Masdar Power

- 1. Masdar Power: Investing in Renewable Projects Globally Frank Wouters, Director

- 2. Masdar Power Business Model ? What we do -Building a portfolio of renewable energy operating assets and making strategic tech investments ? Focus -Solar: Utility scale photovoltaic and concentrating solar power -Wind: Onshore and Offshore wind farms -Technology investment in Wind and CSP -Stable and profitable markets such as the UAE and MENA region as well as the UK, Italy and the US ? Business Model -Originate, develop, finance, construct and operate through project development and direct project investment -Developing strategic partnerships

- 3. Solar Investments - UAE ? Abu Dhabi is committed to a 7% target of renewable power capacity by 2020, which is 1,500 MW, mostly from solar ? Masdar is investing in utility scale Concentrating Solar Power (CSP) and PV projects ? CSP is a dispatchable renewable energy source and key to achieving a large part of the target ? Shams 1 is the first CSP plant using parabolic trough technology in Abu Dhabi. Masdar will own 60%, a foreign shareholder the remaining 40%

- 4. Solar Investments - UAE ? SHAMS 1 Location: Madinat Zayed, Abu Dhabi Capacity: 100 MW Power generation: 210 GWH/a Start of operation: 2012 Plant footprint: 2.5 km2

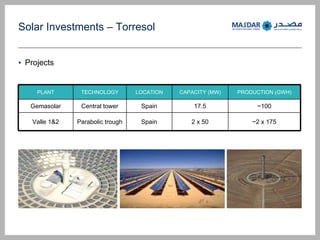

- 5. Solar Investments ¨C Torresol ? Torresol is a Joint Venture between the Spanish group Sener and Masdar. The company develops, builds, owns and operates Concentrated Solar Power (CSP) plants ? Technology Focus: Focuses on Tower and Parabolic Trough technologies; all projects have storage capacity ? Markets: Torresol is currently building 3 plants in Spain (Fully project financed and EPC contracted), and is currently looking at opportunities in the Middle East, North Africa and North America

- 6. Solar Investments ¨C Torresol ? Projects PLANT TECHNOLOGY LOCATION CAPACITY (MW) PRODUCTION (GWH) Gemasolar Central tower Spain 17.5 ~100 Valle 1&2 Parabolic trough Spain 2 x 50 ~2 x 175

- 7. Wind Investments ¨C London Array ? Offshore wind is the fastest growing renewable energy sector with potential for 30 GW by 2020 ? Located in the Outer Thames Estuary, close to London (UK) ? Will be the largest Offshore Wind Farm in the World, with a first Phase of 630 MW (1,000 MW consented) ? Phase 1 will use 175 Siemens 3.6 MW wind turbines Ramsgate

- 8. Wind Investments ¨C London Array ? Masdar Power is partnering with the leading Offshore Wind developers: -E.ON: 54,000MW of installed generation capacity including 2,000MW of wind -Dong: Number 1 offshore wind developer (330MW operating, 1,200 MW in development) ? Masdar owns 20% of the Project ? Phase 1 project costs estimated ?2.2bn ? Project Completion: Jan 2013

- 9. Wind Investments : WinWind Technology ? Unique Multibrid technology ? Combines the reliability of a direct drive with the compactness of a traditional gear system ? Results in high availability, high reliability, high output and low maintenance costs ? Installed base of ~250MW ? Represents a €120 million investment in the high growth wind turbine industry, building out MasdarˇŻs expertise across the wind sector value chain. ? The annual world wide wind turbine market presently represents $30bn 3MW

- 10. Wind Investments: WinWind Markets and Facilities ? Greenfield purpose built facilities completed in 2009 in Finland and India ? Hamina, Finland facility produces 3MW turbines servicing Nordic Europe and actively expanding throughout the continent ? Chennai, India facility produces 1MW turbines and blades, supplying Europe, India and beyond *Annual production capacity