MASTEEL.pdf

- 1. ĚýSchoolĚýOfĚýArchitecture,ĚýBuildingĚý&ĚýDesignĚý FoundationĚýInĚýNaturalĚý&ĚýBuiltĚýEnvironmentĚý Ěý AssignmentĚýTitleĚýĚý:ĚýFinancialĚýRatioĚýAnalysisĚý GroupĚýMembersĚý:ĚýĚý Ěý NAMEĚý STUDENTĚýIDĚý SEETĚýTIONGĚýHONGĚý 0320438Ěý WONGĚýDEÂVINĚý 0319814Ěý BRYANĚýTEHĚýQINGĚýDAĚý 0318590Ěý Ěý BasicĚýAccountingĚý[ACC30205Ěý/ĚýFNBE0145]Ěý LecturerĚý:ĚýChangĚýJauĚýHoĚý SubmissionĚýDateĚý:Ěý4thĚýJuneĚý2015Ěý Ěý Ěý

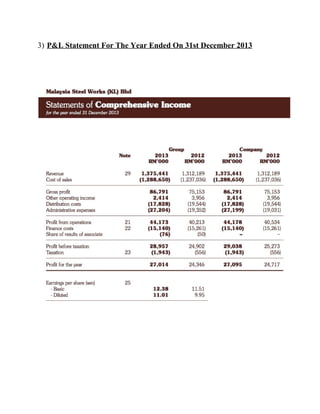

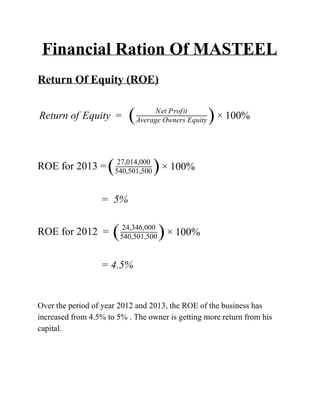

- 4. FinancialĚýRationĚýOfĚýMASTEELĚý Ěý ReturnĚýOfĚýEquityĚý(ROE)ĚýĚýĚý Ěý eturnĚýofĚýEquityĚý 00%ĚýR = Ěý( NetĚýProfit AverageĚýOwnersĚýEquity )Ă— 1 Ěý Ěý Ěý ROEĚýforĚý2013Ěý= 00%Ěý(27,014,000 540,501,500 )Ă— 1 Ěý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý​ĚýĚýĚýĚýĚý=ĚýĚý5%ĚýĚý Ěý ROEĚýforĚý2012ĚýĚý=Ěý 00%Ěý(24,346,000 540,501,500 )Ă— 1 Ěý Ěý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý​ĚýĚýĚýĚýĚý=Ěý4.5%Ěý Ěý Ěý OverĚýtheĚýperiodĚýofĚýyearĚý2012ĚýandĚý2013,ĚýtheĚýROEĚýofĚýtheĚýbusinessĚýhasĚý increasedĚýfromĚý4.5%ĚýtoĚý5%Ěý.ĚýTheĚýownerĚýisĚýgettingĚýmoreĚýreturnĚýfromĚýhisĚý capital.Ěý Ěý Ěý Ěý

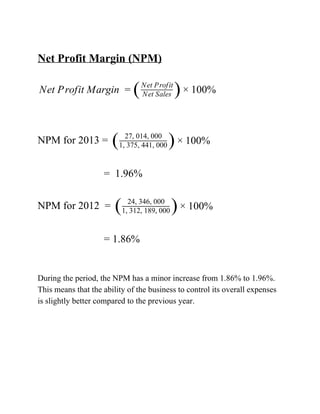

- 5. Ěý NetĚýProfitĚýMarginĚý(NPM)Ěý Ěý etĚýProfitĚýMarginĚý 00%ĚýN = (NetĚýSales NetĚýProfit )Ă— 1 Ěý Ěý Ěý NPMĚýforĚý2013Ěý=Ěý 00%Ěý( 27,Ěý014,Ěý000 1,Ěý375,Ěý441,Ěý000 )Ă— 1 Ěý Ěý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=ĚýĚý1.96%Ěý Ěý NPMĚýforĚý2012ĚýĚý=Ěý 00%Ěý( 24,Ěý346,Ěý000 1,Ěý312,Ěý189,Ěý000 )Ă— 1 Ěý Ěý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=Ěý1.86%Ěý Ěý Ěý DuringĚýtheĚýperiod,ĚýtheĚýNPMĚýhasĚýaĚýminorĚýincreaseĚýfromĚý1.86%ĚýtoĚý1.96%.Ěý ThisĚýmeansĚýthatĚýtheĚýabilityĚýofĚýtheĚýbusinessĚýtoĚýcontrolĚýitsĚýoverallĚýexpensesĚý isĚýslightlyĚýbetterĚýcomparedĚýtoĚýtheĚýpreviousĚýyear.Ěý Ěý Ěý Ěý Ěý Ěý

- 6. GrossĚýProfitĚýMarginĚý(GPM)ĚýĚý Ěý rossĚýProfitĚýMarginĚý 00%ĚýG = ( NetĚýSales GrossĚýProfit )Ă— 1 Ěý Ěý Ěý GPMĚýforĚý2013Ěý=Ěý 00%Ěý( 86,791,000 1,375,441,000 )Ă— 1 Ěý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=ĚýĚý6.31%Ěý Ěý GPMĚýforĚý2012Ěý=Ěý 00%Ěý( 75,153,000 1,312,189,000 )Ă— 1 Ěý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=Ěý5.73%Ěý Ěý OverĚýtheĚýperiodĚýofĚýyearĚý2012ĚýtoĚý2013,ĚýtheĚýGPMĚýhasĚýincreasedĚýfromĚý5.73%Ěý toĚý6.31%.ĚýTheĚýbusinessĚýisĚýgettingĚýbetterĚýinĚýtermsĚýofĚýtheirĚýabilityĚýtoĚýcontrolĚý itsĚýcostĚýofĚýgoodsĚýsoldĚýexpensesĚýforĚýyearĚý2013ĚýthanĚý2012.Ěý Ěý Ěý Ěý Ěý Ěý Ěý Ěý

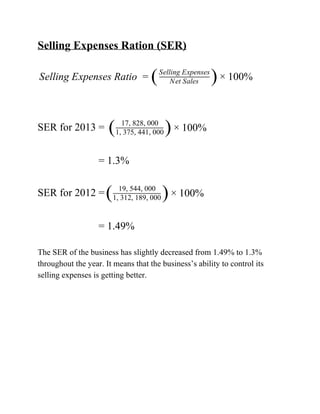

- 7. SellingĚýExpensesĚýRationĚý(SER)Ěý Ěý ellingĚýExpensesĚýRatioĚý 00%ĚýS = ( NetĚýSales SellingĚýExpenses )Ă— 1 Ěý Ěý Ěý SERĚýforĚý2013Ěý=Ěý 00%Ěý( 17,Ěý828,Ěý000 1,Ěý375,Ěý441,Ěý000 )Ă— 1 Ěý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=Ěý1.3%Ěý Ěý SERĚýforĚý2012Ěý= 00%Ěý( 19,Ěý544,Ěý000 1,Ěý312,Ěý189,Ěý000 )Ă— 1 Ěý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=Ěý1.49%Ěý Ěý TheĚýSERĚýofĚýtheĚýbusinessĚýhasĚýslightlyĚýdecreasedĚýfromĚý1.49%ĚýtoĚý1.3%Ěý throughoutĚýtheĚýyear.ĚýItĚýmeansĚýthatĚýtheĚýbusiness’sĚýabilityĚýtoĚýcontrolĚýitsĚý sellingĚýexpensesĚýisĚýgettingĚýbetter.Ěý Ěý Ěý Ěý Ěý Ěý Ěý Ěý

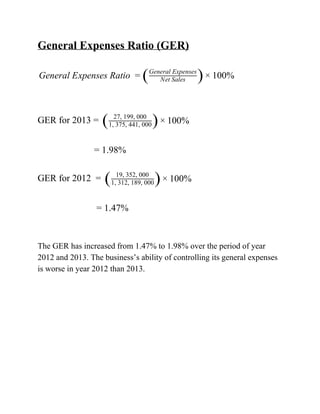

- 8. GeneralĚýExpensesĚýRatioĚý(GER)Ěý Ěý eneralĚýExpensesĚýRatioĚý 00%ĚýG = ( NetĚýSales GeneralĚýExpenses )Ă— 1 Ěý Ěý Ěý GERĚýforĚý2013Ěý=Ěý 00%Ěý( 27,Ěý199,Ěý000 1,Ěý375,Ěý441,Ěý000)Ă— 1 Ěý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=Ěý1.98%Ěý Ěý GERĚýforĚý2012ĚýĚý=Ěý 00%Ěý( 19,Ěý352,Ěý000 1,Ěý312,Ěý189,Ěý000)Ă— 1 Ěý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=Ěý1.47%Ěý Ěý Ěý TheĚýGERĚýhasĚýincreasedĚýfromĚý1.47%ĚýtoĚý1.98%ĚýoverĚýtheĚýperiodĚýofĚýyearĚý 2012ĚýandĚý2013.ĚýTheĚýbusiness’sĚýabilityĚýofĚýcontrollingĚýitsĚýgeneralĚýexpensesĚý isĚýworseĚýinĚýyearĚý2012ĚýthanĚý2013.Ěý Ěý Ěý Ěý Ěý Ěý Ěý Ěý

- 9. FinancialĚýExpensesĚýRatioĚý(FER)Ěý Ěý inancialĚýExpensesĚýRatioĚý 00%ĚýF = ( NetĚýSales FinancialĚýExpenses )Ă— 1 Ěý Ěý Ěý FERĚýforĚý2013Ěý=Ěý 00%Ěý( 15,140,000 1,375,441,000 )Ă— 1 Ěý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=Ěý1.1%Ěý Ěý FERĚýforĚý2012Ěý=Ěý 00%Ěý( 15,261,000 1,312,189,000 )Ă— 1 Ěý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=Ěý1.16%Ěý Ěý Ěý OverĚýtheĚýperiodĚýofĚýyearĚý2012ĚýandĚý2013,ĚýtheĚýFERĚýhasĚýdecreasedĚýbyĚý0.05%,Ěý fromĚý1.16%ĚýtoĚý1.1%.ĚýĚýInĚýotherĚýwords,ĚýtheĚýfinancialĚýexpensesĚýinĚýyearĚý2013Ěý isĚýslightlyĚýlowerĚýthanĚý2012.Ěý Ěý Ěý Ěý Ěý Ěý

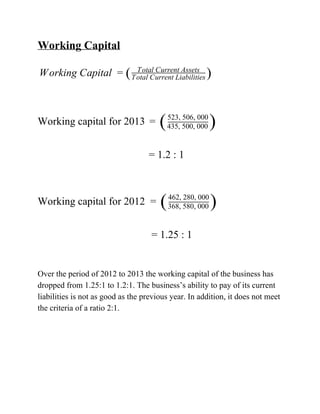

- 10. WorkingĚýCapitalĚý Ěý orkingĚýCapitalĚý ĚýW = ( TotalĚýCurrentĚýAssets TotalĚýCurrentĚýLiabilities )Ěý Ěý Ěý WorkingĚýcapitalĚýforĚý2013Ěý​Ěý​=Ěý Ěý(435,Ěý500,Ěý000 523,Ěý506,Ěý000 )ĚýĚýĚýĚýĚý Ěý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=Ěý1.2Ěý:Ěý1Ěý Ěý Ěý WorkingĚýcapitalĚýforĚý2012ĚýĚý=Ěý Ěý(368,Ěý580,Ěý000 462,Ěý280,Ěý000 )ĚýĚýĚýĚýĚýĚýĚý ĚýĚý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=Ěý1.25Ěý:Ěý1Ěý Ěý Ěý OverĚýtheĚýperiodĚýofĚý2012ĚýtoĚý2013ĚýtheĚýworkingĚýcapitalĚýofĚýtheĚýbusinessĚýhasĚý droppedĚýfromĚý1.25:1ĚýtoĚý1.2:1.ĚýTheĚýbusiness’sĚýabilityĚýtoĚýpayĚýofĚýitsĚýcurrentĚý liabilitiesĚýisĚýnotĚýasĚýgoodĚýasĚýtheĚýpreviousĚýyear.ĚýInĚýaddition,ĚýitĚýdoesĚýnotĚýmeetĚý theĚýcriteriaĚýofĚýaĚýratioĚý2:1.Ěý Ěý Ěý Ěý Ěý

- 11. Ěý TotalĚýDebtĚý Ěý otalĚýDebtĚý 00%ĚýT = ( TotalĚýAssets TotalĚýLiabities ) Ă— 1 Ěý Ěý Ěý TotalĚýDebtĚýforĚý2013Ěý= 00%Ěý( 460,Ěý755,Ěý000 1,Ěý015,Ěý001,Ěý000 )Ă— 1 ĚýĚý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=Ěý45.4%Ěý Ěý TotalĚýDebtĚýforĚý2012ĚýĚý= 00%Ěý(930,Ěý785,Ěý000 404,Ěý028,Ěý000 )Ă— 1 Ěý ĚýĚý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=Ěý43.4%Ěý Ěý FromĚýtheĚýyearĚý2012ĚýtoĚý2013,ĚýtheĚýtotalĚýdebtĚýhasĚýincreasedĚýfromĚý43.4%ĚýtoĚý 45.4%.ĚýTheĚýtotalĚýdebtĚýofĚýthisĚýbusinessĚýhasĚýincreased.ĚýInĚýaddition,ĚýitĚýstillĚý satisfiesĚýtheĚýrequirementĚýofĚýaĚýmaximumĚýofĚý50%Ěýdebt.Ěý Ěý Ěý Ěý Ěý Ěý Ěý

- 12. StockĚýTurnoverĚý Ěý tockĚýTurnoverĚý 365 ĚýS = Ěý Ă· ( AverageĚýInventory CostĚýOfĚýGoodsĚýSold )Ěý Ěý Ěý StockĚýTurnoverĚýforĚý2013Ěý=Ěý 65Ěý Ěý3 Ă· Ěý( 200,Ěý838,Ěý000 1,Ěý288,Ěý650,Ěý000 )Ěý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=Ěý57ĚýdaysĚý Ěý StockĚýTurnoverĚýforĚý2012Ěý= 65Ěý Ěý3 Ă· ( 200,838,000 1,237,036,000 )Ěý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=Ěý60ĚýdaysĚý Ěý Ěý DuringĚýtheĚýperiodĚýofĚýyearĚý2012ĚýandĚý2013,ĚýTheĚýstockĚýturnoverĚýhasĚý decreasedĚýfromĚý60ĚýdaysĚýtoĚý57Ěýdays.ĚýTheĚýbusinessĚýsoldĚýitsĚýgoodsĚýfasterĚýinĚý 2013ĚýcomparedĚýtoĚý2012.Ěý Ěý Ěý Ěý Ěý Ěý Ěý

- 13. DebtorĚýTurnoverĚý Ěý ebtorĚýTurnoverĚý 65 ĚýD = 3 Ă· ( CreditĚýSalesĚý AverageĚýDebtors )Ěý Ěý DebtorĚýTurnoverĚý2013Ěý=ĚýĚý Ěý ĚýĚýĚýĚýĚýĚý=ĚýĚýĚýĚýĚýĚýĚý123Ěýdays65Ěý Ěý3 Ă· ( 687,Ěý720,Ěý500 [(239,952,000Ěý+Ěý222,703,000)Ěý/Ěý2] ) Ěý Ěý DebtorĚýTurnoverĚý2012Ěý=ĚýĚý Ěý ĚýĚýĚýĚýĚýĚý=ĚýĚýĚýĚýĚýĚýĚý129Ěýdays65Ěý Ěý3 Ă· ( 656,Ěý094,Ěý500 [(239,952,000Ěý+Ěý222,703,000)Ěý/Ěý2] ) Ěý Ěý Ěý OverĚýtheĚýperiodĚýofĚýyearĚý2012ĚýtoĚý2013,ĚýtheĚýdebtorĚýturnoverĚýofĚýtheĚýbusinessĚý hasĚýdecreasedĚýfromĚý129ĚýdaysĚýtoĚý123Ěýdays.ĚýItĚýmeansĚýthatĚýtheĚýbusinessĚý receivedĚýtheirĚýmoneyĚýfasterĚýthanĚýtheĚýpreviousĚýyear.Ěý Ěý *(DueĚýtoĚýtheĚýabsenceĚýofĚýcreditĚýsalesĚýfigureĚýinĚýtheĚýannualĚýreport,ĚýweĚýhaveĚý takenĚýtheĚýrevenuesĚýofĚýbothĚýyearsĚýandĚýdividedĚýbyĚý50%)Ěý Ěý Ěý Ěý Ěý Ěý Ěý

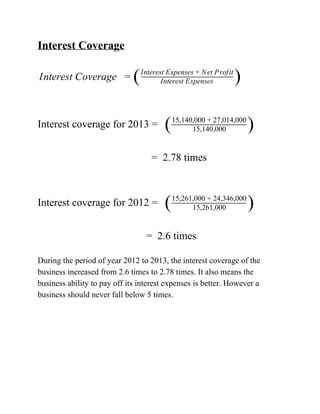

- 14. InterestĚýCoverageĚý Ěý nterestĚýCoverageĚýĚý ĚýI = ( InterestĚýExpenses InterestĚýExpensesĚý+ĚýNetĚýProfit )Ěý Ěý Ěý InterestĚýcoverageĚýforĚý2013Ěý=ĚýĚý Ěý( 15,140,000 15,140,000Ěý+Ěý27,014,000 )ĚýĚý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=ĚýĚý2.78ĚýtimesĚýĚý Ěý Ěý InterestĚýcoverageĚýforĚý2012Ěý=ĚýĚý Ěý( 15,261,000 15,261,000Ěý+Ěý24,346,000 )ĚýĚý Ěý ĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚýĚý=ĚýĚý2.6ĚýtimesĚýĚý Ěý DuringĚýtheĚýperiodĚýofĚýyearĚý2012ĚýtoĚý2013,ĚýtheĚýinterestĚýcoverageĚýofĚýtheĚý businessĚýincreasedĚýfromĚý2.6ĚýtimesĚýtoĚý2.78Ěýtimes.ĚýItĚýalsoĚýmeansĚýtheĚý businessĚýabilityĚýtoĚýpayĚýoffĚýitsĚýinterestĚýexpensesĚýisĚýbetter.ĚýHoweverĚýaĚý businessĚýshouldĚýneverĚýfallĚýbelowĚý5Ěýtimes.Ěý Ěý Ěý Ěý Ěý Ěý

- 15. Ěý P/EĚýRatioĚý Ěý Ěý P/EĚýRatioĚý=Ěý Ěý( EarningĚýPerĚýShare CurrentĚýShareĚýPriceĚý )Ěý Ěý ĚýĚýĚýĚýĚý= ĚýĚý( 0.62Ěý 0.1238 )Ěý Ěý ĚýĚýĚýĚýĚý=ĚýĚýĚý5.008Ěý Ěý Ěý BasedĚýonĚýtheĚýinformationĚýweĚýacquiredĚýfromĚýtheĚýwebpageĚýofĚýBursaĚý MalaysiaĚýdatedĚý3rdĚýJuneĚý2015,ĚýtheĚýshareĚýpriceĚýofĚýMASTEELĚýisĚýRMĚý0.62Ěý andĚýitsĚýearningĚýperĚýshareĚýisĚýRMĚý0.1238.ĚýThisĚýmeansĚýtheĚýP/EĚýratioĚýofĚý MalaysiaĚýSteelĚýWorksĚýBerhadĚýisĚý5.008Ěý(0.62/0.1238).Ěý Ěý Ěý Ěý Ěý Ěý Ěý Ěý Ěý Ěý

- 23. REFERENCEĚý Ěý 1) CompanyĚýHistory.Ěý(n.d.).ĚýRetrievedĚýJuneĚý1,Ěý2015,ĚýfromĚý http://www.masteel.com.my/aboutÂ2/briefÂhistoryÂmilestone/Ěý Ěý 2) ĚýĚýMalaysiaĚýSteelĚýWorksĚý(KL)ĚýBerhadĚýÂĚýInformation.Ěý(n.d.).ĚýRetrievedĚýJuneĚý 1,Ěý2015,ĚýfromĚý http://www.bursamalaysia.com/market/listedÂcompanies/listÂofÂcompanies/ plcÂprofile.html?stock_code=5098Ěý Ěý Ěý 3) Liz,ĚýL.Ěý(2014,ĚýAugustĚý30).ĚýMasteel'sĚýwillĚýofĚýsteelĚýÂĚýBusinessĚýNewsĚý|ĚýTheĚý StarĚýOnline.ĚýRetrievedĚýJuneĚý1,Ěý2015,ĚýfromĚý http://www.thestar.com.my/Business/BusinessÂNews/2014/08/30/Masteels willÂofÂsteelÂSteelÂproducerÂkeenÂforÂrailÂprojectÂtoÂrunÂalongsideÂitsÂcore business/?style=bizĚýĚý Ěý Ěý Ěý Ěý Ěý ĚýĚý ĚýĚý Ěý Ěý ĚýĚý Ěý Ěý

![ĚýSchoolĚýOfĚýArchitecture,ĚýBuildingĚý&ĚýDesignĚý

FoundationĚýInĚýNaturalĚý&ĚýBuiltĚýEnvironmentĚý

Ěý

AssignmentĚýTitleĚýĚý:ĚýFinancialĚýRatioĚýAnalysisĚý

GroupĚýMembersĚý:ĚýĚý Ěý

NAMEĚý STUDENTĚýIDĚý

SEETĚýTIONGĚýHONGĚý 0320438Ěý

WONGĚýDEÂVINĚý 0319814Ěý

BRYANĚýTEHĚýQINGĚýDAĚý 0318590Ěý

Ěý

BasicĚýAccountingĚý[ACC30205Ěý/ĚýFNBE0145]Ěý

LecturerĚý:ĚýChangĚýJauĚýHoĚý

SubmissionĚýDateĚý:Ěý4thĚýJuneĚý2015Ěý

Ěý

Ěý](https://image.slidesharecdn.com/masteel-150625150454-lva1-app6891/85/MASTEEL-pdf-1-320.jpg)

![DebtorĚýTurnoverĚý

Ěý

ebtorĚýTurnoverĚý 65 ĚýD = 3 Ă· ( CreditĚýSalesĚý

AverageĚýDebtors )Ěý

Ěý

DebtorĚýTurnoverĚý2013Ěý=ĚýĚý

Ěý

ĚýĚýĚýĚýĚýĚý=ĚýĚýĚýĚýĚýĚýĚý123Ěýdays65Ěý Ěý3 Ă· ( 687,Ěý720,Ěý500

[(239,952,000Ěý+Ěý222,703,000)Ěý/Ěý2] ) Ěý

Ěý

DebtorĚýTurnoverĚý2012Ěý=ĚýĚý

Ěý

ĚýĚýĚýĚýĚýĚý=ĚýĚýĚýĚýĚýĚýĚý129Ěýdays65Ěý Ěý3 Ă· ( 656,Ěý094,Ěý500

[(239,952,000Ěý+Ěý222,703,000)Ěý/Ěý2] ) Ěý

Ěý

Ěý

OverĚýtheĚýperiodĚýofĚýyearĚý2012ĚýtoĚý2013,ĚýtheĚýdebtorĚýturnoverĚýofĚýtheĚýbusinessĚý

hasĚýdecreasedĚýfromĚý129ĚýdaysĚýtoĚý123Ěýdays.ĚýItĚýmeansĚýthatĚýtheĚýbusinessĚý

receivedĚýtheirĚýmoneyĚýfasterĚýthanĚýtheĚýpreviousĚýyear.Ěý

Ěý

*(DueĚýtoĚýtheĚýabsenceĚýofĚýcreditĚýsalesĚýfigureĚýinĚýtheĚýannualĚýreport,ĚýweĚýhaveĚý

takenĚýtheĚýrevenuesĚýofĚýbothĚýyearsĚýandĚýdividedĚýbyĚý50%)Ěý

Ěý

Ěý Ěý

Ěý

Ěý

Ěý](https://image.slidesharecdn.com/masteel-150625150454-lva1-app6891/85/MASTEEL-pdf-13-320.jpg)