Investment Banking_Curriculum

- 1. INVESTMENT BANKING (Max Marks: 100; Duration: 30 Hours) Investments Bankers are very important part of any Institutions. They are expected to have clear understanding of various Asset Classes, Markets, Financial Analysis, Risk Management. Strong Conceptual foundationininvestmentanalysisand portfolio management is very important criteria. Adequate Knowledge and exposure to areas like Equity, Debt research, asset allocation, portfolio and risk management will help individuals to work in Investment Banking role. Topics which are usually covered are valuation techniques, the pricing of fixed-income securities, equities,Derivativesaswell asthe principlesof finance,includingarbitrage,market efficiency, asset pricingmodelsand portfolio theory, primarily portfolio selection and management on the basis of risk and return. The candidate should know under this subject: Know the basics of the Investment Banking in India. Understand the functioning of Investment Bankers related to Issue Management Process, Substantial Acquisition of Equity Shares, Buyback of Equity Shares and Delisting of Shares. Know the regulatory environment in which the Investment Bankers operates in India. Course Outline: 1. Investment Banking Services Financial Advisory, Corporate Finance, Project Finance, Mergers and Acquisitions, Capital raising, debt, equities, initial public offerings (IPOŌĆÖs). Overview of commercial vs. Investment Banking ŌĆō traditional banking roles, traditional separation commercial and investment banking. 2. Global Capital Market & Capital Raising Instruments: ╦¢ RaisingequityininternationalmarketsADRsandGDRs ╦¢ RaisingdebtininternationalmarketsECBs,FCCBs ╦¢ Studytopici) Performance of ADRsissuedbyIndiancompaniesinlastthree yearsii) ECB regulations ╦¢ Understandingrisksandrewardsof raisingcapital internationally ╦¢ Understandingvariousregulationsforraisingcapital internationally ╦¢ Debt Instruments, Equities / Preferential shares, Private Placement, Initial public offerings (IPOŌĆÖs). ╦¢ The Money Market (T-Bills , Commercial Paper , Certificates of Deposit , Repos and Reverses Repo) ╦¢ The Bond Market (Treasury Notes (T-Notes) and T-Bonds, State and Municipal, Government bonds, Corporate Bonds , International Bonds ,Other types of bonds ╦¢ Common Stocks 3. Financial Statement Analysis ŌĆō An Investment BankerŌĆÖs Perspective ╦¢ Income Statement, Balance Sheet, Cash Flow Statement defined and importance of Comprehensive Financial Statement review ╦¢ Understand how financial statements are inter-related to each other ╦¢ Relationship between the Income Statement and Cash Flow Statement

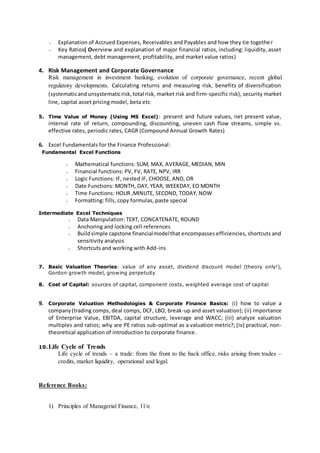

- 2. ╦¢ Explanation of Accrued Expenses, Receivables and Payables and how they tie together ╦¢ Key Ratios( Overview and explanation of major financial ratios, including: liquidity, asset management, debt management, profitability, and market value ratios) 4. Risk Management and Corporate Governance Risk management in investment banking, evolution of corporate governance, recent global regulatory developments. Calculating returns and measuring risk, benefits of diversification (systematicandunsystematicrisk,total risk, market risk and firm-specific risk), security market line, capital asset pricing model, beta etc 5. Time Value of Money (Using MS Excel): present and future values, net present value, internal rate of return, compounding, discounting, uneven cash flow streams, simple vs. effective rates, periodic rates, CAGR (Compound Annual Growth Rates) 6. Excel Fundamentals for the Finance Professional: Fundamental Excel Functions ╦¢ Mathematical functions: SUM, MAX, AVERAGE, MEDIAN, MIN ╦¢ Financial functions: PV, FV, RATE, NPV, IRR ╦¢ Logic Functions: IF, nested IF, CHOOSE, AND, OR ╦¢ Date Functions: MONTH, DAY, YEAR, WEEKDAY, EO MONTH ╦¢ Time Functions: HOUR ,MINUTE, SECOND, TODAY, NOW ╦¢ Formatting: fills, copy formulas, paste special Intermediate Excel Techniques ╦¢ Data Manipulation: TEXT, CONCATENATE, ROUND ╦¢ Anchoring and locking cell references ╦¢ Buildsimple capstone financialmodelthat encompasses efficiencies, shortcuts and sensitivity analysis ╦¢ Shortcuts and working with Add-ins 7. Basic Valuation Theories: value of any asset, dividend discount model (theory only!), Gordon growth model, growing perpetuity 8. Cost of Capital: sources of capital, component costs, weighted average cost of capital 9. Corporate Valuation Methodologies & Corporate Finance Basics: (i) how to value a company(trading comps, deal comps, DCF, LBO, break-up and asset valuation); (ii) importance of Enterprise Value, EBITDA, capital structure, leverage and WACC; (iii) analyze valuation multiples and ratios; why are PE ratios sub-optimal as a valuation metric?; (iv) practical, non- theoretical application of introduction to corporate finance. 10.Life Cycle of Trends Life cycle of trends ŌĆō a trade: from the front to the back office, risks arising from trades ŌĆō credits, market liquidity, operational and legal. Reference Books: 1) Principles of Managerial Finance, 11/e

- 3. Author: Lawrence J Gitman; ISBN: 9788177585544 Publisher: Pearson 2) The Indian Financial System: Markets, Institutions and Services, 3/e Author: Bharati V. Pathak ; ISBN: 9788131728178 Publisher: Pearson Prepared By: Prof. Amit Gupta