What Exactly Does A New York Trustee Do

1 like460 views

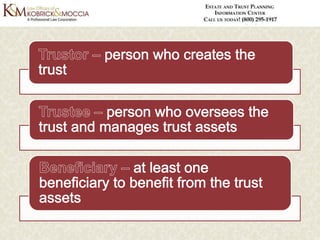

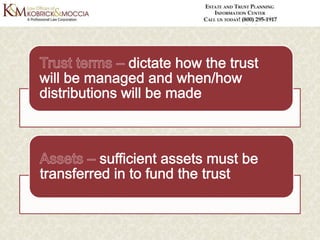

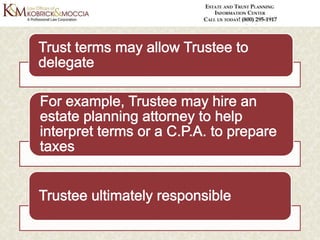

Today, trust agreements are commonly found in the average AmericanˇŻs estate plan, in part because of their versatility. Learn more about New York trustee in this presentation.

1 of 30

Download to read offline

Ad

Recommended

Advanced Directives in New York

Advanced Directives in New YorkSaul Kobrick

?

An advanced directive allows you to decide in advance what medical treatment you want and what medical treatment you don't want. Learn more about advance directives in New York in this presentation.Challenging a Will in Missouri

Challenging a Will in MissouriCharlie Amen

?

Because you wonˇŻt be around to defend it against challengers, it is imperative that you execute a well thought out and professionally drafted Will before you die. Learn more about will in Missouri in this presentation.La agresi¨®nTesla Gutierrez

?

Este documento trata sobre la naturaleza de la agresi¨®n y sus causas. Explora diferentes tipos de agresi¨®n y teor¨Şas sobre sus or¨Şgenes, incluyendo factores biol¨®gicos e influencias del medio ambiente. Tambi¨¦n analiza causas como percepciones, factores sociales y culturales, experiencias previas, sexo, sentimientos negativos y factores ambientales. El documento sugiere que la agresi¨®n resulta de la interacci¨®n entre la herencia y el medio, y ofrece consejos para disminuir el bullying a nivel personal y escolar.What You DonˇŻt Know Can Hurt You in a DUI Case in Tennesee

What You DonˇŻt Know Can Hurt You in a DUI Case in TenneseeStan Bennett

?

The document discusses various aspects of DUI laws in Tennessee, including the potential illegality of stops and challenges to field sobriety tests. It highlights the issues with chemical breath test accuracy and emphasizes the option of jury trials. Additionally, it suggests that negotiations with overworked prosecutors may be possible.Is Probate Always Required

Is Probate Always RequiredMark Eghrari

?

When you use a will to transfer your assets, this court supervises the estate administration process. This process called probate. Learn more about probate process in this presentation.Probate and the Role of the Executor

Probate and the Role of the ExecutorBarry D Horowitz

?

There is a process of estate administration that is initiated after someone passes away.If you use a will to direct the transfer of your personally held property, the process of probate would enter the picture. Learn more about probate and the role of the executor in this presentation.When Will I Get My Inheritance?

When Will I Get My Inheritance?Charlie Amen

?

Wanting to have some idea when to expect your inheritance is perfectly understandable. The problem is that there are numerous factors that can impact the timeframe for the distribution of estate assets.

Shena

ShenaNicole Frances Cagaanan

?

The document discusses the agricultural practices and way of life of early Filipinos. It describes how they transitioned from hunter-gatherers to cultivating plants and herding animals around 10,000 years ago, allowing them to grow in numbers and live in settled communities. It then provides details on their staple foods, styles of dress, social structure led by village chiefs or datus, and arts that developed.Getting Ready for PCI DSS 3.0

Getting Ready for PCI DSS 3.0Armor

?

Kurt Hagerman, a chief information security officer, gave a presentation on getting organizations ready for PCI DSS 3.0 compliance. He discussed the burden of compliance for organizations that lack resources, and recent high-profile data breaches. He then outlined a 6-point checklist for organizations to test their PCI assessment readiness, including reviewing documentation, checking the cardholder data environment, and preparing for an audit. The goal is to identify any remaining control gaps and ensure readiness for the 2015 PCI assessment.PTA Member Portal (PMP) Overview

PTA Member Portal (PMP) OverviewMurali Vasudevan

?

The document describes a PTA Member Portal (PMP) software solution that can help PTAs manage membership registration and renewals, payments, volunteer signups, email campaigns, and other activities more easily than paper-based systems. The PMP allows online registration and payments, prints membership cards, and includes features like a payment manager, volunteer manager, and scholarship manager. It costs $250 for setup plus $250-700 annually for use. The document recommends PTAs implement the PMP in time for their back-to-school membership drives to more easily manage the processes and increase membership.Are Violent Crimes Treated Differently

Are Violent Crimes Treated DifferentlyStan Bennett

?

The document discusses the definition and examples of violent crimes in Tennessee, including the associated penalties. It also covers topics such as firearm sentence enhancements and societal views on violent crimes. Additionally, it addresses the pressure prosecutors may exert in such cases.DepEd Mission, Vision, Core Values and Mandate

DepEd Mission, Vision, Core Values and MandateDr. Joy Kenneth Sala Biasong

?

DepEd's vision is for Filipinos to realize their full potential and contribute meaningfully to building the nation. Its mission is to provide quality, equitable, and complete basic education where students learn in a supportive environment, teachers facilitate learning, and stakeholders share responsibility. DepEd's core values are being God-loving, people-oriented, environmentally-conscious, and nationalistic. DepEd was established in 1863 and mandated by law in 2001 to formulate, implement, and coordinate basic education policies, plans, and programs for both public and private formal and non-formal schools.Segundoparcial ever britezeverbritez

?

Didier Drogba es un delantero marfile?o nacido en 1978 que juega actualmente para el Shangh¨˘i Shenhua de China. Es el m¨˘ximo goleador hist¨®rico de la selecci¨®n de Costa de Marfil y anot¨® 157 goles con el Chelsea, siendo el cuarto m¨˘ximo goleador en la historia de este club ingl¨¦s.Estate Planning 101: Estate Planning Terms, Concepts, and Basic Information f...

Estate Planning 101: Estate Planning Terms, Concepts, and Basic Information f...Saul Kobrick

?

Surveys indicate that most Americans understand the need to have at least a basic estate plan in place. Despite this, less than half of all Americans do have an estate plan in place. Learn more about estate planning in this presentation.Getting Started with Your Estate Plan: Estate Planning Basics for the Beginner

Getting Started with Your Estate Plan: Estate Planning Basics for the BeginnerSaul Kobrick

?

Everyone should have a comprehensive estate plan in place. If you have yet to create yours, there is no time like the present. Learn more about estate plan in this presentation.What Are the Duties and Responsibilities of an Executor

What Are the Duties and Responsibilities of an ExecutorSaul Kobrick

?

If a challenge to the Will is filed, in the form of a Will contest, the Executor must defend the Will submitted to probate. Learn more about duties and responsibilities of an executor in this presentation.Medicaid Planning: Do You Need to Include It in Your Estate Plan

Medicaid Planning: Do You Need to Include It in Your Estate PlanSaul Kobrick

?

Medicaid is primarily funded by the U.S. federal government; however, because it is administered by the individual states the eligibility criteria, as well as available benefits, may vary somewhat among the individual states. Learn more about medicaid planning in this presentation.Incapacity Planning: What Is It and Who Needs It

Incapacity Planning: What Is It and Who Needs ItSaul Kobrick

?

Your estate plan should be comprehensive in nature so that it protects you, your assets and your loved ones both while you are alive and after you are gone. Learn more about incapacity planning in this presentation.Do You Need an Incapacity Plan

Do You Need an Incapacity PlanSaul Kobrick

?

You likely operate under the belief that incapacity wonˇŻt happen to you so why would you need to include incapacity planning in your overall estate plan? Learn more about incapacity plan in this presentation.The Role of Special Needs Trusts in Estate Planning

The Role of Special Needs Trusts in Estate PlanningSaul Kobrick

?

These are crucial legal documents that allow those with physical or mental disabilities or who has a chronic or terminal illness the opportunity to protect his assets. Learn more about special needs trusts in this presentation.Gift and Estate Taxes: Is Your Estate Prepared

Gift and Estate Taxes: Is Your Estate PreparedSaul Kobrick

?

You worked hard all your life, saved meticulously, and invested wisely. As a result, you have amassed a respectable estate to leave behind to your loved ones. Learn more about gift and estate taxes in this presentation.Long Term Care Planning - What You Need to Know

Long Term Care Planning - What You Need to KnowSaul Kobrick

?

Including Medicaid planning in your overall estate plan from early on will ensure that your assets are protected and your long-term care costs are covered. Learn more about long term care planning in this presentation.SSI and SSDI - Eligibility, Benefits, and Procedures

SSI and SSDI - Eligibility, Benefits, and ProceduresSaul Kobrick

?

To qualify for either program, therefore, you must meet the Social Security AdministrationˇŻs (SSA) definition of ˇ°disabledˇ±. Learn more about ssi and ssdi in this presentation.New York SSI and SSDI - Eligibility, Benefits, and Procedures

New York SSI and SSDI - Eligibility, Benefits, and ProceduresSaul Kobrick

?

The document provides an overview of the eligibility, benefits, and application procedures for Social Security Income (SSI) and Social Security Disability Insurance (SSDI) in New York. It explains the definition of 'disabled' according to the Social Security Administration, the requirements for both programs, and the potential benefits for qualifying individuals and their families. Additionally, it discusses the complexities of the application process and the importance of consulting an attorney for assistance.Federal Gift and Estate Tax - Understanding the Tax

Federal Gift and Estate Tax - Understanding the TaxSaul Kobrick

?

Part I of this series helps explain federal gift and estate tax while Part II offers suggestions for strategies that can reduce or eliminate the tax. Learn more about federal gift and estate tax in this presentation.Philantrophy in Your Estate Plan - How to Keep on Giving

Philantrophy in Your Estate Plan - How to Keep on GivingSaul Kobrick

?

Charitable trusts offer a significant amount of flexibility, allowing you to gear your trust agreement to your specific goals and objectives. Learn more about charitable trusts in this presentation.LGBT Estate Planning - How Estate Planning Can Help

LGBT Estate Planning - How Estate Planning Can HelpSaul Kobrick

?

Until recently, the United States federal government effectively discriminated against same-sex couples through the definition of marriage found in the Defense Against Marriage Act, or DOMA. Learn mor about lgbt estate planning in this presentation.LGBT Estate Planning in New York - Part1

LGBT Estate Planning in New York - Part1Saul Kobrick

?

Members of the Lesbian, Gay, Bi-Sexual, and Transgender, or LGBT, community, and their supporters, have struggled for decades to provide equal rights under the law to members of the community ¨C and the fight is not over yet. Learn more about LGBT estate planning in New York in this presentation.New York Probate Process

New York Probate ProcessSaul Kobrick

?

The document outlines the New York probate process and emphasizes the importance of probate avoidance strategies in estate planning. Probate is the legal procedure initiated after an individual's death to manage their estate, which can be complicated and costly, especially for intestate estates. It highlights various strategies such as life insurance, joint ownership, POD/TOD accounts, and trusts that can help individuals bypass probate to ensure a smoother asset transfer to beneficiaries.More Related Content

Viewers also liked (6)

Shena

ShenaNicole Frances Cagaanan

?

The document discusses the agricultural practices and way of life of early Filipinos. It describes how they transitioned from hunter-gatherers to cultivating plants and herding animals around 10,000 years ago, allowing them to grow in numbers and live in settled communities. It then provides details on their staple foods, styles of dress, social structure led by village chiefs or datus, and arts that developed.Getting Ready for PCI DSS 3.0

Getting Ready for PCI DSS 3.0Armor

?

Kurt Hagerman, a chief information security officer, gave a presentation on getting organizations ready for PCI DSS 3.0 compliance. He discussed the burden of compliance for organizations that lack resources, and recent high-profile data breaches. He then outlined a 6-point checklist for organizations to test their PCI assessment readiness, including reviewing documentation, checking the cardholder data environment, and preparing for an audit. The goal is to identify any remaining control gaps and ensure readiness for the 2015 PCI assessment.PTA Member Portal (PMP) Overview

PTA Member Portal (PMP) OverviewMurali Vasudevan

?

The document describes a PTA Member Portal (PMP) software solution that can help PTAs manage membership registration and renewals, payments, volunteer signups, email campaigns, and other activities more easily than paper-based systems. The PMP allows online registration and payments, prints membership cards, and includes features like a payment manager, volunteer manager, and scholarship manager. It costs $250 for setup plus $250-700 annually for use. The document recommends PTAs implement the PMP in time for their back-to-school membership drives to more easily manage the processes and increase membership.Are Violent Crimes Treated Differently

Are Violent Crimes Treated DifferentlyStan Bennett

?

The document discusses the definition and examples of violent crimes in Tennessee, including the associated penalties. It also covers topics such as firearm sentence enhancements and societal views on violent crimes. Additionally, it addresses the pressure prosecutors may exert in such cases.DepEd Mission, Vision, Core Values and Mandate

DepEd Mission, Vision, Core Values and MandateDr. Joy Kenneth Sala Biasong

?

DepEd's vision is for Filipinos to realize their full potential and contribute meaningfully to building the nation. Its mission is to provide quality, equitable, and complete basic education where students learn in a supportive environment, teachers facilitate learning, and stakeholders share responsibility. DepEd's core values are being God-loving, people-oriented, environmentally-conscious, and nationalistic. DepEd was established in 1863 and mandated by law in 2001 to formulate, implement, and coordinate basic education policies, plans, and programs for both public and private formal and non-formal schools.Segundoparcial ever britezeverbritez

?

Didier Drogba es un delantero marfile?o nacido en 1978 que juega actualmente para el Shangh¨˘i Shenhua de China. Es el m¨˘ximo goleador hist¨®rico de la selecci¨®n de Costa de Marfil y anot¨® 157 goles con el Chelsea, siendo el cuarto m¨˘ximo goleador en la historia de este club ingl¨¦s.More from Saul Kobrick (20)

Estate Planning 101: Estate Planning Terms, Concepts, and Basic Information f...

Estate Planning 101: Estate Planning Terms, Concepts, and Basic Information f...Saul Kobrick

?

Surveys indicate that most Americans understand the need to have at least a basic estate plan in place. Despite this, less than half of all Americans do have an estate plan in place. Learn more about estate planning in this presentation.Getting Started with Your Estate Plan: Estate Planning Basics for the Beginner

Getting Started with Your Estate Plan: Estate Planning Basics for the BeginnerSaul Kobrick

?

Everyone should have a comprehensive estate plan in place. If you have yet to create yours, there is no time like the present. Learn more about estate plan in this presentation.What Are the Duties and Responsibilities of an Executor

What Are the Duties and Responsibilities of an ExecutorSaul Kobrick

?

If a challenge to the Will is filed, in the form of a Will contest, the Executor must defend the Will submitted to probate. Learn more about duties and responsibilities of an executor in this presentation.Medicaid Planning: Do You Need to Include It in Your Estate Plan

Medicaid Planning: Do You Need to Include It in Your Estate PlanSaul Kobrick

?

Medicaid is primarily funded by the U.S. federal government; however, because it is administered by the individual states the eligibility criteria, as well as available benefits, may vary somewhat among the individual states. Learn more about medicaid planning in this presentation.Incapacity Planning: What Is It and Who Needs It

Incapacity Planning: What Is It and Who Needs ItSaul Kobrick

?

Your estate plan should be comprehensive in nature so that it protects you, your assets and your loved ones both while you are alive and after you are gone. Learn more about incapacity planning in this presentation.Do You Need an Incapacity Plan

Do You Need an Incapacity PlanSaul Kobrick

?

You likely operate under the belief that incapacity wonˇŻt happen to you so why would you need to include incapacity planning in your overall estate plan? Learn more about incapacity plan in this presentation.The Role of Special Needs Trusts in Estate Planning

The Role of Special Needs Trusts in Estate PlanningSaul Kobrick

?

These are crucial legal documents that allow those with physical or mental disabilities or who has a chronic or terminal illness the opportunity to protect his assets. Learn more about special needs trusts in this presentation.Gift and Estate Taxes: Is Your Estate Prepared

Gift and Estate Taxes: Is Your Estate PreparedSaul Kobrick

?

You worked hard all your life, saved meticulously, and invested wisely. As a result, you have amassed a respectable estate to leave behind to your loved ones. Learn more about gift and estate taxes in this presentation.Long Term Care Planning - What You Need to Know

Long Term Care Planning - What You Need to KnowSaul Kobrick

?

Including Medicaid planning in your overall estate plan from early on will ensure that your assets are protected and your long-term care costs are covered. Learn more about long term care planning in this presentation.SSI and SSDI - Eligibility, Benefits, and Procedures

SSI and SSDI - Eligibility, Benefits, and ProceduresSaul Kobrick

?

To qualify for either program, therefore, you must meet the Social Security AdministrationˇŻs (SSA) definition of ˇ°disabledˇ±. Learn more about ssi and ssdi in this presentation.New York SSI and SSDI - Eligibility, Benefits, and Procedures

New York SSI and SSDI - Eligibility, Benefits, and ProceduresSaul Kobrick

?

The document provides an overview of the eligibility, benefits, and application procedures for Social Security Income (SSI) and Social Security Disability Insurance (SSDI) in New York. It explains the definition of 'disabled' according to the Social Security Administration, the requirements for both programs, and the potential benefits for qualifying individuals and their families. Additionally, it discusses the complexities of the application process and the importance of consulting an attorney for assistance.Federal Gift and Estate Tax - Understanding the Tax

Federal Gift and Estate Tax - Understanding the TaxSaul Kobrick

?

Part I of this series helps explain federal gift and estate tax while Part II offers suggestions for strategies that can reduce or eliminate the tax. Learn more about federal gift and estate tax in this presentation.Philantrophy in Your Estate Plan - How to Keep on Giving

Philantrophy in Your Estate Plan - How to Keep on GivingSaul Kobrick

?

Charitable trusts offer a significant amount of flexibility, allowing you to gear your trust agreement to your specific goals and objectives. Learn more about charitable trusts in this presentation.LGBT Estate Planning - How Estate Planning Can Help

LGBT Estate Planning - How Estate Planning Can HelpSaul Kobrick

?

Until recently, the United States federal government effectively discriminated against same-sex couples through the definition of marriage found in the Defense Against Marriage Act, or DOMA. Learn mor about lgbt estate planning in this presentation.LGBT Estate Planning in New York - Part1

LGBT Estate Planning in New York - Part1Saul Kobrick

?

Members of the Lesbian, Gay, Bi-Sexual, and Transgender, or LGBT, community, and their supporters, have struggled for decades to provide equal rights under the law to members of the community ¨C and the fight is not over yet. Learn more about LGBT estate planning in New York in this presentation.New York Probate Process

New York Probate ProcessSaul Kobrick

?

The document outlines the New York probate process and emphasizes the importance of probate avoidance strategies in estate planning. Probate is the legal procedure initiated after an individual's death to manage their estate, which can be complicated and costly, especially for intestate estates. It highlights various strategies such as life insurance, joint ownership, POD/TOD accounts, and trusts that can help individuals bypass probate to ensure a smoother asset transfer to beneficiaries.Long-Term Care Planning in New York

Long-Term Care Planning in New YorkSaul Kobrick

?

The document discusses the importance of long-term care planning in New York as part of an overall estate plan to protect assets and ensure care during one's later years. It highlights the rising demand for long-term care, the inadequacies of health insurance, and the necessity for Medicaid planning to qualify for benefits without depleting assets. The authors emphasize consulting with an estate planning attorney to develop effective strategies and prevent financial loss related to long-term care needs.Including The Family Pet - In Your Estate Plan

Including The Family Pet - In Your Estate PlanSaul Kobrick

?

The law considers your pet to be your property, meaning you can gift your pet in your Will. Learn more about pet plan in this presentation.New York Executor Duties

New York Executor DutiesSaul Kobrick

?

When someone dies, the estate of the decedent is generally required to pass through the legal process known as probate. Learn more about New York executor duties in this presentation.Incapacity Planning - Why It Should Be Part of Your Estate Plan

Incapacity Planning - Why It Should Be Part of Your Estate PlanSaul Kobrick

?

If your incapacity lasts for more than a short period of time, your spouse may not be able to pay the bills even though you have the funds to do so because a court order is needed to access your assets. Learn more about incapacity planning in this presentation.Ad

Recently uploaded (20)

Professional Investigation Services in Malaysia.pptx

Professional Investigation Services in Malaysia.pptxMVD International

?

MVD Private Investigation is Malaysia's best and largest private detective agency that provides all types of investigation services in Malaysia.What to Do After a Truck Accident A Legal Survival Guide

What to Do After a Truck Accident A Legal Survival GuideMax Adler

?

Involved in a truck accident? This concise legal survival guide outlines the crucial steps to take immediately after the crash, how to protect your rights, and when to seek legal help. From gathering evidence at the scene to dealing with insurance companies, this guide empowers you with practical advice and legal insights to ensure you get the compensation you deserve. DonˇŻt face the aftermath aloneˇŞstart here.Mr. Nitai Bardhan

?vs.

?Meghdoot Inn Private Limited

(Citation-C.P. No. 118...

Mr. Nitai Bardhan

?vs.

?Meghdoot Inn Private Limited

(Citation-C.P. No. 118...aditiswain97

?

This case analysis delves into the corporate dispute between Mr. Nitai Bardhan and Meghdoot Inn Private Limited, a Kolkata-based company incorporated in March 2002. The dispute centers around Mr. BardhanˇŻs claim of ownership and control over Dhansiri Restaurant, a unit operated under the company. The case was brought before the National Company Law Tribunal (NCLT), Kolkata Bench, raising crucial questions on the rights of directors, ownership of business units within a company, and the scope of NCLTˇŻs jurisdiction in internal corporate disputes. This presentation outlines the key facts, legal issues, arguments presented, and broader implications of the case, particularly in the context of corporate governance and fiduciary duties under Indian company law. It highlights the importance of clarity in business ownership and internal agreements among company directors, and serves as a valuable example of how legal forums address intra-company conflicts.

AHRP LB - Issuance of Sharia Securities List ?and Foreign Sharia Securities L...

AHRP LB - Issuance of Sharia Securities List ?and Foreign Sharia Securities L...AHRP Law Firm

?

On 10 April 2025, the Financial Services Authority ("OJK") issued OJK Regulation Number 8 of 2025 on concerning Criteria and Issuance of the Sharia Securities List (ˇ°OJK Reg. 8/2025ˇ±), amending the OJK Regulation Number 35/POJK.04/2017. The issuance of OJK Reg. 8/2025 is aimed at improvements on the application of sharia principles in capital market, particularly regarding the required sharia financial ratio as the selection criteria. the said regulation also refocuses regulations on entities beyond invest managers that issue sharia securities list, enhancing transparency and reporting by issuers and companies. Find out more our insights about this topic in our Legal Brief?publication.Appellant's brief Against Successor Trustee

Appellant's brief Against Successor TrusteeVOLUNT?RIA CAUSA SOCIAL

?

This petition is a formal appeal filed by Alessandra C. Kurchinski (surviving spouse) and Jacqueline G. Kurchinski (daughter) with the Second District Court of Appeal of Florida against Nancy Gorby, who serves as the Personal Representative (PR) and Successor Trustee of Franklin R. KurchinskiˇŻs 2006 Revocable Trust and probate estate.

Purpose of the Petition

The appellants argue that:

They represent 60% of the trust beneficiaries (Alessandra: 20%, Jacqueline: 40%).

Nancy Gorby and her attorney have charged excessive fees from the estate and trust.

These actions violate Florida law, reduce beneficiariesˇŻ inheritance, and go against the late Franklin's wishes.

Main Complaints in the Petition

1. Excessive Legal Fees

Over $97,000 in combined legal and administrative fees have been charged.

Includes hourly charges for basic actions like reading emails, attending hearings, or sending routine communications.

The petition argues this is not "reasonable compensation" under Florida Statutes ˇěˇě 733.6171 and 736.1007.

2. Lack of Transparency

No prior notice was given to the family about these fees.

Trustee and her attorney did not respond to multiple emails asking for explanation or agreements.

Franklin's original estate planning documents (like Wills from 2002 and 2018 and Schedule A) disappeared after being turned over to the law office, leading to police involvement.

3. Conflict of Interest

Nancy Gorby and her attorney have a prior professional relationship (Elks club, business, etc.).

The attorney also witnessed Franklin's documents, raising potential bias and conflict in trust and estate matters.

4. Misuse of Authority

The trustee made decisions without consulting or informing beneficiaries.

The estate was supposed to avoid probate, as per FranklinˇŻs 2006 Will and Trust.

Yet, it was dragged into probate, contrary to his instructions.

5. Emotional & Financial Harm

Alessandra experienced a Baker Act incident after being told the government seized a retirement account ($549,656.15).

The family has faced stress, humiliation, and financial hardship while dealing with legal proceedings.

They feel harassed, especially with charges even for simple emails or asking questions.

6. Demand for Change

They request:

New trustee to be appointed for the daughters.

Reduction of 61% in fees charged to the estate/trust.

Fair and immediate distribution of trust assets as Franklin intended.

Legal Grounds Mentioned

Florida Statutes referenced include:

ˇě733.6171: Compensation of personal representative and attorney.

ˇě736.1007: Compensation of trustee and attorney.

ˇě736.0813, ˇě736.0809, ˇě736.0811, ˇě736.802: Trustee duties like impartiality, loyalty, communication, and accounting.

Final Statement

Alessandra and Jacqueline assert:

They are not lawyers.

TheyˇŻve been forced to represent themselves (pro se).

They ask for oral arguments and request the Court to intervene to protect the beneficiaries, review the conduct of the trustee.×îĐ°ćŇâ´óŔűż¨Ă·Ŕďŵ´óѧ±Ďҵ֤Ł¨±«±·±ő°ä´ˇ˛Ń±Ďҵ֤Ę飩԰涨ÖĆ

×îĐ°ćŇâ´óŔűż¨Ă·Ŕďŵ´óѧ±Ďҵ֤Ł¨±«±·±ő°ä´ˇ˛Ń±Ďҵ֤Ę飩԰涨ÖĆtaqyea

?

2025԰濨÷Ŕďŵ´óѧ±Ďҵ֤Ęépdfµç×Ӱ桾qޱ1954292140ˇżŇâ´óŔű±Ďҵ֤°ěŔíUNICAMż¨Ă·Ŕďŵ´óѧ±Ďҵ֤Ęé¶ŕÉŮÇ®Łżˇľqޱ1954292140ˇżşŁÍâ¸÷´óѧDiploma°ć±ľŁ¬ŇňÎŞŇßÇéѧУÍƳٷ˘·ĹÖ¤Ę顢֤ĘéÔĽţ¶ŞĘ§˛ą°ěˇ˘Ă»ÓĐŐýłŁ±ĎҵδÄÜČĎ֤ѧŔúĂćÁŮľÍҵĚáą©˝âľö°ě·¨ˇŁµ±ÔâÓöąŇżĆˇ˘żőżÎµĽÖÂÎŢ·¨ĐŢÂúѧ·ÖŁ¬»ňŐßÖ±˝Ó±»Ń§ĐŁÍËѧŁ¬×îşóÎŢ·¨±ĎҵÄò»µ˝±Ďҵ֤ˇŁ´ËʱµÄÄăŇ»¶¨ĘÖ×ăÎ޴룬ŇňÎŞÁôѧһłˇŁ¬Ă»ÓĐ»ńµĂ±Ďҵ֤ŇÔĽ°Ń§ŔúÖ¤Ă÷żĎ¶¨ĘÇÎŢ·¨¸ř×ÔĽşşÍ¸¸Ä¸Ň»¸ö˝»´úµÄˇŁ

ˇľ¸´żĚż¨Ă·Ŕďŵ´óѧłÉĽ¨µĄĐĹ·â,Buy Universit¨¤ degli Studi di CAMERINO Transcriptsˇż

ąşÂňČŐş«łÉĽ¨µĄˇ˘Ó˘ąú´óѧłÉĽ¨µĄˇ˘ĂŔąú´óѧłÉĽ¨µĄˇ˘°ÄÖŢ´óѧłÉĽ¨µĄˇ˘ĽÓÄĂ´ó´óѧłÉĽ¨µĄŁ¨q΢1954292140Ł©ĐÂĽÓĆ´óѧłÉĽ¨µĄˇ˘ĐÂÎ÷ŔĽ´óѧłÉĽ¨µĄˇ˘°®¶űŔĽłÉĽ¨µĄˇ˘Î÷°ŕŃŔłÉĽ¨µĄˇ˘µÂąúłÉĽ¨µĄˇŁłÉĽ¨µĄµÄŇâŇĺÖ÷ŇŞĚĺĎÖÔÚÖ¤Ă÷ѧϰÄÜÁ¦ˇ˘ĆŔąŔѧĘő±łľ°ˇ˘ŐąĘľ×ŰşĎËŘÖʡ˘Ěá¸ß¼ȡÂĘŁ¬ŇÔĽ°ĘÇ×÷ÎŞÁôĐĹČĎÖ¤ÉęÇë˛ÄÁϵÄŇ»˛ż·ÖˇŁ

ż¨Ă·Ŕďŵ´óѧłÉĽ¨µĄÄÜą»ĚĺĎÖÄúµÄµÄѧϰÄÜÁ¦Ł¬°üŔ¨ż¨Ă·Ŕďŵ´óѧżÎłĚłÉĽ¨ˇ˘×¨ŇµÄÜÁ¦ˇ˘ŃĐľżÄÜÁ¦ˇŁŁ¨q΢1954292140Ł©ľßĚĺŔ´ËµŁ¬łÉĽ¨±¨¸ćµĄÍ¨łŁ°üş¬Ń§ÉúµÄѧϰĽĽÄÜÓëĎ°ąßˇ˘¸÷żĆłÉĽ¨ŇÔĽ°ŔĎʦĆŔÓďµČ˛ż·ÖŁ¬Ňň´ËŁ¬łÉĽ¨µĄ˛»˝öĘÇѧÉúѧĘőÄÜÁ¦µÄÖ¤Ă÷Ł¬Ň˛ĘÇĆŔąŔѧÉúĘÇ·ńĘĘşĎÄł¸ö˝ĚÓýĎîÄżµÄÖŘŇŞŇŔľÝŁˇ

ÎŇĂÇłĐŵ˛ÉÓõÄĘÇѧУ԰ćÖ˝ŐĹŁ¨Ô°ćÖ˝Öʡ˘µ×É«ˇ˘ÎĆ·Ł©ÎŇĂÇą¤ł§ÓµÓĐČ«Ě×˝řżÚÔ×°É豸Ł¬ĚŘĘ⹤ŇŐ¶ĽĘDzÉÓò»Í¬»úĆ÷ÖĆ×÷Ł¬·ÂŐć¶Č»ů±ľżÉŇÔ´ďµ˝100%Ł¬ËůÓĐłÉĆ·ŇÔĽ°ą¤ŇŐЧąű¶ĽżÉĚáÇ°¸řżÍ»§ŐąĘľŁ¬˛»ÂúŇâżÉŇÔ¸ůľÝżÍ»§ŇŞÇó˝řĐе÷ŐűŁ¬Ö±µ˝ÂúŇâÎŞÖąŁˇ

ˇľÖ÷ÓŞĎîÄżˇż

Ň»ˇ˘ą¤×÷δȷ¶¨Ł¬»ŘąúĐčĎȸř¸¸Ä¸ˇ˘Ç×ĆÝĹóÓŃż´ĎÂÎÄĆľµÄÇéżöŁ¬°ěŔí±Ďҵ֤|°ěŔíÎÄĆľ: Âň´óѧ±Ďҵ֤|Âň´óѧÎÄĆľˇľqޱ1954292140ˇżż¨Ă·Ŕďŵ´óѧѧλ֤Ă÷ĘéČçşÎ°ěŔíÉęÇ룿

¶ţˇ˘»Řąú˝řË˝Ćóˇ˘ÍâĆóˇ˘×ÔĽş×öÉúŇâµÄÇéżöŁ¬ŐâĐ©µĄÎ»ĘDz»˛éŃŻ±Ďҵ֤ŐćαµÄŁ¬¶řÇŇąúÄÚĂ»ÓĐÇţµŔČĄ˛éŃŻąúÍâÎÄĆľµÄŐćĽŮŁ¬Ň˛˛»ĐčŇŞĚáą©Őćʵ˝ĚÓý˛żČĎÖ¤ˇŁĽřÓÚ´ËŁ¬°ěŔíŇâ´óŔűłÉĽ¨µĄż¨Ă·Ŕďŵ´óѧ±Ďҵ֤ˇľqޱ1954292140ˇżąúÍâ´óѧ±Ďҵ֤, ÎÄĆľ°ěŔí, ąúÍâÎÄĆľ°ěŔí, ÁôĐĹÍřČĎÖ¤Trust Litigation Pro Se kurchinski's family against Michael Kouskoutis.pdf

Trust Litigation Pro Se kurchinski's family against Michael Kouskoutis.pdfVOLUNT?RIA CAUSA SOCIAL

?

This transcript is from a trust litigation hearing held on October 26, 2023, in the Sixth Judicial Circuit Court of Florida (Pinellas County). The plaintiff is Nancy Gorby, represented by attorney Michael Kouskoutis, and the defendants are Alessandra Kurchinski and her daughters Jacqueline and Caroline, who are representing themselves (pro se). The case centers around the estate and trust of AlessandraˇŻs late husband, Franklin R. Kurchinski.

1. Objection to the Estate Inventory and Discharge:

Alessandra objects to the closing of the estate.

She says the estate is simple and that the listed asset of $2,863.50 was likely a refund from a credit card tied to a joint account, which she believes should not be treated as estate property.

The court determined that the refund check was made out to Franklin (the deceased), so it correctly belonged to the estate.

Special Master Judge Robert Persante ruled to deny AlessandraˇŻs objection, stating prolonged litigation would reduce what the family ultimately receives.

2. Challenge to Trustee Fees and Administration Costs:

Alessandra claims excessive charges: $10,000 total ˇŞ $3,500 for the Personal Representative (PR), $5,000 for the attorney, and $1,500 for administration ˇŞ for a simple estate.

She says this violates what her husband intended: reimbursement only for travel and phone calls, not fixed percentage-based fees.

She agrees to reasonable compensation (e.g., $50/hour)

3. Videos and Evidence:

Alessandra submitted videos, including police bodycam footage and recordings of conversations with Nancy Gorby.

The judge reserved judgment on their admissibility and promised to review them privately before deciding if they are legally relevant.

4. Trust Inventory Errors and Omissions:

The Kurchinski family claimed missing assets in the original trust inventory, including a 401(k) account and an account with Republic Bank.

Attorney Kouskoutis admitted the initial inventory was incomplete but said it was amended when errors were discovered.

The judge agreed there were mistakes but noted they were corrected, and this didnˇŻt invalidate the trust.

5. Dispute Over Communication and Process:

Alessandra and her daughters emphasize a lack of transparency, poor communication, and feeling excluded.

They claim Nancy Gorby and her attorney didnˇŻt clearly explain the trust or estate process and refused to meet or provide documentation.

They also mention Alessandra being trespassed from the attorneyˇŻs office and not allowed to contact Nancy, making cooperation difficult.

6. Trust Validity Concerns:

The Kurchinski family questions whether the trust is valid, partly because Schedule A (listing the trustˇŻs assets) was missing.

Judge Persante explained that the trust is legally valid even without a complete Schedule A, though he acknowledged their confusion.

He emphasized that if assets were titled in the trustˇŻs name, they are trust assets regardless of listing.

Introduction to Marriage Laws in India: A simplified guide

Introduction to Marriage Laws in India: A simplified guideSiva Prasad Bose

?

This presentation offers a concise and practical overview of marriage laws in India, based on the book Introduction to Marriage Laws in India by Siva Prasad Bose. It is designed for students, legal aspirants, couples, and anyone seeking clarity on Indian matrimonial law.

Key topics covered:

What constitutes a valid marriage under Indian law

Conditions that make a marriage void or voidable

Grounds for divorce, including adultery, cruelty, and mental illness

Mutual consent divorce and contested divorce processes

Legal implications of schizophrenia and mental cruelty

Property division and the concept of streedhan

Understanding court jurisdiction based on domicile

Section 498A IPC and the Domestic Violence Act, 2005

Official Biography, Headshot and Speaking Vita for Ms. Dar'shun Kendrick

Official Biography, Headshot and Speaking Vita for Ms. Dar'shun KendrickKairos Capital Legal Advisors,LLC

?

Official biography, headshot and vita for Ms. Dar'shun Kendrick.

Office of the Privacy Commissioner of Canada (OPC) Content Summary

Office of the Privacy Commissioner of Canada (OPC) Content Summaryglobibo

?

The Office of the Privacy Commissioner of Canada (OPC) is responsible for overseeing compliance with federal privacy laws. It investigates complaints, promotes public awareness, and advises government and private organizations on protecting personal information and ensuring responsible data practices.

Source: Official website. For updates or corrections, please contact us directly.AHRP LB - RUPTL 2025¨C2034 Unveiled What It Means for IndonesiaˇŻs Power & Lega...

AHRP LB - RUPTL 2025¨C2034 Unveiled What It Means for IndonesiaˇŻs Power & Lega...AHRP Law Firm

?

The Government through Ministry of Energy and Mineral Resouces has provided a preview of PT PLN (Persero)ˇŻs upcoming Electricity Supply Business Plan (RUPTL) for period of 2025-2034, which is expected to be finalized soon. The plan outlines a new, higher standard for electricity provisionˇŞplacing a strong emphasis on renewable energy sources. Find out more our insights about this topic in our Legal Brief?publication.Sanidul-sheikh-for-abdul-sheikh-June-4-1.pdf

Sanidul-sheikh-for-abdul-sheikh-June-4-1.pdfsabranghindi

?

Assam Government Gauhati High Court Detained PeopleTop Immigration Lawyers in Phoenix Cima Law Group.pdf

Top Immigration Lawyers in Phoenix Cima Law Group.pdfCimalaw Group

?

Looking for the best immigration lawyers in Phoenix? Cima Law Group is dedicated to helping individuals and families navigate complex immigration matters with confidence and clarity. Our experienced attorneys specialize in green cards, family-based visas, deportation defense, asylum, U visas, and more. We provide personalized legal solutions tailored to your unique situation and are committed to protecting your rights every step of the way. With bilingual services and a reputation for compassionate advocacy, we are proud to be a trusted choice for clients throughout Arizona. Bridging the Billing Divide: How ALB is Transforming Legal Invoice Compliance

Bridging the Billing Divide: How ALB is Transforming Legal Invoice ComplianceAccurate Legal Billing

?

? Bridging the Billing Divide: How ALB is Transforming Legal Invoice Compliance

Meet Andre Wouansi, Founder & CEO of Accurate Legal Billing (ALB) ˇŞ the leader in AI-powered legal billing compliance. With ALBˇŻs revolutionary AI Time Entry Cleansing, law firms are transforming how they manage e-billing, ensure guideline compliance, reduce invoice rejections, and boost revenue realization.

? $225M in increased law firm revenue

? Real-time compliance with OCGs

? Automated billing + faster payments

? Trusted by law firms worldwide

? ALB isnˇŻt just billing software ˇŞ itˇŻs the future of legal billing efficiency.

? Projected to save law firms $500M+ by 2030Official Biography, Headshot and Speaking Vita for Ms. Dar'shun Kendrick

Official Biography, Headshot and Speaking Vita for Ms. Dar'shun KendrickKairos Capital Legal Advisors,LLC

?

Bridging the Billing Divide: How ALB is Transforming Legal Invoice Compliance

Bridging the Billing Divide: How ALB is Transforming Legal Invoice ComplianceAccurate Legal Billing

?

Ad