Karen Costagliola's Resume

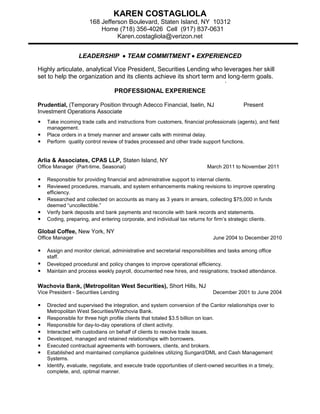

- 1. KAREN COSTAGLIOLA 168 Jefferson Boulevard, Staten Island, NY 10312 Home (718) 356-4026 Cell (917) 837-0631 Karen.costagliola@verizon.net LEADERSHIP  TEAM COMMITMENT  EXPERIENCED Highly articulate, analytical Vice President, Securities Lending who leverages her skill set to help the organization and its clients achieve its short term and long-term goals. PROFESSIONAL EXPERIENCE Prudential, (Temporary Position through Adecco Financial, Iselin, NJ Present Investment Operations Associate • Take incoming trade calls and instructions from customers, financial professionals (agents), and field management. • Place orders in a timely manner and answer calls with minimal delay. • Perform quality control review of trades processed and other trade support functions. Arlia & Associates, CPAS LLP, Staten Island, NY Office Manager (Part-time, Seasonal) March 2011 to November 2011 • Responsible for providing financial and administrative support to internal clients. • Reviewed procedures, manuals, and system enhancements making revisions to improve operating efficiency. • Researched and collected on accounts as many as 3 years in arrears, collecting $75,000 in funds deemed “uncollectible.” • Verify bank deposits and bank payments and reconcile with bank records and statements. • Coding, preparing, and entering corporate, and individual tax returns for firm’s strategic clients. Global Coffee, New York, NY Office Manager June 2004 to December 2010 • Assign and monitor clerical, administrative and secretarial responsibilities and tasks among office staff. • Developed procedural and policy changes to improve operational efficiency. • Maintain and process weekly payroll, documented new hires, and resignations; tracked attendance. Wachovia Bank, (Metropolitan West Securities), Short Hills, NJ Vice President - Securities Lending December 2001 to June 2004 • Directed and supervised the integration, and system conversion of the Cantor relationships over to Metropolitan West Securities/Wachovia Bank. • Responsible for three high profile clients that totaled $3.5 billion on loan. • Responsible for day-to-day operations of client activity. • Interacted with custodians on behalf of clients to resolve trade issues. • Developed, managed and retained relationships with borrowers. • Executed contractual agreements with borrowers, clients, and brokers. • Established and maintained compliance guidelines utilizing Sungard/DML and Cash Management Systems. • Identify, evaluate, negotiate, and execute trade opportunities of client-owned securities in a timely, complete, and, optimal manner.

- 2. KAREN COSTAGLIOLA Cantor Fitzgerald, New York, NY Vice President - Securities Lending September 1993 to December 2001 • Assisted in the startup of a third party Agent Lending Program. • Responsible for three high profile clients that totaled $3.5 billion on loan. • Implemented the Sungard/DML Securities Lending and Cash Management System. • Responsible for day-to-day operations of client activity. • Assisted clients with managing their cash collateral investments with either a separately managed account or a commingled pool. • Interacted with custodians on behalf of clients to resolve trade issues. • Developed, managed and retained relationships with borrowers. • Executed contractual agreements with borrowers, clients, and brokers. • Established and maintained compliance guidelines utilizing Sungard/DML and Cash Management Systems. • Took a leadership role after tragedy struck the firm by working with clients that business will continue as usual while rebuilding the business due to the events of 9/11. The Bank of New York, New York, NY Assistant Vice President - Securities Lending July 1983 to September 1993 • Traded client-owned securities, lending (US & Int’l equities, corporate bonds, & sovereign debt) to the broker dealer community, meeting daily cash collateral business needs. • Earned a reputation as being the first in and last to leave, especially when facing critical deadlines. • Managed securities lending operations. • Led project that increased the return of loaned securities in order to meet obligations of a sale significantly reducing the number of trade fails. • Processed mark to markets of equities and corporate bonds, US treasuries, and agencies. • Facilitated the buy-In process, collection of dividends, and corporate actions. • Settlement of Securities Lending transactions and investments via Federal Reserve Wire (FED), and Depository Trust Clearing, (DTC). LICENSES FINRA Series 7  FINRA Series 63 SKILLS MICROSOFT WORD  MICROSOFT EXCEL  MICROSOFT POWERPOINT LOTUS NOTES/OUTLOOK  BLOOMBERG  SUNGARD/DML  CASH MANAGEMENT