Impact of falling prices on India PVC market & a general update 2016

- 1. Impact Of Low Crude Oil Prices On Indian PVC Market ©C An Update Mr. Sukhdeep Sethi Director ©C AVI Global Plast Pvt. Ltd. Chemorbis Asia 7th Petrochemicals Conference June 24, 2016

- 2. 2? AVI Global Plast Pvt. Ltd., 2016 Overview ?? Impact of Oil Prices ?? Oil Crash of 2014/2015 o? Impact on PVC Prices in India o? Impact on Demand ?? Overall PVC Market in India ?? Domestic Producer-wise Capacity ?? Consumption Data ?? Sector-wise PVC Usage ?? Export Champions to India ?? China PVC Market scenario ?? Conclusion ?? About AVI Global

- 3. ? AVI Global Plast Pvt. Ltd., 2016

- 4. 4? AVI Global Plast Pvt. Ltd., 2016 The Oil Crash of 2014/2015 ?? Crude Oil prices had a steep fall over the past 18 months starting Q4-2014 ?? Experts predict that prices will remain low for the next few years ?? Effect of slowdown in production in the US, etc. expected to show results by Q2 of 2016 ?? This resulted in a price fall across all polymers around the world o?Varying timing & extent of fall influenced by a different set of supply chain & market factors o?Difference between ethylene & propylene feedstock due to use of natural gas o?Thus, supply/demand dynamics affected by factors besides crude oil prices ?? Tremendous impact on overall industry sentiment, demand & earnings of producers & processors of resins Source: Report by Advanced Purchasing Dynamics

- 5. 5? AVI Global Plast Pvt. Ltd., 2016 Movement of Oil prices vis-©ż-vis PVC & key inputs 0 20 40 60 80 100 120 0 200 400 600 800 1000 1200 1400 1600 Ethylene (SEA) EDC (SEA) VCM (SEA) PVC (CIF Ind) Crude Oil (Nymex)

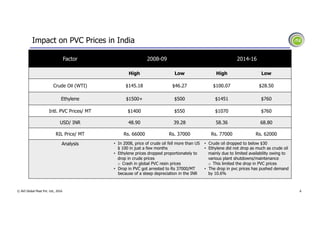

- 6. 6? AVI Global Plast Pvt. Ltd., 2016 Impact on PVC Prices in India Factor 2008-09 2014-16 High Low High Low Crude Oil (WTI) $145.18 $46.27 $100.07 $28.50 Ethylene $1500+ $500 $1451 $760 Intl. PVC Prices/ MT $1400 $550 $1070 $760 USD/ INR 48.90 39.28 58.36 68.80 RIL Price/ MT Rs. 66000 Rs. 37000 Rs. 77000 Rs. 62000 Analysis ?? In 2008, price of crude oil fell more than US $ 100 in just a few months ?? Ethylene prices dropped proportionately to drop in crude prices o? Crash in global PVC resin prices ?? Drop in PVC got arrested to Rs 37000/MT because of a steep depreciation in the INR ?? Crude oil dropped to below $30 ?? Ethylene did not drop as much as crude oil mainly due to limited availability owing to various plant shutdowns/maintenance o? This limited the drop in PVC prices ?? The drop in pvc prices has pushed demand by 10.6%

- 7. 7? AVI Global Plast Pvt. Ltd., 2016 Period 2015-16 Consumption (KT) Domestic Supplies (KT) Domestic Price (USD) Imports (KT) Import Price (USD) WTI Oil (USD) USD/INR April 290 109 $ 950 181 $ 950 $ 59.74 62.35 May 237 111 $ 945 126 $ 970 $ 60.07 63.38 June 210 110 $ 898 100 $ 920 $ 59.12 64.00 July 185 112 $ 884 73 $ 900 $ 46.83 63.53 August 172 97 $ 867 75 $ 910 $ 45.40 65.13 September 200 112 $ 828 88 $ 830 $ 44.87 66.37 October 223 107 $ 862 116 $ 850 $ 43.26 64.76 November 218 100 $ 829 118 $ 850 $ 41.64 66.10 December 235 105 $ 782 130 $ 790 $ 37.11 66.82 January 247 136 $ 761 111 $ 760 $ 33.65 67.77 February 237 130 $ 778 107 $ 770 $ 33.87 68.17 March 245 135 $ 831 110 $ 810 $ 38.04 67.41 Impact on PVC Demand in India

- 8. PVC MARKET IN INDIA ? AVI Global Plast Pvt. Ltd., 2016

- 9. 9? AVI Global Plast Pvt. Ltd., 2016 Producer wise capacity in India (KTA) 750 260 245 150 80 0 100 200 300 400 500 600 700 800 RIL Finolex Chemplast DCW Shriram ? Total: 1485KT in 2016 ? *To ADD: DCW= 80KT | RIL= 100KT Source: Industry estimates

- 10. 10? AVI Global Plast Pvt. Ltd., 2016 Sector-wise PVC usage Finolex gets people together PVC Sector wise Usage Source ©C Industry estimates 70% 8% 5% 4% 3% 3% 3% 2% 1% 1% Pipes Calendering W & C Films Compound Fittings Profiles Footwear Sheets Others Pipes & Fittings 43% Profiles 19% Films & Sheets 17% Wire & Cables 8% Bottles 2% Floorings 3% Others 8% Global Scenario 25 Indian Scenario Source: Industry estimates

- 11. EXPORT CHAMPIONS TO INDIA ? AVI Global Plast Pvt. Ltd., 2016

- 12. 12? AVI Global Plast Pvt. Ltd., 2016 Imports vis-©ż-vis Consumption in India Period Consumption (KT) Domestic Supplies (KT) Imports (KT) Growth (%) 2013-2014 2,333 1,305 1,028 2% 2014-2015 2,440 1,305 1,135 8% 2015-2016 2,699 1,364 1,335 10.6% 2016-2017* 2,968 1,450 1,518 10% 2017-2018* 3,205 1,450 1,755 8% 2018-2019* 3,398 1,450 1,948 6% * Projections Source: Industry estimates

- 13. 13? AVI Global Plast Pvt. Ltd., 2016 Changes in Anti-Dumping duty in April 2014 Country Before April-2014 After April-2014 USD / MT USD / MT Korea Nil Nil Taiwan Highest - 20 Lowest - Nil Highest ©C 33.62 Lowest - Nil US 43 Highest - 115.54 Lowest- 29.99 China Highest - 45 Lowest - 10 Highest - 147.96 Lowest - 91.27 Japan 65 15 Russia Nil Nil Latin America Nil Nil* * Mexichem Mexico ©C US$ 88.10/MT

- 14. 14? AVI Global Plast Pvt. Ltd., 2016 Where is India importing from? (KT) Source: Industry estimates 2013-14 2014-15 2015-16 2016-17 (E) 2017-18 (E) Taiwan 371 335 395 400 410 Korea 257 282 290 300 320 China 177 293 146 200 240 L. America 10 13 77 85 100 Japan 0.1 35 220 250 300 Russia 0 5 12 20 35 Iran 31 45 77 80 90 Norway 5 26 25 30 40 Others 176 177 103 204 275 0 50 100 150 200 250 300 350 400 450 FiguresinKT

- 15. 15? AVI Global Plast Pvt. Ltd., 2016 Future Export Champions Japan ?? Anti Dumping Duty on PVC imports from Japan was reduced to USD 15/MT in April 2014 ?? Due to the FTA between India & Japan, the basic import duty would be brought down from 4.8% in 2014-15 to 2.7% in 2017-18 (currently @3.4%) ?? The net benefit between standard duty and concessional will be 3.2% by 2017 ?? Japanese producers will have a better netback & will continue to focus on maximizing their exports to India Latin America/ Russia ?? Slowdown in economies in Brazil, Argentina, Venezuela & Colombia has resulted in reduction in domestic consumption ?? Spare capacities available for export to countries offering maximum netbacks ?? Currency depreciation ?? Reduced freight rates ?? Result has been focus on countries like India which have seen a huge influx of PVC resin from these markets ?? We estimate sustained exports to India for at least the next 3years Iran ?? Lifting of trade sanctions will result in IranĪ»s emergence as a major PVC resin exporter ?? Increase in local demand from construction, infrastructure projects, etc. will restrict the quantity available for export ?? Focus on export to markets with the highest netback o? Europe & Turkey may be favored markets ?? We estimate that IranĪ»s exports to India will see nominal growth because of the above factors

- 16. China PVC Market Scenario ? AVI Global Plast Pvt. Ltd., 2016

- 17. 17? AVI Global Plast Pvt. Ltd., 2016 China - Ethylene vs. Carbide Supply Trend and overall outlook ?? ChinaĪ»s PVC capacity stands at 30 MMT with a spare capacity of 13 MMT o? 83% is Carbide based o? Overall operating rate @ 55% ?? Demand is 16.2 MMT with meagre growth of 1.2% during the year ?? India raised ADD on Chinese PVC resin from $8-$45/MT to $91-$148/MT o? In 2015-16, the Chinese still managed to sell 146 KTA to India ?? Chinese carbide PVC will continue to find opportunities to sell into India when the ethylene PVC prices increase to over USD 900 ?? We expect that the Chinese will be able to export to India 3 to 4 months in a year depending on the above pricing

- 18. 18? AVI Global Plast Pvt. Ltd., 2016 ?? IndiaĪ»s PVC demand will cross 3 MMT in FY 2016-17 ?? IndiaĪ»s PVC imports are expected to cross 2 million tons by FY 2018-19 ?? Low prices will drive consumption growth rates in India above world average ?? The rain forecast for 2016 is 105% with normal, this will drive higher increase consumption ?? Better netbacks from India & slowdown in other economies will continue to attract producers from across the globe ?? Taiwan & Korea will continue to be the leading exporters to India ?? The new champions in the export market are expected to be Japan, Iran, Latin America & Russia o? Japan exports are expected to increase up to 320 KTA by 2018 Conclusion

- 19. 19? AVI Global Plast Pvt. Ltd., 2016 About AVI Global AVI Global Plast is IndiaĪ»s largest manufacturer of : o? PVC Rigid Films o? PET Sheets (APET/GAG PET/RPET) o? Laminated barrier and high barrier films for MAP packaging. o? Thermoformed products o? Garment packing accessories

- 20. THANK YOU Mr. Sukhdeep Sethi AVI Global Plast Pvt. Ltd. Mumbai, India Email: sethi@avigloplast.com Web: www.avigloplast.com