Marketcalls slack 24th dec 2018

- 1. 12/25/2018 marketprofile | Marketcalls Slack https://marketcalls.slack.com/messages/C0DJJKQ81/ 5/19 rajandran 9:06 AM NF Key reference level to watch out. NIFTY_I (30 Minute) 2018_12_24 (09_05_20).png rajandran 9:17 AM High confidence selling at open in NF okie

- 2. 12/25/2018 marketprofile | Marketcalls Slack https://marketcalls.slack.com/messages/C0DJJKQ81/ 6/19 abilash.s.90 9:22 AM big seller stuck again at the bottom? seeing a 1080 lot trade at the bottom would u call this low confidence selling? price has comback above yesterd or just yesterday’s shorts covering their longs rajandran 9:34 AM Not yet. Just the auction started and prev week low broken if they are not serious sellers activity will happen above prev week low. until then it will rated as high confidence selling abilash.s.90 9:35 AM okay rajandran 9:49 AM BNF high confidence selling Big Seller @ 10760 - 4000+ lots sold NIFTY_I (5 Minute) 2018_12_24 (09_51_37).png rajandran 10:09 AM Buyers supplying liquidity at the days low. So not an easy downtrend from NIFTY_I (5 Minute) 2018_12_24 (10_08_05).png More Big buyers at the days low.

- 3. 12/25/2018 marketprofile | Marketcalls Slack https://marketcalls.slack.com/messages/C0DJJKQ81/ 7/19 NIFTY_I (5 Minute) 2018_12_24 (10_09_15).png abilash.s.90 10:15 AM is it a bear trap? showing a huge sell, then trapping them rajandran 10:17 AM it is a scalping oppourtunity beyond that timeframe I have no idea whether it is a bear trap or not rajandran 10:23 AM Thats 6000+ lots of sellers Sellers also came for defense. NIFTY_I (5 Minute) 2018_12_24 (10_22_57).png Another 4000+ sellers NIFTY_I (5 Minute) 2018_12_24 (10_27_57).png

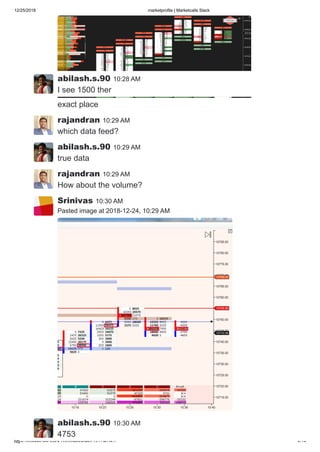

- 4. 12/25/2018 marketprofile | Marketcalls Slack https://marketcalls.slack.com/messages/C0DJJKQ81/ 8/19 abilash.s.90 10:28 AM I see 1500 ther exact place rajandran 10:29 AM which data feed? abilash.s.90 10:29 AM true data rajandran 10:29 AM How about the volume? Srinivas 10:30 AM Pasted image at 2018-12-24, 10:29 AM abilash.s.90 10:30 AM 4753

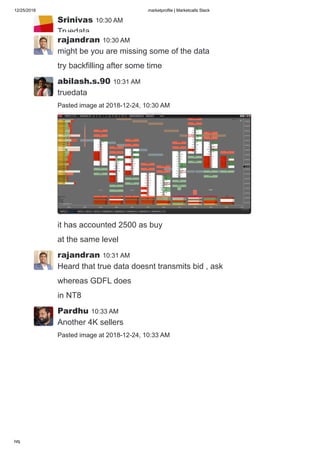

- 5. 12/25/2018 marketprofile | Marketcalls Slack https://marketcalls.slack.com/messages/C0DJJKQ81/ 9/19 Srinivas 10:30 AM Truedata rajandran 10:30 AM might be you are missing some of the data try backfilling after some time abilash.s.90 10:31 AM truedata Pasted image at 2018-12-24, 10:30 AM it has accounted 2500 as buy at the same level rajandran 10:31 AM Heard that true data doesnt transmits bid , ask whereas GDFL does in NT8 Pardhu 10:33 AM Another 4K sellers Pasted image at 2018-12-24, 10:33 AM

- 6. 12/25/2018 marketprofile | Marketcalls Slack https://marketcalls.slack.com/messages/C0DJJKQ81/ 10/19 rajandran 10:35 AM When Big Buyers and Big Sellers are fighting - either rollover started or just a two way auction process in place dont put too much into your mind 1 ritesh 10:36 AM it's monday morning so i assume it might be 2 way auction process Srinivas 10:36 AM Price should go along with winner direction in a fight ? rajandran 10:36 AM tommorow is a holiday ritesh 10:37 AM ohh yaa rajandran 10:37 AM rollovers might start aggressively from wednesday onwards so mostly a two way auction process here with high confidence selling thu ritesh 10:39 AM high conf selling n big orders... price is here only n no volatility... Balance in making ?? likely gill 10:44 AM I am using Truedata and getting same results as @rajandran Pasted image at 2018-12-24, 10:43 AM

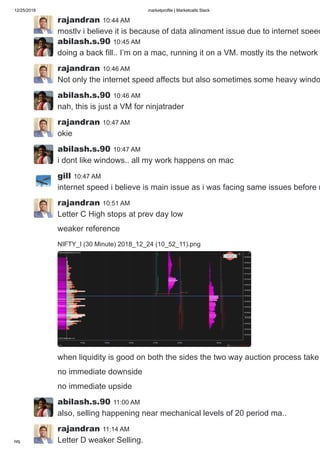

- 7. 12/25/2018 marketprofile | Marketcalls Slack https://marketcalls.slack.com/messages/C0DJJKQ81/ 11/19 rajandran 10:44 AM mostly i believe it is because of data alingment issue due to internet speed abilash.s.90 10:45 AM doing a back fill.. I’m on a mac, running it on a VM. mostly its the network rajandran 10:46 AM Not only the internet speed affects but also sometimes some heavy windo abilash.s.90 10:46 AM nah, this is just a VM for ninjatrader rajandran 10:47 AM okie abilash.s.90 10:47 AM i dont like windows.. all my work happens on mac gill 10:47 AM internet speed i believe is main issue as i was facing same issues before n rajandran 10:51 AM Letter C High stops at prev day low weaker reference NIFTY_I (30 Minute) 2018_12_24 (10_52_11).png when liquidity is good on both the sides the two way auction process take no immediate downside no immediate upside abilash.s.90 11:00 AM also, selling happening near mechanical levels of 20 period ma.. rajandran 11:14 AM Letter D weaker Selling.

- 8. 12/25/2018 marketprofile | Marketcalls Slack https://marketcalls.slack.com/messages/C0DJJKQ81/ 12/19 NIFTY_I (30 Minute) 2018_12_24 (11_13_48).png 2000+ buyers NIFTY_I (5 Minute) 2018_12_24 (11_15_12).png rajandran 11:22 AM ABCDE Balancing. POC formed around prev day low with more rotational NIFTY_I (30 Minute) 2018_12_24 (11_21_46).png rajandran 11:55 AM Not so serious selling when day low is broken. NIFTY_I (5 Minute) 2018_12_24 (11_54_54).png

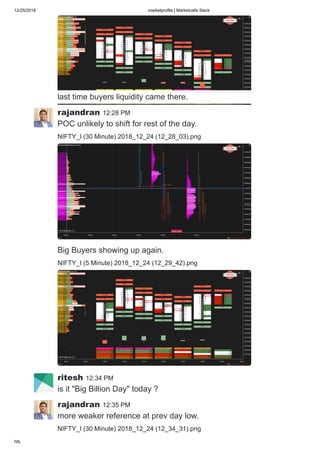

- 9. 12/25/2018 marketprofile | Marketcalls Slack https://marketcalls.slack.com/messages/C0DJJKQ81/ 13/19 last time buyers liquidity came there. rajandran 12:28 PM POC unlikely to shift for rest of the day. NIFTY_I (30 Minute) 2018_12_24 (12_28_03).png Big Buyers showing up again. NIFTY_I (5 Minute) 2018_12_24 (12_29_42).png ritesh 12:34 PM is it "Big Billion Day" today ? rajandran 12:35 PM more weaker reference at prev day low. NIFTY_I (30 Minute) 2018_12_24 (12_34_31).png

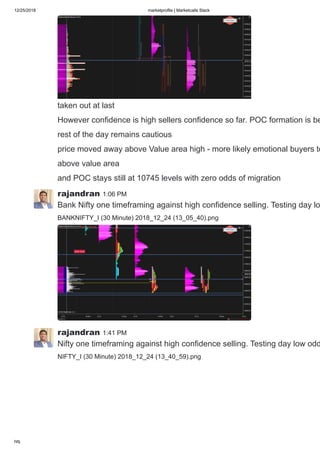

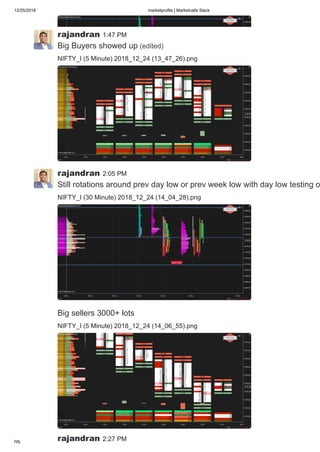

- 10. 12/25/2018 marketprofile | Marketcalls Slack https://marketcalls.slack.com/messages/C0DJJKQ81/ 14/19 taken out at last However confidence is high sellers confidence so far. POC formation is be rest of the day remains cautious price moved away above Value area high - more likely emotional buyers to above value area and POC stays still at 10745 levels with zero odds of migration rajandran 1:06 PM Bank Nifty one timeframing against high confidence selling. Testing day lo BANKNIFTY_I (30 Minute) 2018_12_24 (13_05_40).png rajandran 1:41 PM Nifty one timeframing against high confidence selling. Testing day low odd NIFTY_I (30 Minute) 2018_12_24 (13_40_59).png

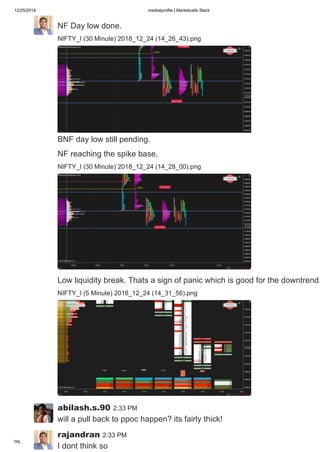

- 11. 12/25/2018 marketprofile | Marketcalls Slack https://marketcalls.slack.com/messages/C0DJJKQ81/ 15/19 rajandran 1:47 PM Big Buyers showed up (edited) NIFTY_I (5 Minute) 2018_12_24 (13_47_26).png rajandran 2:05 PM Still rotations around prev day low or prev week low with day low testing o NIFTY_I (30 Minute) 2018_12_24 (14_04_28).png Big sellers 3000+ lots NIFTY_I (5 Minute) 2018_12_24 (14_06_55).png rajandran 2:27 PM

- 12. 12/25/2018 marketprofile | Marketcalls Slack https://marketcalls.slack.com/messages/C0DJJKQ81/ 16/19 NF Day low done. NIFTY_I (30 Minute) 2018_12_24 (14_26_43).png BNF day low still pending. NF reaching the spike base. NIFTY_I (30 Minute) 2018_12_24 (14_28_00).png Low liquidity break. Thats a sign of panic which is good for the downtrend. NIFTY_I (5 Minute) 2018_12_24 (14_31_56).png abilash.s.90 2:33 PM will a pull back to ppoc happen? its fairly thick! rajandran 2:33 PM I dont think so

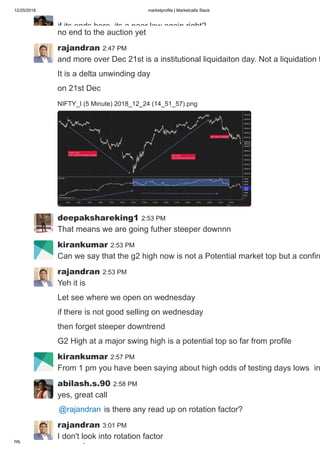

- 13. 12/25/2018 marketprofile | Marketcalls Slack https://marketcalls.slack.com/messages/C0DJJKQ81/ 17/19 it is a low liquidation break And BNF still day low is pending @abilash.s.90: when there is a low liquidation break......stay with the tren abilash.s.90 2:34 PM got it thanks rajandran 2:35 PM BNF day low done. BANKNIFTY_I (30 Minute) 2018_12_24 (14_35_12).png still going down with low liquidity breaks. NIFTY_I (5 Minute) 2018_12_24 (14_37_45).png kirankumar 2:45 PM Are there any chances of poor structure of 21 dec getting repaired in next rajandran 2:46 PM Not immediately coz it is not just a poor structure but a elongated triple distribution as well abilash.s.90 2:47 PM

- 14. 12/25/2018 marketprofile | Marketcalls Slack https://marketcalls.slack.com/messages/C0DJJKQ81/ 18/19 if its ends here, its a poor low again right? no end to the auction yet rajandran 2:47 PM and more over Dec 21st is a institutional liquidaiton day. Not a liquidation f It is a delta unwinding day on 21st Dec NIFTY_I (5 Minute) 2018_12_24 (14_51_57).png deepakshareking1 2:53 PM That means we are going futher steeper downnn kirankumar 2:53 PM Can we say that the g2 high now is not a Potential market top but a confirm rajandran 2:53 PM Yeh it is Let see where we open on wednesday if there is not good selling on wednesday then forget steeper downtrend G2 High at a major swing high is a potential top so far from profile kirankumar 2:57 PM From 1 pm you have been saying about high odds of testing days lows in abilash.s.90 2:58 PM yes, great call @rajandran is there any read up on rotation factor? rajandran 3:01 PM I don't look into rotation factor

- 15. 12/25/2018 marketprofile | Marketcalls Slack https://marketcalls.slack.com/messages/C0DJJKQ81/ 19/19 abilash.s.90 3:02 PM ok rajandran 3:03 PM Today also some higher timeframe liquidation seen overall Cumulative delta is -12K as of now low liquidity liquidation with good momentum selling is nothing but a contin NIFTY_I (5 Minute) 2018_12_24 (15_05_38).png ritesh 3:23 PM Now time for late sellers ? rajandran 3:25 PM NF Key reference level for wednesday trading. NIFTY_I (30 Minute) 2018_12_24 (15_24_37).png abilash.s.90 3:33 PM its not a poor low, hopefully its good!