Investorpresentation fedilusbondoffering-150501114203-conversion-gate02

- 1. Interest and Principal paid Monthly 1885234 Alberta Ltd. Private Placement of 10% Unsecured Bonds Accredited Registered / Cash Offering by Fedilus Funds

- 2. Disclaimer Certain statements contained herein as they relate to Zipcash Financial Trust, Fedilus Limited Partnerships, Moco Management Inc. and the General Partner 1711236 Alberta Ltd. and their respective views or predictions about the possible future events or conditions and their business operations and strategy, are “forward-looking statements“ within the meaning of that phrase under applicable Canadian securities law. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects“, “does not expect“, “is expected“, “anticipates“, “does not anticipate“, “plans“, “estimates“, “believes“, “does not believe“, or “intends“, or stating that certain actions, events or results “may“, “could“, “would“, “might“, or “will“ be taken, occur or achieved) are not statements of historical fact and may be “forward-looking statements“. Forward-looking statements are based on the current expectations, estimates and projections of the management of Zipcash Financial Trust, Fedilus Limited Partnerships, Moco Management Inc. and the General Partner at the time the statements are made. They involve a number of known risks and uncertainties which would cause actual results or events to differ materially from those presently anticipated. The forward-looking statements contained in this document are given as of the date hereof. Except as otherwise required by law, Zipcash Financial Trust, Fedilus Limited Partnerships, Moco Management Inc. and the General Partner does not intend to and assumes no obligation to update or revise these or other forward-looking statements it may provide, whether as a result of new information, plans or events or otherwise. Readers are cautioned not to place undue reliance on these forward-looking statements as there can be no assurance that the condition, events, plans and assumptions on which they were based will occur. Sources PGS IRR Calculator Pine Grove Software, LLC

- 3. Darrell Osadchuk – CEO ? Graduated University of Calgary in 1998 (Economics) ? Successfully Managed Private Fund Since 2001 ? Structured and Invested in Many Deals ? Understanding of both Client and Issuer Investment Criteria ? Canadian Securities Course (1999) ? Created Osadchuk Early Childhood Intervention Fund ? Founder of Fedilus Funds Management

- 4. David Rankine – President ? Graduated University of Nevada Las Vegas in 1994 (Bachelor of Arts) ? 10 Years Sales and Management Experience with General Mills ? Extensive knowledge in the Alternative Investment space ? Advised, Reviewed, Structured, Distributed several Alternative Investments ? Canadian Securities Course (August 2009) ? President of one of the most successful Exempt Market Dealers in Canada ? Joined Fedilus in Spring 2012 Management

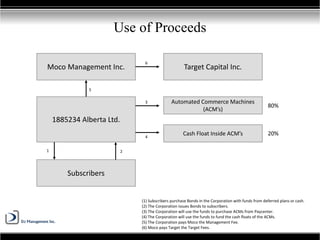

- 5. Use of Proceeds (1) Subscribers purchase Bonds in the Corporation with funds from deferred plans or cash. (2) The Corporation issues Bonds to subscribers. (3) The Corporation will use the funds to purchase ACMs from Paycenter. (4) The Corporation will use the funds to fund the cash floats of the ACMs. (5) The Corporation pays Moco the Management Fee. (6) Moco pays Target the Target Fees. 1885234 Alberta Ltd. Subscribers Automated Commerce Machines (ACM’s) Cash Float Inside ACM’s 80% 20% Moco Management Inc. Target Capital Inc. 1 4 5 2 3 6

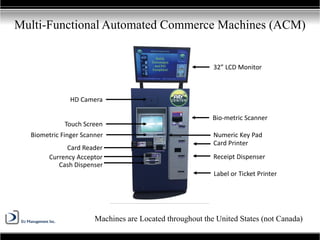

- 6. Multi-Functional Automated Commerce Machines (ACM) Machines are Located throughout the United States (not Canada) 32” LCD Monitor Bio-metric Scanner Numeric Key Pad Card Printer HD Camera Touch Screen Card Reader Currency Acceptor Receipt Dispenser Cash Dispenser Biometric Finger Scanner Label or Ticket Printer

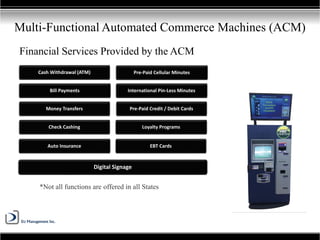

- 7. Financial Services Provided by the ACM Multi-Functional Automated Commerce Machines (ACM) Pre-Paid Cellular Minutes Bill Payments International Pin-Less Minutes Loyalty Programs Auto Insurance Digital Signage Cash Withdrawal (ATM) Pre-Paid Credit / Debit CardsMoney Transfers Check Cashing EBT Cards *Not all functions are offered in all States

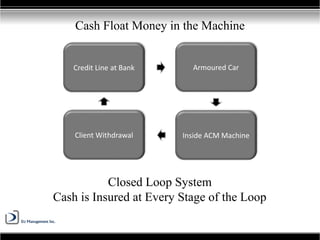

- 8. Cash Float Money in the Machine Credit Line at Bank Armoured Car Inside ACM MachineClient Withdrawal Closed Loop System Cash is Insured at Every Stage of the Loop

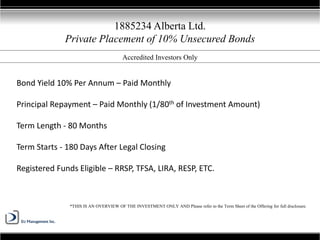

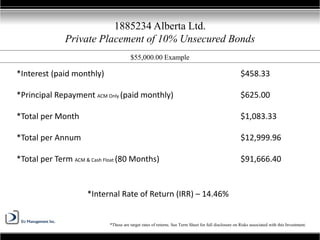

- 9. 1885234 Alberta Ltd. Private Placement of 10% Unsecured Bonds *THIS IS AN OVERVIEW OF THE INVESTMENT ONLY AND Please refer to the Term Sheet of the Offering for full disclosure. Bond Yield 10% Per Annum – Paid Monthly Principal Repayment – Paid Monthly (1/80th of Investment Amount) Term Length - 80 Months Term Starts - 180 Days After Legal Closing Registered Funds Eligible – RRSP, TFSA, LIRA, RESP, ETC. Accredited Investors Only

- 10. 1885234 Alberta Ltd. Private Placement of 10% Unsecured Bonds $55,000.00 Example *Interest (paid monthly) $458.33 *Principal Repayment ACM Only (paid monthly) $625.00 *Total per Month $1,083.33 *Total per Annum $12,999.96 *Total per Term ACM & Cash Float (80 Months) $91,666.40 *These are target rates of returns. See Term Sheet for full disclosure on Risks associated with this Investment. *Internal Rate of Return (IRR) – 14.46%

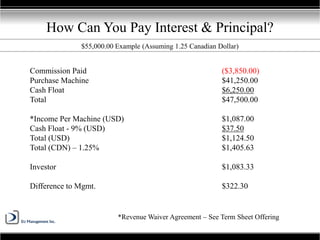

- 11. Commission Paid ($3,850.00) Purchase Machine $41,250.00 Cash Float $6,250.00 Total $47,500.00 *Income Per Machine (USD) $1,087.00 Cash Float - 9% (USD) $37.50 Total (USD) $1,124.50 Total (CDN) – 1.25% $1,405.63 Investor $1,083.33 Difference to Mgmt. $322.30 How Can You Pay Interest & Principal? *Revenue Waiver Agreement – See Term Sheet Offering $55,000.00 Example (Assuming 1.25 Canadian Dollar)

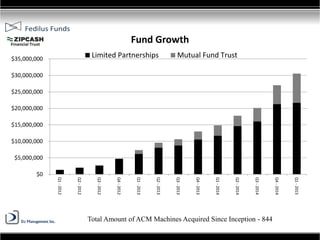

- 12. Total Amount of ACM Machines Acquired Since Inception - 844 $0 $5,000,000 $10,000,000 $15,000,000 $20,000,000 $25,000,000 $30,000,000 $35,000,000 Q1-2012 Q2-2012 Q3-2012 Q4-2012 Q1-2013 Q2-2013 Q3-2013 Q4-2013 Q1-2014 Q2-2014 Q3-2014 Q4-2014 Q1-2015 Fund Growth Limited Partnerships Mutual Fund Trust

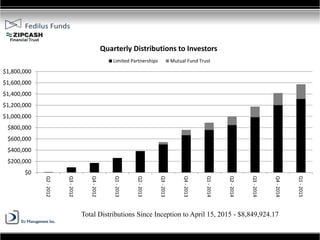

- 13. Total Distributions Since Inception to April 15, 2015 - $8,849,924.17 $0 $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 $1,400,000 $1,600,000 $1,800,000 Q2-2012 Q3-2012 Q4-2012 Q1-2013 Q2-2013 Q3-2013 Q4-2013 Q1-2014 Q2-2014 Q3-2014 Q4-2014 Q1-2015 Quarterly Distributions to Investors Limited Partnerships Mutual Fund Trust

- 14. Track Record – Our Investors Have Never Missed Receiving a Monthly Payment Unique Opportunity – Investors Receive Both Interest & Principal Paid Monthly Management – Many Years of Experience Within the Alternative Investment Category Diversification – Opportunity to Have a More Balanced Investment Portfolio Summary