Investment banking fees for mergers and acquisitions

- 1. InvestmentBank.com1 An overview of fee structure in mid-market sell-side mergers and acquisitions. Mergers & Acquisitions Sell-side Advisory Fees

- 2. InvestmentBank.com2 Standard Fee Structure ÔÇó Known as an upfront fee, work fee, or engagement fee ÔÇó Can be in the form of an initial flat fee or paid out in monthly installments ÔÇó Sometimes rolled back from the success fee upon deal close ÔÇó Also called a back-end fee, this is the primary form of compensation and is paid upon deal close. ÔÇó Will vary with transaction size. ÔÇó Is calculated using the Lehman formula, double Lehman formula, or aligned method. ÔÇó Other fees include minimum fees, breakup fees, and any ancillary expenses associated with the deal. ÔÇó Occasionally, advisors will receive payment in the form of non-cash compensation, such as stock, options, or warrants. Retainer Fee Success Fee Other Fees

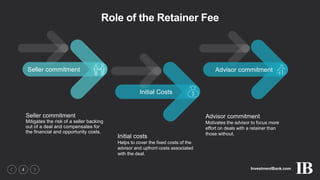

- 4. InvestmentBank.com4 Role of the Retainer Fee Seller commitment Initial Costs Advisor commitment Seller commitment Mitigates the risk of a seller backing out of a deal and compensates for the financial and opportunity costs. Initial costs Helps to cover the fixed costs of the advisor and upfront costs associated with the deal. Advisor commitment Motivates the advisor to focus more effort on deals with a retainer than those without.

- 5. InvestmentBank.com5 Retainer Fee Cost Breakdown Advisors will expect a higher retainer fee when taking on greater risk with less marketable clients. Conversely, a lower fee is required in less risky deals involving a more marketable and profitable client. In cold M&A markets, advisors typically charge lower upfront fees, whereas in hot markets, upfront fees tend to be higher. The retainer fee will reflect fixed costs of the intermediary, such as overhead and compliance, as well as direct costs of the deal, including deal preparation and due diligence. The amount of retainer fees will depend upon the advisorÔÇÖs quality and size, such as a bulge-bracket, middle-market, or boutique advisor. Deal Risk Market Activity Initial Costs Incurred Quality and Size of Intermediary What factors determine the size of the fee?

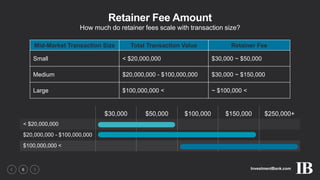

- 6. InvestmentBank.com6 Retainer Fee Amount How much do retainer fees scale with transaction size? $30,000 $50,000 $100,000 $150,000 $250,000+ < $20,000,000 $20,000,000 - $100,000,000 $100,000,000 < Mid-Market Transaction Size Total Transaction Value Retainer Fee Small < $20,000,000 $30,000 ~ $50,000 Medium $20,000,000 - $100,000,000 $30,000 ~ $150,000 Large $100,000,000 < ~ $100,000 <

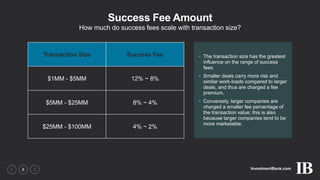

- 8. InvestmentBank.com8 Success Fee Amount How much do success fees scale with transaction size? Transaction Size Success Fee $1MM - $5MM 12% ~ 8% $5MM - $25MM 8% ~ 4% $25MM - $100MM 4% ~ 2% ÔÇó The transaction size has the greatest influence on the range of success fees. ÔÇó Smaller deals carry more risk and similar work-loads compared to larger deals, and thus are charged a fee premium. ÔÇó Conversely, larger companies are charged a smaller fee percentage of the transaction value; this is also because larger companies tend to be more marketable.

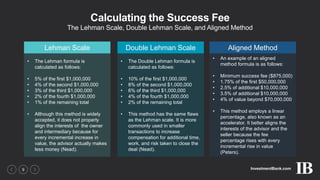

- 9. InvestmentBank.com9 Calculating the Success Fee The Lehman Scale, Double Lehman Scale, and Aligned Method Lehman Scale ÔÇó The Lehman formula is calculated as follows: ÔÇó 5% of the first $1,000,000 ÔÇó 4% of the second $1,000,000 ÔÇó 3% of the third $1,000,000 ÔÇó 2% of the fourth $1,000,000 ÔÇó 1% of the remaining total ÔÇó Although this method is widely accepted, it does not properly align the interests of the owner and intermediary because for every incremental increase in value, the advisor actually makes less money (Nead). Double Lehman Scale ÔÇó The Double Lehman formula is calculated as follows: ÔÇó 10% of the first $1,000,000 ÔÇó 8% of the second $1,000,000 ÔÇó 6% of the third $1,000,000 ÔÇó 4% of the fourth $1,000,000 ÔÇó 2% of the remaining total ÔÇó This method has the same flaws as the Lehman scale. It is more commonly used in smaller transactions to increase compensation for additional time, work, and risk taken to close the deal (Nead). Aligned Method ÔÇó An example of an aligned method formula is as follows: ÔÇó Minimum success fee ($875,000) ÔÇó 1.75% of the first $50,000,000 ÔÇó 2.5% of additional $10,000,000 ÔÇó 3.5% of additional $10,000,000 ÔÇó 4% of value beyond $70,000,000 ÔÇó This method employs a linear percentage, also known as an accelerator. It better aligns the interests of the advisor and the seller because the fee percentage rises with every incremental rise in value (Peters).

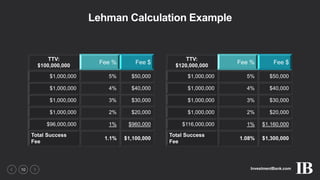

- 10. InvestmentBank.com10 Lehman Calculation Example TTV: $100,000,000 Fee % Fee $ $1,000,000 5% $50,000 $1,000,000 4% $40,000 $1,000,000 3% $30,000 $1,000,000 2% $20,000 $96,000,000 1% $960,000 Total Success Fee 1.1% $1,100,000 TTV: $120,000,000 Fee % Fee $ $1,000,000 5% $50,000 $1,000,000 4% $40,000 $1,000,000 3% $30,000 $1,000,000 2% $20,000 $116,000,000 1% $1,160,000 Total Success Fee 1.08% $1,300,000

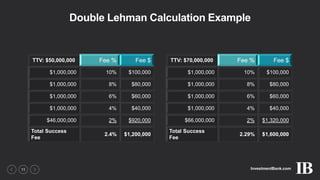

- 11. InvestmentBank.com11 Double Lehman Calculation Example TTV: $50,000,000 Fee % Fee $ $1,000,000 10% $100,000 $1,000,000 8% $80,000 $1,000,000 6% $60,000 $1,000,000 4% $40,000 $46,000,000 2% $920,000 Total Success Fee 2.4% $1,200,000 TTV: $70,000,000 Fee % Fee $ $1,000,000 10% $100,000 $1,000,000 8% $80,000 $1,000,000 6% $60,000 $1,000,000 4% $40,000 $66,000,000 2% $1,320,000 Total Success Fee 2.29% $1,600,000

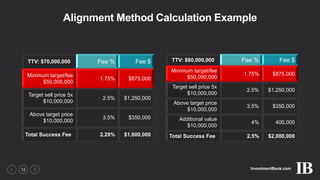

- 12. InvestmentBank.com12 Alignment Method Calculation Example TTV: $70,000,000 Fee % Fee $ Minimum target/fee $50,000,000 1.75% $875,000 Target sell price 5x $10,000,000 2.5% $1,250,000 Above target price $10,000,000 3.5% $350,000 Total Success Fee 2.29% $1,600,000 TTV: $80,000,000 Fee % Fee $ Minimum target/fee $50,000,000 1.75% $875,000 Target sell price 5x $10,000,000 2.5% $1,250,000 Above target price $10,000,000 3.5% $350,000 Additional value $10,000,000 4% 400,000 Total Success Fee 2.5% $2,000,000

- 14. InvestmentBank.com14 Other Fees Other Fees Minimum Fee Breakup Fee Ancillary Expenses Non-cash payment Includes compensation in the form of stock, options, or warrants, though it is more common in capital formation projects than in M&A sell-side transactions May be included in the retainer fee; however, travel and other upfront expenses may be invoiced in addition to the retainer fee Insures the investment bank and discourages the seller from backing out of a mature and closely negotiated deal Guarantees the minimum compensation paid to the advisor upon closing the deal; it is assessed more often in smaller transactions than larger ones

- 15. InvestmentBank.com15 In Closing The purpose of sell-side M&A fee structure is to effectively align the interests of the investment banker with those of the shareholders. Although most fee structures follow a similar rubric, every deal is based on numerous factors that make it unique, and thus subject to negotiation. Ultimately, fees are an inevitable part of any transaction and hiring a quality investment banker can help owners navigate through the complex and tedious process of selling a business.

- 16. InvestmentBank.com16 Reference Citations ÔÇó Carvalho, John, A SUMMARY OF M&A FEES FOR SELL-SIDE TRANSACTIONS, DIVESTOPEDIA (2016), https://www.divestopedia.com/2/8036/sale- process/investment-bankers/a-summary-of-ma-fees-for-sell-side-transactions (last visited Apr 20, 2017). ÔÇó Gravel, Michael, M&AADVISOR FEES ÔÇô IMERGEADVISORS, IMERGEADVISORS (2012), http://www.imergeadvisors.com/ma-advisor-fees (last visited 2017). ÔÇó Nead, Nate, M&A ADVISOR FEES: RETAINERS, SUCCESSES, & ANCILLARY EXPENSES, INVESTMENTBANK.COM, http://investmentbank.com/fees/ (last visited Apr 20, 2017). ÔÇó Peters, Basil, M&AADVISOR FEES FOR SELLING A BUSINESS, STRATEGIC EXITS (2016), http://www.exits.com/blog/ma-advisor-fees-selling-business/ (last visited Apr 21, 2017). ÔÇó Sikora, Martin, THE ROLE AND FEE STRUCTURE OF AN M&A ADVISOR, AXIAL FORUM (2011), http://www.axial.net/forum/how-ma-advisory-firm-earns-its-fees/ (last visited Apr 21, 2017).

- 17. InvestmentBank.com17 About the Author Anthony Gord is currently studying Finance and Accounting at UNLV and will be graduating in the spring of 2018. Upon graduation, he intends on pursuing a career in equity research or investment banking. He holds his Series 7 and has gathered minor experience in financial advising through internships. Anthony is now looking for internships and experience as a financial analyst, and plans to obtain his CFA designation. One day, Anthony hopes to start his own investment company.