Ind AS presentation

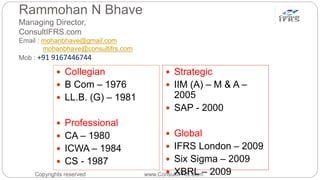

- 2. Rammohan N Bhave Managing Director, ConsultIFRS.com Email : mohanbhave@gmail.com mohanbhave@consultifrs.com Mob : +91 9167446744 Copyrights reserved www.ConsultIFRS.Com ï Collegian ï B Com â 1976 ï LL.B. (G) â 1981 ï Professional ï CA â 1980 ï ICWA â 1984 ï CS - 1987 ï Strategic ï IIM (A) â M & A â 2005 ï SAP - 2000 ï Global ï IFRS London â 2009 ï Six Sigma â 2009 ï XBRL â 2009

- 3. Copyrights reserved www.ConsultIFRS.Com MY JOURNEY Rammohan Bhave - 28 Years industry Now IFRS, valuation, M & A, ECB, FDI, Listing on foreign stock exchange Consultant & faculty Mittal Europe 2006-09 MD & Chief Finance Director Europe Gammon India 2004-06 Reliance Infocomm 2002- 04 â Business Controller Foundation software âUSA Y2K, Sing 2001, Australia 2002 Blue Star & Blue star infotech â 1997 â 99 Mumbai - CFO Mafatlal â 1991 â 94 Surat 1995- 96 Mumbai Crompton Greaves - 1980 to 1990 Nasik Started career

- 4. About ConsultIFRS.Com and implementation experts Copyrights reserved www.ConsultIFRS.Com ï Rammohan Bhave Limca record holder on IFRS, FCA, FCMA, ACS, Six Sigma Green Belt, Dip. IFRS (ACCA,UK), Cert. IFRS (ICAI) ï Worked in USA, Singapore, Australia and of late in London and Bulgaria for the Mittal Group ï Worked with reputed companies like Reliance Infocomm, Mittal Group, Blue Star Ltd, Crompton Greaves etc. ï Speaker at national cost conference in Jan 2011 held by ICWAI at Chennai ï Speaker at National Company secretary conference at Hyderabad in Nov 2009 ï Felicitated by ICSI for special achievements âFLAGBEARER OF THE PROFESSIONâ on 14th August, 2015 at hands of Chief Minister Kerala & president ICSI

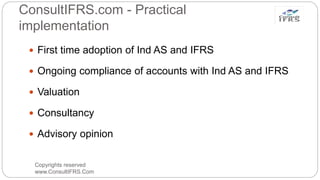

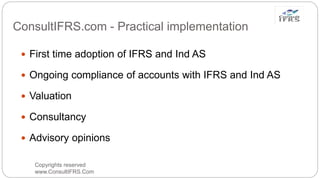

- 5. ConsultIFRS.com - Practical implementation Copyrights reserved www.ConsultIFRS.Com ï First time adoption of Ind AS and IFRS ï Ongoing compliance of accounts with Ind AS and IFRS ï Valuation ï Consultancy ï Advisory opinion

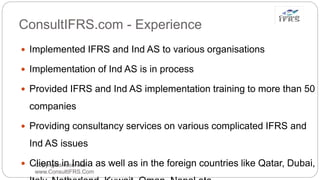

- 6. ConsultIFRS.com - Experience Copyrights reserved www.ConsultIFRS.Com ï Implemented IFRS and Ind AS to various organisations ï Implementation of Ind AS is in process ï Provided IFRS and Ind AS implementation training to more than 50 companies ï Providing consultancy services on various complicated IFRS and Ind AS issues ï Clients in India as well as in the foreign countries like Qatar, Dubai,

- 7. ConsultIFRS- IFRS and Ind AS Implementation industry sectors Copyrights reserved www.ConsultIFRS.Com ï Construction ï Banking and financial ï Publication ï Mobile aggregator ï Wind mill ï Engineering

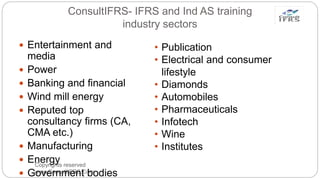

- 8. ConsultIFRS- IFRS and Ind AS training industry sectors Copyrights reserved www.ConsultIFRS.Com ï Entertainment and media ï Power ï Banking and financial ï Wind mill energy ï Reputed top consultancy firms (CA, CMA etc.) ï Manufacturing ï Energy ï Government bodies âĒ Publication âĒ Electrical and consumer lifestyle âĒ Diamonds âĒ Automobiles âĒ Pharmaceuticals âĒ Infotech âĒ Wine âĒ Institutes

- 9. ConsultIFRS.com - Practical implementation Copyrights reserved www.ConsultIFRS.Com ï First time adoption of IFRS and Ind AS ï Ongoing compliance of accounts with IFRS and Ind AS ï Valuation ï Consultancy ï Advisory opinions

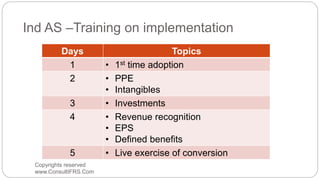

- 10. Ind AS âTraining on implementation Copyrights reserved www.ConsultIFRS.Com Days Topics 1 âĒ 1st time adoption 2 âĒ PPE âĒ Intangibles 3 âĒ Investments 4 âĒ Revenue recognition âĒ EPS âĒ Defined benefits 5 âĒ Live exercise of conversion

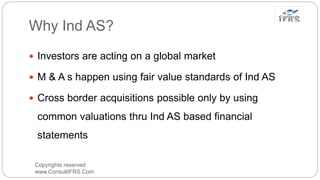

- 11. Why Ind AS? Copyrights reserved www.ConsultIFRS.Com ï Investors are acting on a global market ï M & A s happen using fair value standards of Ind AS ï Cross border acquisitions possible only by using common valuations thru Ind AS based financial statements

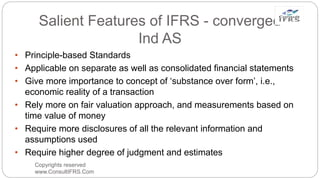

- 12. Salient Features of IFRS - converged Ind AS âĒ Principle-based Standards âĒ Applicable on separate as well as consolidated financial statements âĒ Give more importance to concept of âsubstance over formâ, i.e., economic reality of a transaction âĒ Rely more on fair valuation approach, and measurements based on time value of money âĒ Require more disclosures of all the relevant information and assumptions used âĒ Require higher degree of judgment and estimates Copyrights reserved www.ConsultIFRS.Com

- 13. Benefits to Capital Markets Copyrights reserved www.ConsultIFRS.Com ï Interest cost reduction ï Credibility of local market to foreign investors ï More cross-border investment ï Efficient capital allocation ï Comparability across political boundaries ï Facilitates global education and training

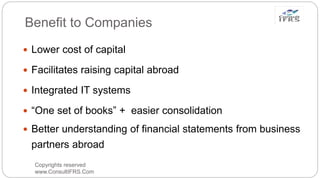

- 14. Benefit to Companies Copyrights reserved www.ConsultIFRS.Com ï Lower cost of capital ï Facilitates raising capital abroad ï Integrated IT systems ï âOne set of booksâ + easier consolidation ï Better understanding of financial statements from business partners abroad

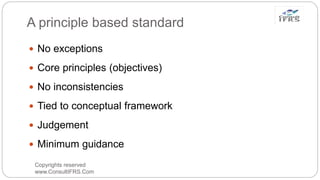

- 15. A principle based standard Copyrights reserved www.ConsultIFRS.Com ï No exceptions ï Core principles (objectives) ï No inconsistencies ï Tied to conceptual framework ï Judgement ï Minimum guidance

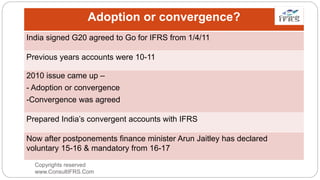

- 16. Copyrights reserved www.ConsultIFRS.Com Adoption or convergence? India signed G20 agreed to Go for IFRS from 1/4/11 Previous years accounts were 10-11 2010 issue came up â - Adoption or convergence -Convergence was agreed Prepared Indiaâs convergent accounts with IFRS Now after postponements finance minister Arun Jaitley has declared voluntary 15-16 & mandatory from 16-17

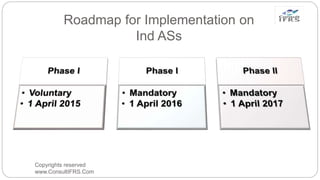

- 17. Roadmap for Implementation on Ind ASs Copyrights reserved www.ConsultIFRS.Com

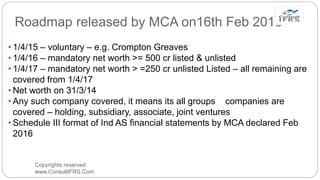

- 18. Roadmap released by MCA on16th Feb 2015 âĒ 1/4/15 â voluntary â e.g. Crompton Greaves âĒ 1/4/16 â mandatory net worth >= 500 cr listed & unlisted âĒ 1/4/17 â mandatory net worth > =250 cr unlisted Listed â all remaining are covered from 1/4/17 âĒ Net worth on 31/3/14 âĒ Any such company covered, it means its all groups companies are covered â holding, subsidiary, associate, joint ventures âĒ Schedule III format of Ind AS financial statements by MCA declared Feb 2016 Copyrights reserved www.ConsultIFRS.Com

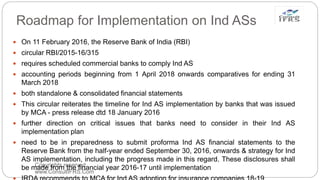

- 19. Roadmap for Implementation on Ind ASs Copyrights reserved www.ConsultIFRS.Com ï On 11 February 2016, the Reserve Bank of India (RBI) ï circular RBI/2015-16/315 ï requires scheduled commercial banks to comply Ind AS ï accounting periods beginning from 1 April 2018 onwards comparatives for ending 31 March 2018 ï both standalone & consolidated financial statements ï This circular reiterates the timeline for Ind AS implementation by banks that was issued by MCA - press release dtd 18 January 2016 ï further direction on critical issues that banks need to consider in their Ind AS implementation plan ï need to be in preparedness to submit proforma Ind AS financial statements to the Reserve Bank from the half-year ended September 30, 2016, onwards & strategy for Ind AS implementation, including the progress made in this regard. These disclosures shall be made from the financial year 2016-17 until implementation

- 20. Thank you Copyrights reserved www.ConsultIFRS.Com Contact & whatsapp : +91 9167446744 Email: mohanbhave@gmail.com mohanbhave@consultIFRS.com Rammohan N Bhave Limca Record Holder on IFRS FCA, FCMA, ACS, LL.B. (G.), IFRS â ICAI, Six sigma green belt. Diploma in IFRS, ACCA, London