Jlr

- 1. Ankit Choudhary Anupam Saxena Rituparna Datta Rohit Pareek Sagar Jogani Sunil Kheria

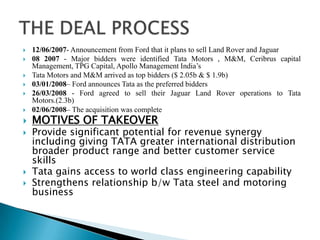

- 2. ’üĮ 12/06/2007- Announcement from Ford that it plans to sell Land Rover and Jaguar ’üĮ 08 2007 - Major bidders were identified Tata Motors , M&M, Ceribrus capital Management, TPG Capital, Apollo Management IndiaŌĆÖs ’üĮ Tata Motors and M&M arrived as top bidders ($ 2.05b & $ 1.9b) ’üĮ 03/01/2008ŌĆō Ford announces Tata as the preferred bidders ’üĮ 26/03/2008 - Ford agreed to sell their Jaguar Land Rover operations to Tata Motors.(2.3b) ’üĮ 02/06/2008ŌĆō The acquisition was complete ’üĮ MOTIVES OF TAKEOVER ’üĮ Provide significant potential for revenue synergy including giving TATA greater international distribution broader product range and better customer service skills ’üĮ Tata gains access to world class engineering capability ’üĮ Strengthens relationship b/w Tata steel and motoring business

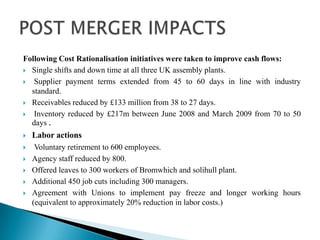

- 3. Following Cost Rationalisation initiatives were taken to improve cash flows: ’üĮ Single shifts and down time at all three UK assembly plants. ’üĮ Supplier payment terms extended from 45 to 60 days in line with industry standard. ’üĮ Receivables reduced by ┬Ż133 million from 38 to 27 days. ’üĮ Inventory reduced by ┬Ż217m between June 2008 and March 2009 from 70 to 50 days . ’üĮ Labor actions ’üĮ Voluntary retirement to 600 employees. ’üĮ Agency staff reduced by 800. ’üĮ Offered leaves to 300 workers of Bromwhich and solihull plant. ’üĮ Additional 450 job cuts including 300 managers. ’üĮ Agreement with Unions to implement pay freeze and longer working hours (equivalent to approximately 20% reduction in labor costs.)

- 5. SHARE PRICE MOVEMENT IN 2008 SHARE PRICE MOVEMENT IN 2010

- 6. ŌĆóBenefits ŌĆó Tata wanted to make a global impact and it thinks that buying these brands at a lower rate now, will give better value later on. ŌĆóThis acquisition also eases the entry of Tata in European market which it has been eyeing for long. ŌĆóReduce the company dependence on the Indian market which accounted for 90% of its sales ŌĆóIncrease sales in emerging markets. ŌĆó Reduce dependence on mature markets ŌĆóOpportunity to spread its business across different customer segment ŌĆóAt the price staring from 63 lakh and going upto 93 lakh, it seems Tata has just got the right place to compete with the current market leaders ŌĆō BMW, Audi, Mercedes ŌĆóPublicity on an international scale ŌĆóAccess to large distribution network ŌĆó JLR had many new models lined up for next 3 years, so no much work just profits ŌĆóStrong R & D culture and facilities ŌĆóComponent sourcing, engineering and design benefits

- 8. ’üĮ The merger seemed poorly timed ’üĮ Demand for luxury cars collapsed as a result of financial crisis ’üĮ Started making profits in 2010 upto 41 % ’üĮ Now an example of a successful merger ’üĮ Entered CHINA in march 2012 with a joint venture with Chery automobiles