Liable Business Income - Taxation (BBAA 23).ppt

- 1. Course Title: Business Taxation Business Taxation Course Code: BBAA 31033 Credit Value: 3 Status : Level 3/ Semester 1 /Core

- 2. Assessable Income from Business BBAA 22033 Taxation

- 3. Learning Outcomes: After completing this topic, you will be able to: âĒ define liable Business income âĒ define trade and business under taxation. âĒ describe allowed income, allowed expenses, disallowed income, and disallowed expenses under taxable business income calculation. âĒ calculate capital allowances on non-current assets according to Inland Revenue Act.

- 4. Assessable income from business âĒ Income from a business for a year of assessment is the gains and profit from conducting the business for the year, âĒ it is liable to income tax.

- 5. Definition of a Business âĒ A trade, profession or vocation

- 6. Income from Trade, Business, Profession, and Vocation âĒ It is one of the major sources of income under an individual, partnership, and company income tax calculation. âĒ Department of Inland Revenue provides guidance, on how to compute assessable income from trade, business and profession.

- 7. Trade âĒ A person has purchased some commercial quantities of items which are more than enough for him, âĒ if such articles are held for a short period, âĒ transactions are repetitive âĒ anything has been done to have a saleable item, âĒ any such motivation to make profits,

- 8. Calculation of Gains and Profits from Business âĒ In order to arrive at the assessable income from the business, all expenses incurred in the production of income are allowed as deductions,

- 9. Profession âĒ Any person engaged in professional activity with his special skills and knowledge. âĒ A Chartered Accountant engaged in accounting practice. âĒ Professional income is subject to withholding tax at the rate of 5%. âĒ It is a tax credit.

- 10. Example âĒ Mr. Mano is a Chartered Engineer working since 2015 for a construction company in Sri Lanka. âĒ He provides engineering consultancy services to few other companies in Sri Lanka as an independent professional, and received consultancy fee. The amount received in cash after deducting withholding tax at 5% is Rs.475, 000. He has deducted expenditure for tax purpose amounting to Rs.123,000. âĒ He also provided consultancy service to a hotel in India being in Sri Lanka, an the net amount received in foreign currency is 1460. 1 US$ equals to Rs.170 as at the end of the year of assessment.

- 11. Vocation âĒ Vocation is an occupation. âĒ she or he is suited, trained or qualified. âĒ Born skills. singer, actor

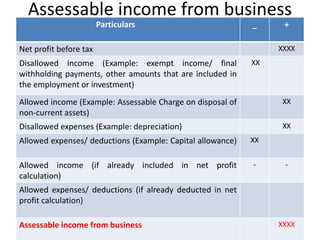

- 12. Assessable income from business Particulars _ + Net profit before tax XXXX Disallowed income (Example: exempt income/ final withholding payments, other amounts that are included in the employment or investment) XX Allowed income (Example: Assessable Charge on disposal of non-current assets) XX Disallowed expenses (Example: depreciation) XX Allowed expenses/ deductions (Example: Capital allowance) XX Allowed income (if already included in net profit calculation) - - Allowed expenses/ deductions (if already deducted in net profit calculation) Assessable income from business XXXX

- 13. Allowed expenses âĒ Some expenses can be allowed to deduct from business income in accordance with Inland Revenue Act. âĒ Such expenses should be related to the production of income or business. Examples: âĒ Salaries to staff âĒ Advertisement cost âĒ Electricity charges âĒ Telephone charges

- 14. Allowed income âĒ Some income can be allowed to add to business income in accordance with Inland Revenue Act. âĒ Such income should be related to the production of income or business. Example: âĒ Old bottle sales for soda Distribution Company

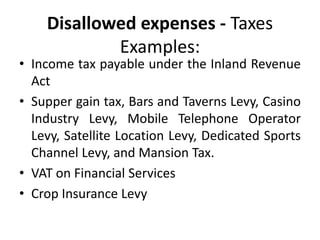

- 15. Disallowed expenses âĒ Some expenses cannot be allowed to deduct from business income in accordance with Inland Revenue Act. âĒ Such expenses are not related to the production of income so cannot be deducted such expenses from business income.

- 16. Disallowed expenses-Examples: âĒ Entertainment expenses or outlays, âĒ Reserves or provisions,

- 17. Disallowed expenses - Taxes Examples: âĒ Income tax payable under the Inland Revenue Act âĒ Supper gain tax, Bars and Taverns Levy, Casino Industry Levy, Mobile Telephone Operator Levy, Satellite Location Levy, Dedicated Sports Channel Levy, and Mansion Tax. âĒ VAT on Financial Services âĒ Crop Insurance Levy

- 18. CAPITAL ALLOWANCES OF NON- CURRENT ASSESTS

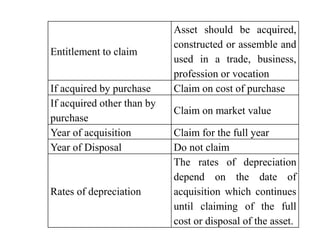

- 19. Entitlement to claim Asset should be acquired, constructed or assemble and used in a trade, business, profession or vocation If acquired by purchase Claim on cost of purchase If acquired other than by purchase Claim on market value Year of acquisition Claim for the full year Year of Disposal Do not claim Rates of depreciation The rates of depreciation depend on the date of acquisition which continues until claiming of the full cost or disposal of the asset.

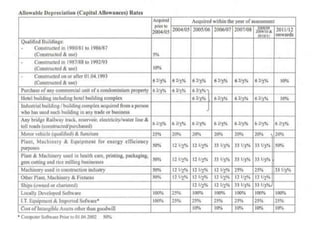

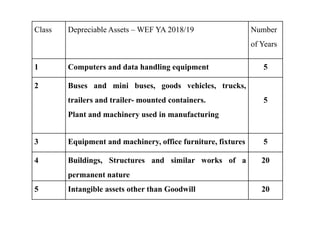

- 21. Class Depreciable Assets â WEF YA 2018/19 Number of Years 1 Computers and data handling equipment 5 2 Buses and mini buses, goods vehicles, trucks, trailers and trailer- mounted containers. Plant and machinery used in manufacturing 5 3 Equipment and machinery, office furniture, fixtures 5 4 Buildings, Structures and similar works of a permanent nature 20 5 Intangible assets other than Goodwill 20

- 22. âĒ Car - not entitled for capital allowances

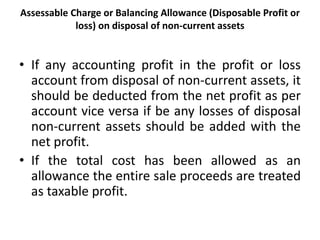

- 23. Assessable Charge or Balancing Allowance (Disposable Profit or loss) on disposal of non-current assets âĒ If any accounting profit in the profit or loss account from disposal of non-current assets, it should be deducted from the net profit as per account vice versa if be any losses of disposal non-current assets should be added with the net profit. âĒ If the total cost has been allowed as an allowance the entire sale proceeds are treated as taxable profit.

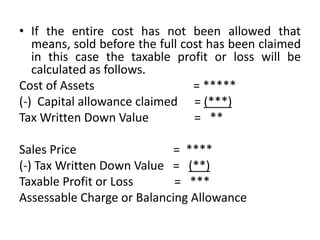

- 24. âĒ If the entire cost has not been allowed that means, sold before the full cost has been claimed in this case the taxable profit or loss will be calculated as follows. Cost of Assets = (-) Capital allowance claimed = (***) Tax Written Down Value = ** Sales Price = **** (-) Tax Written Down Value = (**) Taxable Profit or Loss = *** Assessable Charge or Balancing Allowance

- 25. Replacement âĒ One asset can be replaced with another asset âĒ Replacement should fulfill the three criteria to consider as replacement for the tax. âĒ If full fill above three criteria, the disposal assetâs any taxable profit can be set off against purchase new assets and capital allowance will be allowed for the purchase assets after deducting amount.

- 26. âĒ But any loss occurs by disposal any assets if that time held any replacement, the disposal assetsâ loss cannot be deducted or added with purchase value of the new assets. The loss amount will be considered as allowed expenses.

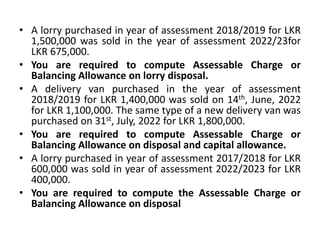

- 27. âĒ A lorry purchased in year of assessment 2018/2019 for LKR 1,500,000 was sold in the year of assessment 2022/23for LKR 675,000. âĒ You are required to compute Assessable Charge or Balancing Allowance on lorry disposal. âĒ A delivery van purchased in the year of assessment 2018/2019 for LKR 1,400,000 was sold on 14th, June, 2022 for LKR 1,100,000. The same type of a new delivery van was purchased on 31st, July, 2022 for LKR 1,800,000. âĒ You are required to compute Assessable Charge or Balancing Allowance on disposal and capital allowance. âĒ A lorry purchased in year of assessment 2017/2018 for LKR 600,000 was sold in year of assessment 2022/2023 for LKR 400,000. âĒ You are required to compute the Assessable Charge or Balancing Allowance on disposal

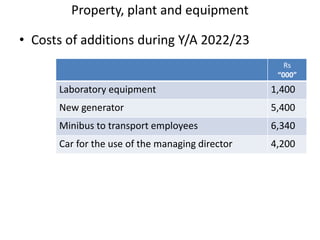

- 28. Property, plant and equipment âĒ Costs of additions during Y/A 2022/23 Rs â000â Laboratory equipment 1,400 New generator 5,400 Minibus to transport employees 6,340 Car for the use of the managing director 4,200

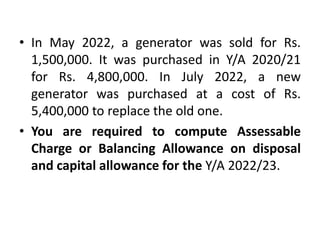

- 29. âĒ In May 2022, a generator was sold for Rs. 1,500,000. It was purchased in Y/A 2020/21 for Rs. 4,800,000. In July 2022, a new generator was purchased at a cost of Rs. 5,400,000 to replace the old one. âĒ You are required to compute Assessable Charge or Balancing Allowance on disposal and capital allowance for the Y/A 2022/23.