Omni Channel Marketing Conference - Kylie Fuentes

- 1. UNDERSTANDING HOW ONLINE BEHAVIOUR INFLUENCES OFFLINE BEHAVIOUR KYLIE FUENTES HEAD OF DIGITAL PRODUCT MANAGEMENT, WESTFIELD

- 2. RETAIL: REDEFINED TodayŌĆÖs consumer is forcing retailers to rethink everything. But, making sense of it all remains elusive to mostŌĆ” even the biggest & the best on the global scale.

- 3. THE DRIVING FORCES BEHIND THE RETAIL REVOLUTION

- 4. TECHNOLOGY ADVANCEMENTS & ADOPTION The change of pace is faster than most business can keep up, but the customer is left wanting

- 5. NEW SHOPPER EXPECTATIONS HAVE BEEN FORMED Shoppers are bringing online behaviour into store, changing their assumptions about what makes great retail delivery SOURCING 24/7 ACCESS SPEED CONTROL ABUDNANCE INTERACTION COMMUNITY TRANSPARENCY SOURCE: Cisco Business Consulting, Retail Group. May 2011

- 6. CONNECTED SHOPPERS: INFLUENCE & POWER Word of mouth is stronger than ever, but now itŌĆÖs fuelled by social platforms that give the consumer huge reach potential. More influential than any brand message or advert.

- 7. MORE SALES CHANNELS THAN EVER In-store, e-commerce, m-commerce, social commerce, subscription services, digital downloadsŌĆ” Consumers have more choice, but the offering is usually fragmented.

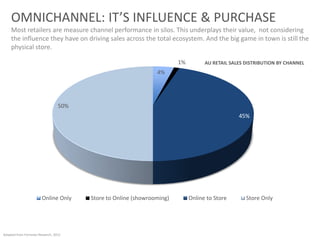

- 8. OMNICHANNEL: ITŌĆÖS INFLUENCE & PURCHASE Most retailers are measure channel performance in silos. This underplays their value, not considering the influence they have on driving sales across the total ecosystem. And the big game in town is still the physical store. 1% AU RETAIL SALES DISTRIBUTION BY CHANNEL 4% 50% 45% Online Only Store to Online (showrooming) Online to Store Store Only Adapted from Forrester Research, 2012

- 9. IMPLICATIONS ON THE SHOPPER JOURNEY

- 10. THE NEW SHOPPER JOURNEY Mindset: I donŌĆÖt know what IŌĆÖm looking for, but want to understand Mindset: I know what I want, but my options am looking for the best solution for Mindset: I know what I want & where I Needs: Inspire me & show me my needs want to get it, but I want an easy whatŌĆÖs available purchase experience Needs: Give me control & comfort that IŌĆÖm making the right choice Needs: Easy, fast & range of payment options. Trusted & secure. Memorable store experience & customer service Discover Search & Find Buy Mindset: IŌĆÖve bought my goods, but I want convenient access to my purchase Needs: Hassle free fulfillment, ability to track purchases, pick up, delivery or hold. Accessibility Relationship Acquire Mindset: Make my next time better. Needs: Know my needs & personalise the experience to save me time. Give me rewards for loyalty. Use Mindset: The product IŌĆÖve purchased needs to meet (or exceed) my expectations. I want to validate I made the right choice Needs: Product support, value added extras, social sharing & amplification

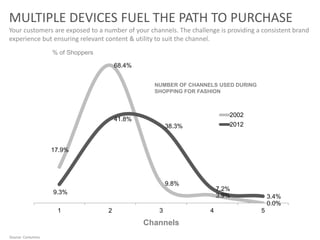

- 11. MULTIPLE DEVICES FUEL THE PATH TO PURCHASE Your customers are exposed to a number of your channels. The challenge is providing a consistent brand experience but ensuring relevant content & utility to suit the channel. % of Shoppers 68.4% NUMBER OF CHANNELS USED DURING SHOPPING FOR FASHION 2002 41.8% 38.3% 2012 17.9% 9.8% 7.2% 9.3% 3.9% 3.4% 0.0% 1 2 3 4 5 Channels Source: Conlumino

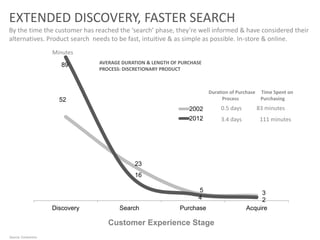

- 12. EXTENDED DISCOVERY, FASTER SEARCH By the time the customer has reached the ŌĆśsearchŌĆÖ phase, theyŌĆÖre well informed & have considered their alternatives. Product search needs to be fast, intuitive & as simple as possible. In-store & online. Minutes 89 AVERAGE DURATION & LENGTH OF PURCHASE PROCESS: DISCRETIONARY PRODUCT Duration of Purchase Time Spent on 52 Process Purchasing 2002 0.5 days 83 minutes 2012 3.4 days 111 minutes 23 16 5 3 4 2 Discovery Search Purchase Acquire Customer Experience Stage Source: Conlumino

- 13. FOR RETAILERS, MOBILE IS THE LYNCHPIN THAT BRINGS IT ALL TOGETHER

- 14. MOBILE USAGE IS SKYROCKETING Australian shoppers have adopted mobile technologies at a higher rate than most of their global counterparts. YOY growth is still booming. Source: Our Mobile Planet Australia, Think With Google 2012

- 15. IMPACT ON RETAIL IS HUGE Australian smartphone users are actively searching for information about products & services. M-commerce conversion is still relatively low, its main function is to facilitate search & drive conversion to offline or desktop. Australian Smartphone Users: What type of activity do you search for on your phone? Source: Our Mobile Planet Australia, Think With Google 2012

- 16. MOBILE IS LOCAL Mobile search is anchored in location. Omni Channel retailers are perfectly positioned to take advantage of this opportunity, using mobile to drive in-store visitation. Source: Our Mobile Planet Australia, Think With Google 2012

- 17. TABLET PROVIDES DIFFERENT UTILITY Tablet combines the benefits of deeper richer experiences found on desktop with the portability of mobile, creating powerful opportunities for retailers. In-store & out of store. Source: Mary Meeker, Internet Trends 2012

- 19. SINGLE VIEW OF SHOPPER The holy grail of Omni Channel, it promises to unlock huge benefits for retailers. Both superior shopper insights to fuel business strategy & greater ROI for marketing investments due to better targeting.

- 20. RELATIONSHIP: EXCHANGE OF VALUE Not all shoppers want a relationship & not all retailers deserve one. Provide value for the shopper in exchange for their data & make sure they understand it. ThereŌĆÖs a fine line between relevant messaging & invasion of space. Transparency & respect for the shopper is paramount

- 21. SHOPPER INSIGHTS & DATA APPLICATION Review the historical, aggregated data to form deeper shopper insights & fuel future business strategy. But just as importantly, integration into campaign management & content management platforms delivers real time, personalised shopper marketing capability, which drives greater ROI Looking back & trying to predict Moment of truth: Right message, the future right time, right channel

- 22. THINK BIG, BUT START SMALL Even the best of the best are grappling with how to sort & use their data set. But the ones who are most advanced have a few things in common. ŌĆó Platform first. A central, scalable data warehouse ŌĆó Aggregate sales, customer & location data around a unique ID. Big effort but big returns ŌĆó Data without intelligence is useless. Analytics integration into campaign management systems ŌĆó Make it easy for yourself. Use the same customer credentials across channels if possible ŌĆó Start with what you have. Implement retargeting or trigger based programs ŌĆó Test & Learn. Test & Learn. Test & Learn

- 23. GEOLOCATION: THE NEXT FRONTIER Location based data from mobile, WiFi & social will give retailers unprecedented ability to influence at the moment of truth. Beyond purchase data, itŌĆÖs the most important lever. Location contextual offers & content Location based services & utilities (including navigation) Retargeting from online browse & purchase behaviour Real time retargeting from showroom behaviour (while still in store!) Notifications to sales staff for high value customer visits Truly personalised in-store service In depth understanding of customer instore behaviour

- 24. SIX OBSERVATIONS FROM THOSE WHO DO IT BETTER

- 25. 1. REFRAME THE MEASURE OF SUCCESS Measure the performance of your ecosystem, not single channel revenue. Understand the value your online channels play in influencing your offline sales channels. Create KPIŌĆÖs to support & instill this thinking into your organisation. ŌĆ£For every $1 spent online influences $5.77 in storeŌĆØ Terry Lundgren, CEO MacyŌĆÖs, Apple

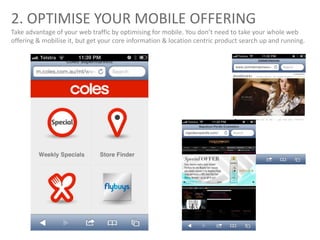

- 26. 2. OPTIMISE YOUR MOBILE OFFERING Take advantage of your web traffic by optimising for mobile. You donŌĆÖt need to take your whole web offering & mobilise it, but get your core information & location centric product search up and running.

- 27. 3. LET THE CUSTOMER DECIDE Provide customers with the option to purchase in their channel of choice. DonŌĆÖt force them to one or the other, but make sure you have a presence where & when they want it. ŌĆ£Physical stores are still the primary way people acquire merchandise, and I think that will be true 50 years from nowŌĆØ Ron Johnson, CEO J.C Penny ex SVP Retail Operations, Apple Adapted from Forrester Research, 2012

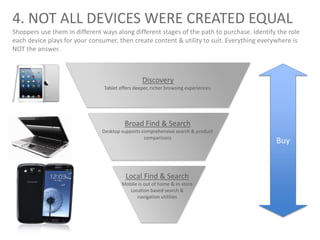

- 28. 4. NOT ALL DEVICES WERE CREATED EQUAL Shoppers use them in different ways along different stages of the path to purchase. Identify the role each device plays for your consumer, then create content & utility to suit. Everything everywhere is NOT the answer. Discovery Tablet offers deeper, richer browsing experiences. Broad Find & Search Desktop supports comprehensive search & product comparisons Buy Local Find & Search Mobile is out of home & in-store Location based search & navigation utilities

- 29. 5. LEVERAGE THE STRENGTH OF YOUR ASSETS Converge the digital & physical experiences. Integrate across platforms to add value for your shoppers & play to the strength of your channels.

- 30. 6. BE CLEAR ABOUT THE VALUE YOU PROVIDE If youŌĆÖre not 100% sure what value you bring to your shoppers, you canŌĆÖt expect them to know either. DonŌĆÖt just venture into new influence or sales channels because you can, be clear about why you should.

- 31. IDENTIFYING SOME OF THE ROADBLOCKS

- 32. WAITING FOR ENLIGHTENMENT Many fall into the trap of wanting to have the perfect strategy, the final destination & the nirvana of technology at their disposal. The longer you wait, the bigger the missed opportunity. The key is to get in and try.

- 33. OVER-ENGINEERING YOUR DIGITAL CHANNELS ItŌĆÖs tempting to come up with feature sets that address every single possible thing that could be of benefit to your shopper. ItŌĆÖs MOST important you set your sights on the Minimum Viable Product that addresses the CORE needs perfectly.

- 34. DEFINING SUCCESS AFTERWARDS The key to getting your data & your channel strategy right is knowing what success looks like upfront. Often key components for data capture & channel measurement are tacked on as an afterthought. This usually leads to less accurate, more costly & more time consuming retrofits.

- 35. DROWNING IN DATA Data overload leads to poorer, not better decision making. Make sure youŌĆÖve got the capability to fuel your business by equipping the right people with the right information at the right time. Find time to turn data into insights. If you donŌĆÖt, youŌĆÖre not taking advantage of the opportunity

- 36. INFLUENCE & SALES CHANNELS: MEASURE THEM AS AN ECOSYSTEM RIGHT CHANNEL, RIGHT EXPERIENCE THROUGH THE NEW SHOPPER JOURNEY MOBILE MERGES ONLINE & OFFLINE: BUT MOST RETAILERS ARE BEHIND THE GAME CREATE AN EXCHANGE OF VALUE WITH YOUR SHOPPERS TO BUILD RELATIONSHIP BESIDES PURCHASE DATA, LOCATION DATA IS KING DONŌĆÖT WAIT FOR PERFECTION. GET IN & LEARN