Basic Tax Information for F-1 Visa Holders

Download as ppt, pdf1 like484 views

This document provides basic tax information for international students at Trinity University holding an F1 visa. It explains that F1 visa holders are exempt from being taxed as US residents for the first 5 years and are only taxed on US source income as non-residents. It outlines filing requirements and forms, discusses tax treatment of scholarships and other income sources, and provides guidance on tax treaties and family tax situations. Resources for additional assistance are also listed.

1 of 22

Download to read offline

Ad

Recommended

Schiller University Letter of-financial-support-for-us

Schiller University Letter of-financial-support-for-usAbhishek Bajaj

Ěý

The document is a letter of financial support for international students applying to Schiller International University in Florida, outlining the requirements for demonstrating financial capability to cover tuition and living expenses. It explains the necessary documentation, including a completed financial support letter, bank statement, and additional paperwork for dependents if applicable. The letter emphasizes the importance of accurate information and the consequences of falsification.Intl orientation august 2013 final

Intl orientation august 2013 finalaleparragonz

Ěý

The document provides an overview of the Office of International Affairs (OIA) at Nova Southeastern University (NSU) and information for international students. It discusses OIA's mission to facilitate international programs and services for students. It also outlines requirements for maintaining legal student visa status such as having a valid I-20, engaging in a full course of study, reporting address changes, and limits on employment. The summary highlights key services provided by OIA including advising on visas, travel, health insurance, taxes, and transportation. It emphasizes the importance of complying with immigration rules and contacting OIA with any questions.Jackson Hewitt for Session 1

Jackson Hewitt for Session 1Lauren Cappello

Ěý

This document provides training notes for filing individual tax returns. It outlines a 13-week training schedule covering topics like filing basics, various forms of income and deductions, credits, and taxes. It also discusses the importance of collecting biographical data on citizenship, residency, age, marital status, and dependents to determine filing requirements. Additional details are provided on categories of taxpayers and income thresholds for dependents. Contact information is listed for questions.Session 1 review2013 basic taxslideshow

Session 1 review2013 basic taxslideshowLauren Cappello

Ěý

This document provides training notes and resources for preparing tax returns. It outlines a 13-week training schedule covering topics like filing basics, deductions, credits, and ethics. Key biographical data needed to determine filing requirements includes citizenship, residency, age, marital status, and dependents. Filing status categories include most taxpayers, dependents, children, self-employed individuals, and aliens. Contact information is provided for additional questions.Orientation summer-2012

Orientation summer-2012ecusamktg

Ěý

This document provides information about financial aid and student employment at East Carolina University. It outlines the application process for financial aid, including required documentation. It lists various financial aid programs available. It also discusses student employment opportunities on and off campus, including federal work study. Students are reminded to check their email regularly and respond promptly to requests. The contact information for the financial aid and student employment offices is provided.Payroll management services tax glacier workshop 2018

Payroll management services tax glacier workshop 2018UTSA_International

Ěý

This document summarizes a presentation on taxation for nonresident aliens. It discusses the differences between nonresident aliens, resident aliens, and US residents for tax purposes. The substantial presence test and green card test are explained for determining resident alien status. Tax forms like 1040NR, 1042-S, and W-7 are also summarized. The document provides an overview of Glacier Tax Prep software for filing taxes and addresses where to mail completed tax documents.Intl Orientation Regional Campus-October Fall 2015

Intl Orientation Regional Campus-October Fall 2015aleparragonz

Ěý

This document provides information for international students at Nova Southeastern University (NSU) regarding studying abroad, maintaining legal student visa status, health insurance, driving in Florida, employment options, payment responsibilities, and contacts for the Office of International Students and Scholars (OISS). Key details include that the top 5 countries NSU students visit are China, Ecuador, Spain, Peru, and Italy, OISS assists with student visa issues and travel authorization, and maintaining full-time enrollment and valid immigration documents are required to remain in legal student status.Scholarship Deadline Email Design

Scholarship Deadline Email DesignRobert Hosier

Ěý

The document reminds students that the priority deadline for academic scholarships at LSU Shreveport for Fall 2010 is January 31st. To be considered for a scholarship, students must submit a complete admissions application, official ACT or SAT scores, and an official high school transcript if attending from out of state, by the deadline. Contact information is provided for the financial aid and admissions offices.How to become a [documented] US Immigrant

How to become a [documented] US ImmigrantHevynHeckes

Ěý

The document outlines the process of becoming a documented U.S. immigrant, detailing various visa types such as immigrant and non-immigrant visas, along with associated costs and fees for applications. It explains the concept of humanitarian parole, including the criteria for eligibility, application process, and requirements for sponsors. Additionally, it highlights the importance of Customs and Border Protection's role in granting entry into the U.S. after approval.Final_GWChinaAlumniNetwork_WelcomeBrochure

Final_GWChinaAlumniNetwork_WelcomeBrochureKatie Elizabeth Ray

Ěý

This document provides information to new GW students and their parents about the university, campus, and city of Washington D.C. It discusses GW's history and campus locations. It provides details about housing options, transportation around D.C., and academic resources. It encourages students to get involved with student organizations and highlights ways to explore D.C., including free museums and historic sites. The document is intended to welcome and orient new students to GW and the surrounding community.FAQ's F1 Visa Renewal with Expired Visa Stamping

FAQ's F1 Visa Renewal with Expired Visa Stampinghappyschools

Ěý

The document provides essential information about F and J visa processes for international students in the U.S., including renewal procedures, application requirements, and considerations when applying from a third country. It emphasizes the importance of maintaining non-immigrant status and outlines the necessary documents and fees involved in the visa application process. Background checks may delay visa issuance, and consults recommend seeking guidance from international student services before applying in a third country.FINAL CASH FOR COLLEGE PRESENTATION 2015

FINAL CASH FOR COLLEGE PRESENTATION 2015Anna Maria Vaccaro

Ěý

This document summarizes a financial aid workshop that discusses various types of financial aid including grants, scholarships, loans, and work study. It outlines key financial aid applications like FAFSA and Cal Grant, how to complete them, and important deadlines. The presentation provides information on different sources of aid from the federal and state government as well as colleges. It also addresses special circumstances, next steps after applying, examples of financial aid award packages, and resources for help or additional information.Marcus Acceptance Letter

Marcus Acceptance LetterMarcus Gaughan

Ěý

Marcus Gaughan has been selected to participate in the Ontario Global Edge Program and receive a $4,000 grant to complete a placement at the Chamber of Commerce in Ecuador during the winter 2016 term. The grant will be provided in 3 installments - the first $2,500 upon attending a pre-departure session and submitting required documents, the second $1,000 before departure for accommodation and living expenses, and the final $500 after returning and completing all program requirements including reports and a presentation.Non profit formation

Non profit formationWayne Lippman

Ěý

The document provides guidance on forming a non-profit social venture, emphasizing the rules for obtaining tax-exempt status and the legal requirements involved. Key points include the importance of adhering to exempt purposes, avoiding political activities, and maintaining a structure that prevents private benefit. Additionally, it outlines options for collaboration with for-profits and other non-profits, emphasizing careful legal and financial planning.Asa College Admission Details

Asa College Admission Details Ahad Khan

Ěý

The document provides an international student enrollment checklist for ASA College, detailing required application items for eligibility and I-20 issuance. It outlines various financial responsibilities and documentation needed for admissions, including proof of funds, application fees, and educational history. The document also mentions scholarship eligibility and contains contact information for the associate director of admissions, Agatha Sabina Castelino.11.5

11.5SBDCLogan

Ěý

When hiring a new employee, there are three important forms that must be completed to comply with legal requirements: the I-9 form to verify employment eligibility, the W-4 form where employees specify tax withholding amounts, and the Utah New Hire Registry form that must be submitted to the state within 20 days of the start date. Failure to fill out these forms can result in fines or legal penalties.IRS Federal income tax for residential aliens 2016

IRS Federal income tax for residential aliens 2016Wayne Lippman

Ěý

The document outlines the IRS's winter/spring 2016 tax workshop specifically for nonresident aliens such as F-1 and J-1 visa holders. It emphasizes that these individuals must file specific forms, including Form 8843, depending on their income and tax circumstances, and clarifies which categories of income are taxable or exempt under U.S. tax law. Additionally, it provides information on deadlines for filing and resources available for participants seeking assistance with their tax obligations.J-1 Scholar Online Orientation

J-1 Scholar Online OrientationUTSA_International

Ěý

The document provides information for maintaining J-1 visa status, including reporting changes of address, maintaining a valid passport, understanding the I-94 form, ensuring the DS-2019 form is valid, having adequate health insurance, following employment guidelines, and knowing requirements for travel and program completion. It lists contact information for the International Scholar Services office at UTSA for questions about J-1 visa status.ACM Link Toolkit: Professional Series- Working, Living & Retiring Abroad Series

ACM Link Toolkit: Professional Series- Working, Living & Retiring Abroad Seriesamericanclubofmadrid

Ěý

This document provides a starter toolkit of reference websites for Americans working, living, and retiring abroad in Spain. For working, it lists the websites of the Spanish Ministry of Employment, general consulates in Miami and San Francisco, and a site to check visa status. For living, it lists resources for citizen services, passports, taxes, voting abroad, and visas. For retirement, it lists the Federal Benefits Unit, Social Security Administration, Medicare, Department of Veterans Affairs, and other retirement-related agencies and their international information. The document aims to be a one-stop reference for Americans accessing essential information and services across different life stages abroad.Revata International - Student Visa Process

Revata International - Student Visa ProcessRevata International

Ěý

This document provides information about obtaining a student visa to study in the US. It outlines the steps including getting an I-20 form, paying SEVIS and visa fees, completing a DS-160 application, scheduling a visa interview, and gathering required documents like financial records, educational documents, and employment records. The recap emphasizes having the I-20, paying fees, filling the DS-160, paying SEVIS fees, scheduling an appointment, and collecting all necessary documents for the visa interview. The goal is to demonstrate strong social and economic ties to one's home country to overcome the presumption of immigrant intent.Wayne Lippman presents Tax Filing Status Guide

Wayne Lippman presents Tax Filing Status GuideWayne Lippman

Ěý

The document outlines the five tax filing statuses available to taxpayers: married filing jointly, qualifying widow(er) with dependent child, head of household, single, and married filing separately. It provides details on eligibility requirements for each status, particularly emphasizing how marital status affects filing options. Additionally, special considerations for married taxpayers who file separately and the implications on deductions and credits are highlighted.NEGAP 2011: Creating an International Student Friendly Website

NEGAP 2011: Creating an International Student Friendly WebsiteNew England Association of Graduate Admissions Professionals

Ěý

The document outlines best practices for creating an international student-friendly website, emphasizing the importance of clarity and simplicity in delivering essential information for prospective and current international students. Key elements include prioritizing content, providing transparent cost details, and offering clear application processes while ensuring accessibility and support through links to relevant resources. It also advises on common pitfalls to avoid, such as requiring original documents that may not be feasible for international applicants.How to file for a travel visa

How to file for a travel visaVietnam Visa On Arrival

Ěý

Filing for a travel visa requires researching visa requirements for your destination country and applying well in advance if required. You should check the State Department or embassy website to determine if a visa is needed, and if so, whether it can be obtained on arrival or requires applying in advance. When applying in advance, the application process often involves providing your personal details, travel plans, passport photos and payment of a visa fee.C:\Fakepath\Application

C:\Fakepath\Applicationguestcca1041

Ěý

The document outlines the standard application procedure for admission to national higher education institutions in Tanzania and for overseas scholarships. Applicants to national institutions must send an application letter and completed form with certified copies of academic transcripts and certificates, passport photos, and application fee. Applicants for overseas scholarships must respond to ministry advertisements with academic transcripts, photos, birth certificate, and letter from parent/guardian guaranteeing financial support.J 1 presentation for online orientation

J 1 presentation for online orientationUTSA_International

Ěý

The document provides information for maintaining J-1 visa status, including reporting changes of address, maintaining a valid passport, proper documentation like I-94 and DS-2019 forms, health insurance requirements, employment authorization, and other responsibilities like paying taxes, leaving the US after the program ends, and J-2 dependent policies. It emphasizes the importance of following the regulations to maintain immigration status and lists resources like the International Scholar Services for any questions or guidance.International Students/Faculty/Staff Tax Workshop 2016

International Students/Faculty/Staff Tax Workshop 2016UTSA_International

Ěý

This document provides information about taxation for non-resident aliens. It defines key terms like non-resident alien, US resident, non-resident alien for tax purposes, and resident alien for tax purposes. It also outlines the substantial presence test and green card test to determine residency status. The document discusses forms like 1042-S, 1040NR-EZ, 1040NR, 8843, and W7 that may need to be filed. It provides guidance on income types, exemptions, deductions, and the Glacier Tax Prep software for filing taxes.Cross border INTEGRATED WEALTH

Cross border INTEGRATED WEALTHStefanie Keller, CFP

Ěý

The document discusses cross-border tax planning and compliance for US persons living in Canada. It outlines how to determine US tax exposure based on citizenship, residency and foreign assets. US persons are required to file annual tax returns, FBARs, and disclosures of foreign accounts, investments and businesses. Failure to comply can result in penalties and criminal charges. Integrated planning is needed to structure assets and income to minimize US tax obligations while meeting Canadian regulations.I-134/I-864 Affidavit of Support: How Much Money is Enough?

I-134/I-864 Affidavit of Support: How Much Money is Enough?mbashyam

Ěý

This document summarizes the requirements for I-134 and I-864 Affidavits of Support. The I-134 is generally not legally binding but is required for some visa applications to show the applicant will not be a public charge. The I-864 is legally binding and required for most family-based immigration cases to prove the sponsored immigrant will not need public benefits. It details the income requirements sponsors must meet based on household size and allows alternatives like assets or joint sponsors if income is insufficient. The obligations and potential enforcement consequences of the I-864 by government agencies or the immigrant are also outlined.FBAR and US Taxes for Expatriates - Intercam Presentation , Ixtapa, Mexico

FBAR and US Taxes for Expatriates - Intercam Presentation , Ixtapa, MexicoDon Nelson Tax Attorney

Ěý

- US citizens living abroad, including in Mexico, are required to file US tax returns and report foreign financial accounts over $10,000. Failure to do so can result in penalties.

- There are tax treaties between the US and Mexico to exchange tax information. The IRS is increasing audits of US expatriates due to inaccurate filings. It's important for expats to properly report all foreign income and assets.

- Expats have options if they have not filed previously, including streamlined filing programs. Filing past returns or disclosures without penalties is possible in some cases. Proper filing and documentation is important to avoid audits.tax presentation students tax presentation students

tax presentation students tax presentation studentsAbdullahakan1

Ěý

The document provides information about federal tax filing requirements and guidance for international students. It outlines the agenda for the tax information session, including discussing tax basics, forms received and completed, tax residency status, filing information for non-residents, tax treaty information, and completing and filing the necessary forms. The session will help international students understand their tax obligations and ensure they correctly file the required federal tax forms by the deadlines.More Related Content

What's hot (17)

How to become a [documented] US Immigrant

How to become a [documented] US ImmigrantHevynHeckes

Ěý

The document outlines the process of becoming a documented U.S. immigrant, detailing various visa types such as immigrant and non-immigrant visas, along with associated costs and fees for applications. It explains the concept of humanitarian parole, including the criteria for eligibility, application process, and requirements for sponsors. Additionally, it highlights the importance of Customs and Border Protection's role in granting entry into the U.S. after approval.Final_GWChinaAlumniNetwork_WelcomeBrochure

Final_GWChinaAlumniNetwork_WelcomeBrochureKatie Elizabeth Ray

Ěý

This document provides information to new GW students and their parents about the university, campus, and city of Washington D.C. It discusses GW's history and campus locations. It provides details about housing options, transportation around D.C., and academic resources. It encourages students to get involved with student organizations and highlights ways to explore D.C., including free museums and historic sites. The document is intended to welcome and orient new students to GW and the surrounding community.FAQ's F1 Visa Renewal with Expired Visa Stamping

FAQ's F1 Visa Renewal with Expired Visa Stampinghappyschools

Ěý

The document provides essential information about F and J visa processes for international students in the U.S., including renewal procedures, application requirements, and considerations when applying from a third country. It emphasizes the importance of maintaining non-immigrant status and outlines the necessary documents and fees involved in the visa application process. Background checks may delay visa issuance, and consults recommend seeking guidance from international student services before applying in a third country.FINAL CASH FOR COLLEGE PRESENTATION 2015

FINAL CASH FOR COLLEGE PRESENTATION 2015Anna Maria Vaccaro

Ěý

This document summarizes a financial aid workshop that discusses various types of financial aid including grants, scholarships, loans, and work study. It outlines key financial aid applications like FAFSA and Cal Grant, how to complete them, and important deadlines. The presentation provides information on different sources of aid from the federal and state government as well as colleges. It also addresses special circumstances, next steps after applying, examples of financial aid award packages, and resources for help or additional information.Marcus Acceptance Letter

Marcus Acceptance LetterMarcus Gaughan

Ěý

Marcus Gaughan has been selected to participate in the Ontario Global Edge Program and receive a $4,000 grant to complete a placement at the Chamber of Commerce in Ecuador during the winter 2016 term. The grant will be provided in 3 installments - the first $2,500 upon attending a pre-departure session and submitting required documents, the second $1,000 before departure for accommodation and living expenses, and the final $500 after returning and completing all program requirements including reports and a presentation.Non profit formation

Non profit formationWayne Lippman

Ěý

The document provides guidance on forming a non-profit social venture, emphasizing the rules for obtaining tax-exempt status and the legal requirements involved. Key points include the importance of adhering to exempt purposes, avoiding political activities, and maintaining a structure that prevents private benefit. Additionally, it outlines options for collaboration with for-profits and other non-profits, emphasizing careful legal and financial planning.Asa College Admission Details

Asa College Admission Details Ahad Khan

Ěý

The document provides an international student enrollment checklist for ASA College, detailing required application items for eligibility and I-20 issuance. It outlines various financial responsibilities and documentation needed for admissions, including proof of funds, application fees, and educational history. The document also mentions scholarship eligibility and contains contact information for the associate director of admissions, Agatha Sabina Castelino.11.5

11.5SBDCLogan

Ěý

When hiring a new employee, there are three important forms that must be completed to comply with legal requirements: the I-9 form to verify employment eligibility, the W-4 form where employees specify tax withholding amounts, and the Utah New Hire Registry form that must be submitted to the state within 20 days of the start date. Failure to fill out these forms can result in fines or legal penalties.IRS Federal income tax for residential aliens 2016

IRS Federal income tax for residential aliens 2016Wayne Lippman

Ěý

The document outlines the IRS's winter/spring 2016 tax workshop specifically for nonresident aliens such as F-1 and J-1 visa holders. It emphasizes that these individuals must file specific forms, including Form 8843, depending on their income and tax circumstances, and clarifies which categories of income are taxable or exempt under U.S. tax law. Additionally, it provides information on deadlines for filing and resources available for participants seeking assistance with their tax obligations.J-1 Scholar Online Orientation

J-1 Scholar Online OrientationUTSA_International

Ěý

The document provides information for maintaining J-1 visa status, including reporting changes of address, maintaining a valid passport, understanding the I-94 form, ensuring the DS-2019 form is valid, having adequate health insurance, following employment guidelines, and knowing requirements for travel and program completion. It lists contact information for the International Scholar Services office at UTSA for questions about J-1 visa status.ACM Link Toolkit: Professional Series- Working, Living & Retiring Abroad Series

ACM Link Toolkit: Professional Series- Working, Living & Retiring Abroad Seriesamericanclubofmadrid

Ěý

This document provides a starter toolkit of reference websites for Americans working, living, and retiring abroad in Spain. For working, it lists the websites of the Spanish Ministry of Employment, general consulates in Miami and San Francisco, and a site to check visa status. For living, it lists resources for citizen services, passports, taxes, voting abroad, and visas. For retirement, it lists the Federal Benefits Unit, Social Security Administration, Medicare, Department of Veterans Affairs, and other retirement-related agencies and their international information. The document aims to be a one-stop reference for Americans accessing essential information and services across different life stages abroad.Revata International - Student Visa Process

Revata International - Student Visa ProcessRevata International

Ěý

This document provides information about obtaining a student visa to study in the US. It outlines the steps including getting an I-20 form, paying SEVIS and visa fees, completing a DS-160 application, scheduling a visa interview, and gathering required documents like financial records, educational documents, and employment records. The recap emphasizes having the I-20, paying fees, filling the DS-160, paying SEVIS fees, scheduling an appointment, and collecting all necessary documents for the visa interview. The goal is to demonstrate strong social and economic ties to one's home country to overcome the presumption of immigrant intent.Wayne Lippman presents Tax Filing Status Guide

Wayne Lippman presents Tax Filing Status GuideWayne Lippman

Ěý

The document outlines the five tax filing statuses available to taxpayers: married filing jointly, qualifying widow(er) with dependent child, head of household, single, and married filing separately. It provides details on eligibility requirements for each status, particularly emphasizing how marital status affects filing options. Additionally, special considerations for married taxpayers who file separately and the implications on deductions and credits are highlighted.NEGAP 2011: Creating an International Student Friendly Website

NEGAP 2011: Creating an International Student Friendly WebsiteNew England Association of Graduate Admissions Professionals

Ěý

The document outlines best practices for creating an international student-friendly website, emphasizing the importance of clarity and simplicity in delivering essential information for prospective and current international students. Key elements include prioritizing content, providing transparent cost details, and offering clear application processes while ensuring accessibility and support through links to relevant resources. It also advises on common pitfalls to avoid, such as requiring original documents that may not be feasible for international applicants.How to file for a travel visa

How to file for a travel visaVietnam Visa On Arrival

Ěý

Filing for a travel visa requires researching visa requirements for your destination country and applying well in advance if required. You should check the State Department or embassy website to determine if a visa is needed, and if so, whether it can be obtained on arrival or requires applying in advance. When applying in advance, the application process often involves providing your personal details, travel plans, passport photos and payment of a visa fee.C:\Fakepath\Application

C:\Fakepath\Applicationguestcca1041

Ěý

The document outlines the standard application procedure for admission to national higher education institutions in Tanzania and for overseas scholarships. Applicants to national institutions must send an application letter and completed form with certified copies of academic transcripts and certificates, passport photos, and application fee. Applicants for overseas scholarships must respond to ministry advertisements with academic transcripts, photos, birth certificate, and letter from parent/guardian guaranteeing financial support.J 1 presentation for online orientation

J 1 presentation for online orientationUTSA_International

Ěý

The document provides information for maintaining J-1 visa status, including reporting changes of address, maintaining a valid passport, proper documentation like I-94 and DS-2019 forms, health insurance requirements, employment authorization, and other responsibilities like paying taxes, leaving the US after the program ends, and J-2 dependent policies. It emphasizes the importance of following the regulations to maintain immigration status and lists resources like the International Scholar Services for any questions or guidance.ACM Link Toolkit: Professional Series- Working, Living & Retiring Abroad Series

ACM Link Toolkit: Professional Series- Working, Living & Retiring Abroad Seriesamericanclubofmadrid

Ěý

NEGAP 2011: Creating an International Student Friendly Website

NEGAP 2011: Creating an International Student Friendly WebsiteNew England Association of Graduate Admissions Professionals

Ěý

Similar to Basic Tax Information for F-1 Visa Holders (20)

International Students/Faculty/Staff Tax Workshop 2016

International Students/Faculty/Staff Tax Workshop 2016UTSA_International

Ěý

This document provides information about taxation for non-resident aliens. It defines key terms like non-resident alien, US resident, non-resident alien for tax purposes, and resident alien for tax purposes. It also outlines the substantial presence test and green card test to determine residency status. The document discusses forms like 1042-S, 1040NR-EZ, 1040NR, 8843, and W7 that may need to be filed. It provides guidance on income types, exemptions, deductions, and the Glacier Tax Prep software for filing taxes.Cross border INTEGRATED WEALTH

Cross border INTEGRATED WEALTHStefanie Keller, CFP

Ěý

The document discusses cross-border tax planning and compliance for US persons living in Canada. It outlines how to determine US tax exposure based on citizenship, residency and foreign assets. US persons are required to file annual tax returns, FBARs, and disclosures of foreign accounts, investments and businesses. Failure to comply can result in penalties and criminal charges. Integrated planning is needed to structure assets and income to minimize US tax obligations while meeting Canadian regulations.I-134/I-864 Affidavit of Support: How Much Money is Enough?

I-134/I-864 Affidavit of Support: How Much Money is Enough?mbashyam

Ěý

This document summarizes the requirements for I-134 and I-864 Affidavits of Support. The I-134 is generally not legally binding but is required for some visa applications to show the applicant will not be a public charge. The I-864 is legally binding and required for most family-based immigration cases to prove the sponsored immigrant will not need public benefits. It details the income requirements sponsors must meet based on household size and allows alternatives like assets or joint sponsors if income is insufficient. The obligations and potential enforcement consequences of the I-864 by government agencies or the immigrant are also outlined.FBAR and US Taxes for Expatriates - Intercam Presentation , Ixtapa, Mexico

FBAR and US Taxes for Expatriates - Intercam Presentation , Ixtapa, MexicoDon Nelson Tax Attorney

Ěý

- US citizens living abroad, including in Mexico, are required to file US tax returns and report foreign financial accounts over $10,000. Failure to do so can result in penalties.

- There are tax treaties between the US and Mexico to exchange tax information. The IRS is increasing audits of US expatriates due to inaccurate filings. It's important for expats to properly report all foreign income and assets.

- Expats have options if they have not filed previously, including streamlined filing programs. Filing past returns or disclosures without penalties is possible in some cases. Proper filing and documentation is important to avoid audits.tax presentation students tax presentation students

tax presentation students tax presentation studentsAbdullahakan1

Ěý

The document provides information about federal tax filing requirements and guidance for international students. It outlines the agenda for the tax information session, including discussing tax basics, forms received and completed, tax residency status, filing information for non-residents, tax treaty information, and completing and filing the necessary forms. The session will help international students understand their tax obligations and ensure they correctly file the required federal tax forms by the deadlines.Affidavit of support

Affidavit of supportklaudya73

Ěý

This document provides instructions for completing Form I-864EZ, Affidavit of Support Under Section 213A of the Act.

1) Form I-864EZ is a shorter version of Form I-864 for family-based immigration cases that meet certain criteria. It is used to show the immigrant will not become a public charge.

2) By signing this form, the sponsor agrees to use their income to support the immigrant if necessary. The sponsor must show they earn enough to prevent the immigrant from relying on public benefits. This may make the immigrant ineligible for public benefits and require the sponsor to repay benefits received.

3) The form must be completed by the US citizen or LPR whoTax Guide for International Students

Tax Guide for International StudentsMark Minassian, CPA

Ěý

This document outlines the U.S. tax obligations for international students, specifically highlighting the differences between resident and nonresident alien tax systems and their respective income tax liabilities. It details the necessary forms, exemptions, and the substantial presence test for tax residency, as well as the specific taxation rules in Massachusetts for nonresidents. Additionally, it emphasizes the importance of filing accurate tax returns and the resources available for assistance.10 Most Common Reasons Why UK Visas Get Rejected – A Definitive Guide.pdf

10 Most Common Reasons Why UK Visas Get Rejected – A Definitive Guide.pdfHiren Patel

Ěý

The document outlines the ten most common reasons for visa rejections in the UK, emphasizing the importance of accurate and complete applications. Key issues include incomplete forms, irregular funds, incorrect visa categories, and insufficient documentation. It advises applicants to seek professional assistance to navigate the rigorous visa approval process, as approval timelines can vary from 15 days to six months.US Expat Foreign Bank, Financial & Asset Reporting Guidance

US Expat Foreign Bank, Financial & Asset Reporting GuidanceDon Nelson Tax Attorney

Ěý

This document outlines the tax obligations for U.S. citizens and green card holders living in Mexico, including the requirement to file U.S. tax returns reporting worldwide income and the potential for tax credits to avoid double taxation. It also details the Foreign Bank Account Report (FBAR) requirements and the penalties for non-compliance, as well as highlights various IRS reporting forms for foreign financial assets and entities. Additionally, it discusses tax benefits for expatriates and increases in IRS audits targeting U.S. expats, while offering services from an experienced attorney in this field.GEO NECF 2015 - Exploring the Challenges of Tax Compliance and the W-8BEN

GEO NECF 2015 - Exploring the Challenges of Tax Compliance and the W-8BENAndrea Huck-Esposito

Ěý

The document discusses the W-8BEN form, its implications for non-U.S. persons, and tax compliance related to U.S. withholding regulations. It explains the differences between the W-8BEN and W-9 forms, consequences of failing to file, and requirements for substantiating nonresident alien status. Additionally, it addresses pertinent topics such as FATCA and backup withholding rules that may affect foreign individuals and entities engaged in activities with U.S. sources of income.Itin Power Point

Itin Power PointNeighborhood Tax Centers

Ěý

- The document discusses the Individual Tax Identification Number (ITIN) program, which issues ITINs to individuals who are not eligible to obtain a Social Security Number but who still need to file a US tax return.

- It describes the requirements and documentation needed to apply for an ITIN, including proof of identity and foreign status. Applicants must demonstrate if they are resident or nonresident for tax purposes using the Substantial Presence Test.

- Common errors in ITIN applications are outlined, such as not including a required tax return, using outdated forms, or failing to properly translate or certify foreign documents. Acceptance Agents can assist individuals in applying for ITINs.guide

guideBrian Kao

Ěý

This document is a guide to various tax credits available to Minnesota taxpayers for tax year 2014, including the Earned Income Tax Credit (EITC), Working Family Credit, Child Tax Credit, Child and Dependent Care Credit, American Opportunity Credit, Lifetime Learning Credit, K-12 Education Credit, and Minnesota Property Tax Refund. It provides information on eligibility requirements, maximum credit amounts, and required documentation for each credit. The guide also explains the difference between refundable and non-refundable tax credits and provides contact information for free tax preparation assistance.U.S. AND CANADA IMMIGRATION LAW NEWS AND UPDATES US Immigration and Family Se...

U.S. AND CANADA IMMIGRATION LAW NEWS AND UPDATES US Immigration and Family Se...Nachman Phulwani Zimovcak (NPZ) Law Group, P.C.

Ěý

This newsletter from Nachman Phulwani Zimovcak (NPZ) Law Group provides updates on recent changes to US immigration laws and policies. It discusses new electronic filing pilots for immigration courts, extended TPS for Yemen, USCIS naturalization processes, immigration court case growth, family separation protests, and options for removing conditional permanent residence due to divorce. It also provides summaries and links for additional information on matters related to asylum claims, issuance of RFES and NOIDs, Notice to Appear guidance, conditional residence removal options, impacts of school transfers on OPT, and the August 2018 visa bulletin.International Taxation Overview & Update

International Taxation Overview & UpdateSan Diego Center for International Trade Development

Ěý

The document provides an overview and update on international taxation rules for cross-border transactions. It discusses key concepts like controlled foreign corporations, foreign tax credits, FACTA requirements, and filing requirements for outbound and inbound international transactions. Failure to comply with foreign reporting rules can result in civil and in some cases criminal penalties. The presentation aims to help people understand and properly adhere to the complex IRS regulations for international tax compliance.Non-resident taxation seminar 2012 at UTSA

Non-resident taxation seminar 2012 at UTSAUTSA_International

Ěý

The document details the non-resident taxation workshop presented on February 28, 2013, focusing on residency status, types of income, and required tax forms for non-residents. It highlights key points such as the substantial presence test, limitations on available credits, and specific forms needed for compliance. Additional resources like the Glacier Tax Prep system and the IRS submission address are also provided for further assistance.Overseas filing for us taxpayers 2017

Overseas filing for us taxpayers 2017NML Consultores - US Tax Consultants

Ěý

U.S. taxpayers, including citizens and resident aliens, must file income tax returns if they meet certain income thresholds, with specific forms due by April 18, 2017, or June 15, 2017. Key topics covered include foreign earned income exclusion, foreign tax credits, and various reporting requirements for foreign financial accounts, including FinCEN Form 114 and FATCA Form 8938. Taxpayers must file accurately to avoid steep penalties, with detailed eligibility and filing requirements outlined for foreign tax credits and the foreign earned income exclusion.ACM NTK seminar Overseas filing for us taxpayers 2017

ACM NTK seminar Overseas filing for us taxpayers 2017NML Consultores - US Tax Consultants

Ěý

U.S. taxpayers living abroad have filing requirements regarding their overseas income and financial accounts. They must file annual tax returns reporting worldwide income and may qualify for the foreign earned income exclusion. The foreign tax credit allows taxpayers to claim taxes paid to foreign governments to avoid double taxation. Additionally, taxpayers with over $10,000 in foreign financial accounts must file an FBAR report and may need to report foreign assets on Form 8938 if thresholds are met. Failure to comply with these filing requirements can result in significant penalties.1000.pdf

1000.pdfkashifkashif29

Ěý

Postcode

Telephone number

( ) ( )

Country code Area code Number

Mobile/cell

Email address

Is the assistant a registered migration agent or exempt from

registration?

No

Yes Please provide:

OR

Migration agent registration number (MARN)

Name of law firm (if relevant)

Declaration and signature

49 I understand that I may be asked to provide further information to verify

any statements made in this nomination.

Signature of

nominator -

Date

Day Month Year

Attachments

50 Please attach the following documents:

- A personal statement summarising the applicant’s achievements

- Details of your own achievements in the same field as the applicant

- Supporting documentation aboutUnit 3 – State and Federal Taxes Review

Unit 3 – State and Federal Taxes ReviewDawn Adams2

Ěý

Unit 3 covers important information about state and federal taxes, including:

- The IRS and state departments of revenue collect taxes to fund government programs.

- Earned income comes from employment while unearned income includes benefits.

- Forms W-4 and W-2 relate to tax withholding and reporting of wages.

- Dependents and filing statuses impact tax returns, which are due April 15 each year.International Taxation – US Citizen and Green Card Holder (Resident Alien)

International Taxation – US Citizen and Green Card Holder (Resident Alien)Smart Accountants

Ěý

The webinar covers essential topics for U.S. citizens and green card holders regarding international taxation, including foreign banks, financial accounts, foreign tax credits, earned income exclusions, and various tax forms like 1040 and 5471. Key discussions involve residency status, the sources of income, and the implications of pre-immigration tax planning. Additionally, it highlights penalties for non-compliance and the benefits of U.S. tax treaties with foreign countries.U.S. AND CANADA IMMIGRATION LAW NEWS AND UPDATES US Immigration and Family Se...

U.S. AND CANADA IMMIGRATION LAW NEWS AND UPDATES US Immigration and Family Se...Nachman Phulwani Zimovcak (NPZ) Law Group, P.C.

Ěý

Ad

More from Trinity University International Student & Scholar Services (6)

Employment in F-1 Status

Employment in F-1 StatusTrinity University International Student & Scholar Services

Ěý

This document summarizes different types of on-campus and off-campus employment options for international students. It discusses working on campus, curricular practical training (CPT) internships, optional practical training (OPT) before and after graduation, economic hardship employment, and special situations like the H-1B extension and international organization employment. The last section provides contact information for the International Student and Scholar Services office for questions about employment authorization.Career Planning Workshop for International Students - Spring 2014

Career Planning Workshop for International Students - Spring 2014Trinity University International Student & Scholar Services

Ěý

The document outlines a four-year career planning strategy for international students at Trinity University, emphasizing the importance of early preparation, engaging with career advisors, and actively seeking job opportunities. It encourages students to enhance their competitiveness through volunteering, internships, and networking while utilizing resources such as TigerJobs and alumni connections. Additionally, it provides information about career advising hours and an immigration planning session.Hiring and inviting international scholars

Hiring and inviting international scholarsTrinity University International Student & Scholar Services

Ěý

This document provides an overview of hiring international employees on H-1B visa status. It discusses the differences between an H-1B visa stamp and H-1B status, as well as the requirements and procedures for employers. The process involves filing an LCA with the Department of Labor, an H-1B petition with USCIS, obtaining an H-1B visa stamp if outside the US, and ongoing compliance requirements for employers and employees.Post graduation employment options for international students

Post graduation employment options for international studentsTrinity University International Student & Scholar Services

Ěý

The document provides information about post-graduation employment options for international students in the United States. It discusses Optional Practical Training (OPT) as the ideal bridge between studies and employment. It warns against skipping OPT and moving directly to H-1B sponsorship, advising that OPT allows students to gain experience and try multiple jobs without paperwork for employers. The document also summarizes the H-1B visa process, including employer obligations, fees, quotas that limit the number of H-1B visas each year, and alternatives to H-1B like the TN, E-3, and J-1 visas.International Women's Day 2014

International Women's Day 2014 Trinity University International Student & Scholar Services

Ěý

International Women's Day is celebrated on March 8th to recognize women's achievements and raise awareness for gender equality. This year's theme calls for advocating for women's advancement in all areas of life. Events around the world include entrepreneurship training in Jordan, a soccer festival in India to honor women in sports, and an event in Nigeria promoting female entrepreneurs. The document also profiles inspirational world leaders and outstanding alumnae from Trinity University who have helped empower women.Employment in F-1 Status

Employment in F-1 StatusTrinity University International Student & Scholar Services

Ěý

This document summarizes the different types of employment options available to international students in the United States, including on-campus employment, off-campus employment, curricular practical training (CPT), optional practical training (OPT), and economic hardship employment. It provides details on eligibility requirements, application processes, and reporting obligations for each type of employment. The document also addresses related topics like traveling abroad during OPT and extending status through H-1B petitions. International students are advised to consult with their International Student and Scholar Services office for the most up-to-date information and regulations.Career Planning Workshop for International Students - Spring 2014

Career Planning Workshop for International Students - Spring 2014Trinity University International Student & Scholar Services

Ěý

Hiring and inviting international scholars

Hiring and inviting international scholarsTrinity University International Student & Scholar Services

Ěý

Post graduation employment options for international students

Post graduation employment options for international studentsTrinity University International Student & Scholar Services

Ěý

Ad

Basic Tax Information for F-1 Visa Holders

- 1. BASIC TAX INFORMATION FOR F1 VISA HOLDERS INTERNATIONAL STUDENTS TRINITY UNIVERSITY

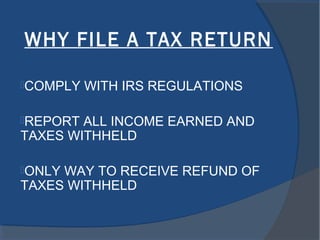

- 3. WHY FILE A TAX RETURN ď‚žCOMPLY WITH IRS REGULATIONS ď‚žREPORT ALL INCOME EARNED AND TAXES WITHHELD ď‚žONLY WAY TO RECEIVE REFUND OF TAXES WITHHELD

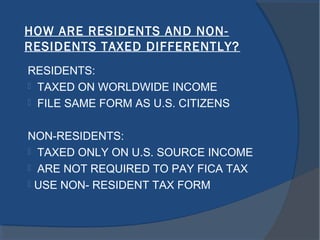

- 4. HOW ARE RESIDENTS AND NON- RESIDENTS TAXED DIFFERENTLY? RESIDENTS: ď‚ž TAXED ON WORLDWIDE INCOME ď‚ž FILE SAME FORM AS U.S. CITIZENS NON-RESIDENTS: ď‚ž TAXED ONLY ON U.S. SOURCE INCOME ď‚ž ARE NOT REQUIRED TO PAY FICA TAX ď‚ž USE NON- RESIDENT TAX FORM

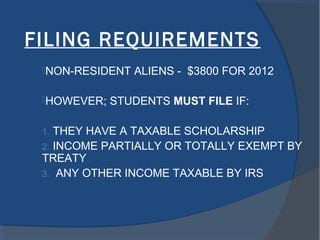

- 5. FILING REQUIREMENTS ď‚žNON-RESIDENT ALIENS - $3800 FOR 2012 ď‚žHOWEVER; STUDENTS MUST FILE IF: 1. THEY HAVE A TAXABLE SCHOLARSHIP 2. INCOME PARTIALLY OR TOTALLY EXEMPT BY TREATY 3. ANY OTHER INCOME TAXABLE BY IRS

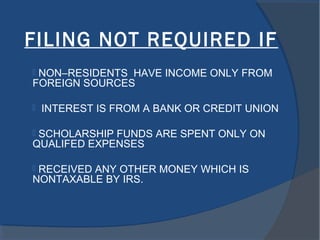

- 6. FILING NOT REQUIRED IF  NON–RESIDENTS HAVE INCOME ONLY FROM FOREIGN SOURCES  INTEREST IS FROM A BANK OR CREDIT UNION  SCHOLARSHIP FUNDS ARE SPENT ONLY ON QUALIFED EXPENSES  RECEIVED ANY OTHER MONEY WHICH IS NONTAXABLE BY IRS.

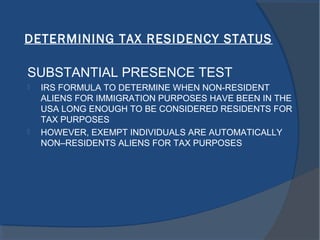

- 7. DETERMINING TAX RESIDENCY STATUS SUBSTANTIAL PRESENCE TEST  IRS FORMULA TO DETERMINE WHEN NON-RESIDENT ALIENS FOR IMMIGRATION PURPOSES HAVE BEEN IN THE USA LONG ENOUGH TO BE CONSIDERED RESIDENTS FOR TAX PURPOSES  HOWEVER, EXEMPT INDIVIDUALS ARE AUTOMATICALLY NON–RESIDENTS ALIENS FOR TAX PURPOSES

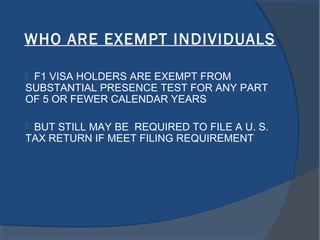

- 8. WHO ARE EXEMPT INDIVIDUALS ď‚ž F1 VISA HOLDERS ARE EXEMPT FROM SUBSTANTIAL PRESENCE TEST FOR ANY PART OF 5 OR FEWER CALENDAR YEARS ď‚ž BUT STILL MAY BE REQUIRED TO FILE A U. S. TAX RETURN IF MEET FILING REQUIREMENT

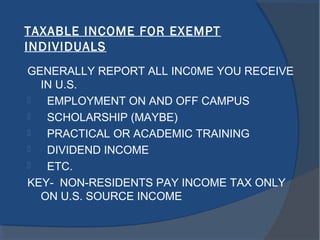

- 9. TAXABLE INCOME FOR EXEMPT INDIVIDUALS GENERALLY REPORT ALL INC0ME YOU RECEIVE IN U.S. ď‚ž EMPLOYMENT ON AND OFF CAMPUS ď‚ž SCHOLARSHIP (MAYBE) ď‚ž PRACTICAL OR ACADEMIC TRAINING ď‚ž DIVIDEND INCOME ď‚ž ETC. KEY- NON-RESIDENTS PAY INCOME TAX ONLY ON U.S. SOURCE INCOME

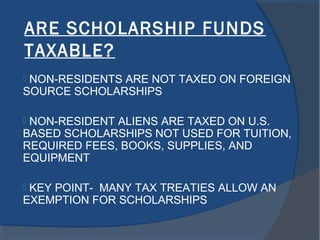

- 10. ARE SCHOLARSHIP FUNDS TAXABLE? ď‚ž NON-RESIDENTS ARE NOT TAXED ON FOREIGN SOURCE SCHOLARSHIPS ď‚ž NON-RESIDENT ALIENS ARE TAXED ON U.S. BASED SCHOLARSHIPS NOT USED FOR TUITION, REQUIRED FEES, BOOKS, SUPPLIES, AND EQUIPMENT ď‚ž KEY POINT- MANY TAX TREATIES ALLOW AN EXEMPTION FOR SCHOLARSHIPS

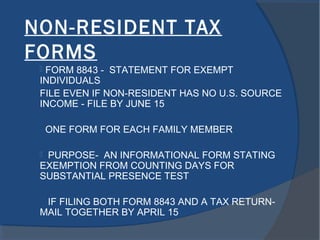

- 11. NON-RESIDENT TAX FORMS ď‚ž FORM 8843 - STATEMENT FOR EXEMPT INDIVIDUALS FILE EVEN IF NON-RESIDENT HAS NO U.S. SOURCE INCOME - FILE BY JUNE 15 ONE FORM FOR EACH FAMILY MEMBER ď‚ž PURPOSE- AN INFORMATIONAL FORM STATING EXEMPTION FROM COUNTING DAYS FOR SUBSTANTIAL PRESENCE TEST IF FILING BOTH FORM 8843 AND A TAX RETURN- MAIL TOGETHER BY APRIL 15

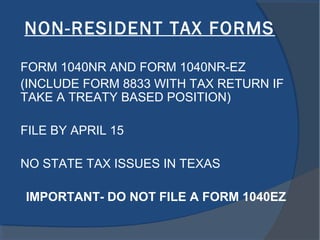

- 12. NON-RESIDENT TAX FORMS FORM 1040NR AND FORM 1040NR-EZ (INCLUDE FORM 8833 WITH TAX RETURN IF TAKE A TREATY BASED POSITION) FILE BY APRIL 15 NO STATE TAX ISSUES IN TEXAS IMPORTANT- DO NOT FILE A FORM 1040EZ

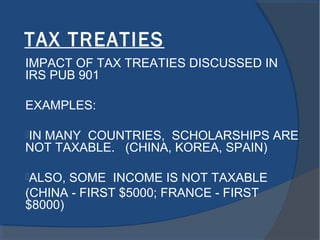

- 13. TAX TREATIES IMPACT OF TAX TREATIES DISCUSSED IN IRS PUB 901 EXAMPLES: ď‚žIN MANY COUNTRIES, SCHOLARSHIPS ARE NOT TAXABLE. (CHINA, KOREA, SPAIN) ď‚žALSO, SOME INCOME IS NOT TAXABLE (CHINA - FIRST $5000; FRANCE - FIRST $8000)

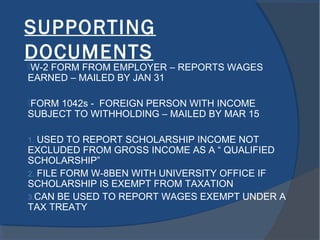

- 14. SUPPORTING DOCUMENTS W-2 FORM FROM EMPLOYER – REPORTS WAGES EARNED – MAILED BY JAN 31 FORM 1042s - FOREIGN PERSON WITH INCOME SUBJECT TO WITHHOLDING – MAILED BY MAR 15 1. USED TO REPORT SCHOLARSHIP INCOME NOT EXCLUDED FROM GROSS INCOME AS A “ QUALIFIED SCHOLARSHIP” 2. FILE FORM W-8BEN WITH UNIVERSITY OFFICE IF SCHOLARSHIP IS EXEMPT FROM TAXATION 3.CAN BE USED TO REPORT WAGES EXEMPT UNDER A TAX TREATY

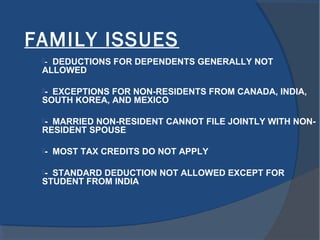

- 15. FAMILY ISSUES ď‚ž- DEDUCTIONS FOR DEPENDENTS GENERALLY NOT ALLOWED ď‚ž- EXCEPTIONS FOR NON-RESIDENTS FROM CANADA, INDIA, SOUTH KOREA, AND MEXICO ď‚ž- MARRIED NON-RESIDENT CANNOT FILE JOINTLY WITH NON- RESIDENT SPOUSE ď‚ž- MOST TAX CREDITS DO NOT APPLY ď‚ž- STANDARD DEDUCTION NOT ALLOWED EXCEPT FOR STUDENT FROM INDIA

- 16. SPOUSE AND DEPENDENTS ď‚ž- FORM 8843 ď‚ž- U.S. SOURCE INCOME MUST BE REPORTED

- 17. FILING STATUS AND DEPENDENTS MOST NON-RESIDENT ALIENS CANNOT CLAIM THEIR DEPENDENTS – EVEN IF THE DEPENDENT IS A U.S. CITIZEN

- 18. SOCIAL SECURITY TAX ď‚žNON-RESIDENTS WITH AN F1 VISA ARE EXEMPT FROM SOCIAL SECURITY AND MEDICARE TAXES ď‚žIF RESIDENT FOR TAX PURPOSES, USUALLY SUBJECT TO FICA TAXES

- 19. FICA REFUNDS WHEN WITHHELD IN ERROR ď‚ž ASK EMPLOYER TO REFUND ď‚ž IF NOT REFUNDED, USE IRS FORM 843 TO REQUEST A REFUND

- 20. DO I NEED A SSN OR ITIN  IF FILING ONLY FORM 8843 - NO NUMBER REQUIRED ANY 1040 TAX FORM – NEED A SOCIAL SECURITY NUMBER OR INDIVIDUAL TAXPAYER IDENTIFICATION NUMBER(ITIN) FILE FORM W-7 TO REQUEST AN ITIN DEPENDENTS MUST ALSO HAVE SSN OR ITIN IF TAX CODE ALLOWS AN EXEMPTION

- 21. ADDITIONAL TAX RESOURCES ď‚žIRS PUBLICATIONS ď‚žPUB 519 TAX GUIDE FOR ALIENS ď‚žPUB 901 TAX TREATIES ď‚žTAX PREPARATION SPECIALISTS

- 22. ADDITIONAL QUESTIONS PLEASE CONTACT: LARRY BARKER ENROLLED AGENT & MASTER TAX ADVISOR LARRY.BARKER@TAX.HRBLOCK.COM 210-653-6507