Lecture 8 responsiblity accounting and transfer pricing

- 2. RESPONSIBILITY CENTERS Characteristics of responsibility centers are: ’üĮ Decision rights are specified for each center. ’üĮ Performance measurement is measured by an internal accounting information system. Types of responsibility centers: cost, profit, investment.

- 3. COST CENTERS Types of Knowledge: ’üĮ Central management knows the desired production quantity. ’üĮ Cost center manager knows how to mix inputs. Decision rights: ’üĮ The cost center manager can choose the quantity and quality of inputs (labor, material, supplies). Measurement: ’üĮ Minimize total cost. ’üĮ Maximize output.

- 4. COST CENTERS ’üĮ Minimizing average cost does not maximize profits. ’üĮ Cost centers have an incentive to produce more units to spread fixed costs over a large number of units. ’üĮ Quality of products must be monitored.

- 5. PROFIT CENTERS Types of Knowledge: ’üĮ Profit center managers know their market including correct product mix, demand and pricing. Decision rights: ’üĮ Profit center managers can chose input mix, product mix, and selling prices. ’üĮ Fixed capital budget. Measurement: ’üĮ Profits. ’üĮ Profits compared to budget.

- 6. CHALLENGES WITH PROFIT CENTERS ’üĮ Setting transfer prices between centers. ’üĮ Allocating corporate overhead costs to centers. ’üĮ Profit centers that focus only on profits often ignore how their actions affect other responsibility centers.

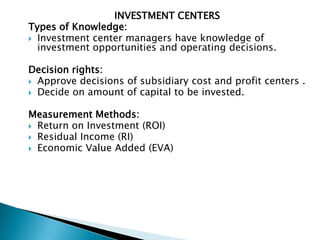

- 7. INVESTMENT CENTERS Types of Knowledge: ’üĮ Investment center managers have knowledge of investment opportunities and operating decisions. Decision rights: ’üĮ Approve decisions of subsidiary cost and profit centers . ’üĮ Decide on amount of capital to be invested. Measurement Methods: ’üĮ Return on Investment (ROI) ’üĮ Residual Income (RI) ’üĮ Economic Value Added (EVA)

- 8. INVESTMENT CENTER MEASURES Return on Investment (ROI) = Accounting net income ’éĖTotal assets invested DuPont formula separates ROI into two components: ROI= Sales turnover ’ĆĀ’é┤ Return on sales ROI= (Sales ’éĖ Total Investment) ’é┤ (Net Income ’éĖ Sales) Focusing on ROI can cause underinvestment.

- 9. INVESTMENT CENTER MEASURES Residual income (RI) = Net income ’ĆŁ (Required rate of return ’é┤ Capital invested) ’üĮ RI is determined by accounting measurements of net income and capital. ’üĮ Each investment center can be assigned a different rate of return depending on its risk. ’üĮ RI can be increased by increasing income or decreasing investment.

- 10. INVESTMENT CENTER MEASURES Economic value added (EVA) = Adjusted net income’ĆŁ (Weighted average cost of capital ’é┤ Capital invested) Examples of EVA adjustments to net income: ’üĮ Research and development (R&D) is amortized over 5 years for EVA, but expensed immediately for financial accounting. ’üĮ Unamortized R&D is included in capital for EVA, but treated is treated as an expired cost (zero value) for financial accounting.

- 11. EVA ’üĮ EVA can be increased in three ways: ŌŚ” Increase the efficiency of existing operations. ŌŚ” Increase the amount of capital invested when the return is greater than the weighted average cost of capital. ŌŚ” Withdraw capital from operations when the investment return is less than the firmŌĆÖs weighted average cost of capital.

- 12. CHALLENGES WITH INVESTMENT CENTER MEASURES ’üĮ Disputes over how to measure income and capital. ’üĮ Difficult to compare investment centers of different sizes. ’üĮ Central management must monitor product quality and market strategies of investment centers to reduce possibility of damage to firmŌĆÖs reputation.

- 13. MEASUREMENT ISSUES Controllability Principle: ’üĮ Hold center managers responsible for only those costs and decisions for which they can control. Drawbacks of controllability principle: ’üĮ If managers suffer no consequences from events outside their direct control, they have no incentive to take actions to mitigate the consequences of uncontrollable events (such as storms, corporate income taxes, etc.)

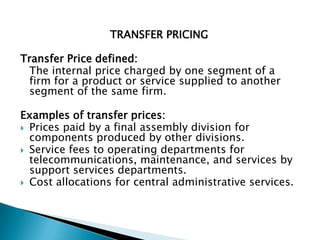

- 14. TRANSFER PRICING Transfer Price defined: The internal price charged by one segment of a firm for a product or service supplied to another segment of the same firm. Examples of transfer prices: ’üĮ Prices paid by a final assembly division for components produced by other divisions. ’üĮ Service fees to operating departments for telecommunications, maintenance, and services by support services departments. ’üĮ Cost allocations for central administrative services.

- 15. Transfer prices have multiple effects: Performance measurement: ’üĮ Transfer prices reallocate company profits among business segments. ’üĮ Influence decision making by division managers. Incentives: ’üĮ Compensation of divisional managers. Partitioning decision rights: ’üĮ Disputes over determining transfer prices.

- 16. DIFFERENT CONCEPTS OF TRANSFER PRICE ’üĮ External market price ŌŚ” If external markets are comparable ’üĮ Variable cost of production ŌŚ” Exclude fixed costs which are unavoidable ’üĮ Full-cost of production ŌŚ” Average fixed and variable cost ’üĮ Negotiated prices ŌŚ” Depends on bargaining power of divisions

- 17. CHALLENGES OF TRANSFER PRICING ’üĮ Disputes over transfer pricing occur because transfer prices influence performance evaluations of managers. ’üĮ Internal accounting data are often used to set transfer prices, even when external market prices are available. ’üĮ Classifying costs as fixed or variable can influence transfer prices determined by internal accounting data. ’üĮ To reduce transfer pricing disputes, firms may combine interdependent segments or spin off some segments as separate firms.

- 18. When products or services of a multinational firm are transferred between segments located in countries with different tax rates, the firm attempts to set a transfer price that minimizes total income tax liability. Segment in higher tax country: Reduce taxable income in that country by charging high prices on imports and low prices on exports. Segment in lower tax country: Increase taxable income in that country by charging low prices on imports and high prices on exports.