Mand a toolkit value creation principles

2 likes1,073 views

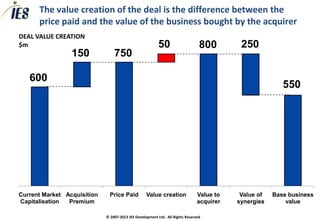

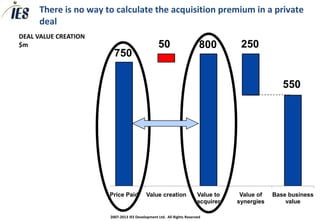

The document discusses valuation principles for mergers and acquisitions (M&A). It provides examples of how the value creation of a deal can be calculated as the difference between the price paid and the value of the business acquired. It also examines how the synergies from a deal must exceed the acquisition premium for the target company to be accurately priced "as is". Finally, it discusses how the share prices of the acquirer and target companies can provide an analysis of the estimated market value creation during a deal.

1 of 7

Recommended

Mand a toolkit negotiating

Mand a toolkit negotiatingchrisdoran

Ěý

The document provides guidance on key considerations for negotiating mergers and acquisitions (M&A). It discusses determining key price points such as the walk-away price and target price. It also covers identifying different shareholder types and their motivations, as well as structuring deals to create win-win value. The document emphasizes doing research beforehand, understanding both sides' valuations, and using an effective negotiating process and tactics.Mand a toolkit facts on manda

Mand a toolkit facts on mandachrisdoran

Ěý

This document provides an overview of best practices and common pitfalls for mergers and acquisitions (M&A). Only 20-30% of M&A deals create value, yet they remain popular due to cognitive biases. Historical data shows that small, related, cash deals with a strong acquirer are most likely to succeed. Poor strategic fit, illusory synergies, overpaying, weak due diligence, and failed integration often lead to value destruction. The keys to M&A success are a clear strategy, aligned thinking throughout the process, and healthy skepticism.Mand a toolkit value hypotheses

Mand a toolkit value hypotheseschrisdoran

Ěý

The document discusses strategic fit and value hypotheses in mergers and acquisitions (M&A). It provides examples of ways to create value through M&A, including undervalued targets, synergies from cost reductions and revenue increases, and financial engineering. It emphasizes that the value hypothesis should quantify and specify how value will be realized through post-merger integration. The "natural owner" concept is introduced as the potential buyer that can realize the highest synergies from a target.Mand a toolkit synergies

Mand a toolkit synergieschrisdoran

Ěý

1) The document discusses valuation techniques for mergers and acquisitions (M&A), focusing on synergies.

2) Synergies are cost savings and revenue increases that can be realized by combining two companies.

3) The value created by a deal is the difference between the price paid and the value of the acquired business including synergies.Mand a toolkit due diligence

Mand a toolkit due diligencechrisdoran

Ěý

Poor due diligence can destroy an acquiring company. Ferranti purchased ISC for $1.1 billion in 1987 without discovering that ISC's profits were non-existent and came from illegal arms sales. Ken Lynch also lost his job as CEO of Bank of America after hastily conducting due diligence on Merrill Lynch over a weekend, resulting in BofA taking a $15.5 billion loss in the first quarter after acquiring Merrill. Due diligence serves to confirm the target's value, prove synergy assumptions, and uncover potential liabilities or "booby traps."Mand a toolkit deal structuring

Mand a toolkit deal structuringchrisdoran

Ěý

The document discusses various deal structuring considerations for mergers and acquisitions (M&A). It addresses primary deal structures such as whether to purchase assets or shares, and methods of payment like cash or stock. Deferred payments are presented as a way to overcome information asymmetry between the buyer and seller and allow deals to be negotiated when they have different assumptions about future performance. Key details to determine for deferred payment structures include payment timing, amount, and conditions.Mand a toolkit valuation methodologies

Mand a toolkit valuation methodologieschrisdoran

Ěý

This document discusses different valuation methodologies for mergers and acquisitions, including asset-based valuation, comparable multiples valuation, and discounted cash flow valuation. It outlines the pros and cons of each approach and notes that companies are rarely truly comparable. The document recommends using multiple valuation methods and presenting a valuation range rather than a single number.Mand a toolkit pmi theory

Mand a toolkit pmi theorychrisdoran

Ěý

The document discusses post-merger integration (PMI) theory and best practices. It emphasizes the importance of [1] protecting the acquired company's key resources, processes, and values to preserve deal value, [2] balancing fast integration with maintaining the acquired company's culture, and [3] determining leadership and integration approaches tailored to each specific deal. The framework provides guidance on assessing integration risks and prioritizing issues based on importance and urgency.Mand a toolkit building a valuation model

Mand a toolkit building a valuation modelchrisdoran

Ěý

The document provides steps for building a valuation model to value a company using discounted cash flow (DCF) analysis. It outlines 8 steps: 1) starting with a free cash flow projection, 2) calculating the weighted average cost of capital (WACC), 3) calculating the net present value for the forecast period by discounting the free cash flows using the WACC, 4) calculating a terminal value to estimate the value of cash flows beyond the projection period, 5) adding the net present value and terminal value to get an enterprise value, 6) deducting debt and other liabilities to derive an equity value, 7) dividing the equity value by shares outstanding to estimate a share price, and 8) performing sensitivity analysis on keyConsulting toolkit calculating financial impact

Consulting toolkit calculating financial impactchrisdoran

Ěý

The document provides guidance on presenting financial information to clients in a consulting context. It recommends structuring financials in a pyramid format with the following levels: 1) Summary financials, 2) Key assumptions and rationale, 3) Key drivers and sensitivities, 4) Upside opportunities and downside risks. It also provides tips on using charts and graphs to visualize numbers and effectively delivering and answering questions about financial projections.Int to Mktng ch1

Int to Mktng ch1Universidad de Monterrey

Ěý

The document provides an overview of marketing concepts. It defines marketing as the activity of creating, communicating, delivering, and exchanging offerings of value for customers, partners and society. It describes four marketing management philosophies: production, sales, marketing and societal orientations. It discusses the differences between sales and market orientations, focusing on customer value and satisfaction. It also provides several reasons for studying marketing, including its importance to business and society as well as career opportunities.20090829 financing overview

20090829 financing overviewMAHENDER BISHT

Ěý

The document discusses capital structure and financing options for firms, outlining sources of capital such as debt and equity and how firms can determine their optimal capital structure. It also reviews the financing process, including obtaining credit ratings and raising debt through private placements or public bond offerings. Key factors rating agencies examine like industry risk, market position, management quality, and financial metrics are outlined.Cox Residential

Cox ResidentialEric Johnson

Ěý

Cox Residential with Global Ambitions, Takes a Common-Sense Approach and is Empowering Real Estate Brokers Across the Nation to Work Together and Build Upon Their Platform for Sustainable Success Utilizing Mandatory Resources to Enhance Their Agents’ Business Across a Broad Spectrum.Tata valuation by aswath

Tata valuation by aswathAcademy of Financial Training

Ěý

Interesting valuation presentation by Aswath Damodaran where he values Tata Group companies using the DCF approach explained in detailBusiness model tbs 2012v3 ppt

Business model tbs 2012v3 pptWai Chamornmarn

Ěý

The document discusses various aspects of business models including value propositions, profit models, customer relationships, and key activities. It provides examples of different business model types such as subscription, loyalty programs, and low-cost carriers. Framework tools for designing business models are also introduced, including the value proposition designer and business model canvas for mapping the key elements of a business.Moats

MoatsSanjay Bakshi

Ěý

The document discusses Warren Buffett's investment in American Express in the 1960s when the company was embroiled in a "salad oil scandal" where it was defrauded of $150 million, causing its stock price to drop significantly. Buffett believed the market was overreacting and that American Express' "travelers checks" represented an attractive source of low-cost financing, as the company had to pay no interest on the funds and they served as a perpetual, revolving source of capital. This discovery of the value of "float" led Buffett to see it as an important competitive advantage for companies.Mand a toolkit generating a fcf forecast

Mand a toolkit generating a fcf forecastchrisdoran

Ěý

This document provides guidance on building a discounted cash flow (DCF) valuation model. It outlines the key steps to build a DCF model, including: 1) entering historical financial data, 2) calculating historical drivers and ratios, 3) projecting initial "vanilla" assumptions, 4) calculating projected financial statements, and 5) debugging the model. It then discusses generating a free cash flow forecast by developing assumptions around a future business "story" and key drivers. The final steps involve building the valuation model to calculate terminal value, equity value, and running sensitivities. Quick checks are also provided to test the model's reasonableness. The overall guidance emphasizes building the model logically and iteratively to generate a credible valuation.Hhtfa8e ch10 stud devry Accounting 212 FINANCIAL ACCOUNTING

Hhtfa8e ch10 stud devry Accounting 212 FINANCIAL ACCOUNTINGaaaala

Ěý

This document discusses different methods for accounting for long-term investments. It describes accounting for available-for-sale investments using fair value, equity method investments using proportionate share of investee income and dividends, and held-to-maturity bond investments using amortized cost. It also covers consolidated financial statements which combine the financial statements of a parent company and its subsidiaries.Added value issue 2

Added value issue 2Dionne Maclean

Ěý

- The document discusses creating or protecting value for clients in business transactions through consideration of the balance sheet. Specifically, it discusses enterprise value versus equity value, cash free/debt free offers, definitions of debt, and positioning these balance sheet factors in early negotiations.

- Key areas that can impact value and require interpretation are surplus assets, free cash, debt, working capital levels, and whether items like corporation tax are considered debt.

- Being prepared at the outset to include discussions of balance sheet factors can help position a client's interests when other parties may focus more on profits alone.What's a good business, what's a mediocre business, what's a bad business and...

What's a good business, what's a mediocre business, what's a bad business and...Sanjay Bakshi

Ěý

1. A business that can grow without requiring incremental capital is very special.

2. Time is a friend of businesses that can reinvest earnings at high rates of return, and an enemy of mediocre businesses that need to constantly pour in more capital for low returns.

3. The best businesses are those that can employ large amounts of incremental capital at very high rates of return over the long run.Stephane Guelat, Head of Strategic Procurement at Eaton Corporation - Develop...

Stephane Guelat, Head of Strategic Procurement at Eaton Corporation - Develop...Global Business Events

Ěý

This document discusses how Eaton can become a more attractive customer to suppliers. It notes that Eaton currently has over 12,000 unique suppliers in Europe. It outlines criteria that smart suppliers look for in customers, such as access to innovation, best total costs, and perfect quality and service. The document suggests Eaton work to establish formal strategic procurement and share data, communication channels, and process improvements with suppliers in order to maximize attractiveness and mutual benefit.Are you ready for Scaling Your Business

Are you ready for Scaling Your BusinessManish Singhal

Ěý

90% of start-ups fail while scaling up...this intuitive model helps you check whether you are ready for scaling your business!Funding Fundamentals

Funding FundamentalsManish Singhal

Ěý

The document discusses various modes of funding available for businesses, including angel investing, venture capital, private equity, debt, and IPOs. It outlines the advantages and disadvantages of each type of funding. The document also covers topics like company valuations, dilution, term sheets, and negotiating preferences between common and preferred stockholders.Driving Sales In A Tough Economy

Driving Sales In A Tough EconomyActegy Consulting

Ěý

Actegy Consulting is a sales growth consulting firm founded in 1996 that helps sales leadership drive results. They provide workshops, roundtables, and advisory services to both large and small clients. Their client list includes companies such as Intel, Comcast, and ADP. They help clients address issues such as pressure from competitors, budget constraints, and slow decision making. Their services include implementing programs to assess and address at-risk accounts and follow formal decision-making processes.Eso Ps

Eso PsCenterPoint Business Advisors

Ěý

This white paper discusses Employee Stock Ownership Plans (ESOPs) and how they can be used by business owners to sell their company. It explains that ESOPs allow owners to cash out at fair market value, pay no taxes on the sale, and transfer the company to employees. However, ESOPs require strong cash flow, good management, little debt, and aligned shareholder-employee interests to work well. The paper also outlines the ESOP buyout process, potential disadvantages like costs and fiduciary responsibilities, and questions owners should consider regarding ESOPs.Perfecting your Pitch for Launch Academy 2012

Perfecting your Pitch for Launch Academy 2012David Shore

Ěý

This is about how to communicate without distracting your audience, focusing your material on a value proposition and the required slides for an investor presentation. Marketing Your Product - A Guide for Entrepreneurs by Pradeep Anand

Marketing Your Product - A Guide for Entrepreneurs by Pradeep AnandPlatform Houston

Ěý

Pradeep Anand has been a keynote speaker at business workshops, conferences and meetings in North America, Speaking, educating and training have been integral to his consulting practice at Seeta Resources—helping CEOs and senior executives accelerate their firms’ revenue and margin growth.

He serves on the Advisory Board of the University of Houston's College of Technology and the Houston Technology Center. He is a founder and trustee of the IIT Alumni of Greater Houston.

Pradeep received his MBA from the University of Houston and his BS in Metallurgical Engineering from the Indian Institute of Technology (IIT), Bombay, India.Lead share alternative_financing_presentation

Lead share alternative_financing_presentationmehtanuj

Ěý

Small business owners face challenges accessing traditional bank financing. This document discusses alternative financing options for small businesses, including accounts receivable financing, friends and family loans, purchase order financing, angel investors, merchant cash advances, peer-to-peer lending, and equipment leasing. It also introduces Compound Profit, an alternative financing provider that offers various financing solutions to help small businesses grow and become profitable.Mand a toolkit 5 types of deal

Mand a toolkit 5 types of dealchrisdoran

Ěý

This document provides an overview of 5 types of M&A deals: overcapacity, geographic roll-up, product or market expansion, R&D, and industry convergence. It describes the strategic objective and value hypothesis for each type. It then provides examples and analyses of specific deals that fall under each category, such as Daimler-Chrysler (overcapacity), Marionnaud (geographic roll-up), and Diageo/Ketel One and Diageo/Seagrams (product expansion).Mand a toolkit pmi project management

Mand a toolkit pmi project managementchrisdoran

Ěý

The document discusses project management of post-merger integration. It emphasizes that integration requires key trade-offs in strategy and approach. A typical structure involves a steering committee, integration director, and cross-functional teams. Critical tasks include appointing leadership, developing communications, and tracking milestones. Effective integration balances the interests of multiple stakeholders through the merger process.More Related Content

What's hot (20)

Mand a toolkit building a valuation model

Mand a toolkit building a valuation modelchrisdoran

Ěý

The document provides steps for building a valuation model to value a company using discounted cash flow (DCF) analysis. It outlines 8 steps: 1) starting with a free cash flow projection, 2) calculating the weighted average cost of capital (WACC), 3) calculating the net present value for the forecast period by discounting the free cash flows using the WACC, 4) calculating a terminal value to estimate the value of cash flows beyond the projection period, 5) adding the net present value and terminal value to get an enterprise value, 6) deducting debt and other liabilities to derive an equity value, 7) dividing the equity value by shares outstanding to estimate a share price, and 8) performing sensitivity analysis on keyConsulting toolkit calculating financial impact

Consulting toolkit calculating financial impactchrisdoran

Ěý

The document provides guidance on presenting financial information to clients in a consulting context. It recommends structuring financials in a pyramid format with the following levels: 1) Summary financials, 2) Key assumptions and rationale, 3) Key drivers and sensitivities, 4) Upside opportunities and downside risks. It also provides tips on using charts and graphs to visualize numbers and effectively delivering and answering questions about financial projections.Int to Mktng ch1

Int to Mktng ch1Universidad de Monterrey

Ěý

The document provides an overview of marketing concepts. It defines marketing as the activity of creating, communicating, delivering, and exchanging offerings of value for customers, partners and society. It describes four marketing management philosophies: production, sales, marketing and societal orientations. It discusses the differences between sales and market orientations, focusing on customer value and satisfaction. It also provides several reasons for studying marketing, including its importance to business and society as well as career opportunities.20090829 financing overview

20090829 financing overviewMAHENDER BISHT

Ěý

The document discusses capital structure and financing options for firms, outlining sources of capital such as debt and equity and how firms can determine their optimal capital structure. It also reviews the financing process, including obtaining credit ratings and raising debt through private placements or public bond offerings. Key factors rating agencies examine like industry risk, market position, management quality, and financial metrics are outlined.Cox Residential

Cox ResidentialEric Johnson

Ěý

Cox Residential with Global Ambitions, Takes a Common-Sense Approach and is Empowering Real Estate Brokers Across the Nation to Work Together and Build Upon Their Platform for Sustainable Success Utilizing Mandatory Resources to Enhance Their Agents’ Business Across a Broad Spectrum.Tata valuation by aswath

Tata valuation by aswathAcademy of Financial Training

Ěý

Interesting valuation presentation by Aswath Damodaran where he values Tata Group companies using the DCF approach explained in detailBusiness model tbs 2012v3 ppt

Business model tbs 2012v3 pptWai Chamornmarn

Ěý

The document discusses various aspects of business models including value propositions, profit models, customer relationships, and key activities. It provides examples of different business model types such as subscription, loyalty programs, and low-cost carriers. Framework tools for designing business models are also introduced, including the value proposition designer and business model canvas for mapping the key elements of a business.Moats

MoatsSanjay Bakshi

Ěý

The document discusses Warren Buffett's investment in American Express in the 1960s when the company was embroiled in a "salad oil scandal" where it was defrauded of $150 million, causing its stock price to drop significantly. Buffett believed the market was overreacting and that American Express' "travelers checks" represented an attractive source of low-cost financing, as the company had to pay no interest on the funds and they served as a perpetual, revolving source of capital. This discovery of the value of "float" led Buffett to see it as an important competitive advantage for companies.Mand a toolkit generating a fcf forecast

Mand a toolkit generating a fcf forecastchrisdoran

Ěý

This document provides guidance on building a discounted cash flow (DCF) valuation model. It outlines the key steps to build a DCF model, including: 1) entering historical financial data, 2) calculating historical drivers and ratios, 3) projecting initial "vanilla" assumptions, 4) calculating projected financial statements, and 5) debugging the model. It then discusses generating a free cash flow forecast by developing assumptions around a future business "story" and key drivers. The final steps involve building the valuation model to calculate terminal value, equity value, and running sensitivities. Quick checks are also provided to test the model's reasonableness. The overall guidance emphasizes building the model logically and iteratively to generate a credible valuation.Hhtfa8e ch10 stud devry Accounting 212 FINANCIAL ACCOUNTING

Hhtfa8e ch10 stud devry Accounting 212 FINANCIAL ACCOUNTINGaaaala

Ěý

This document discusses different methods for accounting for long-term investments. It describes accounting for available-for-sale investments using fair value, equity method investments using proportionate share of investee income and dividends, and held-to-maturity bond investments using amortized cost. It also covers consolidated financial statements which combine the financial statements of a parent company and its subsidiaries.Added value issue 2

Added value issue 2Dionne Maclean

Ěý

- The document discusses creating or protecting value for clients in business transactions through consideration of the balance sheet. Specifically, it discusses enterprise value versus equity value, cash free/debt free offers, definitions of debt, and positioning these balance sheet factors in early negotiations.

- Key areas that can impact value and require interpretation are surplus assets, free cash, debt, working capital levels, and whether items like corporation tax are considered debt.

- Being prepared at the outset to include discussions of balance sheet factors can help position a client's interests when other parties may focus more on profits alone.What's a good business, what's a mediocre business, what's a bad business and...

What's a good business, what's a mediocre business, what's a bad business and...Sanjay Bakshi

Ěý

1. A business that can grow without requiring incremental capital is very special.

2. Time is a friend of businesses that can reinvest earnings at high rates of return, and an enemy of mediocre businesses that need to constantly pour in more capital for low returns.

3. The best businesses are those that can employ large amounts of incremental capital at very high rates of return over the long run.Stephane Guelat, Head of Strategic Procurement at Eaton Corporation - Develop...

Stephane Guelat, Head of Strategic Procurement at Eaton Corporation - Develop...Global Business Events

Ěý

This document discusses how Eaton can become a more attractive customer to suppliers. It notes that Eaton currently has over 12,000 unique suppliers in Europe. It outlines criteria that smart suppliers look for in customers, such as access to innovation, best total costs, and perfect quality and service. The document suggests Eaton work to establish formal strategic procurement and share data, communication channels, and process improvements with suppliers in order to maximize attractiveness and mutual benefit.Are you ready for Scaling Your Business

Are you ready for Scaling Your BusinessManish Singhal

Ěý

90% of start-ups fail while scaling up...this intuitive model helps you check whether you are ready for scaling your business!Funding Fundamentals

Funding FundamentalsManish Singhal

Ěý

The document discusses various modes of funding available for businesses, including angel investing, venture capital, private equity, debt, and IPOs. It outlines the advantages and disadvantages of each type of funding. The document also covers topics like company valuations, dilution, term sheets, and negotiating preferences between common and preferred stockholders.Driving Sales In A Tough Economy

Driving Sales In A Tough EconomyActegy Consulting

Ěý

Actegy Consulting is a sales growth consulting firm founded in 1996 that helps sales leadership drive results. They provide workshops, roundtables, and advisory services to both large and small clients. Their client list includes companies such as Intel, Comcast, and ADP. They help clients address issues such as pressure from competitors, budget constraints, and slow decision making. Their services include implementing programs to assess and address at-risk accounts and follow formal decision-making processes.Eso Ps

Eso PsCenterPoint Business Advisors

Ěý

This white paper discusses Employee Stock Ownership Plans (ESOPs) and how they can be used by business owners to sell their company. It explains that ESOPs allow owners to cash out at fair market value, pay no taxes on the sale, and transfer the company to employees. However, ESOPs require strong cash flow, good management, little debt, and aligned shareholder-employee interests to work well. The paper also outlines the ESOP buyout process, potential disadvantages like costs and fiduciary responsibilities, and questions owners should consider regarding ESOPs.Perfecting your Pitch for Launch Academy 2012

Perfecting your Pitch for Launch Academy 2012David Shore

Ěý

This is about how to communicate without distracting your audience, focusing your material on a value proposition and the required slides for an investor presentation. Marketing Your Product - A Guide for Entrepreneurs by Pradeep Anand

Marketing Your Product - A Guide for Entrepreneurs by Pradeep AnandPlatform Houston

Ěý

Pradeep Anand has been a keynote speaker at business workshops, conferences and meetings in North America, Speaking, educating and training have been integral to his consulting practice at Seeta Resources—helping CEOs and senior executives accelerate their firms’ revenue and margin growth.

He serves on the Advisory Board of the University of Houston's College of Technology and the Houston Technology Center. He is a founder and trustee of the IIT Alumni of Greater Houston.

Pradeep received his MBA from the University of Houston and his BS in Metallurgical Engineering from the Indian Institute of Technology (IIT), Bombay, India.Lead share alternative_financing_presentation

Lead share alternative_financing_presentationmehtanuj

Ěý

Small business owners face challenges accessing traditional bank financing. This document discusses alternative financing options for small businesses, including accounts receivable financing, friends and family loans, purchase order financing, angel investors, merchant cash advances, peer-to-peer lending, and equipment leasing. It also introduces Compound Profit, an alternative financing provider that offers various financing solutions to help small businesses grow and become profitable.Stephane Guelat, Head of Strategic Procurement at Eaton Corporation - Develop...

Stephane Guelat, Head of Strategic Procurement at Eaton Corporation - Develop...Global Business Events

Ěý

Viewers also liked (19)

Mand a toolkit 5 types of deal

Mand a toolkit 5 types of dealchrisdoran

Ěý

This document provides an overview of 5 types of M&A deals: overcapacity, geographic roll-up, product or market expansion, R&D, and industry convergence. It describes the strategic objective and value hypothesis for each type. It then provides examples and analyses of specific deals that fall under each category, such as Daimler-Chrysler (overcapacity), Marionnaud (geographic roll-up), and Diageo/Ketel One and Diageo/Seagrams (product expansion).Mand a toolkit pmi project management

Mand a toolkit pmi project managementchrisdoran

Ěý

The document discusses project management of post-merger integration. It emphasizes that integration requires key trade-offs in strategy and approach. A typical structure involves a steering committee, integration director, and cross-functional teams. Critical tasks include appointing leadership, developing communications, and tracking milestones. Effective integration balances the interests of multiple stakeholders through the merger process.Mand a toolkit closing process

Mand a toolkit closing processchrisdoran

Ěý

The document provides an overview of the key differences between acquiring a listed company versus a private company. It notes that buying a listed company has a strict defined legal process and timetable that must be followed, including requirements for public tender offers, limited negotiation timelines, and regulatory approvals. In contrast, acquiring a private company allows for a more flexible informal process, with unlimited potential to renegotiate terms. It also outlines the major third party advisors involved in M&A deals and the substantial costs that can be incurred, even for failed acquisition attempts.Mand a toolkit regulation

Mand a toolkit regulationchrisdoran

Ěý

There are three types of regulatory approvals needed for M&A deals:

1) Listed company approvals from agencies that regulate stock exchanges to ensure orderly processes and minority shareholder protection.

2) Anti-trust approvals from competition regulators to prevent monopolies and protect consumer welfare. These assess whether the merger will increase market share over thresholds like 25%.

3) Political approvals for deals impacting national security, especially for foreign acquisitions of domestic firms. Approval processes are more predictable in Western countries and relationship-based in China.Mand a toolkit screening targets

Mand a toolkit screening targetschrisdoran

Ěý

This document provides guidance on screening acquisition targets. It recommends casting a wide net to identify potential targets, then applying a crude quantitative screen to generate a long list. A short list should be made by creating profiles for targets that fit the company's strategic rationale and have acceptable valuations and availability. The business development department is responsible for continuously monitoring all targets on the short and watch lists to be prepared for acquisition opportunities.Consulting toolkit preparing dummy pack

Consulting toolkit preparing dummy packchrisdoran

Ěý

The document provides guidance on creating a "dummy pack", which is an early draft presentation that includes placeholder or dummy data. It recommends brainstorming a hypothesis tree to identify the key points, transferring these to an executive summary, and then using the executive summary points to structure dummy charts for each key message. Following this process creates an initial presentation that follows best practices of answering the key questions and repeating the top-level messages.Consulting toolkit handling qand a

Consulting toolkit handling qand achrisdoran

Ěý

This document provides guidance on preparing for and handling questions and answers (Q&A) during a presentation. It discusses why Q&A is important for demonstrating a team's expertise and ability to think on their feet. The document recommends anticipating likely questions, preparing formal answers to challenging questions, and agreeing on team roles. It also provides tips for engaging with the audience, staying calm under pressure, and techniques for effectively responding to different types of questions.Consulting toolkit planning implementation

Consulting toolkit planning implementationchrisdoran

Ěý

The document discusses implementation planning for consulting recommendations. It provides three key aspects to consider: 1) developing a clear "engineering plan" with goals, steps, milestones and resources; 2) identifying and resolving potential implementation issues; and 3) engaging stakeholders through relationship building and addressing what's important to people. The document emphasizes that strong implementation requires both engineering-style planning and social engagement.Consulting toolkit proving your recommendation

Consulting toolkit proving your recommendationchrisdoran

Ěý

1) A hypothesis tree is used to logically break down a solution by identifying everything that needs to be proven for the solution to be correct. 2) It highlights weaknesses, focuses work, and provides structure for presenting the recommendation. 3) Brainstorming is used to kickstart the tree, then statements are organized logically from general to specific.Consulting toolkit evaluating alternatives

Consulting toolkit evaluating alternativeschrisdoran

Ěý

The document provides tools for evaluating alternatives and making recommendations. It describes problem definition sheets to outline the key question and criteria. It also presents matrices to evaluate alternatives based on their market attractiveness and competitive position, as well as prioritize actions based on their impact and ease of implementation. The overall goal is to systematically analyze options and narrow down to the best solution.Module 2 lesson 4

Module 2 lesson 4Erik Tjersland

Ěý

This document contains notes from a math lesson on adding integers. It includes two rules for adding integers: 1) Add integers with the same sign by adding the absolute values and using the common sign. 2) Add integers with opposite signs by subtracting the absolute values and using the sign of the integer with the greater absolute value. The lesson concludes with students practicing adding integers using "speed dating" cards with problems and answers.Consulting toolkit delivering the presentation

Consulting toolkit delivering the presentationchrisdoran

Ěý

This document provides guidance on delivering effective presentations and handling resistance from clients. It discusses communicating recommendations, using body language and vocal techniques during presentations, preparing for questions, and addressing resistance in a constructive manner. The key points are to maintain eye contact, rehearse, tell stories, engage the audience, welcome resistance as normal feedback, and help clients express concerns directly without becoming defensive.Jumpstarting the M&A Integration Process

Jumpstarting the M&A Integration ProcessScottMadden, Inc.

Ěý

Early integration planning is critical for successfully implementing your M&A transaction. Mergers and acquisitions can create immediate value opportunities and provide a solid foundation for growth. However, a key challenge for any merger or acquisition is to quickly integrate operations using the same employees who are required to run the day-to-day business. Early planning, e.g., even prior to having a deal in place, will help you jumpstart the M&A integration process and can minimize employee distraction and workload. This document provides an overview of the steps that you can take to prepare for your merger or acquisition and successfully overcome these challenges.

For more information, please visit www.scottmadden.com.Mand a toolkit make vs buy

Mand a toolkit make vs buychrisdoran

Ěý

The document provides guidance on strategic mergers and acquisitions. It discusses evaluating whether to build capabilities organically or acquire them. Key considerations for the "make vs buy" decision include whether organic growth will be too expensive or slow, if there is a value mismatch that prevents internal development, or if unique assets only allow acquisition. The document also emphasizes that acquisitions should fit a company's strategic direction and competitive advantage. It introduces a framework for analyzing acquisitions based on the resources, processes, and values that are being obtained.Consulting toolkit analogies

Consulting toolkit analogieschrisdoran

Ěý

The document discusses how analogies can help solve complex problems in three steps: [1] Identify a useful source problem; [2] Understand the solution to the source problem; [3] Translate the solution to the target problem. It cautions that analogies should not be stretched too far and differences between the source and target problems need to be considered. Critical thinking is important to accurately apply analogies to strategic problems.Consulting toolkit modelling

Consulting toolkit modellingchrisdoran

Ěý

The document provides tips for building financial models. It recommends designing a model on paper first before building it in a spreadsheet. The model should be built in logical modular steps and simplified as much as possible while still answering the key business questions. Key steps in building a valuation model include entering historical financial data, projecting "vanilla" assumptions, debugging the model, developing business assumptions and scenarios, and calculating terminal values and equity value. The document emphasizes focusing on the most important drivers and ratios, setting up formulas so changing one cell impacts all related cells, and remembering the overall purpose of the model is to provide insights, not accounting perfection.Webinar: Key Aspects for Maximizing Synergies Through Effective Post Merger I...

Webinar: Key Aspects for Maximizing Synergies Through Effective Post Merger I...GPMIP

Ěý

This is the deck as used on our February 20 webinar about 'maximizing synergies through effective post merger integration.'

The dialogue of this webinar is available on youtube: http://youtu.be/NCiVpFhOm8c

Global PMI Partners is the only international network focused exclusively on delivering post-merger integration, separation and transformation services. Please visit us on www.gpmip.com or contact us on info@gpmip.com.Consulting toolkit systems thinking

Consulting toolkit systems thinkingchrisdoran

Ěý

The document provides an introduction to systems thinking as a consulting tool. It discusses key concepts like dynamic complexity, reinforcing and balancing feedback loops, and how these concepts can be applied to analyze business problems. Systems thinking allows consultants to consider interrelated causes of issues rather than isolated factors, address root problems, and avoid short-term fixes that shift problems over the long run.Introduction to the Enneagram

Introduction to the Enneagramchrisdoran

Ěý

The document is an introduction to the Enneagram personality typing system presented by Chris Doran. It discusses how people view the world through "blinkers" based on their personality type, and that self-awareness of one's own blinkers is important for leadership. It outlines the 9 main personality types (3 body types, 3 heart types, 3 head types), their core motivations and strengths/weaknesses. It encourages using Enneagram knowledge for self-improvement rather than excuses, and looking at one's own blind spots rather than just pointing out others'. The purpose is to inspire further learning about the Enneagram.More from chrisdoran (7)

Consulting toolkit root cause analysis

Consulting toolkit root cause analysischrisdoran

Ěý

The document provides an overview of root cause analysis and the 5 whys technique. It explains that root cause analysis is used to identify the underlying root causes of problems rather than superficial causes. The 5 whys technique involves asking "why" five times to explore the cause-and-effect relationships of a problem in order to determine the root cause. An example of using 5 whys to analyze why a business missed its budget target is provided. The document also outlines tips for using root cause analysis and 5 whys, and provides an example of mapping out the root causes that led to the near US debt default in 2011.Consulting toolkit defining the question

Consulting toolkit defining the questionchrisdoran

Ěý

This document discusses the importance of properly defining problems before attempting to solve them. It notes that spending more time understanding and framing the key question is important for developing effective solutions. Several tips and tools are provided for iterating and refining problem questions, such as considering different levels of scope and perspective. Defining the key problem to address, desired outcomes, and criteria for evaluating solutions is presented as a crucial first step.Consulting toolkit creating a workplan

Consulting toolkit creating a workplanchrisdoran

Ěý

The document discusses creating a workplan for consulting projects with the following key steps:

1. Structure the problem-solving process by creating an issue tree to identify sub-issues.

2. For each sub-issue, generate hypotheses and determine what analyses and data sources are needed to evaluate the hypotheses.

3. Assign responsibilities and deadlines to team members and maintain the workplan as a living document throughout the project.Consulting toolkit crafting a storyline

Consulting toolkit crafting a storylinechrisdoran

Ěý

The document provides guidance on effectively communicating recommendations using a structured approach called "The Pyramid Principle." It advises beginning with a concise tagline or executive summary that captures the key point. The main recommendation and supporting rationale are then explained at increasing levels of detail, with unnecessary analysis reserved for an appendix. Follow a logical progression from situation to question to answer to rationale. Iteratively refine the structure to clearly convey the most important elements in as few words as possible.Consulting toolkit structuring the problem

Consulting toolkit structuring the problemchrisdoran

Ěý

The document provides guidance on using issue trees to structure problem solving. It discusses breaking problems down into smaller, more manageable issues. An issue tree has three purposes: to break problems into analyzable chunks; open up the solution space; and get everyone on the same page quickly. The document outlines eight steps to generate an issue tree, including writing the problem, brainstorming solutions, organizing the solutions logically into questions at different levels of generality/specificity, expanding and pruning the tree, and revisiting the problem. Productive brainstorming requires rules like deferring judgment and encouraging novel ideas.Consulting toolkit saying it with charts

Consulting toolkit saying it with chartschrisdoran

Ěý

The document provides guidance on effectively communicating recommendations through charts. It discusses crafting clear messages, illustrating the message, simplifying charts by eliminating visual noise, and making charts engaging. Charts are seen as a key medium for professional business communication.Consulting toolkit profit trees

Consulting toolkit profit treeschrisdoran

Ěý

The document provides information on profit trees, which are used to diagnose opportunities through comparisons of profit drivers across time or businesses. Profit trees break down a business's return on capital employed (ROCE) or profitability to its key drivers in a step-by-step manner. They allow insights by comparing metrics like revenue, operating margin, capital employed, and tax rates over time or across different businesses. The example shows a profit tree for a retail business that breaks down store contribution, sales, costs, working capital, and ROCE.Mand a toolkit value creation principles

- 1. M&A TOOLKIT Valuation: Value Creation principles © 2007-2013 IESIES Development Ltd. All Ltd. Reserved © 2007-2013 Development Rights All Rights Reserved

- 2. The value creation of the deal is the difference between the price paid and the value of the business bought by the acquirer DEAL VALUE CREATION $m 50 800 250 150 750 600 550 Current Market Acquisition Price Paid Value creation Value to Value of Base business Capitalisation Premium acquirer synergies value © 2007-2013 IES Development Ltd. All Rights Reserved

- 3. The synergies must exceed the acquisition premium if the target is accurately priced “as is” DEAL VALUE CREATION $m 100 850 250 150 750 600 600 Current Market Acquisition Price Paid Value creation Value to Value of Base business Capitalisation Premium acquirer synergies value © 2007-2013 IES Development Ltd. All Rights Reserved

- 4. There is no way to calculate the acquisition premium in a private deal DEAL VALUE CREATION $m 50 800 250 150 750 600 550 Current Market Acquisition Price Paid Value creation Value to Value of Base business Capitalisation Premium acquirer synergies value © 2007-2013 IES Development Ltd. All Rights Reserved

- 5. You can analyse the market estimate of value creation by watching the share price of acquirer and target during a deal First rumour On first rumour on 23rd May, Anheuser-Busch share price jumps $5 (+$4,000m market capitalisation) On the same day, Inbev share price drops by €3 (-$2,500m market capitalisation) © 2007-2013 IES Development Ltd. All Rights Reserved

- 6. When a deal is underway, share prices respond to events in the deal process First rumour PV($70) Credit crisis; Agreed Closure speculation that @$70 high % Inbev might walk Offer away @$65 Inbev cancels rights issue © 2007-2013 IES Development Ltd. All Rights Reserved

- 7. An annotated share price graph helps you understand the deal What conclusion would you reach if the stock traded above $12.2? Why doesn’t the stock Coke offer at trade at $12.2? HK$12.2/share Post- announcement, what drives stock price volatility? © 2007-2013 IES Development Ltd. All Rights Reserved