Issues impacting Bitcoin Block Size proposals - Garzik

- 1. Scaling Bitcoin workshop, Sept. 2015 Issues impacting Block Size proposals Jeff Garzik Dunvegan Space Systems / BitPay

- 2. History ? Bitcoin introduced as P2P electronic cash payments ? 1M block size hard limit set for anti-spam purposes ? Otherwise, trivial to create 32M+ blocks at low cost

- 3. Observations - System ? Process of ?nding distributed consensus takes time ? Bitcoin is a settlement system ? Settles on a stable timeline of transactions ? Core service: Censorship Resistance ? Enables permission-less innovation

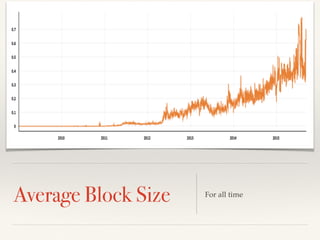

- 4. Average Block Size For all time

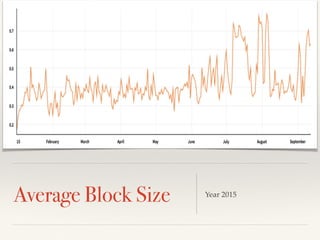

- 5. Average Block Size Year 2015

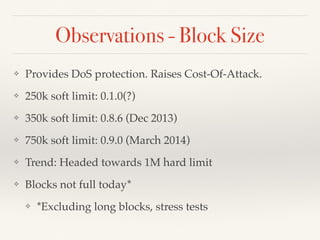

- 6. Observations - Block Size ? Provides DoS protection. Raises Cost-Of-Attack. ? 250k soft limit: 0.1.0(?) ? 350k soft limit: 0.8.6 (Dec 2013) ? 750k soft limit: 0.9.0 (March 2014) ? Trend: Headed towards 1M hard limit ? Blocks not full today* ? *Excluding long blocks, stress tests

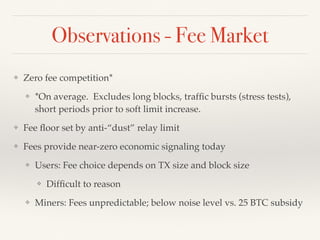

- 7. Observations - Fee Market ? Zero fee competition* ? *On average. Excludes long blocks, traf?c bursts (stress tests), short periods prior to soft limit increase. ? Fee ?oor set by anti-“dust” relay limit ? Fees provide near-zero economic signaling today ? Users: Fee choice depends on TX size and block size ? Dif?cult to reason ? Miners: Fees unpredictable; below noise level vs. 25 BTC subsidy

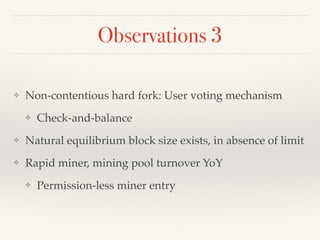

- 8. Observations 3 ? Non-contentious hard fork: User voting mechanism ? Check-and-balance ? Natural equilibrium block size exists, in absence of limit ? Rapid miner, mining pool turnover YoY ? Permission-less miner entry

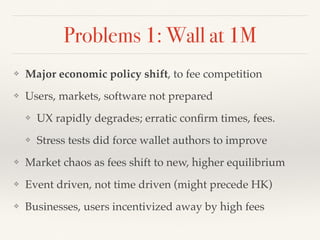

- 9. Problems 1: Wall at 1M ? Major economic policy shift, to fee competition ? Users, markets, software not prepared ? UX rapidly degrades; erratic con?rm times, fees. ? Stress tests did force wallet authors to improve ? Market chaos as fees shift to new, higher equilibrium ? Event driven, not time driven (might precede HK) ? Businesses, users incentivized away by high fees

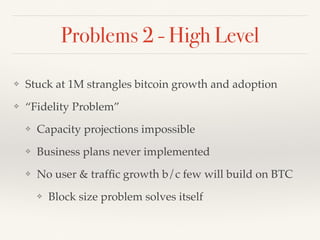

- 10. Problems 2 - High Level ? Stuck at 1M strangles bitcoin growth and adoption ? “Fidelity Problem” ? Capacity projections impossible ? Business plans never implemented ? No user & traf?c growth b/c few will build on BTC ? Block size problem solves itself

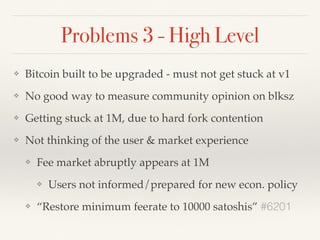

- 11. Problems 3 - High Level ? Bitcoin built to be upgraded - must not get stuck at v1 ? No good way to measure community opinion on blksz ? Getting stuck at 1M, due to hard fork contention ? Not thinking of the user & market experience ? Fee market abruptly appears at 1M ? Users not informed/prepared for new econ. policy ? “Restore minimum feerate to 10000 satoshis” #6201

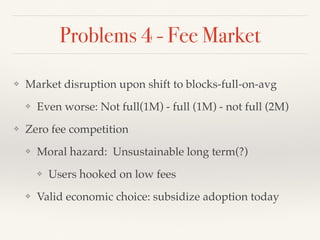

- 12. Problems 4 - Fee Market ? Market disruption upon shift to blocks-full-on-avg ? Even worse: Not full(1M) - full (1M) - not full (2M) ? Zero fee competition ? Moral hazard: Unsustainable long term(?) ? Users hooked on low fees ? Valid economic choice: subsidize adoption today

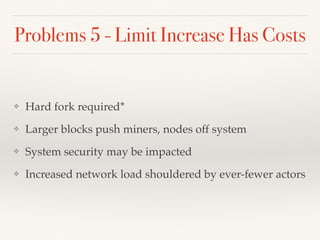

- 13. Problems 5 - Limit Increase Has Costs ? Hard fork required* ? Larger blocks push miners, nodes off system ? System security may be impacted ? Increased network load shouldered by ever-fewer actors

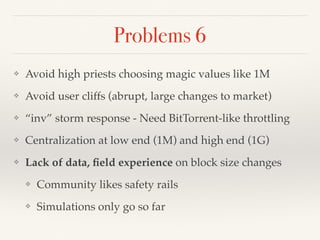

- 14. Problems 6 ? Avoid high priests choosing magic values like 1M ? Avoid user cliffs (abrupt, large changes to market) ? “inv” storm response - Need BitTorrent-like throttling ? Centralization at low end (1M) and high end (1G) ? Lack of data, ?eld experience on block size changes ? Community likes safety rails ? Simulations only go so far

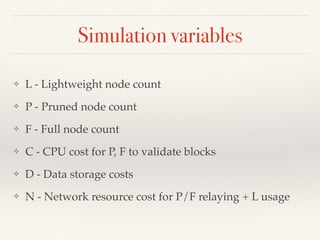

- 15. Simulation variables ? L - Lightweight node count ? P - Pruned node count ? F - Full node count ? C - CPU cost for P, F to validate blocks ? D - Data storage costs ? N - Network resource cost for P/F relaying + L usage

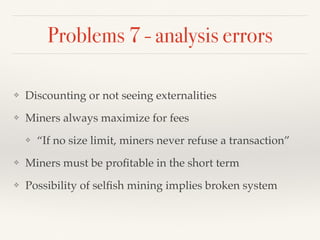

- 16. Problems 7 - analysis errors ? Discounting or not seeing externalities ? Miners always maximize for fees ? “If no size limit, miners never refuse a transaction” ? Miners must be pro?table in the short term ? Possibility of sel?sh mining implies broken system

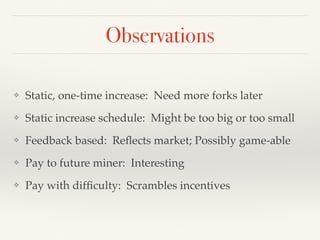

- 17. Observations ? Static, one-time increase: Need more forks later ? Static increase schedule: Might be too big or too small ? Feedback based: Re?ects market; Possibly game-able ? Pay to future miner: Interesting ? Pay with dif?culty: Scrambles incentives

- 18. Observations ? Prediction: 2nd “course correction” hard fork likely ? Do not plan, engineer too far into the future ? All The World’s Coffees will not ?t on blockchain ? Limit increase needed to standard payment growth ? Limit increase also needed for payment channels, Lightning, side chains, other scaling methods.