Incapacity Planning: What Is It and Who Needs It

1 like355 views

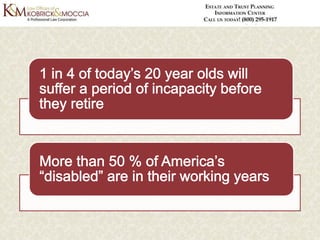

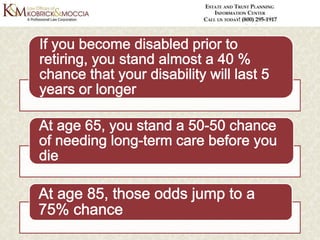

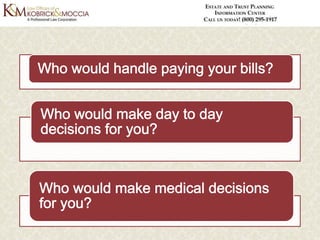

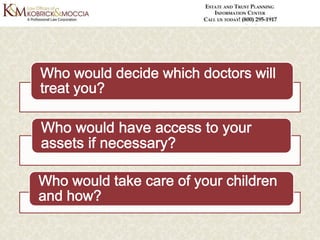

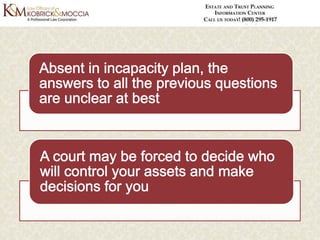

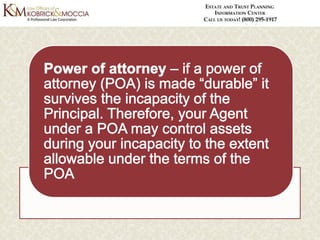

Your estate plan should be comprehensive in nature so that it protects you, your assets and your loved ones both while you are alive and after you are gone. Learn more about incapacity planning in this presentation.

1 of 33

Download to read offline

Ad

Recommended

The Role of Special Needs Trusts in Estate Planning

The Role of Special Needs Trusts in Estate PlanningSaul Kobrick

?

These are crucial legal documents that allow those with physical or mental disabilities or who has a chronic or terminal illness the opportunity to protect his assets. Learn more about special needs trusts in this presentation.Do You Need an Incapacity Plan

Do You Need an Incapacity PlanSaul Kobrick

?

You likely operate under the belief that incapacity won¡¯t happen to you so why would you need to include incapacity planning in your overall estate plan? Learn more about incapacity plan in this presentation.Estate Planning 101: Estate Planning Terms, Concepts, and Basic Information f...

Estate Planning 101: Estate Planning Terms, Concepts, and Basic Information f...Saul Kobrick

?

Surveys indicate that most Americans understand the need to have at least a basic estate plan in place. Despite this, less than half of all Americans do have an estate plan in place. Learn more about estate planning in this presentation.Getting Started with Your Estate Plan: Estate Planning Basics for the Beginner

Getting Started with Your Estate Plan: Estate Planning Basics for the BeginnerSaul Kobrick

?

Everyone should have a comprehensive estate plan in place. If you have yet to create yours, there is no time like the present. Learn more about estate plan in this presentation.What Are the Duties and Responsibilities of an Executor

What Are the Duties and Responsibilities of an ExecutorSaul Kobrick

?

If a challenge to the Will is filed, in the form of a Will contest, the Executor must defend the Will submitted to probate. Learn more about duties and responsibilities of an executor in this presentation.Medicaid Planning: Do You Need to Include It in Your Estate Plan

Medicaid Planning: Do You Need to Include It in Your Estate PlanSaul Kobrick

?

Medicaid is primarily funded by the U.S. federal government; however, because it is administered by the individual states the eligibility criteria, as well as available benefits, may vary somewhat among the individual states. Learn more about medicaid planning in this presentation.Gift and Estate Taxes: Is Your Estate Prepared

Gift and Estate Taxes: Is Your Estate PreparedSaul Kobrick

?

You worked hard all your life, saved meticulously, and invested wisely. As a result, you have amassed a respectable estate to leave behind to your loved ones. Learn more about gift and estate taxes in this presentation.What Exactly Does A New York Trustee Do

What Exactly Does A New York Trustee DoSaul Kobrick

?

Today, trust agreements are commonly found in the average American¡¯s estate plan, in part because of their versatility. Learn more about New York trustee in this presentation.Long Term Care Planning - What You Need to Know

Long Term Care Planning - What You Need to KnowSaul Kobrick

?

Including Medicaid planning in your overall estate plan from early on will ensure that your assets are protected and your long-term care costs are covered. Learn more about long term care planning in this presentation.SSI and SSDI - Eligibility, Benefits, and Procedures

SSI and SSDI - Eligibility, Benefits, and ProceduresSaul Kobrick

?

To qualify for either program, therefore, you must meet the Social Security Administration¡¯s (SSA) definition of ¡°disabled¡±. Learn more about ssi and ssdi in this presentation.New York SSI and SSDI - Eligibility, Benefits, and Procedures

New York SSI and SSDI - Eligibility, Benefits, and ProceduresSaul Kobrick

?

The document provides an overview of the eligibility, benefits, and application procedures for Social Security Income (SSI) and Social Security Disability Insurance (SSDI) in New York. It explains the definition of 'disabled' according to the Social Security Administration, the requirements for both programs, and the potential benefits for qualifying individuals and their families. Additionally, it discusses the complexities of the application process and the importance of consulting an attorney for assistance.Federal Gift and Estate Tax - Understanding the Tax

Federal Gift and Estate Tax - Understanding the TaxSaul Kobrick

?

Part I of this series helps explain federal gift and estate tax while Part II offers suggestions for strategies that can reduce or eliminate the tax. Learn more about federal gift and estate tax in this presentation.Philantrophy in Your Estate Plan - How to Keep on Giving

Philantrophy in Your Estate Plan - How to Keep on GivingSaul Kobrick

?

Charitable trusts offer a significant amount of flexibility, allowing you to gear your trust agreement to your specific goals and objectives. Learn more about charitable trusts in this presentation.Advanced Directives in New York

Advanced Directives in New YorkSaul Kobrick

?

An advanced directive allows you to decide in advance what medical treatment you want and what medical treatment you don't want. Learn more about advance directives in New York in this presentation.LGBT Estate Planning - How Estate Planning Can Help

LGBT Estate Planning - How Estate Planning Can HelpSaul Kobrick

?

Until recently, the United States federal government effectively discriminated against same-sex couples through the definition of marriage found in the Defense Against Marriage Act, or DOMA. Learn mor about lgbt estate planning in this presentation.LGBT Estate Planning in New York - Part1

LGBT Estate Planning in New York - Part1Saul Kobrick

?

Members of the Lesbian, Gay, Bi-Sexual, and Transgender, or LGBT, community, and their supporters, have struggled for decades to provide equal rights under the law to members of the community ¨C and the fight is not over yet. Learn more about LGBT estate planning in New York in this presentation.New York Probate Process

New York Probate ProcessSaul Kobrick

?

The document outlines the New York probate process and emphasizes the importance of probate avoidance strategies in estate planning. Probate is the legal procedure initiated after an individual's death to manage their estate, which can be complicated and costly, especially for intestate estates. It highlights various strategies such as life insurance, joint ownership, POD/TOD accounts, and trusts that can help individuals bypass probate to ensure a smoother asset transfer to beneficiaries.Long-Term Care Planning in New York

Long-Term Care Planning in New YorkSaul Kobrick

?

The document discusses the importance of long-term care planning in New York as part of an overall estate plan to protect assets and ensure care during one's later years. It highlights the rising demand for long-term care, the inadequacies of health insurance, and the necessity for Medicaid planning to qualify for benefits without depleting assets. The authors emphasize consulting with an estate planning attorney to develop effective strategies and prevent financial loss related to long-term care needs.Including The Family Pet - In Your Estate Plan

Including The Family Pet - In Your Estate PlanSaul Kobrick

?

The law considers your pet to be your property, meaning you can gift your pet in your Will. Learn more about pet plan in this presentation.New York Executor Duties

New York Executor DutiesSaul Kobrick

?

When someone dies, the estate of the decedent is generally required to pass through the legal process known as probate. Learn more about New York executor duties in this presentation.Incapacity Planning - Why It Should Be Part of Your Estate Plan

Incapacity Planning - Why It Should Be Part of Your Estate PlanSaul Kobrick

?

If your incapacity lasts for more than a short period of time, your spouse may not be able to pay the bills even though you have the funds to do so because a court order is needed to access your assets. Learn more about incapacity planning in this presentation.The Probate Process in New York

The Probate Process in New YorkSaul Kobrick

?

Probate is the legal process that is required by law following the death of an individual. Learn more about probate process in New York in this presentation.Trusts Basics in New York: What You Need To Know

Trusts Basics in New York: What You Need To KnowSaul Kobrick

?

An important factor in the success or failure of a trust is the Trustee. Though many people consider naming a spouse/parent/child as trustee.Learn more about trusts basics in New York in this presentation.Estate Liquidity: What You Need to Know

Estate Liquidity: What You Need to KnowSaul Kobrick

?

Learn more about estate liquidity in New York and what you need to know in this presentation.Guardianship Process in New York

Guardianship Process in New YorkSaul Kobrick

?

Learn more about guardianship process in New York in this presentation.HEMS Standards

HEMS StandardsSaul Kobrick

?

HEMS is the acronym for "health, education, maintenance and support" distributions. Learn more about HEMS standards in New York and how it can help avoid transfer tax problems later on.HIPAA, Elder Care and Estate Planning

HIPAA, Elder Care and Estate PlanningSaul Kobrick

?

Learn more about Health Insurance Portability and Accountability Act, or HIPAA, and how it affects the way you should create your estate plan in New York.New York Estate Plan Basics

New York Estate Plan BasicsSaul Kobrick

?

In this presentation we will dissect the components of a complete but simple estate plan in New York.Elliot Dear Attorney ¨C Trusted Legal Advocate in Monsey, NY

Elliot Dear Attorney ¨C Trusted Legal Advocate in Monsey, NYElliotDearAttorney

?

Elliot Dear is a respected attorney based in Monsey, New York, with over a decade of experience in civil litigation, family law, personal injury, and real estate matters. Known for his client-first approach, Elliot offers personalized case handling, clear legal strategies, and responsive support. He holds a strong presence in the community through pro bono work and legal outreach. Clients value his integrity, professionalism, and consistent results. Whether it's courtroom advocacy or consultation, Elliot delivers trusted legal representation with honesty, compassion, and skill¡ªmaking him a reliable choice for individuals and businesses across New York.More Related Content

More from Saul Kobrick (20)

Long Term Care Planning - What You Need to Know

Long Term Care Planning - What You Need to KnowSaul Kobrick

?

Including Medicaid planning in your overall estate plan from early on will ensure that your assets are protected and your long-term care costs are covered. Learn more about long term care planning in this presentation.SSI and SSDI - Eligibility, Benefits, and Procedures

SSI and SSDI - Eligibility, Benefits, and ProceduresSaul Kobrick

?

To qualify for either program, therefore, you must meet the Social Security Administration¡¯s (SSA) definition of ¡°disabled¡±. Learn more about ssi and ssdi in this presentation.New York SSI and SSDI - Eligibility, Benefits, and Procedures

New York SSI and SSDI - Eligibility, Benefits, and ProceduresSaul Kobrick

?

The document provides an overview of the eligibility, benefits, and application procedures for Social Security Income (SSI) and Social Security Disability Insurance (SSDI) in New York. It explains the definition of 'disabled' according to the Social Security Administration, the requirements for both programs, and the potential benefits for qualifying individuals and their families. Additionally, it discusses the complexities of the application process and the importance of consulting an attorney for assistance.Federal Gift and Estate Tax - Understanding the Tax

Federal Gift and Estate Tax - Understanding the TaxSaul Kobrick

?

Part I of this series helps explain federal gift and estate tax while Part II offers suggestions for strategies that can reduce or eliminate the tax. Learn more about federal gift and estate tax in this presentation.Philantrophy in Your Estate Plan - How to Keep on Giving

Philantrophy in Your Estate Plan - How to Keep on GivingSaul Kobrick

?

Charitable trusts offer a significant amount of flexibility, allowing you to gear your trust agreement to your specific goals and objectives. Learn more about charitable trusts in this presentation.Advanced Directives in New York

Advanced Directives in New YorkSaul Kobrick

?

An advanced directive allows you to decide in advance what medical treatment you want and what medical treatment you don't want. Learn more about advance directives in New York in this presentation.LGBT Estate Planning - How Estate Planning Can Help

LGBT Estate Planning - How Estate Planning Can HelpSaul Kobrick

?

Until recently, the United States federal government effectively discriminated against same-sex couples through the definition of marriage found in the Defense Against Marriage Act, or DOMA. Learn mor about lgbt estate planning in this presentation.LGBT Estate Planning in New York - Part1

LGBT Estate Planning in New York - Part1Saul Kobrick

?

Members of the Lesbian, Gay, Bi-Sexual, and Transgender, or LGBT, community, and their supporters, have struggled for decades to provide equal rights under the law to members of the community ¨C and the fight is not over yet. Learn more about LGBT estate planning in New York in this presentation.New York Probate Process

New York Probate ProcessSaul Kobrick

?

The document outlines the New York probate process and emphasizes the importance of probate avoidance strategies in estate planning. Probate is the legal procedure initiated after an individual's death to manage their estate, which can be complicated and costly, especially for intestate estates. It highlights various strategies such as life insurance, joint ownership, POD/TOD accounts, and trusts that can help individuals bypass probate to ensure a smoother asset transfer to beneficiaries.Long-Term Care Planning in New York

Long-Term Care Planning in New YorkSaul Kobrick

?

The document discusses the importance of long-term care planning in New York as part of an overall estate plan to protect assets and ensure care during one's later years. It highlights the rising demand for long-term care, the inadequacies of health insurance, and the necessity for Medicaid planning to qualify for benefits without depleting assets. The authors emphasize consulting with an estate planning attorney to develop effective strategies and prevent financial loss related to long-term care needs.Including The Family Pet - In Your Estate Plan

Including The Family Pet - In Your Estate PlanSaul Kobrick

?

The law considers your pet to be your property, meaning you can gift your pet in your Will. Learn more about pet plan in this presentation.New York Executor Duties

New York Executor DutiesSaul Kobrick

?

When someone dies, the estate of the decedent is generally required to pass through the legal process known as probate. Learn more about New York executor duties in this presentation.Incapacity Planning - Why It Should Be Part of Your Estate Plan

Incapacity Planning - Why It Should Be Part of Your Estate PlanSaul Kobrick

?

If your incapacity lasts for more than a short period of time, your spouse may not be able to pay the bills even though you have the funds to do so because a court order is needed to access your assets. Learn more about incapacity planning in this presentation.The Probate Process in New York

The Probate Process in New YorkSaul Kobrick

?

Probate is the legal process that is required by law following the death of an individual. Learn more about probate process in New York in this presentation.Trusts Basics in New York: What You Need To Know

Trusts Basics in New York: What You Need To KnowSaul Kobrick

?

An important factor in the success or failure of a trust is the Trustee. Though many people consider naming a spouse/parent/child as trustee.Learn more about trusts basics in New York in this presentation.Estate Liquidity: What You Need to Know

Estate Liquidity: What You Need to KnowSaul Kobrick

?

Learn more about estate liquidity in New York and what you need to know in this presentation.Guardianship Process in New York

Guardianship Process in New YorkSaul Kobrick

?

Learn more about guardianship process in New York in this presentation.HEMS Standards

HEMS StandardsSaul Kobrick

?

HEMS is the acronym for "health, education, maintenance and support" distributions. Learn more about HEMS standards in New York and how it can help avoid transfer tax problems later on.HIPAA, Elder Care and Estate Planning

HIPAA, Elder Care and Estate PlanningSaul Kobrick

?

Learn more about Health Insurance Portability and Accountability Act, or HIPAA, and how it affects the way you should create your estate plan in New York.New York Estate Plan Basics

New York Estate Plan BasicsSaul Kobrick

?

In this presentation we will dissect the components of a complete but simple estate plan in New York.Recently uploaded (20)

Elliot Dear Attorney ¨C Trusted Legal Advocate in Monsey, NY

Elliot Dear Attorney ¨C Trusted Legal Advocate in Monsey, NYElliotDearAttorney

?

Elliot Dear is a respected attorney based in Monsey, New York, with over a decade of experience in civil litigation, family law, personal injury, and real estate matters. Known for his client-first approach, Elliot offers personalized case handling, clear legal strategies, and responsive support. He holds a strong presence in the community through pro bono work and legal outreach. Clients value his integrity, professionalism, and consistent results. Whether it's courtroom advocacy or consultation, Elliot delivers trusted legal representation with honesty, compassion, and skill¡ªmaking him a reliable choice for individuals and businesses across New York.In-House vs. Outsourced Contract Abstraction Process

In-House vs. Outsourced Contract Abstraction ProcessAeren LPO

?

The In-House vs. Outsourced Contract Abstraction Process compares managing contract abstraction internally with delegating it to specialized external providers. While in-house teams offer greater control, outsourcing provides scalability, faster turnaround, cost savings, and access to expert legal professionals. For efficient and reliable outsourced contract abstraction services, trust Aeren LPO.SILENT EMERGENCY OF CHILD LABOUR WORLD WIDE

SILENT EMERGENCY OF CHILD LABOUR WORLD WIDEaaphazratbal

?

¡°STOLEN CHILDHOODS":

Every pair of tiny hands that holds a tool instead of a toy¡ Holds the weight of a failed society.

Childhood is meant to be a garden of dreams¡ªFilled with laughter, play, and innocent schemes.

Yet, across dusty roads and behind dim factory walls,Little hands tremble not with joy, but with burdened calls.VIETNAM BREAKING NEWS ¡ª CRYPTO WORLD ¡ª DIGITAL ASSET SERVICES

VIETNAM BREAKING NEWS ¡ª CRYPTO WORLD ¡ª DIGITAL ASSET SERVICESDr. Oliver Massmann

?

VIETNAM BREAKING NEWS ¡ª CRYPTO WORLD ¡ª DIGITAL ASSET SERVICES NAVIGATING THE LEGAL LANDSCAPE OF MEGA CONSTELLATION COLLISIONS LIABILITY, I...

NAVIGATING THE LEGAL LANDSCAPE OF MEGA CONSTELLATION COLLISIONS LIABILITY, I...meekhamariam1012

?

Megaconstellations¡ªlarge networks of satellites in low Earth orbit¡ªpose significant risks including space debris, collisions, and signal interference. These risks threaten not only other satellites but also critical infrastructure and scientific missions. As satellite traffic increases, the potential for accidents and cascading debris events (Kessler Syndrome) grows. Insurance becomes essential to mitigate financial losses from damage, liability, and service disruption. Specialized space insurance must evolve to address these complex risks, including third-party liability and collision coverage. With unclear international liability regimes and increasing private sector involvement, robust insurance frameworks are critical for sustainable space operations and responsible megaconstellation deployment¡ªlarge networks of satellites in low Earth orbit¡ªpose significant risks including space debris, collisions, and signal interference. These risks threaten not only other satellites but also critical infrastructure and scientific missions. As satellite traffic increases, the potential for accidents and cascading debris events (Kessler Syndrome) grows. Insurance becomes essential to mitigate financial losses from damage, liability, and service disruption. Specialized space insurance must evolve to address these complex risks, including third-party liability and collision coverage. With unclear international liability regimes and increasing private sector involvement, robust insurance frameworks are critical for sustainable space operations and responsible megaconstellation deploymentOfficial Biography, Headshot and Speaking Vita for Ms. Dar'shun Kendrick

Official Biography, Headshot and Speaking Vita for Ms. Dar'shun KendrickKairos Capital Legal Advisors,LLC

?

Official biography, headshot and vita for Ms. Dar'shun Kendrick.

Inter-faith-couple-BAIL-order19-may-2025-604173.pdf

Inter-faith-couple-BAIL-order19-may-2025-604173.pdfsabranghindi

?

Supreme Court viewed the matter through the lens of personal liberty and marital autonomy, reiterating that the right of adult individuals to live together cannot be curtailed by the state on the ground of religious difference.89th Legislative Session Debrief: Panel Discussion

89th Legislative Session Debrief: Panel Discussiontagdpa

?

This document provides an overview of the 89th Legislative Session, highlighting key outcomes and their implications for the water sector.Hearing Court Kurchinski VS Kouskoutis.pdf

Hearing Court Kurchinski VS Kouskoutis.pdfalekurchinski

?

Highlight the transcript probate court system in Pinellas county. My experience as widow and mother of two young girls. I feel that Special Master has not been impartial. Agent attorney and successor trustee from the trust negotiation excessive compensation fees from the Trust Estate.

It feels like the Estate and Trust are being used to pay for ongoing court fights, and the people in charge Agent Attoney, Successor Trustee, Personal Representative, Special Master, Mediation and Guardian Ad Litem - they are making money while the case keeps going.

With respect and hope for justice,

Alessandra Kurchinski

Widow of Franklin Kurchinski

Mother of Jacqueline and Caroline.

Gideon Korrell Analyzes La Molisana: Faulty Protein Labels in AD Row

Gideon Korrell Analyzes La Molisana: Faulty Protein Labels in AD RowGideon Korrell

?

Gideon Korrell investigates discrepancies in the protein labeling of La Molisana products, specifically within the AD row of the dataset. Through a detailed examination of nutritional data and labeling standards, Korrell uncovers potential errors that may mislead consumers or violate regulatory guidelines. The analysis highlights the importance of accurate labeling in the food industry and raises questions about quality control practices within the La Molisana brand.×îĞ°æÃÀ¹úÓÌËû´óѧ±ÏÒµÖ¤£¨U of U±ÏÒµÖ¤Ê飩԰涨ÖÆ

×îĞ°æÃÀ¹úÓÌËû´óѧ±ÏÒµÖ¤£¨U of U±ÏÒµÖ¤Ê飩԰涨ÖÆTaqyea

?

2025Ô°æÓÌËû´óѧ±ÏÒµÖ¤Êépdfµç×Ӱ桾qޱ1954292140¡¿ÃÀ¹ú±ÏÒµÖ¤°ìÀíU of UÓÌËû´óѧ±ÏÒµÖ¤Êé¶àÉÙÇ®£¿¡¾qޱ1954292140¡¿º£Íâ¸÷´óѧDiploma°æ±¾£¬ÒòΪÒßÇéѧУÍƳٷ¢·ÅÖ¤Êé¡¢Ö¤ÊéÔ¼ş¶ªÊ§²¹°ì¡¢Ã»ÓĞÕı³£±ÏҵδÄÜÈÏ֤ѧÀúÃæÁÙ¾ÍÒµÌṩ½â¾ö°ì·¨¡£µ±ÔâÓö¹Ò¿Æ¡¢¿õ¿Îµ¼ÖÂÎŞ·¨ĞŞÂúѧ·Ö£¬»òÕßÖ±½Ó±»Ñ§Ğ£ÍËѧ£¬×îºóÎŞ·¨±ÏÒµÄò»µ½±ÏÒµÖ¤¡£´ËʱµÄÄãÒ»¶¨ÊÖ×ãÎŞ´ë£¬ÒòΪÁôѧһ³¡£¬Ã»ÓĞ»ñµÃ±ÏÒµÖ¤ÒÔ¼°Ñ§ÀúÖ¤Ã÷¿Ï¶¨ÊÇÎŞ·¨¸ø×Ô¼ººÍ¸¸Ä¸Ò»¸ö½»´úµÄ¡£

¡¾¸´¿ÌÓÌËû´óѧ³É¼¨µ¥ĞÅ·â,Buy The University of Utah Transcripts¡¿

¹ºÂòÈÕº«³É¼¨µ¥¡¢Ó¢¹ú´óѧ³É¼¨µ¥¡¢ÃÀ¹ú´óѧ³É¼¨µ¥¡¢°ÄÖŞ´óѧ³É¼¨µ¥¡¢¼ÓÄôó´óѧ³É¼¨µ¥£¨q΢1954292140£©Ğ¼ÓÆ´óѧ³É¼¨µ¥¡¢ĞÂÎ÷À¼´óѧ³É¼¨µ¥¡¢°®¶ûÀ¼³É¼¨µ¥¡¢Î÷°àÑÀ³É¼¨µ¥¡¢µÂ¹ú³É¼¨µ¥¡£³É¼¨µ¥µÄÒâÒåÖ÷ÒªÌåÏÖÔÚÖ¤Ã÷ѧϰÄÜÁ¦¡¢ÆÀ¹ÀѧÊõ±³¾°¡¢Õ¹Ê¾×ÛºÏËØÖÊ¡¢Ìá¸ß¼ȡÂÊ£¬ÒÔ¼°ÊÇ×÷ΪÁôĞÅÈÏÖ¤ÉêÇë²ÄÁϵÄÒ»²¿·Ö¡£

ÓÌËû´óѧ³É¼¨µ¥Äܹ»ÌåÏÖÄúµÄµÄѧϰÄÜÁ¦£¬°üÀ¨ÓÌËû´óѧ¿Î³Ì³É¼¨¡¢×¨ÒµÄÜÁ¦¡¢Ñо¿ÄÜÁ¦¡££¨q΢1954292140£©¾ßÌåÀ´Ëµ£¬³É¼¨±¨¸æµ¥Í¨³£°üº¬Ñ§ÉúµÄѧϰ¼¼ÄÜÓëÏ°¹ß¡¢¸÷¿Æ³É¼¨ÒÔ¼°ÀÏʦÆÀÓïµÈ²¿·Ö£¬Òò´Ë£¬³É¼¨µ¥²»½öÊÇѧÉúѧÊõÄÜÁ¦µÄÖ¤Ã÷£¬Ò²ÊÇÆÀ¹ÀѧÉúÊÇ·ñÊʺÏij¸ö½ÌÓıÏîÄ¿µÄÖØÒªÒÀ¾İ£¡

ÎÒÃdzĞŵ²ÉÓõÄÊÇѧУ԰æÖ½ÕÅ£¨Ô°æÖ½ÖÊ¡¢µ×É«¡¢ÎÆ·£©ÎÒÃǹ¤³§ÓµÓĞÈ«Ì×½ø¿ÚÔ×°É豸£¬ÌØÊ⹤ÒÕ¶¼ÊDzÉÓò»Í¬»úÆ÷ÖÆ×÷£¬·ÂÕæ¶È»ù±¾¿ÉÒÔ´ïµ½100%£¬ËùÓгÉÆ·ÒÔ¼°¹¤ÒÕЧ¹û¶¼¿ÉÌáÇ°¸ø¿Í»§Õ¹Ê¾£¬²»ÂúÒâ¿ÉÒÔ¸ù¾İ¿Í»§ÒªÇó½øĞе÷Õû£¬Ö±µ½ÂúÒâΪֹ£¡

¡¾Ö÷ÓªÏîÄ¿¡¿

Ò»¡¢¹¤×÷δȷ¶¨£¬»Ø¹úĞèÏȸø¸¸Ä¸¡¢Ç×ÆİÅóÓÑ¿´ÏÂÎÄƾµÄÇé¿ö£¬°ìÀí±ÏÒµÖ¤|°ìÀíÎÄƾ: Âò´óѧ±ÏÒµÖ¤|Âò´óѧÎÄƾ¡¾qޱ1954292140¡¿ÓÌËû´óѧѧλ֤Ã÷ÊéÈçºÎ°ìÀíÉêÇ룿

¶ş¡¢»Ø¹ú½ø˽Æó¡¢ÍâÆó¡¢×Ô¼º×öÉúÒâµÄÇé¿ö£¬ÕâĞ©µ¥Î»ÊDz»²éѯ±ÏÒµÖ¤ÕæαµÄ£¬¶øÇÒ¹úÄÚûÓĞÇşµÀÈ¥²éѯ¹úÍâÎÄƾµÄÕæ¼Ù£¬Ò²²»ĞèÒªÌṩÕæʵ½ÌÓı²¿ÈÏÖ¤¡£¼øÓÚ´Ë£¬°ìÀíÃÀ¹ú³É¼¨µ¥ÓÌËû´óѧ±ÏÒµÖ¤¡¾qޱ1954292140¡¿¹úÍâ´óѧ±ÏÒµÖ¤, ÎÄƾ°ìÀí, ¹úÍâÎÄƾ°ìÀí, ÁôĞÅÍøÈÏÖ¤The Law of Delict: An Overview of Remedies

The Law of Delict: An Overview of RemediesAshwini Singh

?

An introduction to delictual claims in South African law and an overview of the remedies available in for delictual claims.Kathleen Campbell Davis - The Stages of Civil Litigation

Kathleen Campbell Davis - The Stages of Civil LitigationKathleen Campbell Davis

?

Civil litigation refers to a series of legal processes that seek to resolve disputes between individuals, organizations, and businesses. Unlike criminal litigation, which often involves the state and a private entity, civil litigation primarily involves private entities seeking redress or remedies for specific performance or financial compensation. It consists of stages, such as pre-filing and evidence gathering.Top Immigration Lawyers in Phoenix Cima Law Group.pdf

Top Immigration Lawyers in Phoenix Cima Law Group.pdfCimalaw Group

?

Looking for the best immigration lawyers in Phoenix? Cima Law Group is dedicated to helping individuals and families navigate complex immigration matters with confidence and clarity. Our experienced attorneys specialize in green cards, family-based visas, deportation defense, asylum, U visas, and more. We provide personalized legal solutions tailored to your unique situation and are committed to protecting your rights every step of the way. With bilingual services and a reputation for compassionate advocacy, we are proud to be a trusted choice for clients throughout Arizona. Mens Rea & Actus Reus in Criminal Law.pptx

Mens Rea & Actus Reus in Criminal Law.pptxBarrister Amna (A Levels Academy Islamabad)

?

The Concept of Mens Rea and Actus Reus in Criminal Law:

In criminal law, two basic elements must be present for a person to be found guilty of a crime: Mens Rea and Actus Reus. These are Latin terms where Actus Reus means ¡°guilty act¡± and Mens Rea means ¡°guilty mind.¡± Both are essential for most criminal offences. A crime is generally not complete unless a person commits a wrongful act (Actus Reus) with a wrongful intention (Mens Rea).

Actus Reus refers to the physical act of the crime. It is the external action or conduct that is prohibited by law, such as killing, stealing, or hurting someone. For example, if a person hits another person with a stick, the physical act of hitting is the Actus Reus. This act must be voluntary; if the person was forced or acted unconsciously, then it may not be considered a crime. Actus Reus can also include omissions. In some cases, not doing something can be considered a criminal act if the law says there was a duty to act. For example, a parent not feeding their child could be an omission that causes harm, and thus a criminal act.

Mens Rea, on the other hand, is about the mental state of the accused. It refers to the intention or knowledge of wrongdoing. In simple words, it asks the question: Did the person mean to do wrong? If yes, they had Mens Rea. There are different levels of Mens Rea. The most serious is intention, where the person wanted the outcome to happen. Then comes knowledge, where they knew their actions were illegal or harmful. Recklessness involves knowing a risk but choosing to ignore it, and negligence means failing to take reasonable care, which results in harm.

For a crime to be legally proven, the accused must have both Actus Reus and Mens Rea at the same time. For example, if someone plans to kill another person and then actually kills them, both the guilty mind and guilty act are present. But if a person accidentally harms someone without bad intention, the Mens Rea may be missing, and the case may not qualify as a serious crime like murder.

There are some exceptions. In certain minor offences called strict liability offences, Mens Rea is not required. Just doing the act is enough for punishment. These usually relate to traffic rules, public safety, or health regulations.

In conclusion, Mens Rea and Actus Reus are two key elements in criminal law. One is the action, and the other is the intention. Both are usually required to establish criminal responsibility. Without proving both, the accused cannot be fairly punished under the law. This combination ensures that people are only held guilty when they have both done something wrong and meant to do it.Legal Strategics for Startup Success Employment law.pptx

Legal Strategics for Startup Success Employment law.pptxRoger Royse

?

a summary of employment law issues for startupsÎ÷°àÑÀ¹ş¶÷´óѧ³É¼¨µ¥µ÷±«´³´¡Ñ§Éú¿¨±«´³´¡Ñ§ÀúÈÏÖ¤²éѯ°¨ÔÚÏß°ìÀí

Î÷°àÑÀ¹ş¶÷´óѧ³É¼¨µ¥µ÷±«´³´¡Ñ§Éú¿¨±«´³´¡Ñ§ÀúÈÏÖ¤²éѯ°¨ÔÚÏß°ìÀítaqyed

?

2025Ä꼫ËÙ°ì¹ş¶÷´óѧ±ÏÒµÖ¤¡¾qޱ1954292140¡¿Ñ§ÀúÈÏÖ¤Á÷³Ì¹ş¶÷´óѧ±ÏÒµÖ¤Î÷°àÑÀ±¾¿Æ³É¼¨µ¥ÖÆ×÷¡¾qޱ1954292140¡¿º£Íâ¸÷´óѧDiploma°æ±¾£¬ÒòΪÒßÇéѧУÍƳٷ¢·ÅÖ¤Êé¡¢Ö¤ÊéÔ¼ş¶ªÊ§²¹°ì¡¢Ã»ÓĞÕı³£±ÏҵδÄÜÈÏ֤ѧÀúÃæÁÙ¾ÍÒµÌṩ½â¾ö°ì·¨¡£µ±ÔâÓö¹Ò¿Æ¡¢¿õ¿Îµ¼ÖÂÎŞ·¨ĞŞÂúѧ·Ö£¬»òÕßÖ±½Ó±»Ñ§Ğ£ÍËѧ£¬×îºóÎŞ·¨±ÏÒµÄò»µ½±ÏÒµÖ¤¡£´ËʱµÄÄãÒ»¶¨ÊÖ×ãÎŞ´ë£¬ÒòΪÁôѧһ³¡£¬Ã»ÓĞ»ñµÃ±ÏÒµÖ¤ÒÔ¼°Ñ§ÀúÖ¤Ã÷¿Ï¶¨ÊÇÎŞ·¨¸ø×Ô¼ººÍ¸¸Ä¸Ò»¸ö½»´úµÄ¡£

¡¾¸´¿Ì¹ş¶÷´óѧ³É¼¨µ¥ĞÅ·â,Buy Universidad de Ja¨¦n Transcripts¡¿

¹ºÂòÈÕº«³É¼¨µ¥¡¢Ó¢¹ú´óѧ³É¼¨µ¥¡¢ÃÀ¹ú´óѧ³É¼¨µ¥¡¢°ÄÖŞ´óѧ³É¼¨µ¥¡¢¼ÓÄôó´óѧ³É¼¨µ¥£¨q΢1954292140£©Ğ¼ÓÆ´óѧ³É¼¨µ¥¡¢ĞÂÎ÷À¼´óѧ³É¼¨µ¥¡¢°®¶ûÀ¼³É¼¨µ¥¡¢Î÷°àÑÀ³É¼¨µ¥¡¢µÂ¹ú³É¼¨µ¥¡£³É¼¨µ¥µÄÒâÒåÖ÷ÒªÌåÏÖÔÚÖ¤Ã÷ѧϰÄÜÁ¦¡¢ÆÀ¹ÀѧÊõ±³¾°¡¢Õ¹Ê¾×ÛºÏËØÖÊ¡¢Ìá¸ß¼ȡÂÊ£¬ÒÔ¼°ÊÇ×÷ΪÁôĞÅÈÏÖ¤ÉêÇë²ÄÁϵÄÒ»²¿·Ö¡£

¹ş¶÷´óѧ³É¼¨µ¥Äܹ»ÌåÏÖÄúµÄµÄѧϰÄÜÁ¦£¬°üÀ¨¹ş¶÷´óѧ¿Î³Ì³É¼¨¡¢×¨ÒµÄÜÁ¦¡¢Ñо¿ÄÜÁ¦¡££¨q΢1954292140£©¾ßÌåÀ´Ëµ£¬³É¼¨±¨¸æµ¥Í¨³£°üº¬Ñ§ÉúµÄѧϰ¼¼ÄÜÓëÏ°¹ß¡¢¸÷¿Æ³É¼¨ÒÔ¼°ÀÏʦÆÀÓïµÈ²¿·Ö£¬Òò´Ë£¬³É¼¨µ¥²»½öÊÇѧÉúѧÊõÄÜÁ¦µÄÖ¤Ã÷£¬Ò²ÊÇÆÀ¹ÀѧÉúÊÇ·ñÊʺÏij¸ö½ÌÓıÏîÄ¿µÄÖØÒªÒÀ¾İ£¡

ÎÒÃdzĞŵ²ÉÓõÄÊÇѧУ԰æÖ½ÕÅ£¨Ô°æÖ½ÖÊ¡¢µ×É«¡¢ÎÆ·£©ÎÒÃǹ¤³§ÓµÓĞÈ«Ì×½ø¿ÚÔ×°É豸£¬ÌØÊ⹤ÒÕ¶¼ÊDzÉÓò»Í¬»úÆ÷ÖÆ×÷£¬·ÂÕæ¶È»ù±¾¿ÉÒÔ´ïµ½100%£¬ËùÓгÉÆ·ÒÔ¼°¹¤ÒÕЧ¹û¶¼¿ÉÌáÇ°¸ø¿Í»§Õ¹Ê¾£¬²»ÂúÒâ¿ÉÒÔ¸ù¾İ¿Í»§ÒªÇó½øĞе÷Õû£¬Ö±µ½ÂúÒâΪֹ£¡

¡¾Ö÷ÓªÏîÄ¿¡¿

Ò».¹ş¶÷´óѧ±ÏÒµÖ¤¡¾q΢1954292140¡¿¹ş¶÷´óѧ³É¼¨µ¥¡¢ÁôĞÅÈÏÖ¤¡¢Ê¹¹İÈÏÖ¤¡¢½ÌÓı²¿ÈÏÖ¤¡¢ÑÅ˼Íи£³É¼¨µ¥¡¢Ñ§Éú¿¨µÈ£¡

¶ş.Õæʵʹ¹İ¹«Ö¤(¼´Áôѧ»Ø¹úÈËÔ±Ö¤Ã÷,²»³É¹¦²»ÊÕ·Ñ)

Èı.Õæʵ½ÌÓı²¿Ñ§ÀúѧλÈÏÖ¤£¨½ÌÓı²¿´æµµ£¡½ÌÓı²¿Áô·şÍøÕ¾ÓÀ¾Ã¿É²é£©

ËÄ.°ìÀí¹úÍâ¸÷´óѧÎÄƾ(Ò»¶Ôһרҵ·şÎñ,¿ÉÈ«³Ì¼à¿Ø¸ú×Ù½ø¶È)Official Biography, Headshot and Speaking Vita for Ms. Dar'shun Kendrick

Official Biography, Headshot and Speaking Vita for Ms. Dar'shun KendrickKairos Capital Legal Advisors,LLC

?

Ad