International traffic termination session 13b

- 1. ITU workshop on International Roaming and International Traffic Termination Session 12: International Traffic Termination Bangkok 5-8 October, 2010 David Rogerson International Telecommunication Union 1 October 2010

- 2. Agenda Why is international termination different? Why is there a regulatory problem? Stakeholder viewpoints Operators Governments National regulators Approaches to regulation 2

- 3. Why is international termination different? International Telecommunication Union 3 October 2010

- 4. International traffic termination International traffic termination allows subscribers in one country to receive calls from subscribers in other countries. International traffic termination applies to both fixed and mobile termination ŌĆ” although different charges may apply. For the purpose of this presentation we focus on voice traffic but termination can also apply to text (SMS) and switched data services. 4

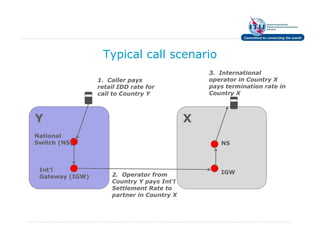

- 5. Typical call scenario 3. International 1. Caller pays operator in Country X retail IDD rate for pays termination rate in call to Country Y Country X Y X National Switch (NS) NS IntŌĆÖl IGW Gateway (IGW) 2. Operator from Country Y pays IntŌĆÖl Settlement Rate to partner in Country X

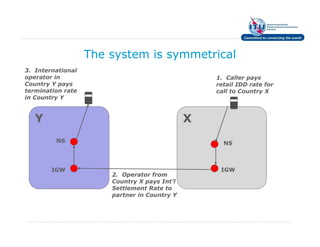

- 6. The system is symmetrical 3. International operator in 1. Caller pays Country Y pays retail IDD rate for termination rate call to Country X in Country Y Y X NS NS IGW IGW 2. Operator from Country X pays IntŌĆÖl Settlement Rate to partner in Country Y

- 7. Key principles of IntŌĆÖl Accounting Rates Developed at a time of national monopolies and before mobile networks were established Initial settlement rates were (at best) loosely based on costs They have failed to keep up with cost reductions caused by technology improvements and competition Although the system appears symmetrical the money flows are from developed to developing countries: Most traffic originates from rich countries High settlement rates favour the recipient countries 7

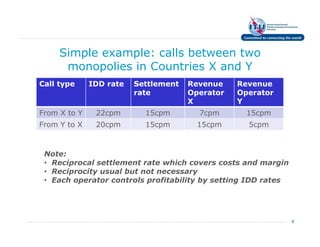

- 8. Simple example: calls between two monopolies in Countries X and Y Call type IDD rate Settlement Revenue Revenue rate Operator Operator X Y From X to Y 22cpm 15cpm 7cpm 15cpm From Y to X 20cpm 15cpm 15cpm 5cpm Note: ŌĆó Reciprocal settlement rate which covers costs and margin ŌĆó Reciprocity usual but not necessary ŌĆó Each operator controls profitability by setting IDD rates 8

- 9. Complication: competition lowers prices in country Y Call type IDD rate Settlement Revenue Revenue rate Operator Operator X Y From X to Y 22cpm 15cpm 7cpm 15cpm From Y to X 16cpm 15cpm 15cpm 1cpm Note: ŌĆó Margins squeezed for operators in Country Y ŌĆó Lower IDD prices increases the % of outbound traffic from Y to X, exacerbating the loss of margin ŌĆó Country Y wants to reduce settlement rates. 9

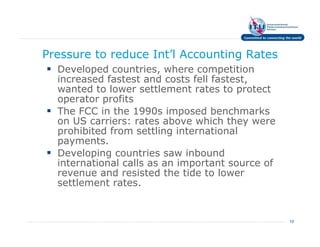

- 10. Pressure to reduce IntŌĆÖl Accounting Rates Developed countries, where competition increased fastest and costs fell fastest, wanted to lower settlement rates to protect operator profits The FCC in the 1990s imposed benchmarks on US carriers: rates above which they were prohibited from settling international payments. Developing countries saw inbound international calls as an important source of revenue and resisted the tide to lower settlement rates. 10

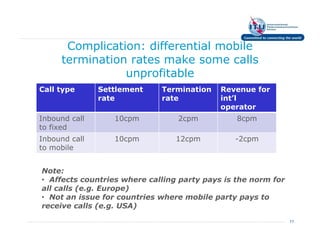

- 11. Complication: differential mobile termination rates make some calls unprofitable Call type Settlement Termination Revenue for rate rate intŌĆÖl operator Inbound call 10cpm 2cpm 8cpm to fixed Inbound call 10cpm 12cpm -2cpm to mobile Note: ŌĆó Affects countries where calling party pays is the norm for all calls (e.g. Europe) ŌĆó Not an issue for countries where mobile party pays to receive calls (e.g. USA) 11

- 12. How to deal with international calls to mobile (in CPP countries) The mobile operator could accepts a lower termination rate for international calls But this encourages refile, where national calls are presented as if international, so as to obtain lower termination rate. Early revenue sharing schemes in Europe were abandoned as a result Differential settlement rates, higher for mobile than for fixed May allow all calls to be profitable, but increases complexity especially between RPP and CPP countries Sustainability requires rapid reduction in mobile termination rates. 12

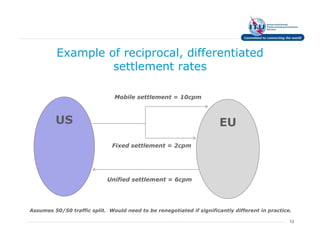

- 13. Example of reciprocal, differentiated settlement rates Mobile settlement = 10cpm US EU Fixed settlement = 2cpm Unified settlement = 6cpm Assumes 50/50 traffic split. Would need to be renegotiated if significantly different in practice. 13

- 14. Why is there a regulatory problem with international termination? International Telecommunication Union 14 October 2010

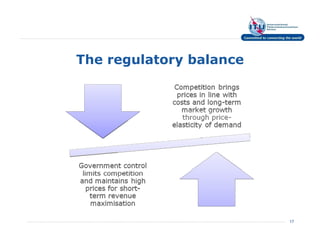

- 15. National regulatory objectives The NRA is charged with looking after the national economic interests Will lower settlement rates be in the national interests? Consumers will benefit from lower international calling charges Operators and Government may prefer the higher rates that brings in hard currency and can fund investment. Where the balance of traffic is heavily in favour of inbound international calls, it is hard to regulate settlement rates down. The benefits of cost-based settlement rates will largely be experienced by consumers in other countries. 15

- 16. Lack of regulatory independence: government objectives may trump regulatorŌĆÖs objectives GovernmentŌĆÖs objectives RegulatorŌĆÖs objectives 16

- 17. The regulatory balance 17

- 18. Stakeholder perspectives International Telecommunication Union 18 October 2010

- 19. Stakeholders in international roaming 19

- 20. Brainstorm of key issues for each stakeholder group 20

- 21. Approaches to regulation International Telecommunication Union 21 October 2010

- 22. Approach 1: Hold back the tide Maintain high settlement rates as long as possible Requires monopoly / government control of international gateway VoIP should be banned to limit bypass Hard to sustain in the face of international pressure, trade agreements, technology change etc

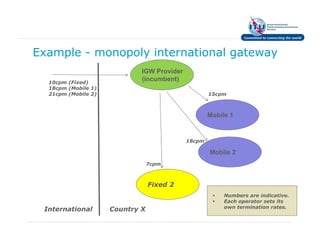

- 23. Example - monopoly international gateway IGW Provider 10cpm (Fixed) (incumbent) 18cpm (Mobile 1) 21cpm (Mobile 2) 15cpm Mobile 1 18cpm Mobile 2 7cpm Fixed 2 Numbers are indicative. Each operator sets its own termination rates. International Country X

- 24. Approach 2: Controlled evolution Accept that international settlement rates are going to fall towards cost- based levels but seek a gradual change Various methods of achieving this e.g: Prohibition on transit traffic Regulated glidepath

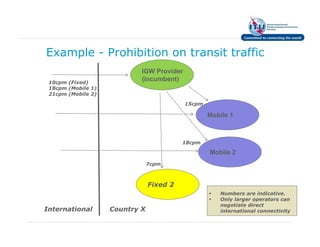

- 25. Example - Prohibition on transit traffic IGW Provider 10cpm (Fixed) (incumbent) 18cpm (Mobile 1) 21cpm (Mobile 2) 15cpm Mobile 1 18cpm Mobile 2 7cpm Fixed 2 Numbers are indicative. Only larger operators can negotiate direct International Country X international connectivity

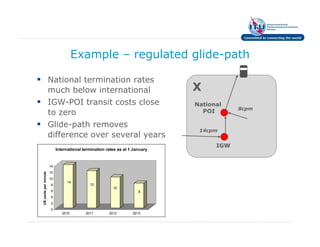

- 26. Example ŌĆō regulated glide-path National termination rates much below international X IGW-POI transit costs close National 8cpm to zero POI Glide-path removes 14cpm difference over several years IGW International termination rates as at 1 January 14 12 US cents per minute 10 14 8 12 10 6 8 4 2 0 2010 2011 2012 2013

- 27. Approach 3: Let the market decide Introduce competition in national and international services Allow transit of incoming international calls Charges for terminating international calls are gradually reduced to similar level to national call termination.

- 28. Liberalised international traffic Any operator can enter this market so long as it can negotiate an agreement with an international partner The ability to handle traffic destined for another network potentially allows smaller operators to achieve sufficient scale to enter this market Margins are competed away because of the transit capability High price elasticity of demand ŌĆō international operators will switch traffic in bulk between national termination partners based on small price differentials.

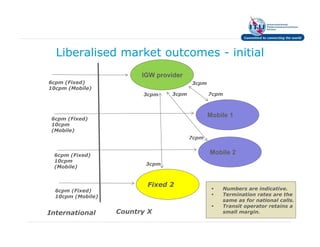

- 29. Liberalised market outcomes - initial IGW provider 6cpm (Fixed) 3cpm 10cpm (Mobile) 3cpm 3cpm 7cpm 6cpm (Fixed) Mobile 1 10cpm (Mobile) 7cpm 6cpm (Fixed) Mobile 2 10cpm 3cpm (Mobile) Fixed 2 6cpm (Fixed) Numbers are indicative. 10cpm (Mobile) Termination rates are the same as for national calls. Transit operator retains a International Country X small margin.

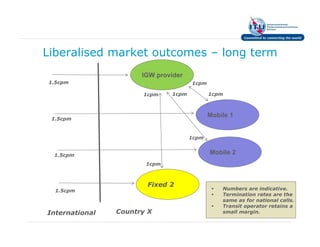

- 30. Liberalised market outcomes ŌĆō long term IGW provider 1.5cpm 1cpm 1cpm 1cpm 1cpm 1.5cpm Mobile 1 1cpm 1.5cpm Mobile 2 1cpm Fixed 2 1.5cpm Numbers are indicative. Termination rates are the same as for national calls. Transit operator retains a International Country X small margin.

- 31. A possible regulatory strategy

- 32. Thank you. In the final session we will look at a case study with role play on international traffic termination International Telecommunication Union 32 October 2010