Info for accountants re the abacus network

- 1. abacus the accountancy network you can count on

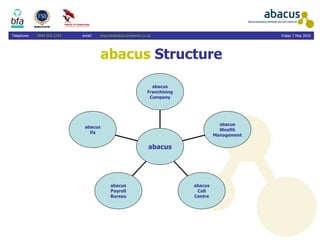

- 2. abacus Structure abacus ifa abacus Payroll Bureau abacus Call Centre abacus Wealth Management abacus Franchising Company abacus

- 3. Meet the abacus team

- 4. Meet the abacus team Steve Jackson – Managing Director abacus Franchise Neil Richmond – Managing Director abacus ifa & Payroll Ian White – Managing Director abacus Wealth Man Paul Hughes – Manager abacus Call Centre - North Jo Rhodes-Lewis – Manager abacus Call Centre - South Kay Phillips – Office Manager Paul Herring – IT Manager

- 5. Steve Jackson Fellow of Chartered Institute of Management Accountants. Early career worked for a number of blue chip companies including Phillips Petroleum, Winthrop laboratories & Rolls Royce Power Engineering Group. In 1993 formed Bals Electrical Engineering. By 2001 Turnover was ÂŁ18.5M with a PBIT of ÂŁ1.5M. In October 2001 sold business to GE. Formed accountancy practice in 2002 and launched the Pilot scheme as the forerunner to abacus.

- 6. The abacus Concept In all SMEs Cash is King. Senior Managers in SMEs wear several hats. Not usually qualified in the additional roles therefore key admin functions are run inefficiently. Insufficient time is spent on their key discipline. Lack of support for SMEs from existing professional Bodies. We provide SMEs with a first class, complete and effective commercial package. Allowing the management team to focus on the development and growth of their business, giving them the competitive edge.

- 7. abacus Pilot Scheme The first half of 2002 sourced specialist consultants in all admin function. Designed website and brochure. Pilot scheme launched second half of 2002. The focus was on the SME market in the North East with the intention to launch a national franchise. SME market equals Businesses with 1 – 75 employees. The concept has been embraced by the SME market and we have a successful multi-disciplined practice.

- 8. abacus Pilot Scheme Cross section of clients. Fees ranged from ÂŁ500 - ÂŁ6,000. Generated high level of introducers commission. Total number of clients 40. (Stopped taking on additional clients at this point to focus on establishing abacus .) Based on success incorporated abacus Group of Companies. Extended alliance partners covering a wide range of services.

- 9. Some of abacus Alliance Partners Nat West Bank Barclays Bank Ward Hadaway Lombard TSG Beer & Partners UNW Prism Adec Solutions NBJ Insurance Franchise Co. Inon Bibby Factors ERA Bachman Group Premier Protection Irun CCH P & A Partnership CDI Cap 2 Wilby Insurance Kashflow Matrix Worth Comms Telecoms Invoice Finance solutions Whitehill Publishing C3 Partnership Sage

- 10. abacus Services Accountancy Services Compliance Added Value Business Services Financial Support Business Support IT Support Financial Services Corporate Financial Planning Personal Financial Planning General Insurance

- 11. abacus Call Centre As well as the 2 managers each call centre has a supervisor with over 10 years experience. All call centre operators are experienced in outbound call centre operations. We also carry out in-house training with all our operators. Both call centres are target driven whereby operators are only paid bonuses on verified appointments. All appointments have at least 2 confirmations prior to issue to the franchisee. When generating the appointments the operators promote the franchisee as an accountant and do not talk about the additional services.

- 12. abacus Call Centre All data for the appointments are updated by Yell Experian. All calls are recorded in the South office and we are reviewing call recording systems for the North. All telephone calls TPS/FPS. Computerised diary system for all franchisees. It is the franchisees responsibility to ensure their diary is kept up-to-date.

- 13. Appointment Ratio Breakdown based on figures provided by existing Franchisees. Band Turnover No. of No. of Average Total Range (£K) Appts Clients Fee £ Fee £ A £750+ 10 4 B £250 – £750 18 8 C £100 – £250 53 23 D £60 – £100 19 8 Total 43 £1,250 £53,750 Figures are for illustration purposes only and cannot be guaranteed.

- 14. abacus Franchise Overview Mapping divided UK into approximately 196 territories www.territorymapping.co.uk – User name: abacus ; Password: st3v3. Each territory has approximately 10,000 SMEs in it. For the purposes of our model, an SME is a business with 1 to 75 employees with turnover up to the audit threshold. The SME market includes both incorporated and unincorporated businesses. The data is updated by Yell Experian and is the basis for the generation of 100 confirmed appointments in bands A – D.

- 15. What do abacus Franchisees receive? An exclusive territory. An off the shelf limited company. Consumer Credit registration. Data Protection registration. Professional Indemnity Insurance. Employers Liability Insurance. VAT registration. Nat West bank business account. Practice stationery – business cards, letterheads, continuation sheets, 4 types of envelopes & accounts front and back covers. Binding machine and metal spines.

- 16. What do abacus Franchisees receive? 50 copies of the company brochure. Installation of a business telephone line and allocation of one of our 0844 telephone numbers (However the franchisee must supply their own telephone and pay the monthly line rental and call charges) Manuals covering Marketing, Accountancy, Taxation, HR Procedures and a Practice manual. CD with draft letters, forms, adverts, contracts & agreements & tax tables. abacus email account i.e. jim.smith@ abacus network.co.uk. Dedicated Tax helpline & VAT helpline.

- 17. What do abacus Franchisees receive? Access to the abacus Intranet. Sage Line 50 software – 50 company licence. CCH Single User Starter Package for 150 Clients. Central Client Database Work in Progress and Timesheets Job Tracking, Call, Notes & Diary Personal Tax returns Corporation Tax Returns Final Accounts Preparation One week in House Induction Course. Head office support.

- 18. What do abacus Franchisees receive? Access to specialist in all other admin functions. Online quotation system specifically designed for abacus. Personal abacus web site. CRM System attached to web site. Incorporation software which compares the tax position of a sole trader or partnership to a limited company. Membership to KashFlow Accountants Program. Twitter account and access to the Group facebook account and Group blog.

- 19. Most Importantly From the data… 100 Confirmed and Verified Appointments From bands A – D in the first year

- 20. Who can purchase an abacus Franchise? Only qualified accountants. SMEs demand professionalism, service of the highest quality and most importantly value for money. This can only be achieved by recruiting into the franchise qualified accountants and not by sending individuals on a five week training course and then promoting them as accountants.

- 21. How much does the abacus Franchise cost? Each Territory costs ÂŁ26,000. Management fees are Fixed Fees as follows: - ÂŁ2,500 Twelve Months from 1 st Appointment. Year 2 - ÂŁ5,000 paid by 12 monthly instalments of ÂŁ416.67. Year 3 - ÂŁ6,000 paid by 12 monthly instalments of ÂŁ500.00. Year 4 - ÂŁ7,000 paid by 12 monthly instalments of ÂŁ583.33. Year 5 - ÂŁ8,000 paid by 12 monthly instalments of ÂŁ666.67. Each year starting on the anniversary of the agreement the franchisee pays an advertising levy of ÂŁ400.

- 22. No Hidden Costs There are NO HIDDEN COSTS in our agreement. The costs listed on the previous slide are THE ONLY COSTS payable to abacus. From year 2 onwards it is the franchisees responsibility to pay for and maintain the items listed on the next slide.

- 23. Franchisee Year 2 onwards costs ÂŁ3,224 pa Total Cost ÂŁ210 pa CRM System Licence ÂŁ300 pa Quotation System Licence ÂŁ120 pa Employers Liability Insurance ÂŁ430 pa Professional Indemnity Insurance ÂŁ299 pa KashFlow Accountants Program Membership ÂŁ1,380 pa CCH Software Licence ÂŁ450 pa Sage Line 50 Software Licence ÂŁ35 pa Data Protection Registration

- 24. Key points from the abacus Franchise agreement The franchise is for a period of 5 years. The start date of the agreement is the date of the first appointment – Not the date you sign the agreement . The renewal fee after year 5 is £1,000. Each franchise must have 1 qualified accountant working for the business (Initially this is you).

- 25. Key points from the abacus Franchise Agreement The Franchisee does not have to have an office day 1 the business can be run from your home. We will pay the Franchisee all their commissions received up to 25 th of the month on the last working day of the month

- 26. Why choose abacus ? Dedicated Contact Centre and Marketing Support. abacus Franchise is the only accounting franchise approved by the BFA that is only for qualified accountants. Comprehensive support for all franchisees in practice management, taxation and VAT. One stop fulfilment of all financial and administrative requirements for you and your clients.

- 27. Who to contact at abacus For more information contact Steve Jackson at abacus Franchise Company Limited via the contact details below: - Head Office Tel 0844 050 2254 Fax 0844 050 2255 Email steve.jackson@ abacus network.co.uk Mobile 07764 617004