Income from house property

- 1. Prof. Mohasin A. Tamboli PIRENS Technical Campus, Loni Bk Email: mohasinat@gmail.com 1Prof. M.A. Tamboli

- 2. ÔÇûUnder the income head from house property, the basis of charge is the annual value of property. 2 Prof. M.A. Tamboli

- 3. ÔÇûThe following conditions must be satisfied to charge a rental income under the head Income from House Property. 1. The property should consist of any building or lands appurtenant thereto : Rental income of vacant plot is not chargeable. 2. The assessee should be owner of the property 3. the property should not be used by the owner for the purpose of any business or profession carried on by him. 3 Prof. M.A. Tamboli

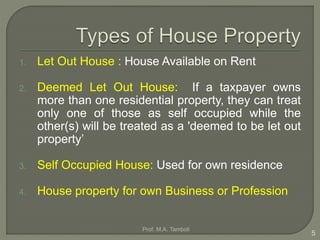

- 4. House Property Let Out House Deemed Let Out House Self Occupied House House Used for Own Business or Profession 4 Prof. M.A. Tamboli

- 5. 1. Let Out House : House Available on Rent 2. Deemed Let Out House: If a taxpayer owns more than one residential property, they can treat only one of those as self occupied while the other(s) will be treated as a 'deemed to be let out property’ 3. Self Occupied House: Used for own residence 4. House property for own Business or Profession 5 Prof. M.A. Tamboli

- 6. ÔÇûThe gross annual value depends upon the following seven factors: 1. Municipal Value (MV): The value of the property declared by municipal corporation for charging municipal tax 2. Fair Rent (FR): The value of similar property in the same locality 3. Standard Rent (SR): The rent which declared under Standard Rent Control Act. The owner not expected to get rent higher than Standard Rent 6 Prof. M.A. Tamboli

- 7. 4. Annual Rent: Rent of the previous year or part of previous year when property is available for letting it out 5. Unrealized Rent: It is the rent which owner cannot be realized. 6. Loss of rent because of vacancy: where the property is let out but was vacant during the whole or part of previous year and owing to such vacancy there is loss of rent. 7. Actual Rent Received or Receivable: Annual Rent-(Unrealized rent + Rent pertaining to vacancy period) 7 Prof. M.A. Tamboli

- 8. Step Activity Step 1 Fair Rent or Municipal Rent which is Higher but not less than Standard Rent Step 2 Annual Rent – Unrealized Rent Step 3 Step 1 or Step 2 which is Higher Step 4 Vacancy Allowance Step 5 Gross Annual Value (GAV) (Step 3 – Step 4) Less Municipal tax paid by landlord only Net Annual Value (NAV) Less Deduction U/S 24 i) Standard deduction (30% of NAV) ii) Interest on Housing Loan INCOME FROM HOUSE PROPERTY 8 Prof. M.A. Tamboli

- 9. I. Let Out House Property : 1. Determination of GAV ÔÇû Step 1 : Find out Reasonable Expected Rent 1. If SR is not applicable: Reasonable Expected Rent is MV or FR which is higher 2. If SR is applicable: Reasonable Expected Rent is the least of the following : 1. MV or FR which is higher 2. Standard Rent 9 Prof. M.A. Tamboli

- 10. Step 2 : Find Out Rent Actually Received Actual Rent Received (ARR) = Annual Rent – (Unrealized Rent + Loss Due to Vacancy) Step 3 : Find GAV 1. If ARR is more than ER then, GAV=ARR 2. If ARR is less than ER then, GAV=ER-Loss due to Vacancy 10 Prof. M.A. Tamboli

- 11. II. Deemed Let Out House Property : In case of deemed let out property, GAV=ER III. Self Occupied House Property: SOP is always exempted from Tax. For SOP, NAV is nil but Standard deduction is applicable 11 Prof. M.A. Tamboli

- 12. ÔÇûAfter getting GAV by deducting Municipal Taxes from it, you get NAV ÔÇûMunicipal tax paid by landlord only consider for ascertaining NAV 12 Prof. M.A. Tamboli

- 13. ÔÇûStandard Deduction : 30% of NAV ÔÇûInterest on borrowed Capital: 1. If the property is LOP then no limitation for deduction of interest. 13 Prof. M.A. Tamboli

- 14. 1. If SOP then following limitations are applicable: 1. If loan taken before 1/4/1999 and if construction not completed within three years from the end of financial year then interest deduction is allowed. Actual interest paid or Rs. 30,000 which is less. 2. If loan taken on or after 1/4/1999, interest deduction is allowed. Actual interest paid or Rs. 1,50,000 which is less. 3. If loan taken for repairs, then date of loan is immaterial and deduction is allowed. Actual Interest paid or Rs. 30,000 which is less 14 Prof. M.A. Tamboli

- 15. Particulars Amount Amount Gross Annual Value XX Less: Municipal Tax Paid by Landlord XX Net Annual Value XXX Less: Deduction U/S 24 i) Standard deduction (30% of NAV) XX ii) Interest on Borrowed Capital XX Income from House Property XXX Note: 1. For SOP, NAV is Nil but deduction on borrowed Capital is allowed 2. In case of More than two house property, consider house property as SOP whose MV is higher. 15 Prof. M.A. Tamboli