)

- 13. Stay in Contact Bonnie Wong At work: bonnie_wong@vancity.com or +1 604 877 8284 All the time: bonnie.o.wong@gmail.com On Twitter: @BonnieOWong Blog: http://beopenionated.wordpress.com (mainly about impact investment and social finance, with links to my other writing)