Insurance act 2015

- 1. 39 ESSEX CHAMBERS Insurance Law Association Singapore 25 May 2015 INSURANCE ACT 2015 Jonathan Bellamy FCIArb, Barrister

- 2. Scope and application IA 2015 ? comes into force 12 August 2016 ? applies to contracts of insurance and reinsurance governed by English law ? applies to contracts of insurance (incl. variations and renewals) made after 12.08.16 ? applies only to non-consumer contracts of insurance (B2B) ? applies to all classes of non-consumer contracts of insurance and industry sectors ? no duty to pay insurance claims within a reasonable time

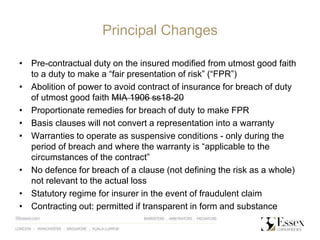

- 3. Principal Changes ? Pre-contractual duty on the insured modified from utmost good faith to a duty to make a °∞fair presentation of risk°± (°∞FPR°±) ? Abolition of power to avoid contract of insurance for breach of duty of utmost good faith MIA 1906 ss18-20 ? Proportionate remedies for breach of duty to make FPR ? Basis clauses will not convert a representation into a warranty ? Warranties to operate as suspensive conditions - only during the period of breach and where the warranty is °∞applicable to the circumstances of the contract°± ? No defence for breach of a clause (not defining the risk as a whole) not relevant to the actual loss ? Statutory regime for insurer in the event of fraudulent claim ? Contracting out: permitted if transparent in form and substance

- 4. Key terms and phrases ? Fair presentation of risk Disclosure of ? °∞every material circumstance which the insured knows or ought to know°± or ? °∞sufficient information to put a prudent insurer on notice that it needs to make further enquiries°± to reveal those material circumstances ? Deliberate or reckless breach ? If the insured knew that it was in breach of the duty of fair presentation or °∞did not care whether it was in breach of that duty°±

- 5. Fair presentation of risk (°∞FPR°±) ? Form: ? °∞disclosure in a manner which would be reasonably clear and accessible to a prudent insurer°± ? need not all be in one document or oral presentation ? Substance: disclosure in which every material representation: ? °∞as to a matter of fact is substantially correct°± ? °∞as to a matter of expectation or belief is made in good faith°±

- 6. Knowledge ? Knowledge: includes actual knowledge and blind-eye knowledge: °∞matters which the individual suspected and of which [he] would have had knowledge but for deliberately refraining from confirming them or enquiring about them°± ? Limited imputation of knowledge of insured: Where insured is not an individual, it knows only what is known to those who are part of its senior management or who are responsible for its insurance ? Defined constructive knowledge of insured: An insured °∞ought to know what should reasonably have been revealed by a reasonable search of information available to the insured°± ? Defined constructive knowledge of insurer: An insurer ought to know something only if an employee or agent knows it and ought reasonably to have passed it on the individual(s) who decides whether to accept the risk

- 7. Remedies for breach of duty FPR ? Would the insurer have acted differently (Pan Atlantic) absent the breach of duty? ? If so, is there a °∞qualifying°± breach? ? If so, is the breach °∞deliberate or reckless°± (DRB) or not (B)? ? If DRB, insurer may avoid contract and retain premium ? If B, and insurer would not have entered the contract on any terms: ®C it may avoid contract and reject all claims but must return premium ? If B, and insurer would have entered contract on different terms (other than premium): ? insurer may treat contract as being on those terms and ? if it would have charged a higher premium, the insurer may reduce proportionately the amount to be paid on a claim

- 8. Remedies for fraudulent claims ? Codification of current law on forfeiture and new right to terminate ? The insurer may: ®C reject the claim ®C recover any money paid out in respect of the claim ®C terminate contract of insurance with effect from the time of the fraudulent act ? On electing to terminate, the insurer may ®C reject any claim occurring or arising after the time of the fraudulent act ®C retain premium paid ? Claims occurring or arising before the time of the fraudulent act are unaffected

- 9. Contracting out ? Presumption of default regime ? Party autonomy (excl. basis clauses) ? For other clauses (e.g. fair presentation of risk, breach of warranty and fraudulent claims), contracting out only if: ®C transparent presentation of °∞disadvantageous term°±: ? form: °∞sufficient steps to draw to insured°Øs attention°± ? substance: °∞clear and unambiguous as to its effect°± ? sophistication/experience of policyholder (e.g. reinsurance) ? °∞circumstances of the transaction°± ? policyholder°Øs actual knowledge of °∞disadvantageous term°± JONATHAN BELLAMY

![Knowledge

? Knowledge: includes actual knowledge and blind-eye knowledge:

°∞matters which the individual suspected and of which [he] would

have had knowledge but for deliberately refraining from confirming

them or enquiring about them°±

? Limited imputation of knowledge of insured: Where insured is not an

individual, it knows only what is known to those who are part of its

senior management or who are responsible for its insurance

? Defined constructive knowledge of insured: An insured °∞ought to

know what should reasonably have been revealed by a reasonable

search of information available to the insured°±

? Defined constructive knowledge of insurer: An insurer ought to know

something only if an employee or agent knows it and ought

reasonably to have passed it on the individual(s) who decides

whether to accept the risk](https://image.slidesharecdn.com/insuranceact2015-ilas250515jmbellamy-150703143413-lva1-app6892/85/Insurance-act-2015-6-320.jpg)