Investment banking services

- 1. Investment Banking Services Zolt├Īn Sikl├│si Global Director of Investments

- 2. Investment Banking Services Extension of Adam Consulting Service Offering with First Class M&A Advisory Activities Clients ’é¦ Company shareholders ’é¦ Company sale contemplating sale ’é¦ Acquisitions ’é¦ Acquisitive companies ’é¦ Investment structuring ’é¦ High net worth individuals ’é¦ Equity / debt private and family offices placement ’é¦ Institutional investors ’é¦ Financial restructuring (private equity funds, sovereign funds, etc.) Global access to investors, acquisition targets and strategic partners

- 3. Transaction Focus Mid-Market M&A Deals Across a Number of Industries Geographic Focus ’é¦ EMEA ’é¦ Business services ’é¦ Media ’é¦ Packaging ’é¦ Food & beverage Sector Specific Transaction Expertise ’é¦ Logistics ’é¦ Real estate ’é¦ Technology ’é¦ etc. Mid-Market Deals ’é¦ Deal size in the $20 million - $100+ million range

- 4. Transaction Process Central Execution Team Closely Co-Operating with Adam Consulting Local Offices Sell-Side Process Identification of Execution (Preparation, Marketing, Negotiations, Origination investors Closing) Local Execution Local Execution Execution Team Offices Team Offices Team Local Offices (support) Buy-Side Process Identification of Execution Origination acquisition targets (Preparation, Marketing, Negotiations, Closing) Local Execution Local Execution Execution Team Offices Team Offices Team Local Offices (support)

- 5. Execution Capabilities Value Maximization Based on Superior Quality Execution Experienced Execution Team VALUE ADDED Experienced & disciplined execution ’é¦ 50+ closed M&A transactions Comprehensive industry experience ’é¦ USD 1 bn+ total deal value ’é¦ Cross-border dealmaking Senior involvment Combination of M&A, PE and asset ’é¦ Access to financial and strategic management experience investors globally Extensive international network ’é¦ 6 experienced investment banking professionals Value maximization

- 6. Execution Team Seasoned M&A Professionals Combining Bulge-Bracket Investment Banking Experience with Entrepreneurial Approach Zolt├Īn Sikl├│si Oliv├®r Martin J├Īnos K┼æv├Īg├│ Managing Partner Partner Partner 20 years of M&A, investment 17 years of M&A, corporate 20 years of investment and securities experience finance and structured finance banking and securities trading experience experience Career milestones: Career milestones: Career milestones: ’é¦ Invescom Corporate Finance (Founder) ’é¦ R├Ība Automotive Group plc (Member of ’é¦ Citibank (Managing Director and Head of ’é¦ Hungarian-American Enterprise Fund Board of Directors) Banking, Hungary, Baltics and Former- (Partner) ’é¦ ABN AMRO Corporate Finance (Acting Head Yugoslavian Countries) ’é¦ Hypo-Securities Hungary (Managing of Hungarian Operation) ’é¦ Nomura Corporate Advisory (Head of CEE) Director) ’é¦ MeesPierson EurAmerica ’é¦ Nomura Securities Budapest (Sales and ’é¦ Nomura Investment Bank Trading Director) ’é¦ MeesPierson EurAmerica ’é¦ ING Baring Securities (Head of Fixed Income Desk) ’é¦ Bank Austria, Daiwa-MKB MBA, Madrid Business School; M. Sc. in M. Sc. in Finance, Technische Universitaet MBA, University of Lincolnshire and Humberside; Electrical Engineering, Budapest Technical Berlin, Germany M. Sc. in Economics from the College of University International Management & Business, Budapest

- 7. Select Track Record Dozens of M&A Transactions Closed in a Broad Range of Industries Sell-side M&A advisory for Sell-side M&A advisory in Sell-side M&A advisory in Sell-side M&A advisory for Grupo Hungarian-owned ACIS Group in relation to the sale of Szenna relation to the sale of 7 cable Bimbo, the leading Mexican food the disposal of its Hungarian, Pack Group to Exal Corp. television channels and 31% company in the sale of its gummy Romanian and Serbian shareholding in M-RTL to RTL candy subsidiary in the Czech companies to Gilbarco Group republic 2012 2012 2011 2010 Sell-side M&A advisory in Sell-side M&A advisory for Sell-side M&A advisory for Buy-side M&A advisory for SIG relation to the sale of two freight Showtime Budapest, a leading French GPV Group in the plc in relation to the acquisition wagon leasing companies in concert promotion business in disposal of its Romanian mail of a Hungarian specialized Slovakia and Hungary to Touax, relation to the sale to Sony Music services subsidiary, GPV Mail building material supplier the leading European logistics Services to D├Łjbeszed┼æ Holding leasing company 2010 2010 2010 2008

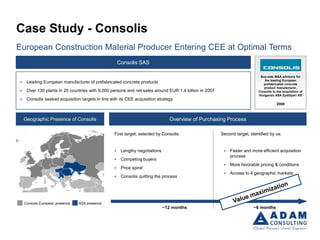

- 8. Case Study - Consolis European Construction Material Producer Entering CEE at Optimal Terms Consolis SAS Buy-side M&A advisory for the leading European ’é¦ Leading European manufacturer of prefabricated concrete products prefabricated concrete product manufacturer, ’é¦ Over 130 plants in 20 countries with 9,000 persons and net sales around EUR 1.4 billion in 2007 Consolis to the acquisition of Hungarian ASA ├ēp├Łt┼æipari Kft ’é¦ Consolis seeked acquisition targets in line with its CEE acquisition strategy 2008 Geographic Presence of Consolis Overview of Purchasing Process First target, selected by Consolis: Second target, identified by us: ’é¦ Lengthy negotiations ’é¦ Faster and more efficient acquisition process ’é¦ Competing buyers ’é¦ More favorable pricing & conditions ’é¦ Price spiral ’é¦ Access to 4 geographic markets ’é¦ Consolis quitting the process Consolis European presence ASA presence ~12 months ~6 months

- 9. Case Study - Salgglas Securing a High Selling Price via a Competitive Sale Process Salgglas Zrt. Sell-side M&A advisory for ’é¦ Leading fabricator of tempered and laminated safety glass in CEE for the automotive industry, customers include Riverside Europe in relation Suzuki and a number of Tier 1 suppliers to the sale of Salgglas Zrt. to CEEIH ’é¦ 100% owned by international Private Equity fund Riverside Europe since 1997 ’é¦ 300 employees, close to $20 million sales in 2006 2007 Overview of the Sale Process Comparison of Received Offers 100+ Investors Contacted 200% 19 Info Memos Sent Out 175% 150% 10 Site Visits 125% 100% 5 Offers 75% 50% Price Buyer 1 Buyer 2 Buyer 3 Buyer 4 Buyer 5 SALE Expectation

- 10. Pipeline Select Investment Opportunities Sector Business Geography Deal Type Deal Size Energy Coal fired power plant project India Majority acquisition $85 million Equity / debt $50 million (total Energy Renewable energy (Off-shore, Biomass) Germany investment funding need) PE fund investing in banks focusing on SME $125 million (target Financial Services Sub-Saharan region, Africa Equity investment customers fund size) Transportation Airline operation Zimbabwe Equity investment $1 million Transportation Airline operation South Sudan Equity investment $40 million Technology Online game developer Hungary Equity investment $4 million Real Estate Luxury hotel Turkey Acquisition N/A Real Estate Premium hotel Turkey Acquisition N/A Real Estate Hotel portfolio United Kingdom Acquisition $100+ million Real Estate 4-star hotel United Kingdom Acquisition $100+ million Wholesale Frozen food distribution Hungary Acquisition $10+ million