Income from salary part 1

- 2. Salary includes the provisions contained in Section 15, 16 & 17.

- 3. Basis of charge (Section:15) 1. Salary is charged on due basis or receipt basis (whichever is earlier) 2. Advance salary is assessed in the year of payment and not taxable in the year which its due. 3. The arrears salary can be assessed in due basis can not be taxed again when its paid.

- 4. Meaning of Salary, Perquisites & profit in lieu of salary(Section 17) Salary - Sec 17(1) Perquisites -Sec 17(2) Profit in lieu of salary- sec 17(3) Meaning

- 5. Salary includes the following: ï Wages; ï Advance salary; ï Any fees commission, perquisites or profit in lieu of salary or wages; ï any retirement benefits( pension, gratuity, PF, leaveï any retirement benefits( pension, gratuity, PF, leave encashment); ï Contribution by employer in pension scheme of section 80CCD.

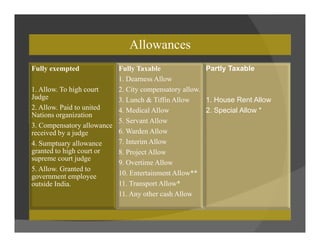

- 6. Allowances Fully exempted 1. Allow. To high court Judge 2. Allow. Paid to united Nations organization 3. Compensatory allowance Fully Taxable 1. Dearness Allow 2. City compensatory allow. 3. Lunch & Tiffin Allow 4. Medical Allow 5. Servant Allow Partly Taxable 1. House Rent Allow 2. Special Allow * 3. Compensatory allowance received by a judge 4. Sumptuary allowance granted to high court or supreme court judge 5. Allow. Granted to government employee outside India. 5. Servant Allow 6. Warden Allow 7. Interim Allow 8. Project Allow 9. Overtime Allow 10. Entertainment Allow** 11. Transport Allow* 11. Any other cash Allow

- 7. Special Allowances* Amt. received & Amt. Spent (whichever is less is exempted) 1. Daily Allow. 2. Conveyance Allow. 3. Uniform Allow. Amt. received & limit specified(whichever is less is exempted) 1. Children Education Allow. (Rs. 100p.m./p.c. maximum 2child) 2. Tribal Allow. (Rs. 200 * Transport Allowance to other than handicapped and blind employee is3. Uniform Allow. 4. Traveling Allow. 5. Helper Allow. 6. Research Allow. 2. Tribal Allow. (Rs. 200 p.m.) 3. Hostel Allow. ( Rs. 300p.m/p.c. maximum 2 child) 4. Transport Allow. (Rs. 3200p.m. only for the blind & handicapped employee) and blind employee is fully taxable. ** Entertainment Allowance to Non- government employee is fully taxable.

- 10. Illus- 1 Mr. X an employee of ABC ltd. Received the following monetary benefits from the company during the previous year 2019-20. B.S. Rs. 10,000 p.m. DA Rs. 2500 p. m. HRA 10% of salary Compute his taxable income from salary for the AY 2020-21

- 11. Computation of Taxable Salary Ordinary Resident PY: 2019-20 Individual AY: 2020-21 PAN:--------- Basic Salary(10,000*12) 1,20,000 Dearness Allowance(2500*12) 30,000 HRA (10% of 1,20,000) 12,000HRA (10% of 1,20,000) 12,000 Gross Salary 1,62,000 Specific deduction u/s 16: * Professional tax --- *Entertainment Allowances --- Taxable Salary 1,62,000

- 12. Illus-2 Mr. X an employee of ABC ltd. Received the following emoluments during the previous year 2019-20: B.S:Rs. 12,500 up to 31st Dec, 2019 Which was incremented by Rs. 5000 from Jan, 2020. DA: Rs. 12,500 p.m. (forming part of retirement benefits) HRA received Rs. 7,500 p.m. (rent paid 12,000 p.m.) Calculate his taxable income from salary for the AY:2020-21

- 13. Computation of Taxable Income from Salary Ordinary Resident PY: 2019-20 Individual AY:2020-21 PAN:_______ Particulars Amt. Amt. B.S. (12,500*9m) 1,12,500 (12,500+5,000=17,500*3m) 52,500 1,65,000 DA (12,500*12) 1,50,000DA (12,500*12) 1,50,000 HRA (7,500*12) 90,000 Less: exempted: (Note 1) 90,000 Nil Gross Salary 3,15,000 Specific deduction u/s 16: *professional tax -- * Ent. Allowance -- Taxable Income from Salary 3,15,000

- 14. Note:1 Minimum of 3 is exempted: 1. Actual HRA received: Rs. 90,000 2. Rent Paid- 10% of Salary: (1,44,000 â 31,500)= Rs. 1,12,500 3. 40% of salary: Rs. 1,26,000 **Salary: B.S+ Spe. DA+ Sales Com**Salary: B.S+ Spe. DA+ Sales Com = 1,65,000+ 1,50,000+0 =Rs. 3,15,000 *10%= 31,500 * 40%= 1,26,000

- 15. Mr.X an employee of XYZ ltd. earned the following income during the P.Y. 2019-20. B.S. Rs. 35,000 D.A. 100% of B.S. (60% of which is forming part of salary) Commission on sales @ 1% (turnover Rs. 1,00,000 p.m.) HRA: 10% of B.S. Rent paid by Mr. X was Rs. 10,000 p.m. in Delhi (up to 31st August he lives in own house with his mother @ Noida)own house with his mother @ Noida) Medical allowance Rs. 500p.m. Compute his taxable income from salary for the AY 2020-21.

- 16. Computation of taxable income from salary Ordinary Resident PY:2019-20 Individual AY:2020-21 PAN______ Particulars Amt. Amt. B.S. (35,000*12m) 4,20,000 DA (100% of B.S.) 4,20,000 Medical Allow. (500*12) 6,000 Sales commission (100000*12m=12,00,000*1%) 12,000 HRA (10% of 4,20,000) 42,000 Less: exempted: (note-1) 24,500 17,500 Gross Salary 8,75,500 Less: specific deduction u/s 16 * Entertainment allow **** * Professional tax **** Taxable Income from Salary 8,75,500

- 17. Note -1 Minimum of the 3 is exempted: (1st Sept to 31st March)=7months 1. Actual HRA received (3500*7 m) = 24,500 2. Rent paid less 10% of salary =(70,000 â 39,900)= 30,100 3. 50% of salary = (50% of 3,99,000)= 1,99,500 Salary for HRA (7 months)Salary for HRA (7 months) B.S = 35000* 7m= 2,45,000 Spe. DA= 35000*60%= 21000*7 m = 1,47,000 Sales commission (1,00,000*7m*1%)= 7,000 3,99,000* 10%= 39,900