Legg Mason

- 1. BY: RAUTION JAISWAL WILLAMETTE UNIVERSITY (ATKINSON GRADUATE SCHOOL OF MANAGEMENT) Company Analysis Presentation November 13, 2007 ______________

- 2. Legg Mason Inc . Overview : Legg Mason is a global asset management company. It serves wide variety of clients including institutional and individual investors. It operates in three divisions: Managed investments, institutional and Wealth Management. Legg MasonˇŻs mission is to be, and be regarded as, one of the best Asset management firm in the world.

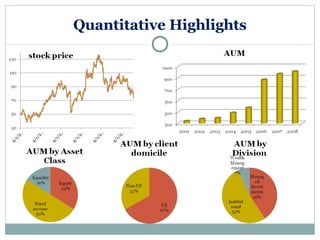

- 3. Legg Mason Inc . Key Facts : Legg Mason Inc. is among the top 5 US money managers. As of Sep. 30, 2007, asset under management is aggregated $ 1.012 trillion. Legg Mason serves institutional and individual clients in over 190 countries. As of Sep. 30, 2007, asset under management from non-US domiciled clients aggregated $336 billion (33%).

- 5. Financial Service Industry: Overview Effects of subprime mortgage industry is deep. Technological advancement and financial product innovation will be key factors to drive growth. Steady growth is expected in Asia and Europe. In short term, economic conditions are not ideal so are the earning prospects.

- 6. Industry Forecast Scale will be the key to generate edge More crowded and complicated industry landscape A measured pace for merger and acquisition Tough pricing environment Tighter lending standards High level of transparency Greater appreciation for risk aversion Product innovation

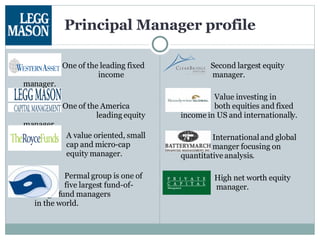

- 7. Principal Manager profile One of the leading fixed income manager. One of the America leading equity manager. A value oriented, small cap and micro-cap equity manager. Permal group is one of the five largest fund-of- hedge-fund managers in the world. Second largest equity manager. Value investing in both equities and fixed income in US and internationally. International and global manger focusing on quantitative analysis. High net worth equity manager.

- 8. Legg Mason Inc. Highlights for 2008-2009: AUM to grow about 10% in FY 08ˇŻ and 12% in 09ˇŻ. Operating profit to grow at 30% p.a. Net distribution expense has reduced by 42% in FY 08ˇŻ and expected to reduced at same rate in 09ˇŻ. Under-performance by top equity managers has effected the earnings of 08ˇŻ.

- 9. Legg Mason: Good Buy or Goodbye ? Benefits of synergy is still to be effective. Equity managers will soon recover from their recent slump. Long term trend favoring retirement planning company such as Legg Mason. Legg Mason missed its earning for three consecutive quarters. It has experienced substantial growth in international market.

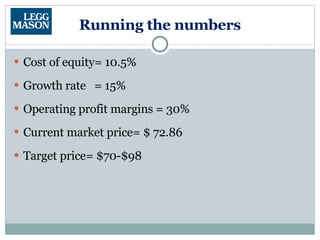

- 10. Running the numbers Cost of equity= 10.5% Growth rate = 15% Operating profit margins = 30% Current market price= $ 72.86 Target price= $70-$98

- 11. Legg Mason Inc. Risk and quality assessment: Market risk Relative investment performance Regulatory issues Integration challenges Operational and support risk Quality of management