Growing Viewership Through Data-Driven Program Promotion

- 1. Growing Viewership through Data-Driven Marketing April 16, 2010

- 2. Who we are Description DNA Investors Founding team are proven media technology entrepreneurs, scientists & engineers Simulmedia is New York City-based TV program promotion ad network founded in 2008. We sell targeted on-air promotion to network marketers and their agencies to grow program viewership for their shows. Venture backed /

- 3. What we believe We believe in the future of linear TV Domination of media ad spend will continue We believe viewers and networks need better program promotion Most viewers don’t know what is on “ Discovery” problem further fragments program audiences and rate cards Current methods too blunt; lack measurement Data-driven promos will change the game Can know what viewers want, where they are Can reach them with predictability, precision and ROI measurement Some predict doom for traditional television media Not Simulmedia…

- 4. TV is Digital Measurability Accountability Scale Impact Measurability Accountability Digital Media TV Media Advantages of… With the recent availability of set-top box data with national coverage and at scale, a new wave of analytical applications are coming to market with the potential to unlock additional value from TV Media. Simulmedia’s Focus: Television Program Promotion

- 5. What we do Simulmedia is a program promotion ad network. We deliver more effective media for program promotion to television network marketers. Simulmedia licenses anonymous viewing data from 15+ million US set-top boxes (national and local footprints) from five major system operators Partnerships with TV system operators Benefits to TV network marketers Data Inventory Bigger Audiences Better ROI Superior Insights Simulmedia coordinates and controls data-targeted on-air promotion delivery in local cable inventory on systems reaching more than 60%+ of US TV households from major system operators Bring more viewers to programming, reliably and predictably, by addressing receptive and available audiences Smarter programming and marketing using intelligence on viewers’ preferences and responsiveness to promotion Optimized promotional media spend with measures of conversion rates and per-spot contributions to tune-in

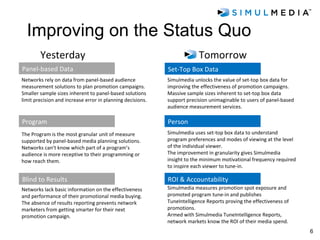

- 6. Improving on the Status Quo Simulmedia uses set-top box data to understand program preferences and modes of viewing at the level of the individual viewer. The improvement in granularity gives Simulmedia insight to the minimum motivational frequency required to inspire each viewer to tune-in. The Program is the most granular unit of measure supported by panel-based media planning solutions. Networks can’t know which part of a program’s audience is more receptive to their programming or how reach them. Yesterday Tomorrow Program Panel-based Data Person Set-Top Box Data Blind to Results ROI & Accountability Networks rely on data from panel-based audience measurement solutions to plan promotion campaigns. Smaller sample sizes inherent to panel-based solutions limit precision and increase error in planning decisions. Networks lack basic information on the effectiveness and performance of their promotional media buying. The absence of results reporting prevents network marketers from getting smarter for their next promotion campaign. Simulmedia unlocks the value of set-top box data for improving the effectiveness of promotion campaigns. Massive sample sizes inherent to set-top box data support precision unimaginable to users of panel-based audience measurement services. Simulmedia measures promotion spot exposure and promoted program tune-in and publishes TuneIntelligence Reports proving the effectiveness of promotions. Armed with Simulmedia TuneIntelligence Reports, network markets know the ROI of their media spend.

- 7. And it works Interest-driven optimization outperforms conventional approaches (sex/age, panel-based) Episodic maintenance Procedural Crime Series Prime-time Major broadcast network + 82% Tune-in Higher tune-in from re-buy plan vs. original plan + 246% ROI Program Launch Comedy series Prime-time Major broadcast network + 64% Tune-in Higher tune-in from re-buy plan vs. original plan + 192% ROI Trial A Trial B

- 8. Representative Results In trials, Simulmedia consistently delivered superior results with fewer impressions. 82% Lift Program 2 25% Lift Program 3 105% Lift Program 6 83% Lift Program 5 15% Lift Program 4 96% Lift Program 1 Program 7 70% Lift

- 9. Platform Capability: Close measures of program promotion Bones on TNT at 8:30PM 550 of 2,819 STBs Tuned in NCIS on USA at 5:00PM 3,750 of 31,718 STBs Tuned in

- 10. Solution: Simulmedia a 7 Platform™ Automated Audience Attention Aggregation Allocation Attribution Architecture More Viewers Data Attention Inventory

- 11. Early learnings: viewing data can predict future viewing 70% of viewing choices predictable with 99% accuracy based upon 1 year viewing history – Simulmedia a 7

- 12. Early learnings: viewing data can predict future viewing

- 13. Better Media for Promo High Performance List for a Primetime Broadcast Program Programs have relatively high incidence of the receptive, available audience Program - Time (Network) Target/ Total IndexĚý Program - Time (Network) Target/ Total Index Everybody Loves Raymond-530pm (TBS) 43k / 91k (47%) 297 Amazing Wedding Cakes-10pm (WE) 41k / 115k (36%) 225 The King of Queens-430pm (TBS) 41k / 88k (47%) 296 Man v. Food-10pm (TRAVEL) 39k / 110k (36%) 227 Jon & Kate Plus 8-12am (TLC) 71k / 159k (45%) 271 Intervention-1am (A&E) 43k / 121k (35%) 224 Unwrapped-1130pm (FOOD) 41k / 96k (43%) 271 Psych-10pm (USA) 39k / 111k (35%) 221 Kendra-1030pm (E!) 53k / 123k (43%) 260 Police Women of Broward County-8pm (TLC) 51k / 153k (33%) 209 Diners, Drive-Ins and Dives-1030pm (FOOD) 66k / 158k (42%) 265 The Golden Girls-11pm (HALLMARK) 45k / 136k (33%) 209 The Daily Show With Jon Stewart-11pm (COMEDY) 36k / 88k (41%) 259 Operation Repo-10pm (TRUTV) 68k / 212k (32%) 202 Toddlers & Tiaras-10pm (TLC) 44k / 111k (40%) 253 M*A*S*H-10pm (TVLAND) 35k / 114k (31%) 196 Paula's Best Dishes-1130am (FOOD) 42k / 104k (40%) 252 Army Wives-9pm (LIFETIME) 84k / 283k (29%) 190 The Bill Engvall Show-930pm (TBS) 46k / 117k (40%) 249 Bones-6pm (TNT) 55k / 187k (29%) 188 Iron Chef America-9pm (FOOD) 49k / 124k (39%) 250 Drop Dead Diva-11pm (LIFETIME) 83k / 282k (29%) 184 Family Guy-930pm (TBS) 52k / 131k (39%) 248 Law & Order: Special Victims Unit-3pm (USA) 70k / 249k (28%) 178 Chopped-10pm (FOOD) 54k / 136k (39%) 247 Design Star-10pm (HGTV) 84k / 304k (28%) 174 The Real Housewives of Atlanta-10pm (BRAVO) 68k / 183k (37%) 228 House Hunters-9pm (HGTV) 43k / 157k (27%) 173 Bridezillas-9pm (WE) 42k / 116k (36%) 229 HLN News-7am (HEADLINENEWS) 77k / 318k (24%) 152

- 14. Early learnings: viewing data can drive better program promotion 148% Lift 105% Lift 68% Lift 52% Lift

Editor's Notes

- #5: In the 1990s, spurred by the satellite systems touting their expansive channel line-ups, cable systems invested heavily to convert their footprints from analog to digital. The end result: near ubiquitous penetration of measurement-compatible client-side technology – the set-top boxes. To digital media veterans like Simulmedia, it looks a lot like the internet.

- #11: Automated, audience, attention, aggregation, allocation, attribution, architecture

![Thank You [email_address]](https://image.slidesharecdn.com/simulmediacorp10slide20100416-100421134443-phpapp01/85/Growing-Viewership-Through-Data-Driven-Program-Promotion-15-320.jpg)