Interpreting accounting information for sole proprietors

- 1. Interpreting accounting information for sole proprietors AS90980

- 2. Contents 1. Analyse Profitability 2. Interpret Profitability 3. Analyse Liquidity 4. Interpret Liquidity 5. Analyse Stability 6. Interpret Stability

- 4. This is ALL of them! You will get this sheet in your exam so no need to remember the formulae BRING a calculator to class every day.

- 5. Contents 1. Analyse Profitability 2. Interpret Profitability 3. Analyse Liquidity 4. Interpret Liquidity 5. Analyse Stability 6. Interpret Stability Click here first

- 6. Mark-up percentage WHAT is it? How much does a business add on to the cost of goods to get their selling price? How do we calculate it? Gross Profit x 100 Cost of Goods Sold 1

- 7. Remember, its Gross Profit divided by Cost of Goods Sold 100 1 times

- 8. Remember, its Gross Profit divided by Cost of Goods Sold 100 1 times 24000 96000

- 9. 100 1 times 24000 96000 0.25 times 100 1 times equals 25% This means that the business works out 25% of the cost of the goods and adds that on to work out a selling price.

- 10. 2004 2005 2006 Sales 225,000 250,000 280,000 Cost of Goods Sold 135,000 150,000 175,000 Gross profit 90,000 100,000 105,000 Financial Information for Kids R Us daycare The mark-up percentage for 2005 is: a. 25% b. 75% c. 67% d.100%

- 11. Well done! You have learned how to calculate the Mark-up percent. Later we will learn about how this helps us to understand more about a business. MOVE on NOW to Gross Profit percent. Correct mark-up percent

- 12. Gross profit percentage WHAT is it? What portion of each $1 of sales does a business receive as gross profit? How do we calculate it? Sales Gross Profit 100 1 times

- 13. Remember, its Gross Profit divided by Sales this time. 100 1 times

- 14. Remember, its Gross Profit divided by Cost of Goods Sold 100 1 times 24000 120000

- 15. 100 1 times 24000 120000 0.20 times 100 1 times equals 20% This means that the business keeps 20 cents out of every dollar of sales as gross profit. Remember that expenses then come out of that 20 cents.

- 16. 2004 2005 2006 Sales 225,000 250,000 280,000 Cost of Goods Sold 135,000 150,000 175,000 Gross profit 90,000 100,000 105,000 Financial Information for Kids R Us daycare The Gross Profit percentage for 2005 is: a. 25% b. 40% c. 67% d.100%

- 17. Well done! You have learned how to calculate the Gross Profit percent. Later we will learn about how this helps us to understand more about a business. MOVE on NOW to Expense percent.

- 18. Expenses percent • There are 3 you can calculate. • One for each of the 3 expenses groups (Distribution Costs, Administrative Expenses and Finance Costs). WHAT is it? How much of each $1 of sales is a business paying on expenses? How do we calculate it? Sales Expense Group 100 1 times

- 19. Distribution Costs Sales 66000 398600 100 1 times 0.16557 x 100 = 16.56%

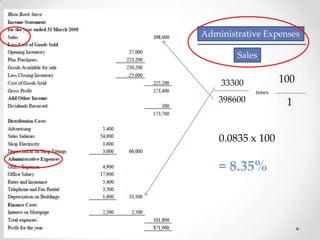

- 20. Administrative Expenses Sales 33300 398600 100 1 times 0.0835 x 100 = 8.35%

- 21. Finance Costs Sales 2500 398600 100 1 times 0.00627 x 100 = .63%

- 22. Expenses percent Expense Group Expense Percent Distribution Costs 16.56% Administrative Expenses 8.35% Finance Costs 0.63% Huia Bookstore 16.56 cents in every $1 of sales is spent on Distribution Costs 8.35 cents in every $1 of sales is spent on Administrative Expenses .63 cents in every $1 of sales is spent on Finance Costs

- 23. 2004 2005 2006 Sales 225,000 250,000 280,000 Cost of Goods Sold 135,000 150,000 175,000 Gross profit 90,000 100,000 105,000 Distribution costs 31,500 40,000 37,800 Administrative Expenses 27,000 26,000 28,000 Finance costs 9,000 10,000 14,000 Profit for the year 22,500 24,000 25,200 Financial Information for Kids R Us daycare The Finance Cost percentage for 2004 is: a. 2.5% b. 7.5% c. 12% d.4%

- 24. Well done! You have learned how to calculate the Gross Profit percent. Later we will learn about how this helps us to understand more about a business. MOVE on NOW to Profit Percent.

- 25. Recheck the formula and try again. GO BACK and check the formula GO BACK and retake the question GO BACK and see how to work out the answer Incorrect Mark-up Percent

- 26. 100 1 times 100000 150000 0.667 times 100 1 times equals 67% This means that the business works out 67% of the cost of the goods and adds that on to work out a selling price. Gross Profit Cost of Goods Sold

- 27. Recheck the formula and try again. GO BACK and check the formula GO BACK and retake the question GO BACK and see how to work out the answer Incorrect Gross Profit Percent

- 28. 100 1 times 100000 250000 0.40 times 100 1 times equals 40% This means that the business keeps 40 cents for every dollar of sales made as Gross Profit. Gross Profit Sales

- 29. Recheck the formula and try again. GO BACK and check the formula GO BACK and retake the question GO BACK and see how to work out the answer Incorrect Expense Percent