KPCB Internet Trends 2013

- 1. INTERNET TRENDS D11 CONFERENCE 5 / 29 / 2013 Mary Meeker / Liang Wu

- 2. Outline ŌĆó Key Internet Trends ŌĆō Growth Continues ŌĆó Re-Imagination ŌĆō Being Re-Imagined & Uploaded ŌĆó Mobile ŌĆō Aggressive Momentum ŌĆó Computing ŌĆō Yet Another Platform ChangeŌĆ” ŌĆó Lots to Learn from China ŌĆō Volume + Innovation ŌĆó Most Enabled Entrepreneurs Ever? ŌĆó So, You Want to Be a Public Company? ŌĆó High-Skilled Immigration ŌĆō Perspective ŌĆó Appendix ŌĆō Re-Imagination is Alive & Well ŌĆō Traditional Industries Being Re-Imagined ŌĆō USA, Inc. 2

- 3. KEY INTERNET TRENDS ŌĆō GROWTH CONTINUES 3

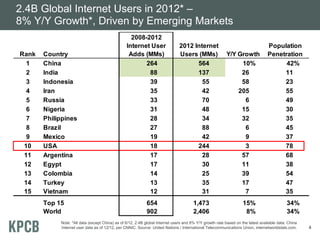

- 4. Note: *All data (except China) as of 6/12, 2.4B global Internet users and 8% Y/Y growth rate based on the latest available data. China Internet user data as of 12/12, per CNNIC. Source: United Nations / International Telecommunications Union, internetworldstats.com. 2.4B Global Internet Users in 2012* ŌĆō 8% Y/Y Growth*, Driven by Emerging Markets 4 Rank Country 2008-2012 Internet User Adds (MMs) 2012 Internet Users (MMs) Y/Y Growth Population Penetration 1 China 264 564 10% 42% 2 India 88 137 26 11 3 Indonesia 39 55 58 23 4 Iran 35 42 205 55 5 Russia 33 70 6 49 6 Nigeria 31 48 15 30 7 Philippines 28 34 32 35 8 Brazil 27 88 6 45 9 Mexico 19 42 9 37 10 USA 18 244 3 78 11 Argentina 17 28 57 68 12 Egypt 17 30 11 38 13 Colombia 14 25 39 54 14 Turkey 13 35 17 47 15 Vietnam 12 31 7 35 Top 15 654 1,473 15% 34% World 902 2,406 8% 34%

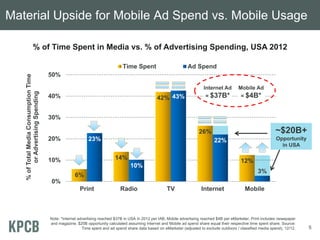

- 5. 6% 14% 42% 26% 12% 23% 10% 43% 22% 3% 0% 10% 20% 30% 40% 50% Print Radio TV Internet Mobile %ofTotalMediaConsumptionTime orAdvertisingSpending Time Spent Ad Spend % of Time Spent in Media vs. % of Advertising Spending, USA 2012 ~$20B+ Opportunity in USA Material Upside for Mobile Ad Spend vs. Mobile Usage Note: *Internet advertising reached $37B in USA in 2012 per IAB, Mobile advertising reached $4B per eMarketer. Print includes newspaper and magazine. $20B opportunity calculated assuming Internet and Mobile ad spend share equal their respective time spent share. Source: Time spent and ad spend share data based on eMarketer (adjusted to exclude outdoors / classified media spend), 12/12. Internet Ad = $37B* Mobile Ad = $4B* 5

- 6. 80% of Top Ten Global Internet Properties ŌĆśMade in USAŌĆÖŌĆ” 81% of Users Outside America Top 10 Internet Properties by Global Monthly Unique Visitors, 2/13 Source: comScore Global, 2/13. 6 0 200 400 600 800 1,000 1,200 Tencent Glam Media Apple Amazon.com Wikipedia Yahoo! Facebook Microsoft Google Monthly Unique Visitors (MMs) USA Users International Users

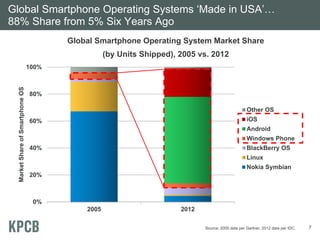

- 7. Global Smartphone Operating Systems ŌĆśMade in USAŌĆÖŌĆ” 88% Share from 5% Six Years Ago 2005 2012 0% 20% 40% 60% 80% 100% MarketShareofSmartphoneOS Other OS iOS Android Windows Phone BlackBerry OS Linux Nokia Symbian Global Smartphone Operating System Market Share (by Units Shipped), 2005 vs. 2012 Source: 2005 data per Gartner, 2012 data per IDC. 7

- 8. RE-IMAGINATION - BEING RE-IMAGINED & UPLOADED @ AN ACCELERATING PACE 8

- 9. Long Ago, People Danced @ Concerts, Now They Video / Click / Share / TweetŌĆ” 1990s 9 2010s Source: Left image ŌĆō 123RF.com. Right image ŌĆō amadarose.co.uk.

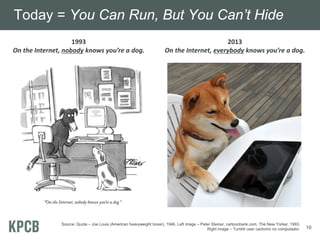

- 10. Today = You Can Run, But You CanŌĆÖt Hide Source: Quote ŌĆō Joe Louis (American heavyweight boxer), 1946. Left image ŌĆō Peter Steiner, cartoonbank.com, The New Yorker, 1993. Right image ŌĆō Tumblr user cachorro no computador. 10 2013 On┬Āthe┬ĀInternet,┬Āeverybody knows┬ĀyouŌĆÖre┬Āa┬Ādog.┬Ā 1993 On┬Āthe┬ĀInternet,┬Ānobody knows┬ĀyouŌĆÖre┬Āa┬Ādog.┬Ā

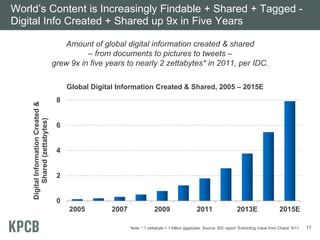

- 11. WorldŌĆÖs Content is Increasingly Findable + Shared + Tagged - Digital Info Created + Shared up 9x in Five Years 0 2 4 6 8 2005 2007 2009 2011 2013E 2015E DigitalInformationCreated& Shared(zettabytes) Amount of global digital information created & shared ŌĆō from documents to pictures to tweets ŌĆō grew 9x in five years to nearly 2 zettabytes* in 2011, per IDC. Note: * 1 zettabyte = 1 trillion gigabytes. Source: IDC report ŌĆ£Extracting Value from ChaosŌĆØ 6/11. Global Digital Information Created & Shared, 2005 ŌĆō 2015E 11

- 12. Media + Data Uploading + Sharing from Mobiles = Ramping Fast & Still Early Stage Explosive Growth, But Still Early Stage Ramping Very Fast Emerging Emerging Source: Far right Illustration ŌĆō Eric Prommelt. 12

- 13. PhotosŌĆ” 13

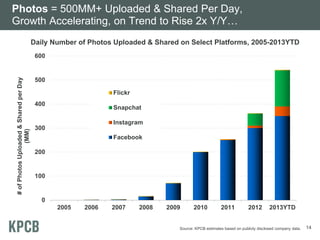

- 14. Photos = 500MM+ Uploaded & Shared Per Day, Growth Accelerating, on Trend to Rise 2x Y/YŌĆ” 0 100 200 300 400 500 600 2005 2006 2007 2008 2009 2010 2011 2012 2013YTD #ofPhotosUploaded&SharedperDay (MM) Flickr Snapchat Instagram Facebook Daily Number of Photos Uploaded & Shared on Select Platforms, 2005-2013YTD Source: KPCB estimates based on publicly disclosed company data. 14

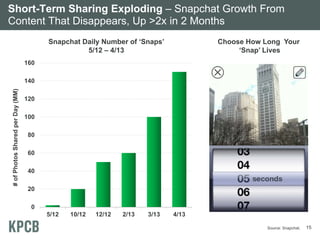

- 15. Short-Term Sharing Exploding ŌĆō Snapchat Growth From Content That Disappears, Up >2x in 2 Months 0 20 40 60 80 100 120 140 160 5/12 10/12 12/12 2/13 3/13 4/13 #ofPhotosSharedperDay(MM) Snapchat Daily Number of ŌĆśSnapsŌĆÖ 5/12 ŌĆō 4/13 Choose How Long Your ŌĆśSnapŌĆÖ Lives 15Source: Snapchat.

- 16. VideoŌĆ” 16

- 17. Video = 100 Hours Per Minute Uploaded to YouTube, Up from ~Nada Six Years Ago 0 20 40 60 80 100 120 6/07 1/09 5/09 3/10 11/10 5/11 5/12 5/13 HoursofVideoUploadedperMinute YouTube Hours of Video Uploaded per Minute, 6/07 ŌĆō 5/13 17Source: YouTube.

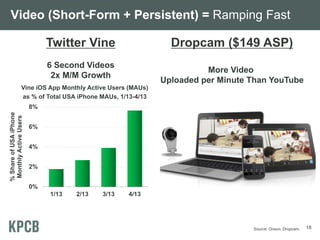

- 18. Video (Short-Form + Persistent) = Ramping Fast Dropcam ($149 ASP) More Video Uploaded per Minute Than YouTube Twitter Vine 6 Second Videos 2x M/M Growth 18 Vine iOS App Monthly Active Users (MAUs) as % of Total USA iPhone MAUs, 1/13-4/13 0% 2% 4% 6% 8% 1/13 2/13 3/13 4/13 %ShareofUSAiPhone MonthlyActiveUsers Source: Onavo, Dropcam.

- 19. Opt-In Video ŌĆō ŌĆśBig BrotherŌĆÖ Meets Big Mother? 19 30% of Dropcam viewers used Talk Back to interact over past 2 weeks. When I am on the road, I still join my husband in singing bedtime lullabies using Dropcam, a Wi-Fi video monitoring camera that streams to my phone and computer. ŌĆō Randi Zuckerberg Parents Can See & Talk With Children While Away From Home Source: Dropcam,5/13. Mashable, 4/13

- 20. SoundŌĆ” 20

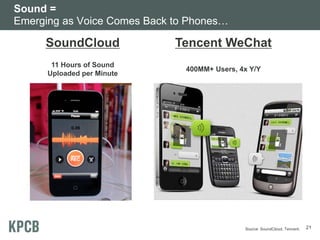

- 21. Sound = Emerging as Voice Comes Back to PhonesŌĆ” SoundCloud 11 Hours of Sound Uploaded per Minute Tencent WeChat 400MM+ Users, 4x Y/Y 21Source: SoundCloud, Tencent.

- 22. DataŌĆ” 22

- 23. Win-Win-Win Sharing = Growing Quickly ŌĆō You Help Me, I Help You, We Help Others 23 Waze ŌĆó 48MM Users, +2x Y/Y ŌĆó 1B+ Miles Driven per Month w/ Waze Open Jawbone UP Per DayŌĆ” ŌĆó Billions of Steps ŌĆó 700K+ Hours of Sleep ŌĆó 5x App Interactions per User Yelp ŌĆó 102MM Users, +43% Y/Y ŌĆó 39MM User-Generated Reviews, +42% Y/Y Source: Company data.

- 24. Fitness Data on Mobile + Wearable Devices = ~2x Month-on-Month Growth 24 0 10 20 30 40 50 60 10/12 11/12 12/12 1/13 2/13 3/13 4/13 #ofAPICalls(MM) MyFitnessPal - # of API Calls*, 10/12 ŌĆō 4/13 Note: *API calls are data request from fitness devices (such as Jawbone UP) and GPS-enabled activity tracking apps (such as Endomondo / Runtastic) that partner with MyFitnessPal. Source: MyFitnessPal.

- 25. Health Outcomes ŌĆō Behavior (at 40%) is Biggest Driver of Premature Death 40% 30% 15% 5% 10% Behavioral Patterns* Genetic Composition Social Circumstances Environmental Exposure Health Care USA Proportional Contribution to Premature Death, 2007 *Smoking: 44%, Obesity & Inactivity 37%, Alcohol 9%, Other 10%. Source: ŌĆ£We Can Do Better ŌĆö Improving the Health of the American PeopleŌĆØ - The New England Journal of Medicine, 2007. 25

- 26. SharingŌĆ” 26

- 27. Which of the Following Social Media Do You Use? 27 0% 20% 40% 60% 80% 100% Foursquare Tumblr Instagram MySpace Pinterest LinkedIn Google+ Twitter YouTube Facebook 2012 2011 Social Media ŌĆō Facebook Leads, YouTube + Twitter + Google+ + Pinterest + Instagram + Tumblr Rising Fast Source: Frank N. Magid Associates, ŌĆ£Facebook Fatigue - Fact or Fiction?ŌĆØ, March 2013. Based on a study of 2K social media users aged 12-64 who were asked ŌĆ£Which of the Following Social Media Do You Use?ŌĆØ 2011 Pinterest and Instagram data from 9/12 / 4/12.

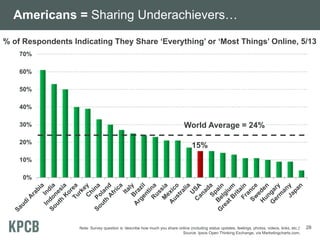

- 28. Americans = Sharing UnderachieversŌĆ” 0% 10% 20% 30% 40% 50% 60% 70% 28 % of Respondents Indicating They Share ŌĆśEverythingŌĆÖ or ŌĆśMost ThingsŌĆÖ Online, 5/13 World Average = 24% Note: Survey question is ŌĆśdescribe how much you share online (including status updates, feelings, photos, videos, links, etc.)ŌĆÖ Source: Ipsos Open Thinking Exchange, via Marketingcharts.com. 15%

- 29. Unprecedented Transparency in Time of Tremendous Global UncertaintyŌĆ” Ramp in Always-On Connected Global Citizens ŌĆó 1.1B+ global active Facebook usersŌĆ”68% on mobilesŌĆ”60% log in dailyŌĆ”with average 200+ friendsŌĆ” 350MM photos uploaded dailyŌĆ”* ŌĆó ItŌĆÖs hard to hide - ŌĆśtruthŌĆÖ can be a photo or video / clickŌĆōsend away. ŌĆó ŌĆśClean, well-lighted place to do business?ŌĆÖ ŌĆśPeople are basically good?ŌĆÖ ŌĆó Perhaps the world is on cusp of being safer than ever? ŌĆó There are lots of sacrifices. This is new terrain. ŌĆó Only time will tell how all this plays outŌĆ” * Source: Facebook, 5/13. 29

- 31. Smartphones = Extraordinary Attributes - Connected + Excited + Curious / Interested + Productive Source: IDC, 3/13. Facebook-sponsored research asked smartphone owners how an array of social and communication activities on their phones made them feel. Most owners use ~7.4 social and communications apps on their phones. Responses are indexed above. 31 0 2 4 6 8 RelativeSentimentIndex (10=Strongest,0=Weakest) USA Smartphone User Relative Sentiment Index (10 = Strongest, 0 = Weakest), 3/13 When Asked How Social and Communication Activities on Smartphones Made You Feel

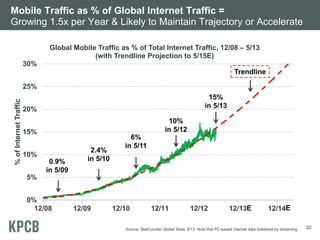

- 32. Mobile Traffic as % of Global Internet Traffic = Growing 1.5x per Year & Likely to Maintain Trajectory or Accelerate 0% 5% 10% 15% 20% 25% 30% 12/08 12/09 12/10 12/11 12/12 12/13 12/14 %ofInternetTraffic Global Mobile Traffic as % of Total Internet Traffic, 12/08 ŌĆō 5/13 (with Trendline Projection to 5/15E) 0.9% in 5/09 2.4% in 5/10 15% in 5/13 Source: StatCounter Global Stats, 5/13. Note that PC-based Internet data bolstered by streaming. 32 6% in 5/11 10% in 5/12 Trendline E E

- 33. China ŌĆō Mobile Internet Access Surpassed PC, Q2:12 0% 20% 40% 60% 80% 100% 6/07 12/07 6/08 12/08 6/09 12/09 6/10 12/10 6/11 12/11 6/12 12/12 %ofTotalInternetUsersinChina via Desktop PC via Mobile Phone 28% 71% 75% 96% % of Chinese Internet Users Accessing the Web via Desktop PCs vs. via Mobile Phones, 6/07 ŌĆō 12/12 Source: CNNIC, 1/13. 33

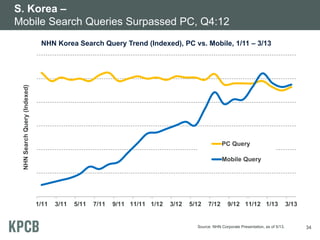

- 34. 1/11 3/11 5/11 7/11 9/11 11/11 1/12 3/12 5/12 7/12 9/12 11/12 1/13 3/13 NHNSearchQuery(Indexed) PC Query Mobile Query S. Korea ŌĆō Mobile Search Queries Surpassed PC, Q4:12 Source: NHN Corporate Presentation, as of 5/13. 34 NHN Korea Search Query Trend (Indexed), PC vs. Mobile, 1/11 ŌĆō 3/13

- 35. 0% 10% 20% 30% 40% 50% 1/11 4/11 7/11 10/11 1/12 4/12 7/12 10/12 1/13 GrouponNorthAmericaTransactions CompletedonMobile(%) % of Groupon North America Transactions Completed on Mobile, 1/11 ŌĆō 3/13 Groupon N. America ŌĆō 45% of Transactions on Mobile, Up from <15% Two Years Ago 35Source: Groupon, as of 3/13. 14% 45%

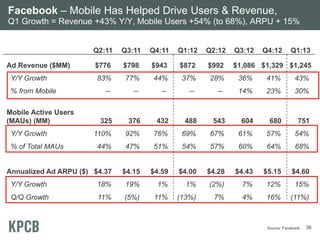

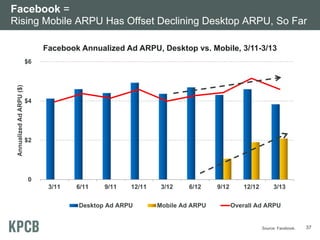

- 36. Facebook ŌĆō Mobile Has Helped Drive Users & Revenue, Q1 Growth = Revenue +43% Y/Y, Mobile Users +54% (to 68%), ARPU + 15% Q2:11 Q3:11 Q4:11 Q1:12 Q2:12 Q3:12 Q4:12 Q1:13 Ad Revenue ($MM) $776 $798 $943 $872 $992 $1,086 $1,329 $1,245 Y/Y Growth 83% 77% 44% 37% 28% 36% 41% 43% % from Mobile -- -- -- -- -- 14% 23% 30% Mobile Active Users (MAUs) (MM) 325 376 432 488 543 604 680 751 Y/Y Growth 110% 92% 76% 69% 67% 61% 57% 54% % of Total MAUs 44% 47% 51% 54% 57% 60% 64% 68% Annualized Ad ARPU ($) $4.37 $4.15 $4.59 $4.00 $4.28 $4.43 $5.15 $4.60 Y/Y Growth 18% 19% 1% 1% (2%) 7% 12% 15% Q/Q Growth 11% (5%) 11% (13%) 7% 4% 16% (11%) Source: Facebook. 36

- 37. Facebook = Rising Mobile ARPU Has Offset Declining Desktop ARPU, So Far 0 $2 $4 $6 3/11 6/11 9/11 12/11 3/12 6/12 9/12 12/12 3/13 AnnualizedAdARPU($) Desktop Ad ARPU Mobile Ad ARPU Overall Ad ARPU Facebook Annualized Ad ARPU, Desktop vs. Mobile, 3/11-3/13 Source: Facebook. 37

- 38. COMPUTING ŌĆō YET ANOTHER PLATFORM CHANGEŌĆ” 38

- 39. We Just Began to Figure Out SmartphonesŌĆ” 39

- 40. Note: *Japan data per Morgan Stanley Research estimate. Source: Informa. 2013E Global Smartphone Stats: Subscribers = 1,492MM Penetration = 21% Growth = 31% Smartphone Subscriber Growth = Remains Rapid 1.5B Subscribers, 31% Growth, 21% Penetration in 2013E 40 Rank Country 2013E Smartphone Subs (MM) Smartphone as % of Total Subs Smartphone Sub Y/Y Growth Rank Country 2013E Smartphone Subs (MM) Smartphone as % of Total Subs Smartphone Sub Y/Y Growth 1 China 354 29% 31% 16 Spain 20 33% 14% 2 USA 219 58 28 17 Philippines 19 18 34 3 Japan* 94 76 15 18 Canada 19 63 21 4 Brazil 70 23 28 19 Thailand 18 21 30 5 India 67 6 52 20 Turkey 17 24 30 6 UK 43 53 22 21 Argentina 15 25 37 7 Korea 38 67 18 22 Malaysia 15 35 19 8 Indonesia 36 11 34 23 South Africa 14 20 26 9 France 33 46 27 24 Netherlands 12 58 27 10 Germany 32 29 29 25 Taiwan 12 37 60 11 Russia 30 12 38 26 Poland 11 20 25 12 Mexico 21 19 43 27 Iran 10 10 40 13 Saudi Arabia 21 38 36 28 Egypt 10 10 34 14 Italy 21 23 25 29 Sweden 9 60 16 15 Australia 20 60 27 30 Hong Kong 8 59 31

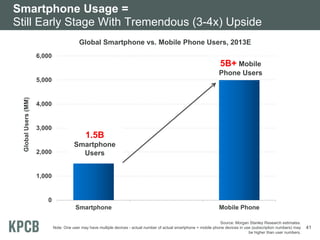

- 41. Smartphone Usage = Still Early Stage With Tremendous (3-4x) Upside 0 1,000 2,000 3,000 4,000 5,000 6,000 Smartphone Mobile Phone GlobalUsers(MM) Global Smartphone vs. Mobile Phone Users, 2013E Source: Morgan Stanley Research estimates. Note: One user may have multiple devices - actual number of actual smartphone + mobile phone devices in use (subscription numbers) may be higher than user numbers. 1.5B Smartphone Users 5B+ Mobile Phone Users 41

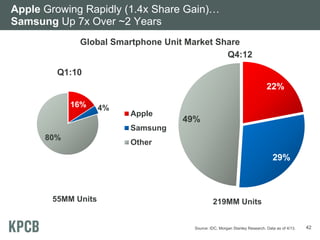

- 42. 55MM Units Apple Growing Rapidly (1.4x Share Gain)ŌĆ” Samsung Up 7x Over ~2 Years 22% 29% 49% Q4:12 42 16% 4% 80% Q1:10 Apple Samsung Other 219MM Units Source: IDC, Morgan Stanley Research. Data as of 4/13. Global Smartphone Unit Market Share

- 44. 0 10,000 20,000 30,000 40,000 50,000 60,000 0 1 2 3 4 5 6 7 8 9 10 11 12 GlobalUnitShipments(000) Quarters After Launch iPad iPhone 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000 0 1 2 3 4 5 6 7 8 9 10 11 12 GlobalUnitShipments(000) Quarters After Launch iPad iPhone First 12 Quarters Cumulative Unit Shipments, iPhone vs. iPad Source: Apple, as of CQ1:13 (12 quarters post iPad launch). Launch Dates: iPhone (6/29/07), iPad (4/3/10). Tablet Growth = More Rapid than Smartphones, iPad = ~3x iPhone Growth 44

- 45. Tablet Shipments = Surpassed Desktop PCs & Notebooks in Q4:12, < 3 Years from Intro Global PC (Desktop / Notebook) and Tablet Shipments by Quarter Q1:95 ŌĆō Q1:13 Note: Notebook PCs include Netbooks. Source: Katy Huberty, Ehud Gelblum, Morgan Stanley Research. Gartner. Data as of 4/13. 0 10 20 30 40 50 60 Q1:95 Q1:97 Q1:99 Q1:01 Q1:03 Q1:05 Q1:07 Q1:09 Q1:11 Q1:13 GlobalUnitsShipped(MMs) Desktop PCs Notebook PCs Tablets 45

- 46. Demand for Large-Screen Computing Devices is Robust, But Mix Favors Tablets, Not Notebooks & Desktops Global PC (Desktop / Notebook) and Tablet Shipments by Quarter Q1:1995 ŌĆō Q1:2013 Note: Notebook PCs include Netbooks. Source: Katy Huberty, Ehud Gelblum, Morgan Stanley Research. Gartner. Data and Estimates as of 4/13. 0 20 40 60 80 100 120 140 160 1Q95 1Q97 1Q99 1Q01 1Q03 1Q05 1Q07 1Q09 1Q11 1Q13 GlobalUnitsShipped(MMs) Desktop PCs Notebook PCs Tablets 46

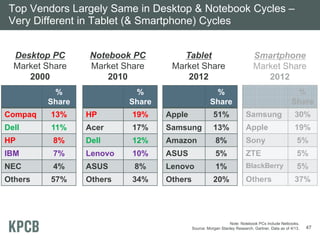

- 47. Top Vendors Largely Same in Desktop & Notebook Cycles ŌĆō Very Different in Tablet (& Smartphone) Cycles % Share Compaq 13% Dell 11% HP 8% IBM 7% NEC 4% Others 57% % Share HP 19% Acer 17% Dell 12% Lenovo 10% ASUS 8% Others 34% % Share Apple 51% Samsung 13% Amazon 8% ASUS 5% Lenovo 1% Others 20% Desktop PC Market Share 2000 Notebook PC Market Share 2010 Tablet Market Share 2012 Note: Notebook PCs include Netbooks. Source: Morgan Stanley Research. Gartner. Data as of 4/13. 47 % Share Samsung 30% Apple 19% Sony 5% ZTE 5% BlackBerry 5% Others 37% Smartphone Market Share 2012

- 48. An Unusual PatternŌĆ” In Two Computing CyclesŌĆ” 1) Smartphones 2) Tablets ŌĆ”Entering a Third CycleŌĆ” 3) Wearables / Drivables / Flyables / Scannables 48

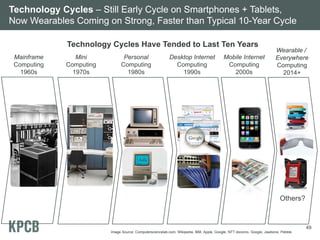

- 49. Image Source: Computersciencelab.com, Wikipedia, IBM, Apple, Google, NTT docomo, Google, Jawbone, Pebble. Technology Cycles Have Tended to Last Ten Years Technology Cycles ŌĆō Still Early Cycle on Smartphones + Tablets, Now Wearables Coming on Strong, Faster than Typical 10-Year Cycle Mainframe Computing 1960s Personal Computing 1980s Desktop Internet Computing 1990s Mobile Internet Computing 2000s Mini Computing 1970s Wearable / Everywhere Computing 2014+ Others? 49

- 50. Note: PC installed base reached 100MM in 1993, cellphone / Internet users reached 1B in 2002 / 2005 respectively; Source: ITU, Morgan Stanley Research. New Major Technology Cycles = Often Support 10x More Users & Devices, Driven by Lower Price + Improved Functionality 1 10 100 1,000 10,000 100,000 1960 1970 1980 1990 2000 2010 2020 Devices/Users(MMinLogScale) 1MM+ Units 100MM+ Units 10B+ Units??? 10MM+ Units Computing Growth Drivers Over Time, 1960 ŌĆō 2020E 1B+ Units / Users 50

- 52. Smartphone Users Reach to Phone ~150x a DayŌĆ” Could be Hands-Free with Wearables 14 3 3 5 6 8 8 9 12 13 18 22 23 0 5 10 15 20 25 Other Search Web Calendar News & Alerts Alarm Camera Social Media Gaming Music Checking Time Voice Call Messaging # of Times Typical User Checks Phone per Day Other includes voicemail, charging, and miscellaneous activities. Source: TomiAhonen Almanac 2013. 52

- 53. Hands-Free Always-On Environment -Aware Connected Attention- Getting Development Platform Sensor-Enabled Wearable Attributes ŌĆó GPS ŌĆó Accelerometer ŌĆó Compass ŌĆó Camera ŌĆó Microphone ŌĆó Other Sensors ŌĆó Wi-Fi ŌĆó 3G / 4G ŌĆó Bluetooth ŌĆó NFC ŌĆó Low power consumption ŌĆó Instant wake ŌĆó Background working / sensing ŌĆó Less distracting when receiving alerts / reminders / messages ŌĆó 3rd party apps ŌĆó API partners ŌĆó Accessories ŌĆó Voice / gesture control 53Source: MIT, KPCB.

- 54. Some People Laugh at WearablesŌĆ” 54Source: Saturday Night Live, 5/13. And ŌĆśSNLŌĆÖ Does RuleŌĆ” ;)

- 55. ŌĆ”Some People Laughed at PC & Internet 55 There is no reason anyone would want a computer in their home. - Ken Olsen (Founder) Digital Equipment 1977 May 1999

- 57. A Car or a Computer on Four Wheels? 57

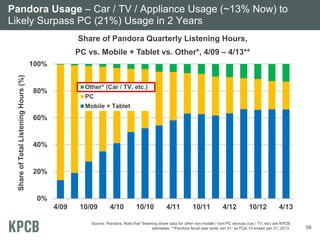

- 58. Pandora Usage ŌĆō Car / TV / Appliance Usage (~13% Now) to Likely Surpass PC (21%) Usage in 2 Years 0% 20% 40% 60% 80% 100% 4/09 10/09 4/10 10/10 4/11 10/11 4/12 10/12 4/13 ShareofTotalListeningHours(%) Other* (Car / TV, etc.) PC Mobile + Tablet Share of Pandora Quarterly Listening Hours, PC vs. Mobile + Tablet vs. Other*, 4/09 ŌĆō 4/13** 58 Source: Pandora. Note that *listening share data for other non-mobile / non-PC devices (car / TV, etc) are KPCB estimates. **Pandora fiscal year ends Jan 31, so FQ4:13 ended Jan 31, 2013.

- 60. ItŌĆÖs a Bird, ItŌĆÖs a Plane, ItŌĆÖs a Mini-DroneŌĆ” Use Cases of Low-Cost Drones 60 Agriculture GPS-Enabled Photos Help Pinpoint Potential Crop Damage Early On Sports / Entertainment Unique Angle of View Provides Insights for Training + Broadcast Audience Public Safety / Disaster Relief* Providing Aerial Video Coverage / First-Aid / Other Supplies in Challenging Conditions Source: Left image ŌĆō Shutterstock; Middle image ŌĆō Dronereport.net; *Right image ŌĆō Drone carrying cameras + other sensors being deployed during search & rescue mission of 7.0-magnitude earthquake in Lushan, China (4/13).

- 61. Scannables ŌĆō Codes / Tags + Cameras / Sensors 61

- 62. QR Codes = Scan & Be Scanned to Get StuffŌĆ” 62 SCAN Quick Scan w/ Smartphone For Info on Nutrition / Product / PriceŌĆ” BE SCANNED Smartphone-Generated Codes For Boarding Pass / Ticket / Payment / RewardsŌĆ”

- 63. China - Follow UK Embassy Weibo Account by Scanning QR Code Outside Embassy in Beijing 63

- 64. QR Code Scanning = Up 4x Y/Y in China, Offline Businesses Driving Online Connections 0 2 4 6 8 10 3/12 3/13 ChinaMonthlyQRCodesScanned (MMs) Payment Information (Nutrition Info, Business Card Exchange...) Promotions (Billboard, AdvertisingŌĆ”) Passcode (Coupons, Rewards, Tickets, Check-Ins...) 42% 33% China Monthly QR Codes Scanned by Use Case, 3/12 vs. 3/13 Note: * March 2012 use case breakdown not available. Source: Imageco, China QR Code Market Study, 2013. We believe data are understated. 64 2MM* 9MM 22% 3%

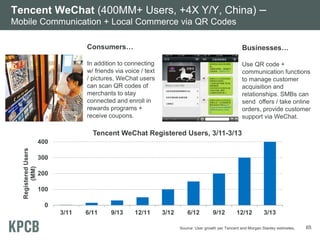

- 65. 65 Tencent WeChat (400MM+ Users, +4X Y/Y, China) ŌĆō Mobile Communication + Local Commerce via QR Codes BusinessesŌĆ” Use QR code + communication functions to manage customer acquisition and relationships. SMBs can send offers / take online orders, provide customer support via WeChat. 0 100 200 300 400 3/11 6/11 9/13 12/11 3/12 6/12 9/12 12/12 3/13 RegisteredUsers (MM) Tencent WeChat Registered Users, 3/11-3/13 ConsumersŌĆ” In addition to connecting w/ friends via voice / text / pictures, WeChat users can scan QR codes of merchants to stay connected and enroll in rewards programs + receive coupons. Source: User growth per Tencent and Morgan Stanley estimates.

- 66. LOTS TO LEARN FROM CHINA ŌĆō VOLUME + INNOVATION 66

- 67. 0 50 100 150 200 250 1/11 3/11 5/11 7/11 9/11 11/11 1/12 3/12 5/12 7/12 9/12 11/12 1/13 ActiveiOSandAndroidDevices(MM) China USA Active iOS and Android Devices, USA vs. China (MM), 1/11 ŌĆō 2/13 China ŌĆō iOS + Android Users Surpassed USA, Q1:13 67Source: Flurry Analytics.

- 68. 6% 14% 42% 26% 12% 11% 5% 29% 33% 22% 0% 10% 20% 30% 40% 50% Print Radio TV Internet Mobile %ofTotalMediaConsumptionTime USA China % of Time Spent in Media, USA vs. China, 2012 China Leads USA in Mobile + Internet Time Spent vs. TV = China @ 55% vs. 38% in USA Source: USA media time spent share data based on eMarketer as of 12/12, China media time spent data per Miaozhen SystemsŌĆÖ (a leading 3rd party ad tech platform) survey of 35,750 samples as of 12/12. 68

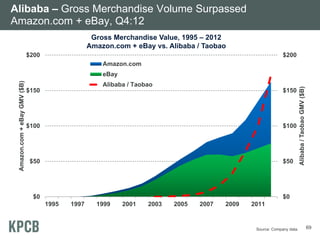

- 69. Alibaba ŌĆō Gross Merchandise Volume Surpassed Amazon.com + eBay, Q4:12 69 $0 $50 $100 $150 $200 $0 $50 $100 $150 $200 1995 1997 1999 2001 2003 2005 2007 2009 2011 Alibaba/TaobaoGMV($B) Amazon.com+eBayGMV($B) Amazon.com eBay Alibaba / Taobao Gross Merchandise Value, 1995 ŌĆō 2012 Amazon.com + eBay vs. Alibaba / Taobao Source: Company data.

- 70. JD.com (360buy) ŌĆō Same Day Delivery with Real-Time Item Tracking on Map / MobileŌĆ”Often on Bicycle Free* Same-Day Delivery in 25+ Cities in China / Customer Can Track Package Location on Map / Mobile Devices and Contact Delivery Person in Real Time 70Note: *For orders > $8.

- 71. Taxi Apps* ŌĆō China ŌĆō Push to Talk to Driver / Bid Extra to Increase Chance of Getting Car on Your Terms 71 Push to Talk Say current location and where youŌĆÖre going. Your voice message will be delivered instantly to all nearby available taxis Bid to Win Increase your chance of hailing a cab during peak hours by offering extras tips up front (in addition to regular fare) Real Time Tracking View your taxiŌĆÖs location in real-time, push to talk to the driver directly to coordinate pick-up *Source: Left image - Yao Yao Zhao Che; Center image ŌĆō Di Di Da Che; Right image ŌĆō Kuai Di Da Che.

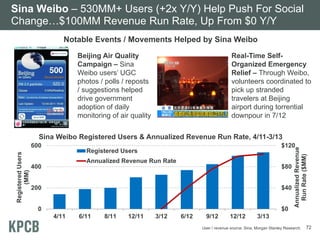

- 72. Sina Weibo ŌĆō 530MM+ Users (+2x Y/Y) Help Push For Social ChangeŌĆ”$100MM Revenue Run Rate, Up From $0 Y/Y 72 $0 $40 $80 $120 0 200 400 600 4/11 6/11 8/11 12/11 3/12 6/12 9/12 12/12 3/13 AnnualizedRevenue RunRate($MM) RegisteredUsers (MM) Registered Users Annualized Revenue Run Rate Sina Weibo Registered Users & Annualized Revenue Run Rate, 4/11-3/13 Notable Events / Movements Helped by Sina Weibo Beijing Air Quality Campaign ŌĆō Sina Weibo usersŌĆÖ UGC photos / polls / reposts / suggestions helped drive government adoption of daily monitoring of air quality Real-Time Self- Organized Emergency Relief ŌĆō Through Weibo, volunteers coordinated to pick up stranded travelers at Beijing airport during torrential downpour in 7/12 User / revenue source: Sina, Morgan Stanley Research.

- 73. 0% 10% 20% 30% 40% %ofGlobalGDP USA Europe China India Latin America 27% 16% 33% 15% 2% 19% 16% 6% 8% 2% 0% 10% 20% 30% 40% %ofGlobalGDP USA Europe China India Latin America 27% 16% 33% 15% 2% 19% 16% 6% 8% 2% 0% 10% 20% 30% 40% %ofGlobalGDP USA Europe China India Latin America 27% 16% 33% 15% 2% 19% 16% 6% 8% 2% Percent of Global GDP, 1820 ŌĆō 2012, USA vs. Europe vs. China vs. India vs. Latin America 0% 10% 20% 30% 40% %ofGlobalGDP USA Europe China India Latin America 27% 16% 33% 15% 2% 19% 16% 6% 8% 2% 0% 10% 20% 30% 40% %ofGlobalGDP USA Europe China India Latin America 27% 16% 33% 15% 2% 19% 16% 6% 8% 2% GDP = China Share Gains vs. Europe & USA are Epic Source: Angus Maddison, University of Groningen, OECD, data post 1980 based on IMF data (GDP adjusted for purchasing power parity). 73

- 74. MOST ENABLED ENTREPRENEURS EVER? ZERO -> 1 MILLION USERS IN RECORD TIME(S) 74

- 75. Selective Formative Events of Past 20 Years September, 2001 USA Terrorist Attacks ŌĆō Destabilized sense of security Rise of China as Global Super Power ŌĆō Altered global competition Global Financial Crisis, 2008+ ŌĆō Destabilized financial security High Unemployment Levels ŌĆō Destabilized career optimism Potential Fiscal Debt Challenges ŌĆō Rise in need to depend on selves Rise of Cheap / Available Computing ŌĆō 24x7 global access to loads of stuff including shared goods Rise of New ŌĆśGeekŌĆÖ Entrepreneur Heroes ŌĆō Jobs + Sergey / Larry + ZuckŌĆ” Rise in Social Connectivity ŌĆō Ability to find / create / share / provide + get feedback Rise in Value of Social / Virtual vs. Financial + Physical Currency Is This Generation Different? 75

- 76. Turning Passion Into BusinessesŌĆ”On an Epic Internet Palette Art / Creativity Georg Petschnigg / Fiftythree Books Otis Chandler / Goodreads Sports David Finocchio / BleacherReport Home Decoration Adi Tatarko + Alon Cohen / Houzz 76 Music Daniel Ek / Spotify Sound Alex Ljung + Eric Wahlforss / SoundCloud News & Politics Chris Altchek + Jake Horowitz / PolicyMic Product Design Ben Kaufman Quirky Design / Inspiration Ben Silbermann Pinterest

- 77. SO, YOU WANT TO BE A PUBLIC COMPANY? 77

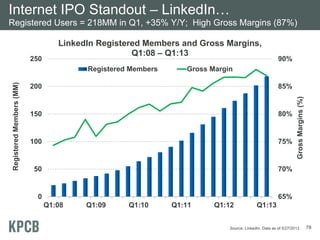

- 78. Internet IPO Standout ŌĆō LinkedInŌĆ” Registered Users = 218MM in Q1, +35% Y/Y; High Gross Margins (87%) 65% 70% 75% 80% 85% 90% 0 50 100 150 200 250 Q1:08 Q1:09 Q1:10 Q1:11 Q1:12 Q1:13 GrossMargins(%) RegisteredMembers(MM) LinkedIn Registered Members and Gross Margins, Q1:08 ŌĆō Q1:13 Registered Members Gross Margin Source: LinkedIn. Data as of 5/27/2013. 78

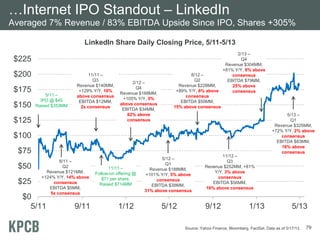

- 79. ŌĆ”Internet IPO Standout ŌĆō LinkedIn Averaged 7% Revenue / 83% EBITDA Upside Since IPO, Shares +305% $0 $25 $50 $75 $100 $125 $150 $175 $200 $225 5/11 9/11 1/12 5/12 9/12 1/13 5/13 LinkedIn Share Daily Closing Price, 5/11-5/13 8/11 ŌĆō Q2 Revenue $121MM, +124% Y/Y, 14% above consensus EBITDA $5MM, 5x consensus 2/12 ŌĆō Q4 Revenue $168MM, +105% Y/Y, 5% above consensus EBITDA $34MM, 62% above consensus 5/12 ŌĆō Q1 Revenue $188MM, +101% Y/Y, 5% above consensus EBITDA $38MM, 31% above consensus 11/11 ŌĆō Follow-on offering @ $71 per share, Raised $714MM 11/11 ŌĆō Q3 Revenue $140MM, +129% Y/Y, 10% above consensus EBITDA $12MM, 2x consensus Source: Yahoo Finance, Bloomberg, FactSet. Data as of 5/17/13. 79 5/11 ŌĆō IPO @ $45 Raised $353MM 8/12 ŌĆō Q2 Revenue $228MM, +89% Y/Y, 6% above consensus EBITDA $50MM, 15% above consensus 11/12 ŌĆō Q3 Revenue $252MM, +81% Y/Y, 3% above consensus EBITDA $56MM, 16% above consensus 2/13 ŌĆō Q4 Revenue $304MM, +81% Y/Y, 8% above consensus EBITDA $79MM, 25% above consensus 5/13 ŌĆō Q1 Revenue $325MM, +72% Y/Y, 2% above consensus EBITDA $83MM, 16% above consensus

- 80. Full lifetime data for all companies not available. Company (Years of Data) as follows: Amazon (19), eBay (17), Facebook (6), Tencent (12), Google (14), Apple (37 for revenue, 26 for others). Operating expenses exclude one-time, non-recurring charges and include depreciation, amortization, stock-based compensation. Data for eBay includes Paypal. eBay users are active members of eBay marketplace. Data for Google includes DoubleClick (back to 1996). Google gross margin based on revenue net of TAC. Google user data per ComScore. Market cap. figures as of 5/21/2013. Capital expenditures for Facebook include capital leases. Apple user figures based on estimated installed base of Mac, iPad, iPhone, iPod units assuming a 4- year replacement cycle for Macs, 3-year for iPads, 2-year for iPhones and iPods. Figures are not de-duplicated. Source: Public filings, FactSet, Morgan Stanley Research, Yahoo! Finance, ComScore. Financial Dynamics of Internet Leaders 80 eCommerce Communication Search Hardware Amazon eBay Facebook Tencent Google Apple Years Since Founding 19 18 9 15 15 37 People 91K 32K 5K 24K 54K 80K Users 209MM 116MM 1.1B 798MM 1.2B 500MM+ Cumulative Operating Expense $50B $42B $5B $5B $63B $87B R&D $15B $7B $2B $2B $26B $21B Capital Expenditures $9B $6B $3B $2B $20B $30B Revenue $246B $79B $12B $20B $153B $695B Gross Margin (%) 27% 69% 72% 56% 72% 37% Free Cash Flow $12B $19B $1B $7B $53B $138B Market Capitalization $122B $71B $62B $73B $301B $415B

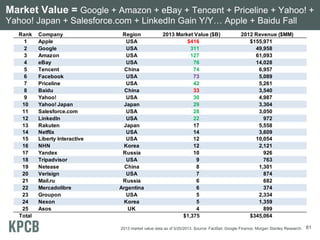

- 81. Market Value = Google + Amazon + eBay + Tencent + Priceline + Yahoo! + Yahoo! Japan + Salesforce.com + LinkedIn Gain Y/YŌĆ” Apple + Baidu Fall 812013 market value data as of 5/20/2013. Source: FactSet, Google Finance, Morgan Stanley Research. Rank Company Region 2013 Market Value ($B) 2012 Revenue ($MM) 1 Apple USA $416 $155,971 2 Google USA 311 49,958 3 Amazon USA 127 61,093 4 eBay USA 76 14,028 5 Tencent China 74 6,957 6 Facebook USA 73 5,089 7 Priceline USA 42 5,261 8 Baidu China 33 3,540 9 Yahoo! USA 30 4,987 10 Yahoo! Japan Japan 29 3,304 11 Salesforce.com USA 28 3,050 12 LinkedIn USA 22 972 13 Rakuten Japan 17 5,558 14 Netflix USA 14 3,609 15 Liberty Interactive USA 12 10,054 16 NHN Korea 12 2,121 17 Yandex Russia 10 926 18 Tripadvisor USA 9 763 19 Netease China 8 1,301 20 Verisign USA 7 874 21 Mail.ru Russia 6 682 22 Mercadolibre Argentina 6 374 23 Groupon USA 5 2,334 24 Nexon Korea 5 1,359 25 Asos UK 4 899 Total $1,375 $345,064

- 83. Immigration in America & The Growing Shortage of High-Skilled Workers Report / Presentation Can Be Found at www.kpcb.com/insights 83

- 84. Why Did We Publish a Report on High-Skilled Immigration? ŌĆó America is the global leader in the technology industry. ŌĆó Immigrants (often with STEM* degrees) have been (and are) especially important to the vibrancy of tech companies. ŌĆó America has a shortage of high-skilled STEM workers and our tech leaders believe it's constraining their ability to compete and grow jobs in America. ŌĆó Government policy helps send many qualified foreign high-skilled workers home and constrains those that can come to America. ŌĆó Global environment for recruiting high-skilled STEM workers is likely to get much more competitive. ŌĆó Potential for immigration reform in America is very real and the future direction will likely be determined this year. ŌĆó This is a big issue for the technology industry ŌĆō we encourage you to read / share / opine on the report ŌĆō it can be found at kpcb.com/insights 84*Note: STEM = Science / Technology / Engineering / Mathematics.

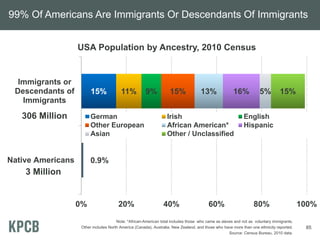

- 85. 0.9% 15% 11% 9% 15% 13% 16% 5% 15% 0% 20% 40% 60% 80% 100% Native Americans Immigrants or Descendants of Immigrants German Irish English Other European African American* Hispanic Asian Other / Unclassified USA Population by Ancestry, 2010 Census 3 Million 306 Million Note: *African-American total includes those who came as slaves and not as voluntary immigrants. Other includes North America (Canada), Australia, New Zealand, and those who have more than one ethnicity reported. Source: Census Bureau, 2010 data. 99% Of Americans Are Immigrants Or Descendants Of Immigrants 85

- 86. 270MM U.S. Born 87% of Total Population 4MM, 1% 19MM, 6% 6MM, 2% 11MM, 4% 40MM Immigrants 13% Legal Immigrants (High-Skilled) Legal Immigrants (Family-Based) Legal Immigrants (Refugees & Other) Undocumented Immigrants Total USA Population = 310MM Note: Number of undocumented immigrants currently residing in USA is an estimate by PEW Hispanic Center based on Census data. Precise breakdown of legal immigrants currently residing in USA by type of admission is not available and is an estimate based on Census data as well as Department of Homeland Security immigrant admission data from 1986 to 2010. Source: Census Bureau, PEW, DHS. U.S. Population at a Glance, U.S. Born vs. Immigrants by Type of Admission, 2010 High-Skilled Immigrants Are Only 1% Of Total U.S. Population 86

- 87. Founders / Co-Founders of Top 25 U.S. Public Tech Companies, Ranked by Market Capitalization 60% of Top 25 Tech Companies Founded By 1st & 2nd Generation Americans = 1.3MM Employees, 2012 Source: FactSet as of 3/13; ŌĆ£The ŌĆśNew AmericanŌĆÖ Fortune 500ŌĆØ, a report by the Partnership for a New American Economy; ŌĆ£American Made, The Impact of Immigrant Founders & Professionals on U.S. CorporationsŌĆØ 87 Rank Company Mkt┬ĀCap┬Ā($MM) LTM┬ĀRev┬Ā($MM) Employees Founder┬Ā/┬ĀCoŌĆÉ Founder Generation 1 Apple $416,622 $164,346 76,100 Steve┬ĀJobs 2ndŌĆÉGen,┬ĀSyria 2 Google 268,445 49,958 53,861 Sergey┬ĀBrin 1stŌĆÉGen,┬ĀRussia 3 IBM 239,530 104,507 434,246 Herman┬ĀHollerith 2ndŌĆÉGen,┬ĀGermany 4 Microsoft┬Ā 234,828 72,764 94,000 Bill┬ĀGates ŌĆÉŌĆÉ 5 Oracle┬Ā 172,044 37,230 115,000 Larry┬ĀEllison 2ndŌĆÉGen,┬ĀRussia 6 Amazon.com 119,011 61,093 88,400 Jeff┬ĀBezos 2ndŌĆÉGen,┬ĀCuba 7 Cisco 116,904 47,252 66,639 Leonard┬ĀBosack ŌĆÉŌĆÉ 8 Intel┬Ā 105,721 53,341 105,000 Andrew┬ĀGrove 1stŌĆÉGen,┬ĀHungary 9 Ebay 65,357 14,028 31,500 Pierre┬ĀOmidyar 1stŌĆÉGen,┬ĀFrance 10 Facebook 63,472 5,089 4,619 Mark┬ĀZuckerberg ŌĆÉŌĆÉ 11 EMC 53,347 21,714 60,000 Roger┬ĀMarino 2ndŌĆÉGen,┬ĀItaly 12 HewlettŌĆÉPackard┬Ā 43,118 118,397 331,800 William┬ĀHewlett ŌĆÉŌĆÉ 13 Texas┬ĀInstruments 38,756 12,690 34,151 Cecil┬ĀGreen 1stŌĆÉGen,┬ĀUK 14 VMware 35,917 4,605 13,800 Edouard┬ĀBugnion 1stŌĆÉGen,┬ĀSwitzerland 15 Priceline 35,583 5,261 7,000 Jay┬ĀWalker ŌĆÉŌĆÉ 16 Automatic┬ĀData┬ĀProcessing 31,274 10,945 57,000 Henry┬ĀTaub 2ndŌĆÉGen,┬ĀPoland 17 salesforce.com 25,840 3,050 9,800 Marc┬ĀBenioff ŌĆÉŌĆÉ 18 Dell 25,003 56,982 111,300 Michael┬ĀDell ŌĆÉŌĆÉ 19 Yahoo! 24,306 4,987 11,700 Jerry┬ĀYang 1stŌĆÉGen,┬ĀTaiwan 20 Cognizant┬ĀTechnology 23,648 7,346 156,700 Francisco┬ĀD'Souza 1stŌĆÉGen,┬ĀNairobi 21 Adobe 20,640 4,373 11,144 John┬ĀWarnock ŌĆÉŌĆÉ 22 Broadcom┬Ā 19,713 8,006 11,300 Henry┬ĀSamueli 2ndŌĆÉGen,┬ĀPoland 23 Intuit 19,393 4,153 8,500 Scott┬ĀCook ŌĆÉŌĆÉ 24 LinkedIn┬Ā 19,357 972 3,458 Konstantin┬ĀGuericke 1stŌĆÉGen,┬ĀGermany 25 Symantec┬Ā 16,916 6,839 20,500 Gary┬ĀHendrix ŌĆÉŌĆÉ Total┬ĀFounded┬Āby┬Ā1st┬Āor┬Ā2nd┬ĀGen┬ĀImmigrants $1,633,048 $555,768 1,252,216

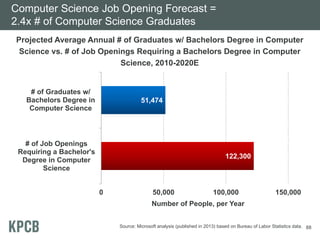

- 88. 122,300 51,474 0 50,000 100,000 150,000 # of Job Openings Requiring a Bachelor's Degree in Computer Science # of Graduates w/ Bachelors Degree in Computer Science Number of People, per Year Source: Microsoft analysis (published in 2013) based on Bureau of Labor Statistics data. Projected Average Annual # of Graduates w/ Bachelors Degree in Computer Science vs. # of Job Openings Requiring a Bachelors Degree in Computer Science, 2010-2020E Computer Science Job Opening Forecast = 2.4x # of Computer Science Graduates 88

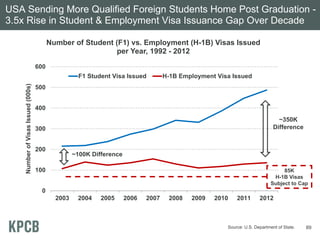

- 89. USA Sending More Qualified Foreign Students Home Post Graduation - 3.5x Rise in Student & Employment Visa Issuance Gap Over Decade 0 100 200 300 400 500 600 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 NumberofVisasIssued(000s) Number of Student (F1) vs. Employment (H-1B) Visas Issued per Year, 1992 - 2012 F1 Student Visa Issued H-1B Employment Visa Issued ~100K Difference ~350K Difference 85K H-1B Visas Subject to Cap Source: U.S. Department of State. 89

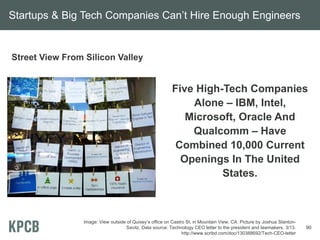

- 90. Startups & Big Tech Companies CanŌĆÖt Hire Enough Engineers Street View From Silicon Valley Five High-Tech Companies Alone ŌĆō IBM, Intel, Microsoft, Oracle And Qualcomm ŌĆō Have Combined 10,000 Current Openings In The United States. Image: View outside of QuixeyŌĆÖs office on Castro St. in Mountain View, CA. Picture by Joshua Stanton- Savitz. Data source: Technology CEO letter to the president and lawmakers, 3/13. http://www.scribd.com/doc/130388692/Tech-CEO-letter 90

- 91. Read More @ kpcb.com/insights 91

- 92. APPENDIX 92

- 94. U.S. Postal Service Mail Volume Peaked in 2006 Owing to Email RiseŌĆ” Profitability Plummeted Pieces of Mail Delivered (MM) and Net Profit / (Loss) ($MM) of U.S. Postal Service, 1886 - 2012 Source: Annual Report of the Postmaster General. Data not available for 1914 - 1925. ($20,000) ($15,000) ($10,000) ($5,000) $0 $5,000 0 50,000 100,000 150,000 200,000 250,000 1886 1900 1914 1928 1942 1956 1970 1984 1998 2012 NetProfit/(Loss)($MM) PiecesofMailDelivered(MM) Pieces of Mail (MM) Net Profit / (Loss) ($MM) 94

- 95. Relative Impact of Technology on Large Organizations = #2 Concern & Rising Rapidly 95 Source: IBM, ŌĆ£Capitalizing on Complexity: Insights from Global CEO StudyŌĆØ, May 2010. Study consisted of face-to-face conversations with over 1,500 CEOs worldwide. Executives were asked to discuss top three external forces that will have the biggest impact on their organizations. 2004 2006 2008 2010 Market Factors Technological Factors Macroeconomic Factors People Skills Regulatory Concerns Globalization Environmental Issues Socioeconomic Factors Geopolitical Factors 84% 67% 48% 56% 42% 44% 48% 39% 39% 41% 35% 38% 37% 33% 25% 21% % of CEOs Who Thought The Following External Factors Would Have The Biggest Impact on Their OrganizationsŌĆ”

- 96. Financial Services - Context ŌĆó 600MM+ credit cards in use in USA, average American carries 3-4 credit cards in addition to check cards / loyalty cards / coupons / cash in wallet. ŌĆó 17% average credit card borrowing rate vs. 1.8% 10-Year US Treasury bond yield*. ŌĆó 16B paper bills sent per year in USA. ŌĆó 4.3B bills paid by paper check per year in USA. Source: *Credit Card #s per Federal Reserve Bank of Boston, Credit Card interest rate per Indexcreditcards, 10-year Treasury yield are 5/13 averages, per Dept. of Treasury. Bill data per Fiserv. 96

- 97. Emerging Financial Services Metrics 97 Company Gross Volume Y/Y Growth # Users $15B+ Gross Payment Volume Processed to Date ~3x Y/Y 4MM+ Merchants $1.8B+ Loans Issued to Date ~3x Y/Y 137K+ Loans Funded to Date $500MM+ Gross Payment Volume of bills Per Year ~17x Y/Y 8MM+ Registered Users 18MM+ Cumulative Transactions ~5x Y/Y 11MM+ Bitcoins in Circulation $29B+ Gross Mobile Payment Volume Per Year ~2.5x Y/Y 20MM+ Registered Users Square Y/Y growth excludes partnerships. Lending Club loans issued to date as of 5/25/2013. Bitcoins data as of 5/25/2013, per Blockchain. Source: Square, LendingClub, Check, Blockchain.info, JP Morgan Chase.

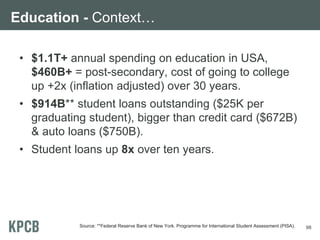

- 98. Education - ContextŌĆ” ŌĆó $1.1T+ annual spending on education in USA, $460B+ = post-secondary, cost of going to college up +2x (inflation adjusted) over 30 years. ŌĆó $914B** student loans outstanding ($25K per graduating student), bigger than credit card ($672B) & auto loans ($750B). ŌĆó Student loans up 8x over ten years. Source: **Federal Reserve Bank of New York. Programme for International Student Assessment (PISA). 98

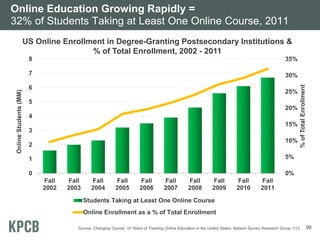

- 99. Online Education Growing Rapidly = 32% of Students Taking at Least One Online Course, 2011 99 0% 5% 10% 15% 20% 25% 30% 35% 0 1 2 3 4 5 6 7 8 Fall 2002 Fall 2003 Fall 2004 Fall 2005 Fall 2006 Fall 2007 Fall 2008 Fall 2009 Fall 2010 Fall 2011 %ofTotalEnrollment OnlineStudents(MM) Students Taking at Least One Online Course Online Enrollment as a % of Total Enrollment US Online Enrollment in Degree-Granting Postsecondary Institutions & % of Total Enrollment, 2002 - 2011 Source: Changing Course: 10 Years of Tracking Online Education in the United States. Babson Survey Research Group 1/13.

- 100. Online Education = Quickly Becoming More Accepted 100 Academic LeadersŌĆÖ Perceptions of Learning Outcomes in Online Education Compared to face-to-face Source: Changing Course: 10 Years of Tracking Online Education in the United States. Babson Survey Research Group 1/13. 0% 20% 40% 60% 80% 100% 2003 2004 2006 2009 2010 2011 2012 Inferior & Somewhat Inferior Same Superior & Somewhat Superior 77% of academic leaders at over 2,800 US colleges perceive online education as the same or superior as compared to face-to-face education

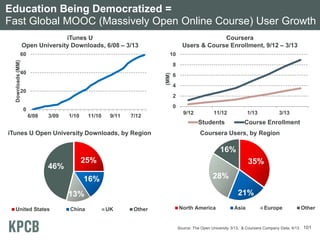

- 101. 0 2 4 6 8 10 9/12 11/12 1/13 3/13 (MM) Students Course Enrollment 35% 21% 28% 16% North America Asia Europe Other 101Source: The Open University 3/13, & Coursera Company Data, 4/13. 0 20 40 60 6/08 3/09 1/10 11/10 9/11 7/12 Downloads(MM) iTunes U Open University Downloads, 6/08 ŌĆō 3/13 Coursera Users & Course Enrollment, 9/12 ŌĆō 3/13 25% 16% 13% 46% United States China UK Other iTunes U Open University Downloads, by Region Coursera Users, by Region Education Being Democratized = Fast Global MOOC (Massively Open Online Course) User Growth

- 102. Healthcare ŌĆō ContextŌĆ” ŌĆó $2.6T+ annual spend on healthcare in USA, 18% of GDP in 2010, up from 5% in 1960, and 2x OECD average. ŌĆó ~100MM Americans (30%) of Americans considered obese in 2012, up from 15% in 1990. ŌĆó $147B estimated medical costs associated with obesity in 2008, up from $79B in 1998. 102Source: American Heart Association, Center for Medicare & Medicaid Services, 2012, OECD.

- 103. 103 Right Story, Great ReportingŌĆ”Perhaps, Right Time When we debate health care policy, we seem to jump right to the issue of who should pay the bills, blowing past what should be the first question: Why exactly are the bills so high? - Steven Brill, Time, March 2013

- 104. Re-Imagination is Alive & Well 104

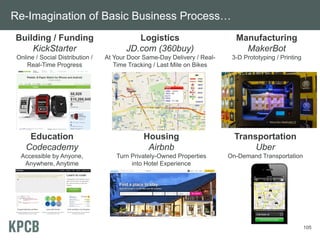

- 105. Re-Imagination of Basic Business ProcessŌĆ” 105 Building / Funding KickStarter Online / Social Distribution / Real-Time Progress Logistics JD.com (360buy) At Your Door Same-Day Delivery / Real- Time Tracking / Last Mile on Bikes Manufacturing MakerBot 3-D Prototyping / Printing Education Codecademy Accessible by Anyone, Anywhere, Anytime Housing Airbnb Turn Privately-Owned Properties into Hotel Experience Transportation Uber On-Demand Transportation

- 106. Re-Imagination of Asset-Heavy Products / ServicesŌĆ” 106 Music (Spotify) Pay for Access / Instant On-Demand Streaming on Internet-Enabled Devices Video (Netflix) On-Demand / Instant Access Anywhere Textbooks (Chegg) Pay For Usage Rights During Semester Wallet (Square) Smartphone is the New Wallet Employment (oDesk / eLance) Workforce as a Service (WaaS) / On-Demand / Global Store Fronts (Zaarly) Anyone Can Open / Beautifully Designed

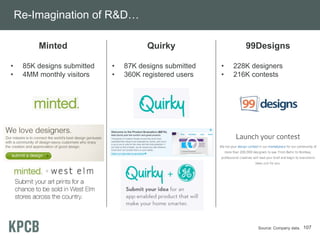

- 107. Re-Imagination of R&DŌĆ” 107 Minted ŌĆó 85K designs submitted ŌĆó 4MM monthly visitors Quirky ŌĆó 87K designs submitted ŌĆó 360K registered users 99Designs ŌĆó 228K designers ŌĆó 216K contests Source: Company data.

- 108. Re-Imagination of ŌĆ£Learning ToolsŌĆØ = Twitter / YouTube / Google Docs / Google / WordPress 108 Company 2012 Rank 2009 Rank Twitter 1 1 YouTube 2 3 Google Docs* 3 5 Google Search 4 8 WordPress 5 6 Dropbox 6 71 Skype 7 11 Powerpoint 8 13 Facebook 9 31 Wikipedia 10 17 Moodle 11 14 Evernote 12 27 ║▌║▌▀Żshare 13 7 Prezi 14 28 Blogger / BlogSpot 15 14 Source: Centre for Learning & Performance Technology (C4LPT) Top 100 Tools For Learning 2012. C4LPT Ranking of Top Learning Tools ŌĆó 582 learning professionals worldwide were asked to provide their top 10 tools used for learning in 2012 / 2009 ŌĆó ŌĆśLearning toolŌĆÖ is defined as any tool that you could use to create or deliver learning content/solutions for others, or a tool you use for your own personal learning ŌĆó The 2012 survey compiled data from 582 learning professionals worldwide (55% working in education & 45% in non- educational organizations

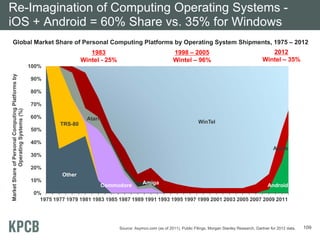

- 109. 109 Global Market Share of Personal Computing Platforms by Operating System Shipments, 1975 ŌĆō 2012 Other TRS-80 AndroidCommodore Atari Amiga Apple WinTel 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 MarketShareofPersonalComputingPlatformsby OperatingSystems(%) Source: Asymco.com (as of 2011), Public Filings, Morgan Stanley Research, Gartner for 2012 data. Re-Imagination of Computing Operating Systems - iOS + Android = 60% Share vs. 35% for Windows 1983 Wintel - 25% 1998 ŌĆō 2005 Wintel ŌĆō 96% 2012 Wintel ŌĆō 35%

- 110. USA, Inc. Report / Presentation Can Be Found at www.kpcb.com/insights 110

- 111. 0 20 40 60 80 100 120 140 160 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 ConsumerConfidenceIndex(1985=100) Consumer Confidence = At Five-Year Highs, Though Still Well Below 30-Year Average The Conference Board Consumer Confidence Index, 1978 ŌĆō 2013 YTD Note: Index started in 1967 / benchmarked to 1985=100. The Index is calculated each month on the basis of a household survey of consumers' opinions on current conditions and future expectations of the economy. Source: The Conference Board, 5/13. 35 Year Average CCI = 91.5 2/09 Trough CCI = 25.3 4/13 CCI = 68.1 111

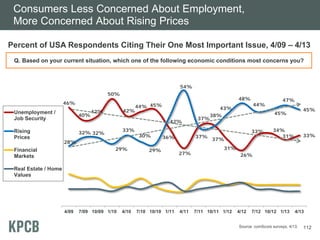

- 112. Consumers Less Concerned About Employment, More Concerned About Rising Prices 112Source: comScore surveys, 4/13. Percent of USA Respondents Citing Their One Most Important Issue, 4/09 ŌĆō 4/13 46% 40% 42% 50% 42% 44% 45% 36% 27% 37% 38% 31% 26% 33% 34% 31% 33% 28% 32% 32% 29% 33% 30% 29% 42% 54% 37% 37% 43% 48% 44% 45% 47% 45% 4/09 7/09 10/09 1/10 4/10 7/10 10/10 1/11 4/11 7/11 10/11 1/12 4/12 7/12 10/12 1/13 4/13 Unemployment / Job Security Rising Prices Financial Markets Real Estate / Home Values Q. Based on your current situation, which one of the following economic conditions most concerns you?Q. Based on your current situation, which one of the following economic conditions most concerns you?

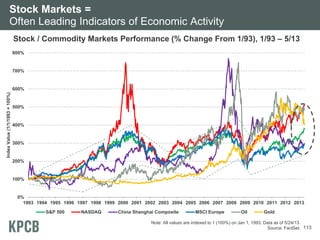

- 113. Stock Markets = Often Leading Indicators of Economic Activity Stock / Commodity Markets Performance (% Change From 1/93), 1/93 ŌĆō 5/13 Note: All values are indexed to 1 (100%) on Jan 1, 1993. Data as of 5/24/13. Source: FactSet. 113 0% 100% 200% 300% 400% 500% 600% 700% 800% 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 IndexValue(1/1/1993=100%) S&P 500 NASDAQ China Shanghai Composite MSCI Europe Oil Gold

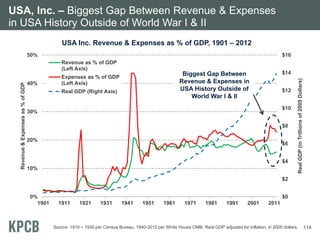

- 114. $0 $2 $4 $6 $8 $10 $12 $14 $16 0% 10% 20% 30% 40% 50% 1901 1911 1921 1931 1941 1951 1961 1971 1981 1991 2001 2011 RealGDP(inTrillionsof2005Dollars) Revenue&Expensesas%ofGDP Revenue as % of GDP (Left Axis) Expenses as % of GDP (Left Axis) Real GDP (Right Axis) USA Inc. Revenue & Expenses as % of GDP, 1901 ŌĆō 2012 Source: 1910 ŌĆō 1930 per Census Bureau, 1940-2012 per White House OMB. Real GDP adjusted for inflation, in 2005 dollars. Biggest Gap Between Revenue & Expenses in USA History Outside of World War I & II 114 USA, Inc. ŌĆō Biggest Gap Between Revenue & Expenses in USA History Outside of World War I & II

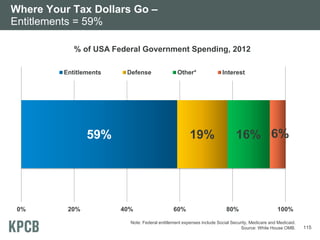

- 115. Where Your Tax Dollars Go ŌĆō Entitlements = 59% 59% 19% 16% 6% 0% 20% 40% 60% 80% 100% Entitlements Defense Other* Interest % of USA Federal Government Spending, 2012 Note: Federal entitlement expenses include Social Security, Medicare and Medicaid. Source: White House OMB. 115

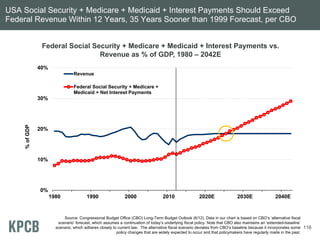

- 116. USA Social Security + Medicare + Medicaid + Interest Payments Should Exceed Federal Revenue Within 12 Years, 35 Years Sooner than 1999 Forecast, per CBO Federal Social Security + Medicare + Medicaid + Interest Payments vs. Revenue as % of GDP, 1980 ŌĆō 2042E 0% 10% 20% 30% 40% 1980 1990 2000 2010 2020E 2030E 2040E %ofGDP Revenue Federal Social Security + Medicare + Medicaid + Net Interest Payments Source: Congressional Budget Office (CBO) Long-Term Budget Outlook (6/12). Data in our chart is based on CBOŌĆÖs ŌĆśalternative fiscal scenarioŌĆÖ forecast, which assumes a continuation of todayŌĆÖs underlying fiscal policy. Note that CBO also maintains an ŌĆśextended-baselineŌĆÖ scenario, which adheres closely to current law. The alternative fiscal scenario deviates from CBOŌĆÖs baseline because it incorporates some policy changes that are widely expected to occur and that policymakers have regularly made in the past. 116

- 117. 117 The information offered in this presentation speaks to industry trends in general, and should not be construed as providing any particular recommendations or analysis for any specific company that is mentioned in this presentation. KPCB is a venture capital firm that owns significant equity positions in certain of the companies referenced in this presentation. Disclosure